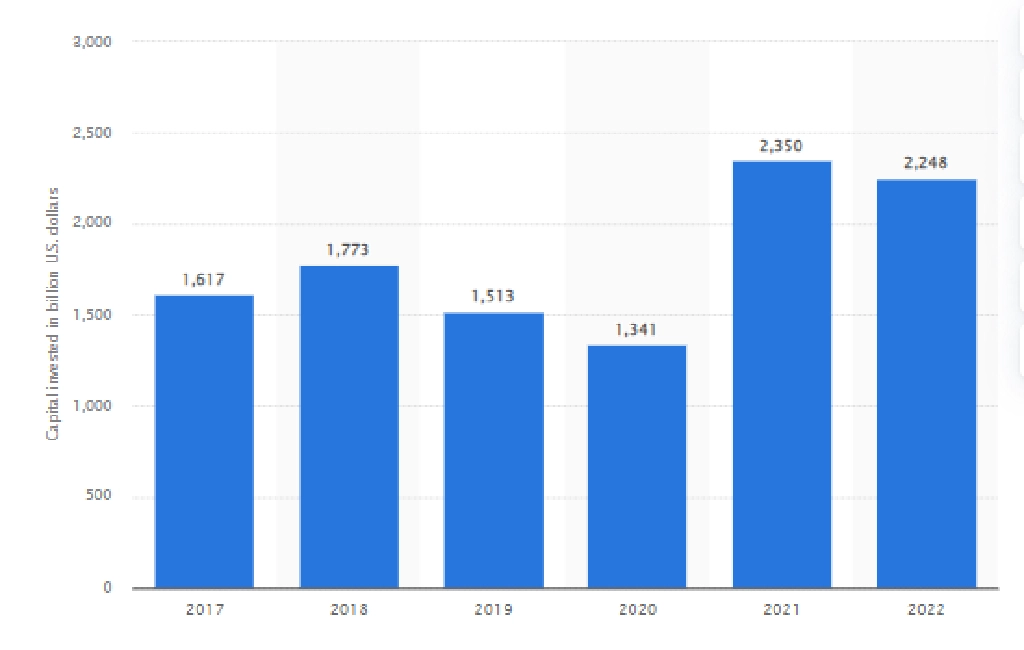

From 2017 to 2022, the global investment in private equity experienced growth, albeit with certain variances. A notable dip was seen in 2020, with investments totaling approximately USD 1,341 billion. By 2022, this figure surged to its zenith, reaching a noteworthy USD 2,248 billion.

In the vast world of finance and investments, you may often hear the term “equity investments”. What Are Equity Investments? Are they different from regular investments? This article will comprehensively address all these queries and provide an understanding of the intricate world of equity investments.

What is Equity?

Equity represents ownership in any asset after all debts associated with that asset are cleared off. In the context of a business, it signifies the residual interest in the assets of the entity after deducting liabilities. Equity represents the value that would be returned to a company’s shareholders if all assets were liquidated and all debts repaid.

Equity investment offers the potential for substantial returns in a dynamic market setting. While the possibility of quick gains is appealing, it’s essential to remember that a significant degree of risk is involved. For those looking to dive into equity investment, it’s advisable to consult a financial expert or a brokerage firm to ensure seamless transactions. Such transactions, which involve buying and selling shares, occur on the stock exchange.

What Are Different Types of Investment Securities?

Investments play a pivotal role when it comes to growing your wealth and securing your financial future . With the vast array of investment options available today, it can be daunting to understand which one fits your financial goals, risk tolerance, and time horizon best. At the core of these investment options lie three primary types of securities – Equity Stakes, Debt Securities, and Money Market Securities.

Equity Stakes

Equity stakes represent an investor’s ownership in a company or venture. When you buy shares or stocks of a company, you are purchasing a piece of the company’s equity, making you a shareholder. The value of these shares can fluctuate based on various factors, such as the company’s financial health, market demand, and overall economic conditions.

One of the most significant benefits of equity investments is the potential for high returns, especially in the long run. On the downside, equities tend to be more volatile, meaning they can experience sharp price swings upwards and downwards in shorter time frames.

Debt Securities

Unlike equity stakes, where you’re buying a piece of the company, debt securities mean you’re lending money to the issuer, which could be a company, municipality, or government. Bonds are a classic example of this. In return for your loan, the issuer agrees to pay you periodic interest and to return the principal amount at a specified maturity date.

The primary advantage of debt securities is that they usually offer more stable and predictable returns than equities. They also provide a steady stream of income through interest payments. However, the potential for capital appreciation is often lower than that of equities.

