Managing student loans is a significant responsibility, and one of the most crucial aspects to consider is how these loans impact your credit score. Your credit score is vital to your financial health, influencing everything from loan approvals to interest rates.

So, how do student loans affect credit score?

In this blog, we’ll explore how student loans can influence your credit score, from the factors calculated into your score to the impact of timely payments, deferments, and refinancing. Whether you’re just starting your repayment journey or looking to improve your credit, understanding the connection between student loans and your credit score will help you make informed financial decisions and maintain a healthy credit profile.

What is a Student Loan Credit Score?

A credit score is a numerical representation of your creditworthiness; lenders use it to assess the risk of lending you money. The most commonly used credit score in the United States is the FICO score, which ranges from 300 to 850. The higher your FICO score, the more likely you will be approved for loans and credit at favorable interest rates. This score is calculated based on various factors, including payment history, amounts owed, length of credit history, new credit inquiries, and credit mix. Each factor plays a crucial role in determining your overall credit score.

When we talk about a student loan credit score, we’re referring to how your student loans specifically impact your overall credit score. Since student loans are a type of installment loan, they contribute to the credit mix portion of your FICO score. Successfully managing your student loans by making timely payments can positively affect your credit score, while missed or late payments can have the opposite effect. Therefore, your student loan credit score is essentially your overall credit score influenced by how well you manage your debt.

It’s important to note that student loans are typically reported to the three major credit bureaus—Experian, Equifax, and TransUnion—just like any other form of debt. This means how you handle your student loans will be reflected in your credit report and, consequently, in your credit score. Student loans are often their first significant experience with credit for many borrowers, and how they manage these loans can set the tone for their credit history for years to come.

Understanding your student loan credit score is vital because it affects your ability to secure additional loans and other financial opportunities, such as renting an apartment or even getting a job. By being aware of how student loans impact your credit score, you can manage your debt responsibly, build a

A credit score is a numerical representation of your creditworthiness; lenders use it to assess the risk of lending you money. The most commonly used credit score in the United States is the FICO score, which ranges from 300 to 850. The higher your FICO score, the more likely you will be approved for loans and credit at favorable interest rates. This score is calculated based on various factors, including payment history, amounts owed, length of credit history, new credit inquiries, and credit mix. Each factor plays a crucial role in determining your overall credit score.

When we talk about a student loan credit score, we’re referring to how your student loans specifically impact your overall credit score. Since student loans are a type of installment loan, they contribute to the credit mix portion of your FICO score. Successfully managing your student loans by making timely payments can positively affect your credit score, while missed or late payments can have the opposite effect. Therefore, your student loan credit score is essentially your overall credit score influenced by how well you manage your debt.

It’s important to note that student loans are typically reported to the three major credit bureaus—Experian, Equifax, and TransUnion—just like any other form of debt. This means how you handle your student loans will be reflected in your credit report and, consequently, in your credit score. Student loans are often their first significant experience with credit for many borrowers, and how they manage these loans can set the tone for their credit history for years to come.

Understanding your student loan credit score is vital because it affects your ability to secure additional loans and other financial opportunities, such as renting an apartment or even getting a job. By being aware of how student loans impact your credit score, you can manage your debt responsibly, build a strong credit history, and maintain a healthy financial future.

strong credit history, and maintain a healthy financial future.

What Does a Student Loan Cover?

Student loans can cover a wide range of educational expenses beyond just tuition. Student loan coverage typically includes tuition fees, room and board, textbooks, school supplies, and even transportation. Some student loans also cover personal expenses, which can be essential for students living away from home.

Tuition Fees

One of the primary expenses that student loans cover is tuition fees. These are the costs associated with enrolling in courses at a college or university and often represent the largest portion of a student’s educational expenses.

Housing Expenses

Student loans can also be used to cover housing expenses, whether you live on-campus in dormitories or off-campus in an apartment. This includes rent, utilities, and even some living expenses, helping you manage living costs while studying.

