Congratulations! You’re considering buying a home, a significant step towards building your future. But before you dive into open houses and bidding wars, understanding mortgage interest is crucial. It’s the cost of borrowing money to finance your dream home, and significantly impacts your monthly payments and overall loan cost.

This comprehensive guide to how does mortgage interest work will be your one-stop shop for all things mortgage interest. We’ll break down the different types of interest rates, explore how they’re calculated based on your financial profile, and equip you with tips to secure the most favorable terms. By the end of this journey, you’ll be able to confidently navigate conversations with lenders and make informed decisions toward homeownership. Let’s unlock the door to understanding mortgage interest!

What is an Interest Rate on a Mortgage?

When considering homeownership, understanding mortgage interest rates is essential. These rates are not just numbers on a page; they significantly impact your monthly payments and the total cost of your loan over the years. In simpler terms, the interest rate represents the cost of borrowing money to finance your home purchase.

Mortgage interest rates function similarly to a rental fee. Instead of paying the entire home price upfront, the lender allows you to spread the cost out over a set term, typically 15 or 30 years. This convenience comes at a cost, expressed as a yearly percentage rate (APR). The APR considers not just the base interest rate, but also any additional closing costs or fees associated with the loan. So, how does mortgage interest work? Well, there are two primary types of mortgage interest rates: fixed and adjustable.

A fixed-rate mortgage offers stability with a locked-in interest rate for the entire loan term. This ensures consistent monthly payments for budgeting purposes. Adjustable-rate mortgages, on the other hand, can fluctuate based on market conditions. These loans may offer lower initial rates but carry the risk of increases in the future. Carefully evaluating these options and their implications is crucial to securing the most affordable mortgage that aligns with your long-term financial goals.

How Does Mortgage Interest Work?

Understanding mortgage interest is crucial for anyone considering homeownership. It’s not just a fee; it significantly impacts your monthly payments and the total cost of the loan over the years. In essence, the interest rate represents the cost of borrowing money to finance your home purchase.

Mortgage interest functions similarly to a loan repayment structure. The lender allows you to spread out the home’s cost over a set term (often 15 or 30 years) instead of requiring full payment upfront. There’s a cost associated with this convenience, expressed as a yearly percentage rate (APR). The APR incorporates not just the base interest rate, but also any additional closing costs or fees associated with the loan.

There are two main types of mortgage interest rates to consider: fixed and adjustable. A fixed-rate mortgage offers stability with a locked-in interest rate for the entire loan term. This ensures consistent monthly payments, simplifying budgeting. Adjustable-rate mortgages (ARMs), on the other hand, can fluctuate based on market conditions. These loans may offer lower initial rates but carry the risk of increases in the future.

Understanding how does mortgage interest work is also important. The lender calculates the interest amount each month based on your remaining loan balance. As you make your monthly payments, the principal amount you owe decreases. This decrease in the principal amount also reduces the interest you owe each month. This is because the interest is calculated on a smaller remaining loan balance.

Understanding “How does mortgage interest work?” empowers you to make informed decisions about your loan options. You’ll be better equipped to estimate your monthly payments and the total cost of homeownership, allowing you to plan for your financial future with greater confidence. So, how does mortgage interest work? This is how.

How is Mortgage Interest Calculated?

Knowing how mortgage interest is calculated can help you manage your mortgage more effectively. This knowledge can assist in budgeting and planning, ensuring that you make the most out of your home investment. Here are the key components involved in the calculation of mortgage interest:

Principal

The principal is the original amount of money you borrow to buy a home. It does not include interest, taxes, insurance, or other fees. When you make your monthly mortgage payment, a portion of it goes towards reducing the principal. Here’s a closer look at the principal:

Impact on Payments: In the early years of a mortgage, a smaller portion of your monthly payment goes towards the principal. As the loan term progresses, more of your payment is applied to the principal.

