Ever looked at your paycheck and felt a pang of confusion—or even panic—wondering, “Where did all my money go?” You’re not alone. For many employees, the numbers on that stub just don’t seem to add up. One moment, you’re expecting a full salary, and the next, a noticeable chunk is missing before taxes even enter the picture. What’s going on?

The answer lies in something called pre-tax deductions—those stealthy subtractions that happen before your paycheck gets taxed. But don’t worry, these aren’t your enemies. In fact, they can be your best financial allies. Pre-tax deductions include things like retirement contributions, health insurance premiums, and savings accounts for medical expenses. They lower your taxable income, which means less money going to the government and more staying in your pocket—or better yet, going toward your future.

Think of them as a smart financial strategy built right into your paycheck. Once you understand how they work, you’ll stop dreading that paycheck breakdown and start seeing it as a road map to savings. This guide will walk you through everything you need to know about pre-tax deductions, with real-life examples to show how they can work for you. Let’s dive in.

What Are Pre-Tax Deductions and Contributions?

Pre-tax deductions are amounts taken from your paycheck before taxes are calculated. By reducing your taxable income, they can lower the amount of income tax you owe—leaving more money in your pocket. These deductions are often used for benefits like retirement contributions, health insurance premiums, and flexible spending accounts (FSAs).

Let’s break it down: say you earn $60,000 a month. If you contribute $5,000 to a 401(k) retirement plan, you’re only taxed on $55,000. That $5,000 goes straight into your retirement savings—tax-deferred—and you pay less tax now. It’s like giving your future self a raise while easing your current tax burden.

Pre-tax deductions aren’t just about savings—they’re about smart planning. They help you prepare for future expenses (like healthcare or retirement) and stretch your income further today. Whether it’s setting aside money for medical needs through an FSA, or funding a secure retirement, these contributions are a powerful way to boost your financial well-being.

Bottom line: understanding and using pre-tax deductions can help you save money now and build a stronger financial foundation for later. It’s a win-win for your present and your future.

Common Types of Pre-Tax Deductions and Contributions

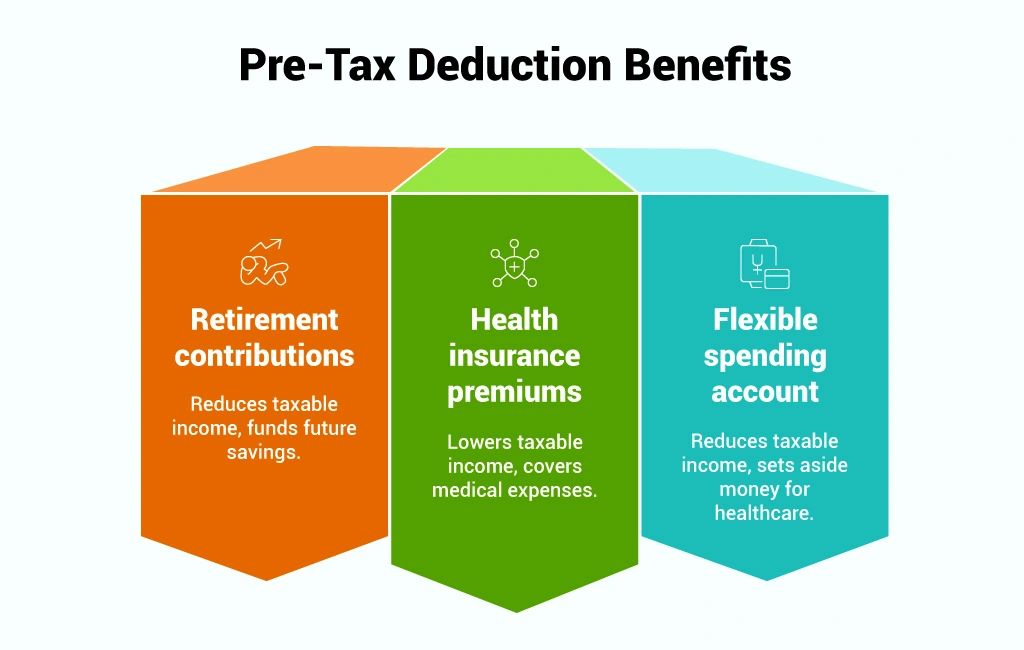

Pre-tax deductions can significantly lower your taxable income and boost your savings. Here’s a quick look at the most common types:

1. Retirement Contributions

Retirement plans like a 401(k) or 403(b) let you stash away money before it’s taxed. Say you earn $60,000 a month and put $5,000 into your 401(k)—you’re only taxed on $55,000. It’s a smart way to save for the future while trimming your tax bill today.

2. Health Insurance Premiums

Most employer-sponsored health insurance premiums—medical, dental, and vision—are pre-tax. This means your contributions come out of your paycheck before taxes, lowering your taxable income and making healthcare a bit more affordable.

3. Flexible Spending Accounts (FSAs)

FSAs let you set aside pre-tax money for out-of-pocket medical expenses. If you put $2,000 a month into an FSA, that money avoids income tax. It’s especially useful for planned healthcare needs like prescriptions or doctor visits.

