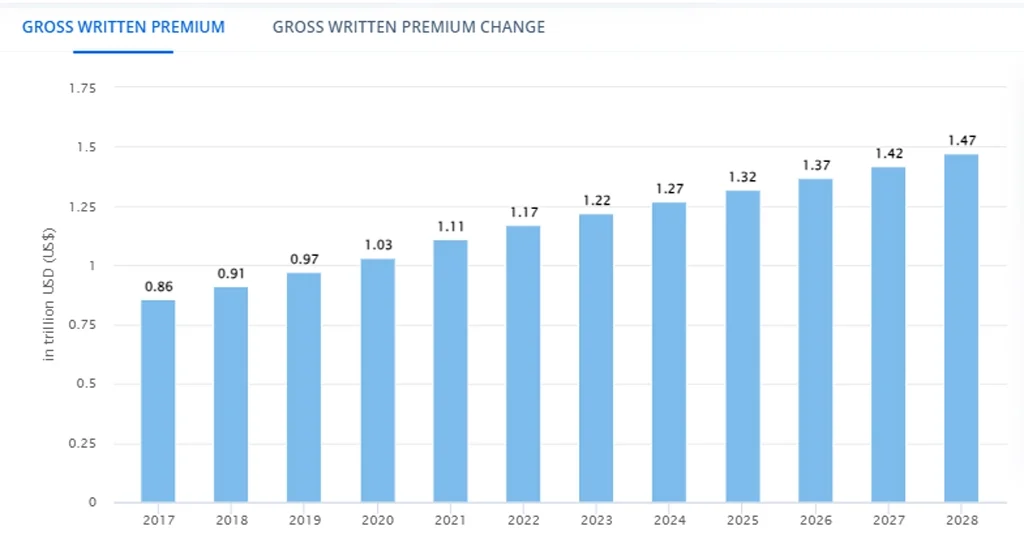

Navigating the complexities of life insurance and its tax implications is increasingly relevant in today’s financial landscape, especially given the robust growth of the US life insurance market. As of October 2023, the gross written premium of this market is projected to reach a staggering US$1.27 trillion in 2024, with forecasts suggesting a rise to US$1.47 trillion by 2028. This growth, characterized by a Compound Annual Growth Rate (CAGR) of 3.72%, underscores the vitality of the life insurance sector and the growing need for individuals to understand how these financial instruments interact with their tax obligations.

Is life insurance tax deductible? Understanding the tax implications of life insurance premiums is more pertinent than ever for many policyholders navigating this expanding market. This article aims to demystify the tax aspects of life insurance, addressing key queries and offering insights into how life insurance policies can affect your taxes. Whether you’re a new policyholder or looking to understand your existing plan better, this article seeks to provide clarity on the tax implications of your life insurance investments.

What is a Tax Deduction?

A tax deduction is a critical concept in personal finance and taxation, serving as a mechanism that reduces your taxable income. Essentially, it allows you to subtract certain expenses from your total income before calculating the amount of tax you owe. This reduction in taxable income can potentially lower your overall tax burden, making tax deductions a valuable aspect of financial planning. Common examples of tax deductions include mortgage interest, educational expenses, and certain types of healthcare costs. Each of these deductions is governed by specific rules and limitations set by tax authorities, which define how and when they can be applied.

Understanding tax deductions is especially important when considering financial products like life insurance. Whether life insurance is tax deductible often arises as individuals seek to know how their premiums could impact their taxable income. Unlike other expenses that qualify as tax deductions, the premium payments for life insurance are not typically deductible on personal income tax returns. However, the tax treatment of life insurance extends beyond just the premiums, encompassing aspects like death benefits and cash value components, which carry their own unique tax implications. This interplay of life insurance with tax regulations highlights the importance of understanding tax deductions in the broader context of personal financial planning.

Are Life Insurance Premiums Tax Deductible?

A common question is: Is life insurance tax deductible? The answer, generally, is no. Life insurance premiums are not typically deductible on your personal tax returns. However, notable exceptions to this rule are particularly relevant in specific circumstances and for certain business arrangements.

Group Term Life Insurance Exceptions

One such exception involves group-term life insurance, commonly offered by small business owners. The IRS excludes the first $50,000 coverage under group-term life insurance policies. Suppose the total benefit of the policy does not exceed $50,000. In that case, the premiums paid by the business are not considered taxable income for the employees and can be deducted by the business. However, for coverage exceeding $50,000, the cost of the coverage is subject to Social Security and Medicare taxes and must be included in the employee’s income.

Life Insurance Donations to Charity

Another scenario where life insurance premiums may be tax deductible is when a policy is donated to a charitable organization. If you transfer ownership of your life insurance policy to a charity, the premiums you have paid and those paid after the transfer may be eligible for a tax deduction. It’s important to note that this deduction can vary depending on whether the premiums are paid directly to the insurance company or the charity.

162 Executive Bonus Plans

Business owners can also benefit from tax deductions through what are known as 162 Executive Bonus Plans. Under this arrangement, a business can deduct the premiums it pays for individual life insurance coverage on a key employee as long as the employee reports these premiums as taxable income.

Older Alimony Agreements and Life Insurance

There is a special consideration for older alimony agreements. In cases where life insurance is mandated as part of an alimony agreement made before 2019, the premiums may be deductible. This is due to the provisions of The Tax Cuts and Jobs Act, which changed the tax treatment of alimony-related expenses for agreements made in 2019 and later, eliminating the tax deduction for life insurance premiums under these newer agreements.

Are Life Insurance Death Benefits Taxable?