Money Market Securities

Money market securities are short-term, highly liquid assets considered relatively safe. These can include Treasury bills, commercial paper, and certificates of deposit. Given their short-term nature, investors often use money market securities as a temporary holding place for funds, offering a better return than a traditional savings account but with minimal risk.

They are a popular choice for investors looking for a short-term parking place for their funds without exposing them to significant volatility. However, the returns on money market securities are typically lower than those on longer-term assets, such as bonds or stocks.

What are Popular Investment Strategies?

Navigating the world of investments can be intricate. With many choices available, selecting the right strategy becomes essential to align with one’s financial goals. Understanding and employing the best-suited investment strategy can be the difference between growing wealth and facing unnecessary financial risks. Here, we outline seven popular investment strategies investors consider, shedding light on their dynamics and potential benefits.

#1 – Passive and Active Strategies

Passive investing is often termed as a ‘buy and hold’ strategy. It involves building and maintaining a portfolio over time, regardless of market fluctuations. Typically, passive investors will purchase index funds that mirror the performance of a particular market segment, aiming for long-term gains with minimal buying and selling.

On the other hand, active investing requires a hands-on approach. Investors frequently buy and sell assets to outperform the market or a particular benchmark. Its strategy demands continuous monitoring, analysis, and decision-making based on market trends.

#2 – Growth Investing (Short-Term and Long-Term Investments)

Growth investing targets assets that show potential for significant returns. These could be company shares that might not pay dividends but are expected to grow substantially. Investors often focus on emerging industries or innovative companies.

It can be categorized into short-term and long-term strategies. While short-term growth investors may seek quick gains in months or even weeks, long-term growth investors are in for the extended haul, believing in the prolonged growth trajectory of their chosen investments.

#3 – Value Investing

Rooted in the teachings of Benjamin Graham and David Dodd, value investing is about finding undervalued stocks and holding them until the market recognizes their worth. Investors hunt for stocks trading for less than their intrinsic values.

The approach requires patience and a keen understanding of fundamental analysis. While it might mean waiting out periods of undervaluation, the potential returns can be substantial when the market corrects itself.

#4 – Income Investing

For those prioritizing regular income streams, income investing is the go-to strategy. Assets chosen under this method, such as bonds or dividend-paying stocks, provide returns in the form of interest or dividends.

Such investments might offer little capital appreciation but are considered stable and reliable. They’re particularly popular among retirees or those nearing retirement, aiming for consistent income without eroding their principal.

#5 – Dividend Growth Investing

This strategy zeroes in on companies that pay dividends and consistently increase them. Dividend growth investing is a subset of both growth and income investing, focusing on the compound growth potential of rising dividends over time.

While the immediate yields might not be sky-high, the continuous growth of dividends can result in attractive long-term returns. It’s a strategy that marries income generation with capital appreciation.

#6 – Contrarian Investing

As the name suggests, contrarian investing is about going against the current market trends. When everyone is buying, contrarian investors are selling, and vice versa.

It’s a bold approach rooted in the belief that the majority of investors can overreact to news, whether good or bad. Contrarians aim to capitalize on these market overreactions by taking the opposite stance, buying undervalued assets or selling overvalued ones.

#7 – Indexing

Indexing is a passive strategy wherein investors buy a representative benchmark, like the S&P 500 index. The idea is not to outperform the market but to mirror its performance.

It’s a cost-effective strategy due to index funds’ typically low expense ratios. Indexing can be an ideal strategy for those who believe in the efficient market hypothesis, which posits that stock prices always incorporate and reflect all relevant information.

What Are Equity Investments? Why Should I Consider Equities?

Equities represent an ownership interest in a company, which means as the company grows and profits, so does your investment. The allure of wealth enhancement drives investments, aiming to augment an investor’s funds over an extended period. Hence, capital appreciation and dividend yields stand out as primary motivators for delving into equities.

Stocks provide dividends and potential interest, typically distributed annually. Investors can augment their holdings when stock prices seem attractive or liquidate them during price surges. When a firm looks to raise its capital, current shareholders can further their gains by opting for the right stocks.

While equity investments have the potential for impressive returns in a shorter time frame, they also come with exposure to market volatility, making them inherently risky. Yet, with guidance from seasoned financial experts, this avenue becomes an enticing proposition for those eyeing long-term financial growth.

What are the Potential Benefits of Equity Investments?

Equity investments, often a cornerstone in many investors’ portfolios, offer a range of advantages that make them appealing. Whether you’re a seasoned investor or just starting, understanding these benefits can help shape your investment strategies and expectations. Let’s delve into some of the prominent benefits of investing in equities.

Risk Spread

One of the standout advantages of equity investments is the opportunity for diversification. Investors can spread their risk by holding stocks from different sectors or regions. This means that even if one sector or stock underperforms, the performance of others might offset the losses, potentially stabilizing the overall portfolio.