Reduction Over Time: As you pay down the principal, the interest portion of your payment decreases, because interest is calculated on the remaining loan balance.

Interest

Interest is the cost of borrowing money from the lender. It is calculated based on the interest rate and the outstanding principal balance of the loan. Here’s what you need to know about interest:

Interest Rate: This is the percentage that the lender charges for borrowing the principal. It can be fixed (remains the same throughout the loan term) or adjustable (can change periodically).

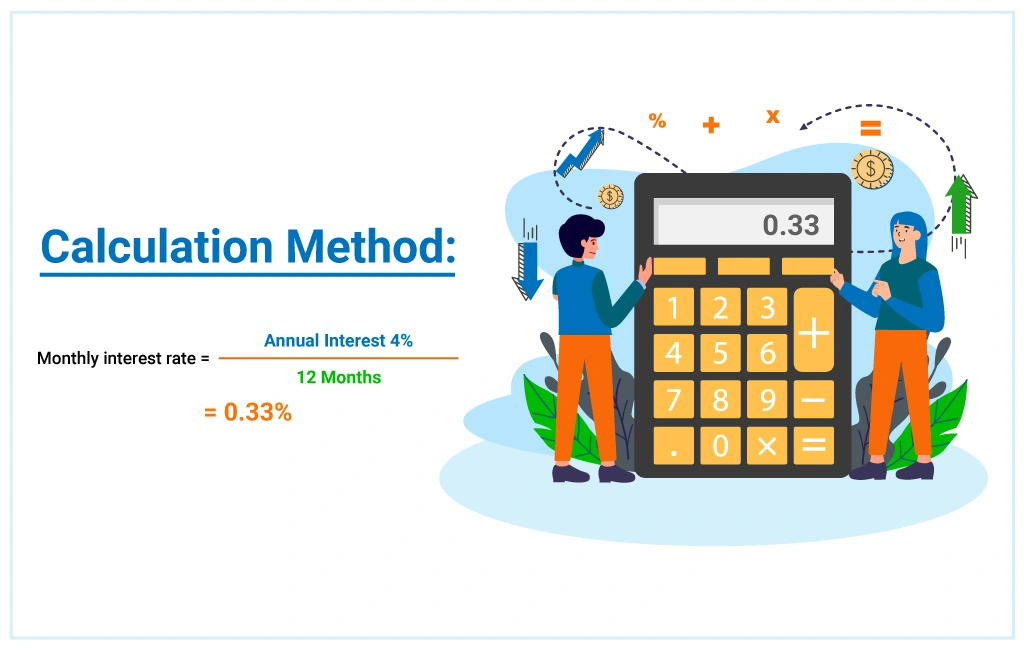

Calculation Method: Interest is typically calculated monthly based on the annual interest rate. For example, if your annual interest rate is 4%, the monthly interest rate would be 0.33% (4% divided by 12 months).

Impact of Principal Reduction: As you pay down the principal, the amount of interest you owe each month decreases because the interest is applied to the remaining loan balance.

Taxes

Property taxes are usually included in your monthly mortgage payment, collected by your lender, and then paid to the local government on your behalf. Key points about property taxes include:

Assessment: Taxes are assessed based on the value of your property and can vary widely depending on your location.

Escrow Account: Lenders often require an escrow account for taxes and insurance. They collect a portion of your property tax each month and pay the tax bill when it’s due.

Impact on Payments: Property tax rates can change annually, which may affect your monthly mortgage payment if the tax amount increases or decreases.

Mortgage Insurance

Mortgage insurance protects the lender in case you default on the loan. It is typically required if your down payment is less than 20% of the home’s purchase price. Important details include:

Private Mortgage Insurance (PMI): For conventional loans, PMI is required when the down payment is less than 20%. It can usually be canceled once you have paid down enough of the loan.

FHA Mortgage Insurance: Federal Housing Administration (FHA) loans require mortgage insurance premiums (MIP) regardless of the down payment amount. These premiums are typically paid for the life of the loan.

