In the dynamic business realm, understanding the “Primary Goal of Financial Management” is absolutely necessary. Financial management strategies and goals can make or break the fate of a company. This article aims to elucidate the concept, focusing on financial management’s primary goal for aspiring business leaders, finance students, or anyone who wishes to gain a comprehensive insight into this domain.

Financial management is a vast field with numerous concepts, principles, and objectives, each crucial in business growth and sustenance. Among them, one stands paramount—the primary goal of financial management. This seemingly simple goal is deep-rooted in every financial decision an organisation makes.

Understanding Financial Management

Financial management revolves around the strategic planning, executing, directing, monitoring, and controlling of financial activities within an organisation. It’s a specialised function directly associated with top management. Financial management has undergone significant transformations over the years, moving from a traditional approach to a modern approach focusing more on wealth maximisation.

The crux of financial management lies in its objectives—profit maximisation, wealth maximisation, ensuring proper flow of funds, and achieving financial stability. Understanding these objectives is integral to comprehending the essence of financial management and its role in achieving organisational goals.

What is Financial Management?

Financial management is a complex process that involves the administration of a company’s financial activities and resources. It focuses on managing finances to increase shareholder value and ensure long-term profitability. The scope of financial management includes investment, financing, and dividend decisions, each with its considerations and challenges.

Managing finances involves both a scientific and artistic approach. It’s a science because it involves systematic methods and techniques, while it’s an art because it requires judgment, skill, and acumen. A competent financial manager merges the scientific aspects of the field with the artful nuances, ensuring a balanced and effective approach to financial management.

Objectives of Financial Management

Financial management objectives aim to efficiently obtain and use funds. They are directed toward achieving the overall objectives of the organisation. Key objectives include ensuring a regular and adequate supply of funds, effectively utilising invested capital, and creating real and safe investment opportunities for investors.

Additionally, financial management is responsible for ensuring that the balance between risk and return is optimal. It also aims at ensuring fair returns to shareholders, contributing to the stability and growth of the company and creating a solid market presence.

Scope of Financial Management

In a world defined by financial dynamics and market volatility, understanding the scope of financial management becomes pivotal. Any organisation’s survival, growth, and profitability hinge on how well its financial resources are managed. The financial management process involves planning, budgeting, managing and assessing risk, and implementing specific procedures that guide the entire process.

Planning in Financial Management

Effective financial management is centered around the practice of financial planning. It is an ongoing process that involves formulating short-term and long-term financial objectives, developing comprehensive plans to achieve these goals, and regularly revisiting them to accommodate the ever-evolving market dynamics.

Financial planning helps businesses map their financial future, providing a clear direction for growth and expansion. It aids in efficiently allocating resources, ensuring that every financial decision, from investing in infrastructure to hiring new employees, aligns with the organisation’s strategic goals.

Budgeting: a Key Component of Financial Management

Budgeting is another critical facet of financial management. It provides a financial roadmap for businesses, guiding them in their expenditures and investments. By outlining the income and expenses over a specific period, a budget offers a clear snapshot of the company’s financial health and aids in making informed decisions.

Budgeting ensures financial discipline within the organisation, reducing wasteful spending and promoting the efficient use of resources. A well-crafted budget allows for performance evaluation, enabling managers to compare actual financial results with budgeted expectations and implement necessary adjustments.

Managing and Assessing Risk: The Safety Net of Financial Management

lNo business venture is devoid of risk, making risk management an indispensable part of financial literacy. It involves identifying potential financial risks, assessing their potential impact, and devising strategies to mitigate them.

Risk management is a proactive approach to protect the organisation from volatile market conditions, fluctuations in interest rates, and potential defaults on loans, among other financial risks. It entails diversifying investments, hedging against risks, and maintaining appropriate insurance covers to safeguard the organisation’s financial health.

Procedures: The Backbone of Financial Management

A set of established procedures and policies underpins financial management. The procedures ensure that the organisation’s financial activities comply with statutory requirements and internal controls.

Financial procedures involve establishing guidelines for budget preparation, investment evaluation, risk management strategies, financial reporting, and auditing processes. These procedures foster transparency, accountability, and efficiency in financial management, contributing to the overall financial stability of the organisation.

Capital Structure Decisions: Balancing Debt and Equity

Capital structure decisions play a pivotal role in financial management. The capital structure is critical as it affects a company’s profitability and risk level, impacting its valuation and shareholders’ return.

This balance between debt and equity requires a careful analysis of various factors such as market conditions, business risk, profitability, and the firm’s growth rate. Striking the right balance provides the company with financial flexibility and sustainability, even in challenging economic situations.