Easy to Transfer

Equities, especially those listed on major stock exchanges, are highly liquid assets. This means they can be easily sold or bought, providing investors with flexibility. The ease of transfer makes it convenient for investors to restructure their portfolios when necessary, adapting to changing financial goals or market conditions.

Dividends and Interests

Equities can offer two primary sources of returns: capital appreciation and dividends. While the former is tied to the stock’s price movement, dividends are periodic company payments to their shareholders. Not only do they provide a regular income stream for investors, but they also signify the company’s financial health and profitability.

Profitability

Historically, equities have provided one of the highest returns over the long run compared to other asset classes. Despite the inherent market volatility, the potential for significant capital gains is a compelling reason many investors are drawn to the stock market. With the right strategies and patience, equity investments can considerably grow wealth.

Easy to Monitor

In today’s digital age, monitoring equity investments has always been challenging. With numerous platforms, apps, and online brokerage services, investors can track the performance of their holdings in real-time. This accessibility allows them to make informed decisions quickly based on current market data and trends.

What are Equity Securities?

Equity securities, commonly known as “stocks” or “shares,” represent ownership in a corporation. When investors purchase these securities, they essentially acquire a piece of the company, becoming its shareholders. This ownership stake entitles them to a fraction of the company’s assets and earnings proportional to the amount of stock they hold.

The primary allure of equity securities lies in the potential for capital appreciation. As the company grows and becomes more profitable, the value of its stock can increase, offering investors the opportunity to sell their shares at a higher price than their purchase point. This capital growth and the possibility of dividend payments make equity securities an attractive investment option for many.

However, it’s worth noting that with ownership comes risk. Equity securities do not guarantee returns. If a company underperforms or faces financial distress, the value of its stock can decrease. Thus, while the potential for high returns is present, so is the potential for significant losses. This dynamic nature of equity securities makes thorough research and understanding of the market crucial for investors.

What are Debt Securities?

Debt securities represent a debt or a borrowed sum of money that a company or government body owes to the security holders. Unlike equity securities, which signify ownership, debt securities are more akin to a loan made by the investor to the issuer. In return, the issuer promises to repay the principal amount on a specified maturity date and often agrees to make periodic interest payments, commonly referred to as the “coupon.”

The allure of debt securities, such as bonds or debentures, stems from their predictable income stream and relative safety. Typically, they offer fixed interest payments at regular intervals, which can provide a steady cash flow to investors. This predictability and stability make them particularly appealing to conservative investors or those seeking to balance out riskier assets in their portfolios.

However, it’s essential to note that debt securities are generally considered safer than equities but are not without risks. Interest rate fluctuations, credit risk of the issuer, and inflation can impact the returns from these securities. Nonetheless, with appropriate due diligence, they can serve as a vital tool for diversification and wealth preservation in an investor’s arsenal.

Which is the Better One?

Both equity and debt securities have their advantages and risks. The choice depends on individual investment goals, risk tolerance, and market conditions.

Choosing between equity and debt securities is akin to comparing apples to oranges—both have unique attributes and potential advantages, depending on an investor’s objectives and risk tolerance. Equity securities like stocks typically come with higher potential returns, driven by company performance and overall market dynamics. They provide investors with a piece of the company’s future growth but expose them to its setbacks, making them inherently volatile.

Debt securities, on the other hand, offer more predictability and are generally considered less risky than equities. Bonds and similar instruments provide regular interest payments and return the principal upon maturity. However, the trade-off for this stability is often lower potential returns compared to equities.

In reality, neither is universally “better” than the other. The optimal choice hinges on individual preferences, investment goals, risk appetite, and the time horizon. For many, a balanced portfolio containing both equity and debt securities offers a harmonized approach, blending growth prospects with stability.

Equity Financing and Risks

Equity financing, where companies raise capital by selling shares, presents numerous opportunities for growth and returns. However, it is not devoid of risks. By understanding these potential pitfalls, investors can make more informed decisions and craft strategies to mitigate their exposures.

Credit Risk

Credit risk, often linked with debt securities, can also be relevant in equity investments. It pertains to the possibility that the company in which one has invested faces financial difficulties, impacting its ability to continue operations or grow. A company’s declining creditworthiness can severely depress its stock price.

Liquidity Risk

Liquidity risk refers to the possibility that an investor might be unable to quickly buy or sell shares without causing a significant price movement. Particularly for stocks of smaller companies or those not traded on major exchanges, there might be few buyers or sellers at any given time.

Foreign Currency Risk

The foreign currency risk becomes relevant for those investing in equities of companies based overseas or in multinational corporations with significant foreign operations. Fluctuations in currency exchange rates can significantly affect the value of the investment when converted back to the investor’s home currency.