Generally, these death proceeds are exempt from income tax. If the policyholder passes away while the policy is active, beneficiaries can receive a payout not subject to income tax, providing them financial support and flexibility in using the funds. However, some nuances and exceptions to this general rule are important to understand.

Taxation on Death Benefits Paid by Installments

There could be tax implications if a beneficiary opts to receive the death benefits in installments rather than a lump sum. Specifically, any amount that exceeds the actual death proceeds may be subject to taxable income. This excess amount is often determined by the settlement option selected by the beneficiary. Beneficiaries must know this potential tax liability when deciding how to receive the death benefits.

Estate Taxes and Life Insurance Proceeds

Another consideration is the impact of estate taxes on life insurance proceeds. The IRS (Internal Revenue Service) sets a lifetime tax exemption limit on gifts and estates, adjusted annually for inflation. For the year 2024, the exemption limit is $13.61 million. Life insurance proceeds are included in the beneficiary’s taxable estate, which means if the total estate, including the life insurance payout, exceeds the remaining lifetime exclusion at the time of the policy owner’s death, the excess could be subject to estate tax. While different from income tax, this is an important aspect for beneficiaries to consider in their estate planning.

The Transfer-for-Value Rule

There’s also the transfer-for-value rule to consider. Some insurance policies allow the policy owner to sell their life insurance policy to another party in exchange for something of value, such as money or property. In these scenarios, a portion of the death benefit may become taxable as ordinary income unless it falls under specific exceptions. This rule underscores the need for policyholders to understand the tax implications of transferring their life insurance policies, as it can significantly affect the tax treatment of the death benefits.

How is Life Insurance Cash Value Taxed?

Permanent life insurance policies have a cash value component with unique tax implications. One key feature of this cash value is its tax-deferred growth within the policy. This means that as long as the cash value continues to grow within the confines of the policy, the policyholder does not incur any immediate tax liabilities on this growth.

However, the tax scenario changes once actions like surrendering the policy or withdrawing from the cash value are taken. In such cases, taxes become due on the interest earned on the cash value. This tax obligation arises because the interest represents income earned beyond the premiums paid into the policy.

When a policyholder partially surrenders their policy, the transaction is typically treated as a non-taxable recovery of the premiums paid initially. Taxes are only levied if the amount withdrawn exceeds the total investment in the policy up to that point. It’s important to note that this rule assumes the policy is not classified as a Modified Endowment Contract (MEC).

The tax rules for MECs differ significantly: for these contracts, distributions, including loans and partial surrenders, are taxed as income first, and then as a recovery of investment. Additionally, distributions from an MEC made before the age of 59 1/2 may incur a 10% penalty on the taxable portion of the proceeds. Despite these tax implications, it’s worth noting that, similar to non-MEC policies, the death benefits from MECs remain income tax-free.

For instance, consider a non-MEC whole-life policy with a $30,000 cash value. If you decide to withdraw this amount or surrender the policy, and you have paid $20,000 in premiums with $5,000 representing interest, taxes would be applicable only on the $10,000 interest portion. The initial $20,000, which means your premiums, would not be subjected to taxes. This distinction between the treatment of premiums and interest earnings is crucial for policyholders to understand when considering the tax implications of the cash value components of their life insurance policies.

Taxes and Life Insurance Cash Value

When dealing with the cash value of a life insurance policy, it’s important to understand the tax implications. Any gains on the cash value are subject to tax only upon withdrawal. This is one of the reasons why life insurance can be an effective tool for long-term financial planning.

When accessing the cash value, most withdrawals are typically tax-free, provided they do not exceed the total premiums paid into the policy. It’s important to understand that this favorable tax treatment applies only when withdrawals exceed the sum of premiums paid. Beyond this threshold, the additional amounts withdrawn are subject to taxation.

It’s crucial to remember that while these general tax rules apply to most life insurance policies, the diverse nature of life insurance means that different policies might have specific nuances and terms. Given the complexity and variation in policies, consulting with a knowledgeable professional is always advisable.

Whether it’s your plan administrator, life insurance agent, or financial planner, getting expert advice can help clarify the specific tax implications for your individual policy and ensure that you are making the most informed decisions about your life insurance and its cash value component.

Final Words

Is life insurance tax deductible? Navigating the tax implications of life insurance can be complex yet crucial for effective financial planning. This article aims to provide a comprehensive overview, clarifying the tax treatment of life insurance premiums, death benefits, and the cash value component. It’s important to remember that while general rules apply, life insurance policies vary, and specific circumstances may alter the tax implications. Therefore, consulting with financial experts for personalized advice is always beneficial.

For more insights into financial matters, including various aspects of life insurance and tax planning, we invite you to explore our blogs at Educounting. Our content is tailored to demystify complex financial topics, helping you make informed decisions for your financial well-being. Whether you’re looking to deepen your understanding or seeking practical advice, our resources are designed to guide you through the intricate world of finance. Visit Educounting for more enlightening and educational content.

FAQs

Is whole life insurance tax deductible?

No, premiums for whole life insurance are generally not tax deductible for individuals. However, there are exceptions, such as in certain business contexts where the premiums may be deductible.

Do you need to report life insurance on your taxes?

Life insurance death benefits are typically not reported on personal income taxes, as they are usually income tax-free. However, any interest accrued if receiving benefits in installments or if the estate is large enough to be taxable may need to be reported.

Can you write off life insurance on taxes?

In most cases, life insurance premiums cannot be written off on personal taxes. There are specific scenarios, like certain business-related policies, where premiums may be deductible.

What type of insurance is tax deductible?

Some types of insurance premiums, like health insurance for self-employed individuals, are tax deductible. However, life insurance premiums are usually not deductible, except in certain business situations or older alimony agreements.