Travel

For students who live far from their campus, student loans can help cover travel expenses. This includes transportation costs such as gas, public transit, or even airfare if you need to travel home during breaks or holidays.

Books and Supplies

On average, the yearly cost of a college student on books and supplies is $1215. Student loans commonly purchase textbooks and essential equipment for your courses. Whether it’s a laptop, lab materials, or specialized tools for your field of study, these costs can add up, and loans can help alleviate this financial burden.

Miscellaneous

Lastly, student loans can be used for various miscellaneous expenses that support your education. These might include supplies, personal expenses, and even some extracurricular activities that are part of your college experience.

How a Student Loan Credit Score is Calculated

Your student loan credit score calculation follows the same principles as other credit score calculations. Factors include your payment history, the amount of debt you owe, the length of your credit history, new credit inquiries, and the mix of credit types. Each factor plays a role in determining how your student loan affects your overall credit score. Understanding student loan credit calculation can help you manage your loan more effectively and maintain a healthy credit score.

So, how do student loans affect credit score and how is the score calculated?

Lenders use your credit score as a gauge of your financial responsibility and past money management. A higher FICO score, typically 670 or above, is considered good and suggests that you are a low-risk borrower who has previously reliably managed debt. Such a score boosts your chances of being approved for a loan and positions you favorably to receive lower interest rates.

Having a poor or limited credit history can pose significant challenges in securing a student loan without additional support. For individuals with lower credit scores, lenders perceive a higher risk of loan default, which can lead to tougher borrowing conditions. If you have a low credit score, you might still qualify for a loan, but likely at higher interest rates and additional fees, as lenders aim to mitigate the risk.

Lenders do not uniformly apply a single credit scoring model; however, the FICO score is commonly used to evaluate loan applications. This scoring system takes into account various factors from your credit history, including payment history, amounts owed, length of credit history, new credit, and types of credit used. Lenders can get a comprehensive view of your creditworthiness by assessing these aspects.

The implication is clear: maintaining a good credit score is essential for those seeking to finance their education through private loans. It influences not only the likelihood of approval but also the financial terms of the loan itself. For students with poor credit scores, considering a co-signer with a stronger credit history can improve the chances of securing a loan with more favorable terms.

How Do Student Loans Affect Your Credit Score: Explained

So, how do student loans affect credit score? Several credit score factors can have both positive and negative impacts. On the positive side, timely payments can boost your credit score by demonstrating responsible debt management.

On the negative side, missed or late payments can severely damage your score. The amount of debt you owe compared to your credit limits, known as your credit utilization ratio, also plays a significant role. High balances can lower your score, while consistent payments can improve it.

Payment History

One of the pivotal ways how do student loans affect credit score is through your payment history. Consistent, on-time payments on student loans can bolster your credit score significantly, as these actions reflect positively in your credit reports. Conversely, missing payments can lead to negative marks that may persist for years, undermining your creditworthiness.

Credit Inquiries

How do student loans affect credit score can also be seen when you first apply for a student loan. The lender will perform a hard credit inquiry to evaluate your creditworthiness, which might temporarily reduce your credit score. Although this impact is typically minor, limiting the number of hard inquiries when shopping for loans is important to avoid cumulative effects on your credit score.

Credit Length

The length of your credit history also influences how do student loans affect credit score. Student loans can help by adding to the length of your credit history, demonstrating to creditors your ability to manage and commit to long-term financial obligations, which can positively affect your credit score.

Defaulting

Defaulting on student loans is severely detrimental to how do student loans affect credit score. It signals to potential lenders that you are a high-risk borrower, which can restrict your access to future credit and lead to significantly higher interest rates on approved loans. Maintaining regular payments and communicating with lenders during financial hardships can prevent defaults and protect your credit score.

Does Paying Student Loans Build Credit?

One of the most common questions is whether paying off student loans builds credit. The answer is yes. Student loan credit building occurs when you make regular, on-time payments. These positive payment histories are reported to the credit bureaus and can help build and improve your credit score over time. Consistently paying off your student loans can demonstrate financial responsibility, which is crucial for maintaining and improving your credit score.

