Starting and running a small business often requires financial support, and loans are a common solution. However, understanding the different types of loans available can be confusing. A frequent question is: Is a small business loan installment or revolving? In this article, we’ll explore the two main types of loans—installment and revolving. We’ll break down their pros and cons to help you make an informed decision for your business, ensuring you choose the financial support that best fits your needs and goals.

What are Installment Loans?

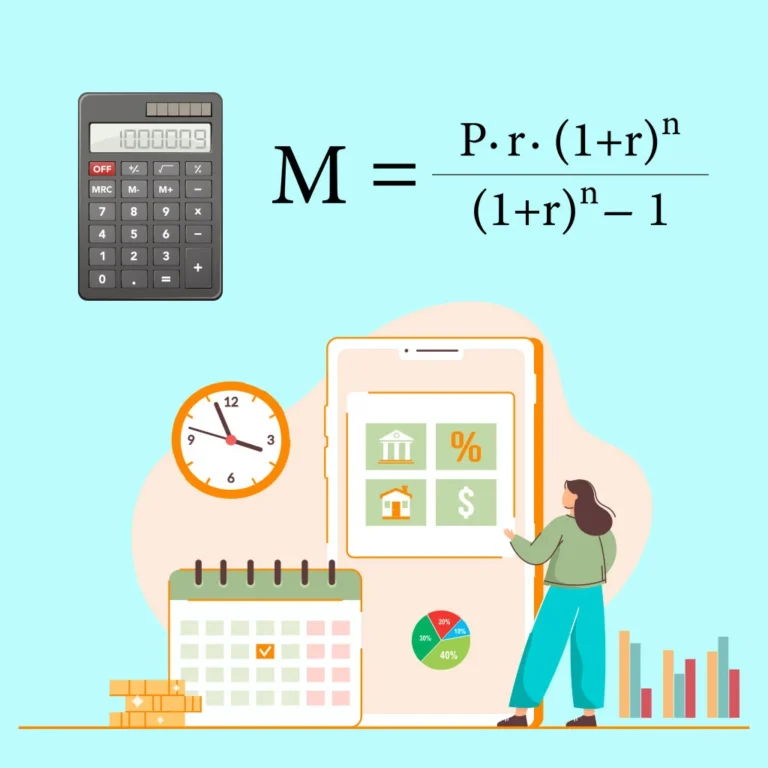

Installment loans are structured financial products where you borrow a fixed amount of money and repay it over a set period, typically with regular monthly payments. These loans come with a clear repayment schedule and a specific end date by which the loan must be fully repaid. Installment loans are generally used for substantial, one-time expenses such as purchasing equipment, expanding your business, or making other significant investments. The predictability of fixed monthly payments makes budgeting easier, allowing you to plan your finances with greater confidence.

What are Revolving Loans?

Revolving loans, in contrast, operate much like a credit card. They provide a credit limit from which you can borrow, repay, and borrow again as needed, without having to reapply each time. The main advantage of revolving loans is their flexibility. You can access funds whenever necessary, up to the credit limit, making them ideal for managing day-to-day cash flow needs, unexpected expenses, or smaller recurring costs. However, unlike installment loans, the amount you repay each month can vary, depending on how much you’ve borrowed and repaid.

The Pros and Cons of Small Business Installment Loans

Installment loans come with advantages and disadvantages for small businesses. Choosing the best financing option depends on your specific business needs.

Pros

Predictable Payments: Since business installment loans have fixed payments, it’s easier to budget your monthly expenses.

Lower Interest Rates: These loans often come with lower interest rates compared to revolving loans.

Builds Credit: Regular, on-time payments can help build your business credit score.

Large Sum: Ideal for significant expenses, like buying equipment or expanding your business.

Cons

Less Flexibility: Once you’ve borrowed the money, you can’t borrow more without applying for a new loan.

Fixed Terms: You’re committed to a repayment schedule, which might be a burden if your business hits a rough patch.

Qualification Requirements: Sometimes, installment loans have strict qualification criteria, which can be challenging for new businesses.

The Pros and Cons of a Small Business Revolving Loan

Revolving loans offer unique benefits and drawbacks for small businesses, often providing more access to funds compared to installment loans.

Pros

Flexibility: You can borrow and repay as needed, perfect for handling cash flow changes. This is key when asking: Is a small business loan installment or revolving?

Accessibility: Once approved, you can access funds quickly without reapplying.

Credit Utilization: Only pay interest on the amount you use, which can save money compared to a large lump sum loan.