Impact on Payments: Mortgage insurance adds to your monthly mortgage payment, increasing your overall housing costs.

Term/Length

The term or length of your mortgage is the number of years you have to repay the loan. Common terms are 15, 20, and 30 years. The term of your mortgage affects your monthly payments and the total amount of interest paid over the life of the loan. Considerations include:

Shorter Terms: A 15-year mortgage typically has higher monthly payments but a lower interest rate. You pay off the loan faster and pay less interest overall.

Longer Terms: A 30-year mortgage has lower monthly payments, but you’ll pay more interest over the life of the loan because the loan term is longer.

Choosing a Term: The right term depends on your financial situation and long-term goals. Shorter terms save money on interest, while longer terms offer lower monthly payments.

Amortization

Amortization is the process of paying off a loan over time through regular payments. With a fixed-rate mortgage, your monthly payments remain the same, but the allocation of each payment between principal and interest changes. Key points include:

Amortization Schedule: An amortization schedule shows how much of each monthly payment goes towards interest and principal. Initially, a larger portion of the payment goes towards interest, but this shifts over time.

Impact on Principal and Interest: As the principal is paid down, the interest portion of the payment decreases. By the end of the loan term, most of your payment goes towards the principal.

Benefit of Extra Payments: Making extra payments towards the principal can reduce the total interest paid and shorten the loan term. Even small additional payments can have a significant impact over time.

Knowing how does mortgage interest work will save you money in the long run.

What are the Different Types of Loans?

Financing a home is a significant undertaking, and selecting the right mortgage product is crucial for long-term financial stability.

Loans are one of the pillars of the answer to the question “how does mortgage interest work?” This guide explores some of the most common mortgage options, outlining their key features, advantages, and potential drawbacks to empower you to make informed decisions.

Fixed-Rate Mortgages: Stability and Predictability

The cornerstone of the mortgage world, fixed-rate mortgages offer stability with a locked-in interest rate for the entire loan term, typically 15 or 30 years. This translates to consistent monthly payments, making budgeting and financial planning considerably easier.

Fixed-rate mortgages are ideal for borrowers who prioritize predictability and dislike the uncertainty associated with fluctuating interest rates. However, they may come with slightly higher initial interest rates compared to some adjustable-rate options.

Adjustable-Rate Mortgages (ARMs): Potential for Savings with Calculated Risk

Adjustable-rate mortgages (ARMs) present a different approach. These loans feature an interest rate that can adjust periodically, typically after an initial fixed-rate period. ARMs often boast lower initial rates than fixed-rate mortgages, potentially leading to significant savings in the early years of your loan. However, this benefit comes with inherent risk.

If interest rates rise, your monthly payments could increase, potentially straining your budget. ARMs are best suited for borrowers comfortable with some level of interest rate volatility and who plan to sell their homes before the fixed-rate period ends.

Interest-Only Mortgages: Lower Initial Payments, Higher Long-Term Costs

Interest-only mortgages offer a unique structure, where borrowers only pay the interest on the loan for a set period, often 5-10 years. This can be attractive for those seeking lower initial monthly payments, particularly in high-cost housing markets. However, it’s crucial to understand that with an interest-only mortgage, you’re not paying down the principal amount of the loan during the initial period.

This means you’ll still owe the entire loan amount at the end of the interest-only period, and your monthly payments will increase significantly when principal repayment begins. Interest-only mortgages are best suited for very specific financial situations and require careful consideration and long-term planning.

Jumbo Mortgages: Financing Luxury Homes

Jumbo mortgages cater to borrowers financing homes that exceed the conforming loan limits set by government-sponsored entities like Fannie Mae and Freddie Mac. These limits vary by location but typically fall around $600,000 to $900,000. Jumbo mortgages often come with stricter qualification requirements, such as higher credit scores and larger down payments compared to conventional mortgages. However, they offer the flexibility to finance luxury homes that wouldn’t be possible with traditional mortgage products.