Do student loans affect credit score?

Timely payments are the most significant factor in credit score calculations, demonstrating financial reliability to lenders. Regular, on-time payments on your student loans can significantly enhance your credit history, providing a solid foundation for future financial activities.

Adding student loans to your credit report can benefit your credit score by diversifying your credit mix, especially if you have previously only used one type of credit, such as a credit card. While the impact of credit mix on your score is relatively minor compared to payment history, it still contributes positively by showing your ability to manage different types of credit. However, avoiding taking on debt you cannot afford is essential just to improve your credit mix.

The credit implications for student loans taken out by parents, such as federal parent PLUS loans and private parent loans, are specific to the parent. These loans affect only the credit of the individual who signed for the loan, impacting their credit history and score based on their payment performance.

Conversely, if you have a student loan that your parent co-signed, the loan will appear on both of your credit reports. This means both your and your parent’s credit scores can be affected, for better or worse, depending on how these loans are managed.

Student Loan Refinancing and Its Impact on Credit Score

Refinancing student loans can also impact your credit score. Loan impact on credit from refinancing can be positive or negative depending on how it’s managed. Refinancing involves taking out a new loan to pay off existing loans, often at a lower interest rate. While this can reduce your payments and save money, it also involves a credit inquiry and can temporarily lower your credit score.

Shopping around for the best refinancing rate is advisable, and thankfully, it can be done without negatively affecting your credit score significantly. By applying for all loan refinancing options within a 14-day window, you can minimize the impact of hard inquiries on your credit report. According to the FICO credit scoring model, multiple inquiries for the same type of loan within this period are counted as just one inquiry.

Using lenders’ pre-qualification processes is another smart approach to shopping for loan refinancing rates without a hard credit check. Many lenders offer rate estimates based on preliminary information, which does not impact your credit score. This initial step allows you to compare rates and terms from various lenders without any risk to your credit health.

How do student loans affect credit score?

It’s crucial to understand that while applying within a short time frame protects your score from multiple hits, the actual act of refinancing can still have other effects. Refinancing usually involves paying off old debts and creating a new one, which can temporarily lower your credit score due to the closure of the old loan accounts and the opening of a new one.

Nevertheless, if managed wisely, refinancing can lead to more favorable loan terms and easier debt management in the long run. Always ensure that the benefits of a lower interest rate or better loan terms outweigh the temporary dip in your credit score. This strategy can be an essential part of managing and reducing your debt over time while maintaining a healthy credit score.

How Student Loans Can Improve Your Credit Score

When managed well, student loans can help improve your credit score. Credit score improvement occurs when you make consistent, on-time payments and maintain a healthy credit utilization ratio.

So, how do student loans affect credit score positively?

Make On-Time Payments

Making on-time payments on your student loans is crucial for maintaining and improving your credit score. Consistent, timely payments demonstrate to creditors your reliability as a borrower, which can positively affect your credit score. It’s the most direct way that student loans can enhance your credit reputation, making it essential to set reminders or automate payments to avoid slips. Do student loans affect credit score if you make on-time payments? Yes, it does.

Add to Your Credit Mix

Student loans can add diversity to your credit mix, which benefits your credit score. Do student loans affect credit score on a credit mix? Credit scoring models favor having a variety of credit types because it shows you can manage different kinds of credit responsibly. While this factor doesn’t carry as much weight as payment history, it still contributes positively, especially if your credit portfolio includes only revolving credit (like credit cards).

Pay Down the Balance

Reducing the balance on your student loans can also positively impact your credit score. As you pay down your loans, you decrease your credit utilization ratio, which measures how much of your available credit you’re using. Credit scoring algorithms view lower utilization rates favorably, which can lead to improvements in your score.