Useful for Smaller, Recurring Expenses: Perfect for managing operational costs, inventory purchases, or unexpected expenses.

Cons

Higher Interest Rates: Revolving loans often come with higher interest rates, which can add up if you carry a balance.

Potential for Debt Cycle: It’s easy to fall into a cycle of borrowing and repaying, which can be hard to break.

Variable Payments: Monthly payments can vary, making budgeting a bit more challenging.

Credit Limit: Your borrowing capacity is limited by the credit limit, which might not be sufficient for large expenses.

The Difference Between Installment Loans and Revolving Credit

Understanding the difference between installment loans and revolving credit is key to making informed financial decisions for your small business.

Installment Loans involve borrowing a fixed amount of money and repaying it over a set period through regular, predictable payments. These loans have a defined repayment schedule and a specific end date. They are typically used for significant, one-time expenses like purchasing equipment, expanding your business, or financing a major project. The fixed payment structure makes budgeting straightforward, as you know exactly how much you need to pay each month until the loan is fully repaid.

Revolving Credit, on the other hand, operates more like a credit card. You are given a credit limit, and you can borrow up to that limit, repay the borrowed amount, and then borrow again as needed. This type of loan offers flexibility, allowing you to access funds whenever necessary without reapplying each time. The payments are variable, depending on how much of the credit limit you’ve used. Revolving credit is ideal for managing short-term or recurring expenses, such as inventory purchases, operational costs, or unexpected financial needs. However, the variable payment amounts can make budgeting more challenging compared to installment loans.

Is a Small Business Loan Installment or Revolving Credit Right for You?

Deciding between an installment loan and revolving credit depends on your business needs and financial situation. Each has its own pros and cons. An installment loan might be right for you if you want a fixed amount with predictable monthly payments over a long period.

Choose an Installment Loan if:

Large Sum for a Specific Purpose: If your business needs a substantial amount of money for a specific investment, such as purchasing equipment, expanding facilities, or financing a major project, an installment loan is ideal. You receive a lump sum upfront and repay it over a set period with regular monthly payments. This structure provides predictability, making it easier to budget and plan your finances.

Predictable Payments: Installment loans offer fixed payments, which help you manage your monthly budget more effectively. Knowing exactly how much you need to pay each month can provide peace of mind and financial stability.

Choose a Revolving Loan if:

Ongoing Access to Funds: If your business requires continuous access to funds for variable expenses, such as inventory purchases, managing operational costs, or covering unexpected expenses, a revolving loan is more suitable. This type of credit allows you to borrow up to a set limit, repay, and borrow again as needed without reapplying.

Flexibility: Revolving loans offer greater flexibility, which is beneficial for managing cash flow fluctuations. You only pay interest on the amount you use, and the payments can vary based on your usage, providing a dynamic financial tool for day-to-day operations.

Which is Better for a Small Business, an Installment Loan or a Revolving Loan?

There is no definitive answer to whether an installment loan or revolving credit is better for a small business, as it largely depends on your specific financial needs and goals.

For Predictability and Large Purchases: Installment loans are often better because they provide a lump sum with predictable payments, making them ideal for large, planned investments.

For Flexibility and Cash Flow Management: Revolving loans are more suitable as they offer ongoing access to funds, allowing you to manage varying cash flow needs efficiently.

Understanding if a small business loan is installment or revolving is crucial for good financial decisions. When asking, “Is a small business loan installment or revolving?” think about your specific needs. Both types of loans offer unique advantages and disadvantages, depending on your needs. Installment loans are ideal for large, one-time expenses with predictable payments while revolving loans provide flexibility and are great for managing cash flow fluctuations.

Choosing the right loan type involves considering your business’s specific circumstances and financial goals. By carefully evaluating the pros and cons of each, you can select the loan that best fits your business strategy and helps you achieve your objectives.

Conclusion

By understanding the differences between installment and revolving loans, you can make more informed decisions and find the right financial solutions for your small business. This knowledge is vital when asking: Is a small business loan installment or revolving? Whether you need a large sum for an investment or flexible access to funds for ongoing expenses, knowing your options will help you navigate the financial landscape with confidence.

Frequently Asked Questions

Is it a small personal loan installment or revolving?

Small personal loans are typically installment loans, where you borrow a fixed amount and repay it over time with regular payments.

Is a small business loan secured or unsecured debt?

Small business loans can be either secured or unsecured. Secured loans require collateral, while unsecured loans do not, but they might come with higher interest rates and stricter qualification requirements.