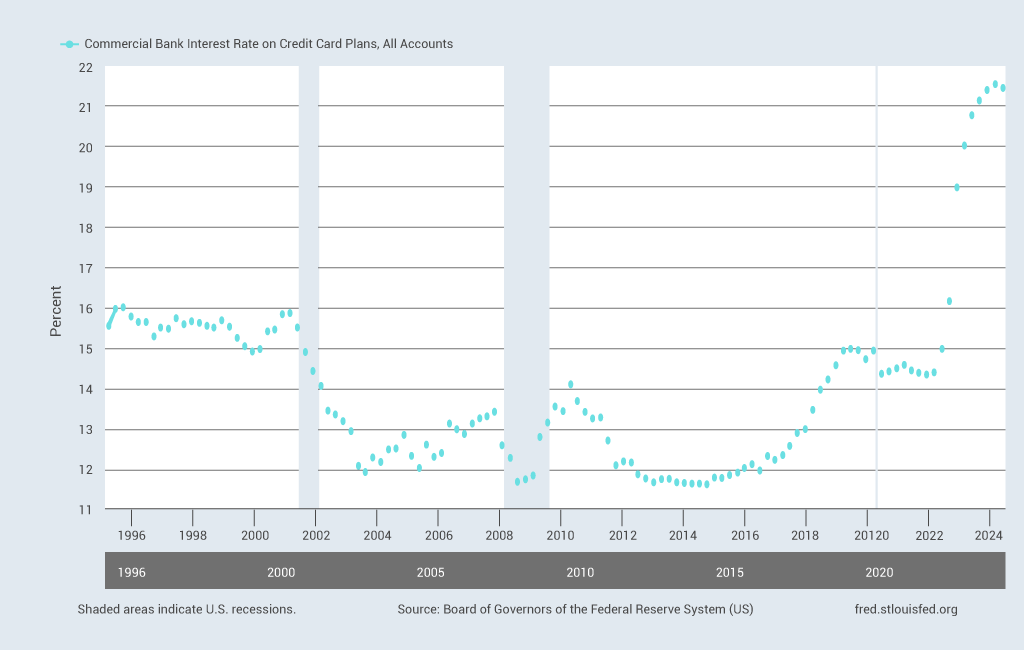

Credit cards can be a convenient financial tool, but high interest rates can quickly lead to debt if not managed carefully. As of May 2024, the average commercial bank interest rate on credit card plans for all accounts was 21.51 percent. With such high rates, it’s crucial to understand how to manage your credit card wisely to avoid costly interest charges.

One of the most effective ways to avoid interest is by paying your balance in full each month. This blog will explore how to avoid interest on a credit card by understanding how credit card interest works, utilizing grace periods, and adopting smart payment strategies to keep your finances on track.

What is Credit Card Interest?

Credit card interest is the fee you pay for borrowing money when you don’t pay off your full balance each month. It’s calculated as a percentage of your outstanding balance, and this percentage is called the Annual Percentage Rate (APR). Credit card interest can add up quickly, making your purchases more expensive if you carry a balance from month to month.

Understanding credit interest is important for managing your credit card wisely. The interest rate on credit cards can vary depending on your card type and creditworthiness. Some credit cards may have lower APRs, while others may charge higher rates, especially if you have a lower credit score.

When you don’t pay your balance in full by the due date, the credit card company starts charging interest on the remaining amount. This is how the interest compounds, meaning you end up paying interest on top of interest. This can make it difficult to pay down your balance if you only make the minimum payments each month.

The key to how to avoid interest on a credit card is simple: pay your full balance before the due date. By doing so, you won’t carry a balance into the next billing cycle, and no interest will be charged. Utilizing the grace period, the time between the end of your billing cycle and the payment due date can also help you avoid interest charges.

Understanding How Credit Card Interest Works

To avoid interest, it’s important to grasp how credit card interest works. Interest is usually charged on any remaining balance after the due date if you don’t pay it off in full. The interest is calculated using your card’s Annual Percentage Rate (APR) divided by 365 days to find the daily rate. This daily interest rate is then applied to your balance every day, and it remains unpaid, leading to additional costs over time.

For example, let’s say you have a credit card with a 20% APR and a $1,000 balance. The daily interest rate would be 0.0548% (20% divided by 365). If you carry the $1,000 balance for 30 days, you’d accumulate approximately $16.44 in interest ($1,000 x 0.0548% x 30 days). Over time, these interest charges add up, making it more expensive to pay off your debt.

Understanding how credit card interest is calculated can help you manage your spending better and avoid unnecessary costs. By keeping track of your payments and taking advantage of grace periods, you can stay ahead and avoid falling into costly debt.