Thicken Your Credit File

A student loan can thicken your credit file by adding to the list of active credit accounts in your name. A thicker credit file can be beneficial, particularly for younger consumers or those with little credit history, as it provides more data on your financial behavior for credit bureaus to analyze.

Increase the Age of Your Accounts

Maintaining long-standing accounts like student loans can increase the average age of your credit accounts, which can positively influence your credit score. This aspect of your credit score reflects the length of your credit history; longer credit histories are considered less risky because they demonstrate more experience handling credit.

How Deferment and Forbearance Affect Credit Score

Loan deferment affects your credit score, depending on the situation. Deferment and forbearance allow you to pause or reduce your student loan payments temporarily. While these options can relieve financial hardship, they also impact your credit score. If your loan is in good standing when you enter deferment or forbearance, your credit score shouldn’t be affected negatively. However, your score could suffer if you miss payments before entering these programs.

Deferment is often a preferable option if you qualify, especially for those with subsidized federal student loans or Perkins loans where interest does not accrue during the deferment period. This means the loan balance doesn’t grow, and because the suspension of payments is officially sanctioned, your credit score remains unaffected. Deferment is particularly beneficial if you’re unemployed or experiencing significant financial hardship, as it pauses payments without damaging your credit health.

Unlike deferment, forbearance can apply to a wider range of financial situations but typically results in interest accruing on all types of loans during the pause. This can increase the total amount you owe, making it a less favorable option in the long run. However, like deferment, entering into forbearance does not directly hurt your credit score because it, too is an officially recognized status by lenders. Using forbearance judiciously is crucial, as the accumulating interest can expand your debt load, and the financial relief is only temporary.

So, do student loans affect credit score in deferment and forbearance?

Both deferment and forbearance do not negatively affect your credit score directly because they prevent you from being reported as late or missing payments. However, the increased debt from accrued interest in forbearance can indirectly impact your financial health. For borrowers considering these options, exploring other repayment plans or financial advice is advisable if the anticipated financial challenge is prolonged.

Tips for Managing Student Loans to Protect Your Credit Score

How do student loans affect credit score in terms of management? Managing student loans wisely is key to protecting your credit score. Here are some tips for credit score improvement:

Pay Your Bills on Time

Consistently paying your student loan bills on time is one of the most important steps to protect your credit score. Timely payments demonstrate financial responsibility and help build a positive payment history, a significant factor in your overall credit score.

Avail of a Student Credit Card

Consider availing a student credit card to build credit while you’re still in school. Using the card responsibly, such as making small purchases and paying off the balance each month, can help establish a solid credit history alongside your student loans.

Only Use a Small Portion of Your Student Credit Card Limit

To maintain a good credit score, it’s important to keep your credit utilization low. Try to use only a small portion of your student credit card limit—ideally, less than 30%—to show that you can manage credit without relying heavily on it.

Add Additional Payments to Your Credit Report

If possible, make additional payments on your student loans and ensure these are reported to the credit bureaus. This will reduce your loan balance faster and positively impact your credit score by demonstrating your commitment to paying down debt.