Financial Performance Evaluation: The Report Card of Financial Management

Evaluating financial performance is crucial in managing finances as it helps to understand the company’s financial condition and how efficiently it operates. This involves analysing financial statements, calculating key financial ratios, and comparing performance with industry peers and historical data.

Evaluating financial performance helps identify strengths, weaknesses, opportunities, and threats in a company’s financial strategy. It informs management about the effectiveness of their financial decisions and the areas that need improvement.

Furthermore, regular financial performance evaluation supports transparency and accountability. It provides crucial information to various stakeholders, including shareholders, investors, creditors, and regulatory agencies, about the company’s financial stability and growth potential.

The Primary Goal of Financial Management: Long-Term Financial Stability

In the world of business, financial management serves as the backbone of all operational and strategic decisions. It navigates a company’s journey toward its ultimate financial stability objective. But what does this entail, and why is it the primary goal of financial management? Let’s explore.

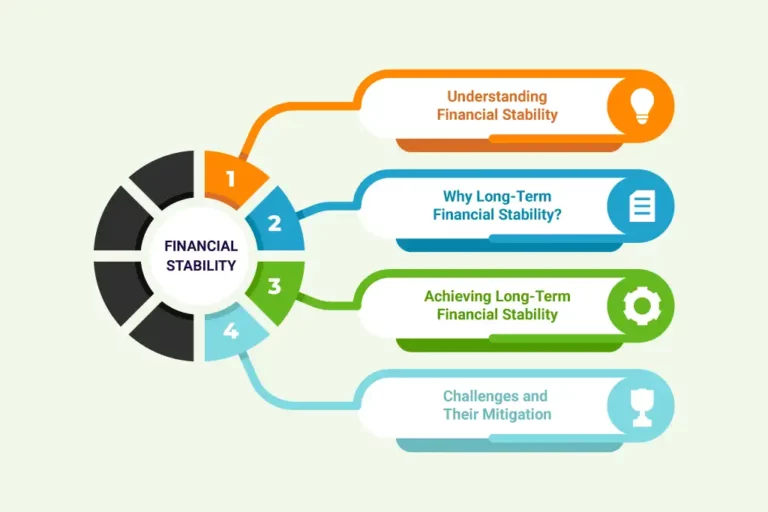

Understanding Financial Stability

Financial stability refers to a firm’s ability to consistently meet its financial obligations, sustain its operations, and invest in growth opportunities over a long period. It implies resilience to market fluctuations, economic downturns, and unexpected financial challenges. A financially stable company can effectively balance income generation with expense management, ensuring a healthy cash flow and profitability.

Why Long-Term Financial Stability?

While short-term profits are important, they don’t necessarily translate into long-term financial stability. A business may experience short-term gains, but without a solid financial strategy, these gains might be unsustainable in the long run. Therefore, the primary goal of financial management is to secure financial stability over an extended period, ensuring the firm’s survival, growth, and sustainability.

Achieving Long-Term Financial Stability

To attain long-term financial stability, several key strategies should be in place. These include maintaining a healthy capital structure, efficiently managing assets and liabilities, diversifying revenue streams, and maintaining an adequate reserve for contingencies.

Investing in profitable growth opportunities is also crucial. However, the rate and nature of growth should align with the organisation’s financial capacity to prevent any threat to its financial stability.

Challenges and Their Mitigation

Achieving long-term financial stability isn’t a walk in the park. It involves overcoming numerous challenges like market volatility, economic downturns, and financial risks. To navigate these obstacles, businesses must establish robust financial management systems, adapt to changing economic environments, manage risks effectively, and consistently strive for operational efficiency.

Strategies for Achieving Long-Term Financial Stability

Achieving long-term financial stability requires implementing sound financial management strategies. These include maintaining a strong capital structure, efficient management of assets and liabilities, diversifying revenue streams, and maintaining adequate reserves for contingencies.

Furthermore, investing in growth opportunities is also crucial. An organisation that is continually growing and expanding is more likely to achieve long-term financial stability. However, ensuring that the pace and nature of growth do not endanger the organisation’s financial stability is equally important.

Maintaining a Healthy Capital Structure

The first step towards long-term financial stability is maintaining a healthy capital structure – an optimal balance of debt and equity. Too much debt can strain a business’s cash flow and limit its flexibility, while over-reliance on equity can dilute ownership. Therefore, companies should carefully analyse their financial position and market conditions to decide the best mix of debt and equity.

Diversifying Revenue Streams

Placing all your eggs in one basket is a risk no business should take. Diversifying revenue streams is a crucial strategy that ensures financial stability. Diversification increases revenue and reduces the impact of any single revenue source’s potential downfall.