Credit Card Billing Cycle and Grace Period

Your credit card billing cycle is the period during which your transactions are recorded before you receive a bill. This cycle usually lasts between 28 to 31 days, depending on your credit card issuer. Each month, on the same date, the billing cycle begins and ends, ensuring consistency in the timing of your statements.

At the end of your billing cycle, your credit card company will send you a statement that summarizes all the purchases, payments, and fees from that cycle. You can receive this either by mail or electronically, depending on your preference. This statement shows the total balance due, the minimum payment required, and the due date for that payment.

After your billing cycle ends, a grace period of the credit card begins. This is the time between when your statement is issued and the payment due date. During this period, you have the opportunity to pay off your balance without incurring interest. According to federal law, credit card companies must provide a grace period of at least 21 days, giving you enough time to settle your bill.

The grace period can sometimes extend a little longer to account for delays in mailing or statement processing. It’s important to pay your balance in full during this period to avoid interest charges. Paying on time not only helps you avoid interest but also keeps your credit score in good shape.

Understanding your billing cycle and grace period helps you manage your credit card payments better. By knowing exactly when your cycle ends and your grace period begins, you can plan your payments to maximize the benefits of your credit card without paying extra in interest.

When Should You Pay Your Credit Card to Avoid Interest?

To avoid interest payments on your credit card, the key is to pay off your statement balance in full before the due date each month. As long as you do this, you won’t be charged any interest, and you can continue using your card without worrying about extra costs. This strategy allows you to take full advantage of your card’s benefits without falling into debt.

Once your billing cycle ends and your statement is issued, you’ll enter what’s called a grace period. This is the time between when your statement is issued and the payment due date. If you pay the entire balance during this grace period, no interest will be charged on your purchases.

If you make only the minimum payment or carry a balance beyond the due date, interest will begin accumulating on the remaining balance. This can quickly increase what you owe, making it harder to pay off your balance in the future. That’s why it’s important to aim for full payment every month.

In short, to avoid interest, always make sure to pay off your balance by the due date. By staying on top of your payments and making it a habit to pay in full, you can enjoy the convenience of credit cards without the burden of high-interest charges.

How to Avoid Interest on a Credit Card - Key Strategies

To answer the question of how to avoid interest on a credit card, there are several strategies you can adopt:

1. Take Advantage of an Introductory 0% APR Promotion

One of the best ways how to avoid interest on a credit card is by taking advantage of a 0% APR promotion. Many credit cards offer this deal to new cardholders, allowing them to make purchases without accruing interest for a set period, usually between 12 to 18 months. This can be especially helpful if you need to make large purchases or want to pay down debt without interest piling up.

2. Pay Your Credit Card Bill in Full Every Month

The simplest strategy for how to avoid interest on a credit card is to pay your balance in full each month. By doing this, you avoid carrying a balance into the next billing cycle, which would otherwise generate interest charges. Paying in full ensures that you’re not paying more than you need to for your purchases.

3. Consolidate Debt with a Balance Transfer Credit Card

If you have existing credit card debt, using a balance transfer card is an effective method for how to avoid interest on a credit card. Many cards offer a low or 0% APR for balance transfers during an introductory period. This gives you a chance to pay off your debt without adding more interest, as long as you pay off the balance within the promotion window.

4. Be Strategic About Major Purchases

Another way how to avoid interest on a credit card is to be smart about when you make large purchases. Plan major expenses around your billing cycle and grace period to ensure you can pay them off in full by the due date. This allows you to avoid interest charges while still making the purchases you need.

5. Look Into Auto Pay

Setting up auto pay is a convenient method for how to avoid interest on a credit card. By automating your payments, you can ensure that your bill is paid on time every month, reducing the chance of accidentally missing a payment. This keeps your account in good standing and helps you avoid costly interest charges.

How Much Should You Pay on Your Credit Card to Avoid Interest?

To avoid interest, you should aim to pay the credit card payment amount in full, not just the minimum payment. Paying only the minimum will result in interest charges on the remaining balance. Always try to pay off the entire balance to keep your account interest-free and prevent debt from accumulating.

If you can’t pay off your full balance due to unexpected expenses, try to pay as much as possible. While making the minimum payment will keep your account current and avoid late fees, it won’t stop interest from accruing on the remaining balance. The larger the unpaid balance, the more interest you’ll have to pay over time.

Even if you need to carry a balance for a short period, remember that you can regain your interest-free grace period once you’ve paid off the full amount again. Once you clear your balance in full, any future purchases you make can be interest-free as long as you continue paying off the full statement amount before the due date.