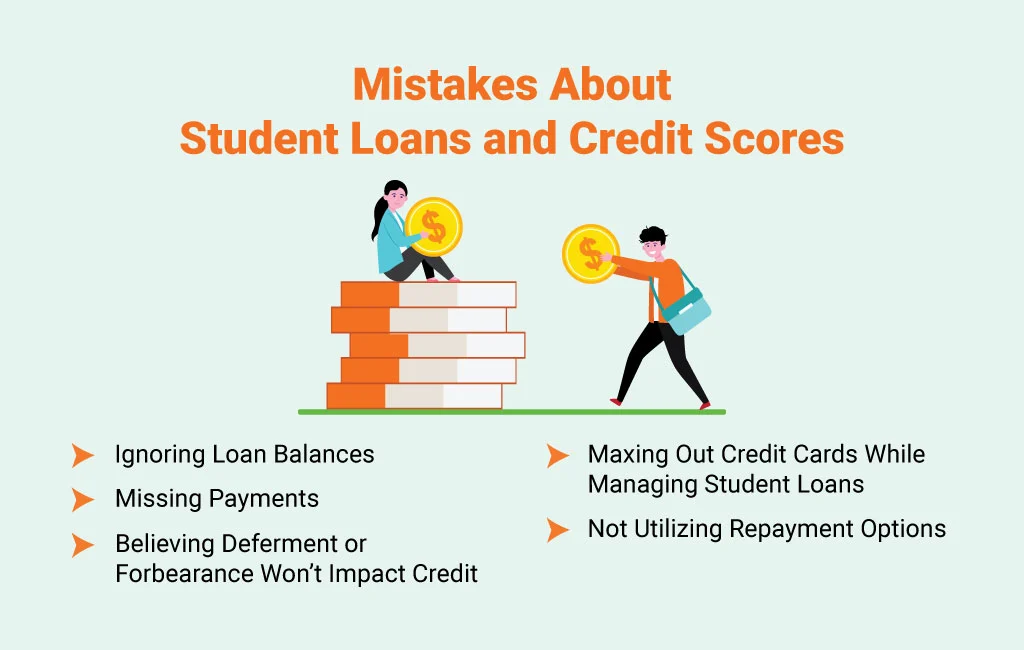

Common Mistakes About Student Loans and Credit Scores

So, do student loans affect credit score? Yes, and there are several mistakes in student loan credit that can harm your credit score.

Ignoring Loan Balances

One of the biggest mistakes borrowers make is ignoring their overall student loan balance. While making minimum payments is essential to staying current, it’s equally important to track how much you owe.

As interest accrues, the balance can grow significantly, which may lead to difficulties in repaying the loan over time. Do student loans affect credit score? Ignoring loan balances can negatively impact your score by increasing your debt-to-income ratio, a key factor that lenders consider when assessing your creditworthiness.

Missing Payments

Missing payments is another critical mistake that can have a severe impact on your credit score. Payment history accounts for a significant portion of your credit score, and even one missed payment can cause a noticeable drop.

Do student loans affect credit score when payments are missed? Absolutely. Consistently making on-time payments is crucial for maintaining a healthy credit score. Unfortunately, many borrowers overlook this, especially during financial hardships, not realizing the long-term damage it can cause to their credit profile.

Believing Deferment or Forbearance Won’t Impact Credit

Many borrowers mistakenly believe entering deferment or forbearance on their student loans will not impact their credit score. However, do student loans affect credit score during deferment or forbearance? While these options can prevent late payments from being reported negatively, they are not entirely without consequences.

For example, interest often continues to accrue during these periods, increasing the total balance and potentially leading to higher monthly payments in the future. Additionally, extended periods of deferment or forbearance might signal financial instability to lenders, which can indirectly affect your credit score.

Maxing Out Credit Cards While Managing Student Loans

Another common mistake is relying too heavily on credit cards while managing student loan payments. High credit card balances can lead to a high credit utilization ratio, negatively impacting your credit score. Do student loans affect credit score when combined with maxed-out credit cards? Yes, borrowers who max out their credit cards while juggling student loans risk damaging their credit scores and making it more challenging to qualify for favorable loan terms in the future.

Not Utilizing Repayment Options

Failing to explore alternative repayment options can lead to unnecessary financial strain and harm your credit score. Do student loans affect credit score if repayment options are ignored? The answer is yes. Income-driven repayment plans, for example, can lower monthly payments based on your income, making it easier to stay current on your loans.

Ignoring these options may result in missed payments or default, significantly damaging your credit score. Understanding and utilizing the various repayment plans available can help you manage debt more effectively and protect your credit score over time.

Final Words

Do student loans affect credit score?

Absolutely. Student loans significantly impact your credit score, depending on how they are managed. By making timely payments, understanding the factors that influence your score, and avoiding common mistakes, you can use your student loans to build and maintain a strong credit score. Stay informed and proactive about your loans to protect your financial future.