By understanding the distinct characteristics of these common mortgage options, you can embark on your homeownership journey with a clear understanding of the financial implications. Consulting with a qualified mortgage professional can further personalize your loan selection process, ensuring you choose the mortgage product that best aligns with your financial goals and risk tolerance.

The Best Ways to Get a Lower Mortgage Interest Rate

Obtaining a competitive mortgage interest rate can significantly impact the affordability of your dream home. Here’s a roadmap to navigate the process and potentially save thousands of dollars over the life of your loan:

1. Building a Stellar Credit Score: The Foundation of Affordability

Lenders view a high credit score as an indicator of responsible financial behavior. A strong score (ideally above 740) qualifies you for the most attractive interest rates. Focus on improving your credit score well before applying for a mortgage.

Strategies include paying down existing debt to reduce your credit utilization ratio (the amount of credit you’re using compared to your total limit), consistently making on-time payments for all your bills, and avoiding opening new lines of credit unless necessary.

2. Bolstering Your Down Payment: Reducing Risk and Saving Money

A larger down payment translates to a lower loan amount for the lender, reducing their risk. This incentivizes them to offer you a more favorable interest rate.

While the minimum down payment for conventional mortgages can be as low as 3%, aiming for a higher percentage, ideally 20% or more, can significantly reduce your interest rate and eliminate the need for private mortgage insurance (PMI), which protects the lender in case of default but adds to your monthly payments.

3. Comparison Shopping: Unveiling the Best Deals

Don’t settle for the first rate offered by your bank or credit union. Mortgage rates can vary significantly between lenders. Dedicate time to compare rates and terms from multiple lenders, including online lenders, traditional banks, and credit unions.

Utilize online mortgage calculators to estimate potential savings based on different interest rates and loan terms.

4. Leveraging Discount Points: A Strategic Investment

Discount points are upfront fees paid to the lender in exchange for a lower interest rate. Each point typically represents 1% of the loan amount and can reduce your interest rate by about 0.25%. Carefully evaluate this option.

While it requires an upfront investment, the long-term savings from a lower interest rate can be substantial, especially if you plan to stay in your home for an extended period.

5. Locking in Your Rate: Securing Stability

Once you’ve identified a competitive interest rate, consider locking it in. This guarantees the rate for a specific period, typically 30 to 60 days, protecting you from potential rate increases before closing.

Locking the rate comes with a fee, but it provides peace of mind knowing your interest rate won’t spike during the loan application process.

Wrapping Up

Understanding the question, “How does mortgage interest work?” is crucial for anyone looking to buy a home. Grasping the basics of interest rates, their calculation methods, and the various types of loans available empowers you to make informed decisions, ultimately saving you a substantial amount of money over the life of your mortgage.

Interest rates are influenced by several factors, including your credit score, the loan amount, the term of the loan, and market conditions. A higher credit score typically qualifies you for a lower interest rate, so it’s beneficial to improve your credit before applying for a mortgage. This can be achieved by paying down existing debt, making on-time payments, and correcting any errors on your credit report.

Saving for a larger down payment is another effective strategy. A higher down payment reduces the loan amount, which can lower your interest rate and may eliminate the need for mortgage insurance, further reducing your monthly payments. Additionally, it demonstrates financial stability to lenders, which can result in better loan terms.

Shopping around is essential. Different lenders offer different rates and terms, so it’s important to compare multiple offers. Look for lenders who provide the best combination of interest rates, fees, and customer service. Don’t hesitate to negotiate terms and ask about any available discounts or promotions.

Consider discount points, which allow you to pay upfront fees to lower your interest rate. Each point typically costs 1% of the loan amount and can reduce your rate by about 0.25%. While this increases your initial costs, it can lead to significant savings over time, especially if you plan to stay in your home for many years.