How to Maximize the Benefits of Your Credit Card Grace Period

The credit card grace period is one of the most effective tools for avoiding interest. A credit card grace period allows you to use borrowed money for an extended time without paying interest, as long as you pay off your balance in full by the due date. To make the most of this, try to make purchases at the very beginning of your billing cycle. This gives you the longest possible period — typically 51 to 56 days — to pay off your purchase without incurring interest or fees.

If you’re planning to make a large purchase, timing it at the start of your billing cycle can give you even more flexibility. You’ll have the entire billing cycle plus the grace period, usually 23 to 25 days before you need to pay the balance. This means you can effectively borrow money for free as long as you pay off the entire balance by the due date.

For example, if your billing cycle runs from September 10 to October 9, and you make a purchase on September 10, your bill won’t be due until early November. That gives you plenty of time to set aside money for the payment. If you get paid biweekly, you may even receive two to three paychecks during that time, making it easier to cover the cost without worrying about interest.

However, it’s essential to be cautious with this strategy. While the grace period gives you extra time, relying on future paychecks to cover your balance can be risky. If an emergency comes up or your expected income changes, you might not have enough to pay off the full balance, leading to interest charges.

How to Reduce Your Credit Card Interest

If you’re unable to pay off your full balance, there are ways to reduce credit card interest:

Use a Debt Repayment Method

One effective strategy for how to avoid interest on a credit card is using a debt repayment method, like the snowball or avalanche method. The snowball method involves paying off your smallest balances first, while the avalanche method focuses on paying down high-interest debt first. Both approaches help you reduce your overall credit card balance faster, which, in turn, reduces the interest you’re charged.

Make More Than One Credit Card Payments Per Month

Another way to manage how to avoid interest on a credit card is by making multiple payments each month. Paying off smaller portions of your monthly balance can reduce your average daily balance, lowering the interest charged on your remaining balance. This approach can also help you stay on top of your debt and make managing it easier.

Tap Into Savings to Pay Down Debt

If you want to learn how to avoid interest on a credit card, consider tapping into your savings to pay off your outstanding balances. By using savings to reduce your credit card debt, you can avoid the high interest rates typically associated with credit cards. While it might be tough to part with savings, the amount you save on interest could be worth it in the long run.

Consider a Personal Loan

A personal loan could be a useful option for those searching for how to avoid interest on a credit card. Personal loans often come with lower interest rates than credit cards. By consolidating your credit card debt into a personal loan, you can pay off your high-interest credit card balances and save on interest payments moving forward.

Additional Tips for Managing Credit Card Interest

By managing your credit card usage carefully, you can avoid unnecessary interest charges and keep your debt under control.

Know Your Card’s APR

One of the best ways to manage credit card interest is knowing your card’s APR (Annual Percentage Rate). Understanding how much interest is charged on any outstanding balance can help you make better financial decisions. If your APR is high, you may want to focus on paying off your balance quickly to avoid accumulating interest.

Look for a Credit Card That Charges 0% APR on New Purchases

Another useful credit card interest tip is to find a card that offers a 0% APR on new purchases for an introductory period. These promotions can provide interest-free borrowing for a set time, usually 12 to 18 months. If you plan on making big purchases, this type of card can help you avoid interest as long as you pay off the balance within the promotional period.

Avoid Cash Advances

Avoiding cash advances is essential if you want to manage credit card interest. Cash advances typically come with much higher interest rates than regular purchases, and they often have no grace period, meaning interest starts accruing immediately. If possible, steer clear of this feature to prevent unnecessary fees.

Consider Deferred Interest Financing

Deferred interest financing is another option to explore. Some retailers offer this type of financing, allowing you to make a purchase without paying interest for a set period. However, it’s important to note that if you don’t pay off the balance before the promotional period ends, you’ll be charged interest retroactively. This is an important credit card interest tip to keep in mind.

Stay Under Your Credit Limit

To manage credit card interest, it’s important to stay under your credit limit. Exceeding your limit can lead to over-limit fees and potentially higher interest rates. Keeping your balance low also helps with your credit utilization ratio, which can positively impact your credit score.

Opt Into a Buy Now, Pay Later Plan

Many retailers now offer buy now, pay later (BNPL) plans, which allow you to spread out payments without interest over time. This option can help you make larger purchases without relying on credit cards that accrue interest. However, make sure to keep track of payment deadlines to avoid late fees.

Final Words

So, how to avoid interest on a credit card?

It is a matter of understanding your credit card’s terms, paying your balance in full, and using strategies like maximizing your grace period. By following these tips, you can make sure you’re not paying extra money in interest and keep your financial health in check.

For more insights and helpful financial tips, check out our blog at EduCounting, where we provide resources to help you make the most out of your credit and financial decisions. With the right strategies, you can take control of your finances and make credit work for you, not against you.