Economic Concentration Risk

Investors heavily concentrating their equity investments in a single sector or industry expose themselves to economic concentration risk. If that particular sector faces a downturn, it could lead to significant losses, underscoring the importance of diversification.

Inflation Risk

Inflation erodes the purchasing power of money over time. If the returns on an equity investment don’t outpace inflation, the real value or purchasing power of the invested capital and any returns may diminish, even if the nominal value looks positive.

Political Risk

Political events, changes in government policies, or geopolitical tensions can also influence equities. Companies operating in regions with political instability or frequent regulatory shifts might affect their stock prices as investors perceive increased uncertainties.

Expert Tips for Investing

Navigating the world of investments can be challenging, especially given the inherent risks and vast array of options available. To maximize returns and safeguard your capital, consider these fundamental tips as guiding principles for your investment journey:

Diversify Your Portfolio

Don’t put all your eggs in one basket” is sage advice in investment. By spreading your investments across various asset classes, sectors, or geographical regions, you can mitigate the impact of a poor-performing segment. Diversification is a key strategy to help cushion against unforeseen market downturns.

Stay Informed and Updated

The financial landscape is ever-evolving, influenced by global events, policy changes, and technological innovations. Staying updated on market news, trends, and economic indicators is crucial to make informed decisions. Regularly reading financial news, attending webinars, or even using investment apps can keep you in the loop.

Understand Your Risk Tolerance

Every individual has a different appetite for risk, influenced by age, financial goals, and personal circumstances. It’s essential to introspect and determine how much risk you will take. Whether you’re risk-averse or open to taking investment gambles, aligning your investments with your risk profile is crucial.

Invest in What You Know

One of the golden rules of investing is understanding where you’re putting your money. If you’re considering investing in a company, understand its business model, industry dynamics, and potential challenges. Investing in familiar sectors or companies can offer a sense of confidence and reduce the chances of unpleasant surprises.

Review and Rebalance Your Portfolio Regularly

Over time, market movements can shift the weight of your portfolio, making some investments more dominant than initially intended. Regular reviews can help identify these imbalances. By rebalancing, you realign your portfolio to your desired asset allocation, ensuring it reflects your current investment strategy and risk appetite.

FAQs

What are examples of equities?

Equities represent ownership in a business, and they come in various forms. Common examples include:

- Common Stocks: These are the most typical forms of equities investors buy. Owners of common stocks may get dividends and have voting rights in the company.

- Preferred Stocks: Owners of preferred stocks receive dividends before common stockholders and have a higher claim on company assets in the event of liquidation. However, they usually don’t have voting rights.

- Convertible Stocks: These types of preferred stock can be converted into common stock.

- Employee Stock Options (ESOs): These grant employees the right to buy a certain amount of company shares at a predetermined price.

- Stock Warrants: Similar to options, they give the holder the right to purchase shares at a specific price within a set timeframe.

Are equities the same as stocks?

Yes, the terms “equities” and “stocks” are used interchangeably in most contexts. Both refer to a stake of ownership in a company. However, it’s worth noting that “equity” can have a broader meaning in finance, referring to the amount of ownership after debts and liabilities have been subtracted from assets. For example, home equity refers to the value of a homeowner’s interest in their property after subtracting the outstanding mortgage.

Is it risky to invest in equity?

Investing in equities does come with inherent risks. Stock prices fluctuate based on a myriad of factors, including company performance, market trends, global economic conditions, and geopolitical events. While equities have historically provided higher returns than other asset classes over the long term, there’s no guarantee of returns, and it’s possible to lose a significant portion or even the entirety of the invested capital. As with any investment, it’s essential to conduct thorough research, understand one’s own risk tolerance, and, ideally, consult with financial professionals before making equity investments.

Final Words: What are Equity Investments?

Equity investments are more than just buying and selling shares; they represent an avenue to potentially achieve financial growth and to be a part of a company’s journey. These investments, however, come with challenges, and the ever-evolving financial landscape can sometimes be daunting.

This is where EduCounting steps in. As a beacon of financial education, EduCounting offers insightful blogs that demystify the complex world of finance, ensuring you are always informed and empowered.

If you’re keen on diving deeper and enhancing your financial literacy, EduCounting offers courses designed to equip you with the knowledge and skills required to navigate the investment world with confidence. From understanding the basics to mastering advanced strategies, these courses cater to learners at all levels.

While the world of equity investments can seem complex, you can chart a path to informed and successful investing with the right resources, like those provided by EduCounting. So, equip yourself, stay curious, and remember that investing is a step towards a brighter financial future.