Effective Risk Management

Effective risk management is a proactive approach to identify potential financial threats, assess their impact, and devise strategies to mitigate them. This could include maintaining adequate insurance, diversifying investments, or adopting hedging strategies. An efficient risk management framework strengthens a firm’s ability to navigate uncertainties and attain financial stability.

Building Reserves

Reserves can help businesses withstand financial hardships during economic downturns without disrupting operations. They also provide the necessary funds for investment opportunities or unexpected expenses, contributing to the firm’s financial resilience.

Key Principles of Financial Management for Long-term Stability

Certain key financial management principles should have adhered to attain long-term stability. These include the principles of risk and return trade-off, maintaining a diverse investment portfolio, and practising sound cash management.

Moreover, the principle of transparency is fundamental to any financial management system. This includes maintaining transparent accounting and reporting practices to give stakeholders a clear picture of the organisation’s financial health.

Principle of Risk and Return Trade-off

Financial stability requires businesses to strike a balance between risk and return. Taking on too much risk can be detrimental, while taking on too little can prevent growth. Therefore, firms should analyse different opportunities and invest wisely.

Principle of Efficient Financial Planning

Efficient financial planning is paramount for long-term financial stability. It involves forecasting financial needs, budgeting resources, and setting financial goals. A well-formulated financial plan guides financial decision-making, helping to allocate resources effectively and prepare for future financial challenges.

Principle of Sustainable Growth Rate

Sustainable growth is a principle that emphasizes maintaining a growth rate that the firm can support without resorting to excessive borrowing or overextending its capabilities. Adhering to this principle ensures a business expands at a pace consistent with its financial capacity, thereby promoting long-term stability.

Principle of Profit Maximization

Profit maximisation, while a fundamental business goal, should be pursued with a long-term perspective. Short-term profit maximisation can compromise long-term stability, especially if it involves high-risk strategies or neglects customer satisfaction or corporate social responsibility. Thus, financial management should strive for sustainable profitability that aligns with the firm’s long-term objectives.

Turning Challenges Into Opportunities: a Guide to Achieving Long-term Financial Stability

Achieving long-term financial stability is a complex journey, fraught with numerous challenges. These hurdles can impede a company’s financial growth and stability if not properly managed.

Managing Market Volatility

Market volatility is a significant challenge that can destabilise businesses financially. Fluctuations in interest rates, currency values, and commodity prices can all adversely impact a company’s financial health. Therefore, monitoring market conditions and developing strategies to manage volatility is essential.

Ensuring Compliance with Regulations

In an era of increasing regulation, staying compliant can be challenging. Non-compliance can lead to hefty penalties and reputational damage and threaten a company’s survival. Businesses must, therefore, establish robust compliance procedures, stay abreast of regulatory changes, and ensure that all financial practices align with the relevant laws and regulations.

Adapting to Technological Changes

The rapid pace of technological change presents both a challenge and an opportunity. Companies that fail to adapt risk being left behind, while those that embrace it can gain a competitive advantage. Businesses should continually invest in technology to automate financial processes, enhance financial analysis, and improve decision-making.

Maintaining Financial Discipline

Maintaining financial discipline is crucial for long-term financial stability but can be challenging. It involves managing expenses, limiting debt, building reserves, and adhering to the budget. To foster financial discipline, companies need to cultivate a culture of financial responsibility, regularly review financial performance, and hold all stakeholders accountable for financial decisions.

Frequently Asked Questions (FAQ)

What is managing finances?

Managing finances involves planning, organising, controlling, and monitoring financial resources to achieve objectives. It includes budgeting, risk management, forecasting, and investing.

What is a financial management role?

The role of financial management is to plan for, obtain, and manage the company’s capital. It includes making decisions about investments and dividends, managing cash flow, and assessing the organisation’s financial performance.

What are the key strategies of financial management?

Key financial management strategies include efficient resource allocation, effective risk management, maintaining a strong capital structure, and ensuring long-term financial stability.

What are the key components of financial management?

Critical components of financial management include financial planning, financial control, financial decision-making, and risk management.

How does financial management impact the decision-making process?

Financial management provides the data and analysis needed for making informed business decisions. It helps assess the financial implications of various strategic choices and facilitates decision-making.

Conclusion

The “Primary Goal of Financial Management” – long-term financial stability, although complex, is fundamental to the success of any organisation. It lays the foundation for sustainable growth and prosperity. Understanding and implementing sound financial management principles and strategies is essential for any business to thrive in the competitive market landscape. Ultimately, financial management is about making strategic decisions today that will ensure the organization’s financial stability.

Here at EduCounting, we are dedicated to empowering people with the essential knowledge to understand and manage finances effectively. As you embark on your financial journey, we extend our wholehearted support and best wishes for a prosperous future!