4. Health Savings Accounts (HSAs)

HSAs work similarly but are tied to high-deductible health plans. Contributions are pre-tax, and withdrawals for medical expenses are tax-free. Plus, unused funds roll over year to year—making them a great long-term tool.

5. Commuter Benefits

If your employer offers it, you can use pre-tax money for things like public transit passes or parking fees. It’s a small perk that can lead to meaningful savings if you commute regularly.

These pre-tax deductions not only reduce how much tax you owe but also help you plan for future expenses, making them a valuable part of any paycheck.

The Financial Impact of Pre-Tax Deductions

Pre-tax deductions might seem like just another line on your paycheck, but they quietly do a lot of heavy lifting for your finances. When money is taken out of your salary before taxes are calculated, your taxable income drops—and that means you owe less in federal (and often state) income taxes. In simple terms: you keep more of what you earn.

Let’s break it down. Imagine you make $60,000 a year. If you contribute $5,000 to a pre-tax retirement plan like a 401(k), your taxable income drops to $55,000. You’re not only saving for your future—you’re also reducing how much the IRS takes out of your pocket today.

But it’s not just employees who benefit. Employers save too. When pre-tax deductions lower taxable wages, businesses owe less in payroll taxes like Social Security and Medicare. So the system creates a little win-win scenario: you save money, and so does your employer.

Plus, pre-tax options can make high-cost benefits—like health insurance—more affordable, since you’re paying for them with untaxed dollars. That can mean big savings over time, especially when paired with tools like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs).

In short, pre-tax deductions don’t just shrink your paycheck—they also shrink your tax bill and boost your long-term financial game. They’re one of the easiest ways to take control of your money without lifting a finger.

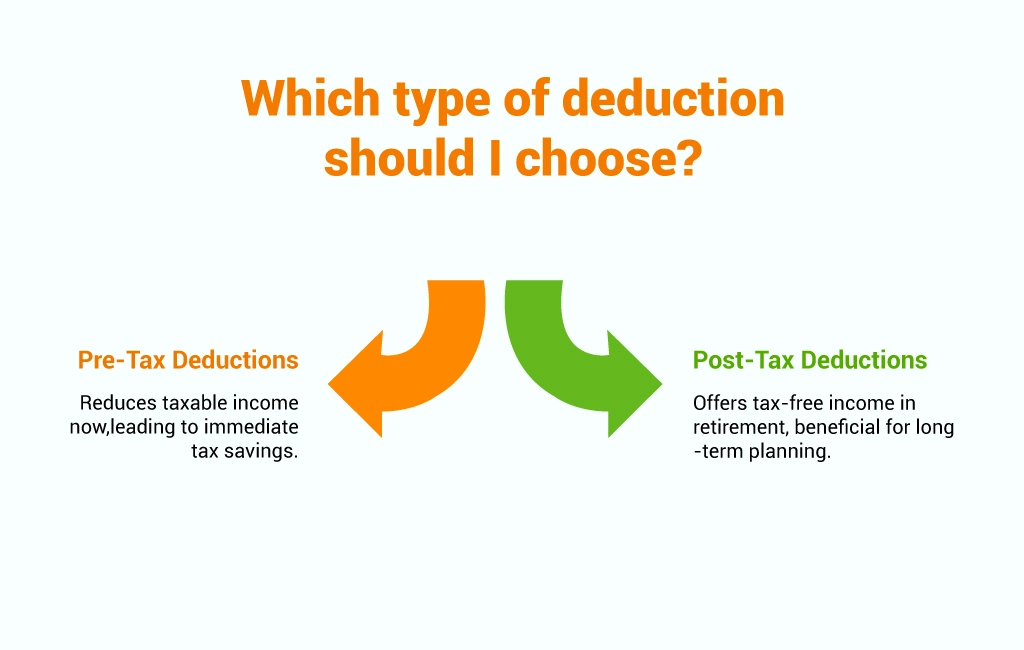

Pre-Tax vs. Post-Tax Deductions: What’s the Difference and Why It Matters

When it comes to your paycheck, not all deductions are created equal. Understanding the difference between pre-tax and post-tax deductions can help you make smarter financial decisions—and keep more money in your pocket.

Let’s break it down.

Pre-tax deductions are taken from your earnings before taxes are calculated. This means they lower your taxable income, which can reduce the amount of tax you owe. Think of it as a legal way to shrink your tax bill while investing in your future. Common examples include contributions to a traditional 401(k), health insurance premiums, Health Savings Accounts (HSAs), and Flexible Spending Accounts (FSAs). These deductions can lead to significant tax savings and increase your take-home pay.

On the other hand, post-tax deductions are taken after taxes have been applied to your income. These don’t reduce your taxable income, but they can still be valuable, depending on your financial goals. A great example is the Roth IRA. You contribute with money that’s already been taxed, but the payoff comes later—qualified withdrawals in retirement are completely tax-free. Other post-tax deductions might include life insurance premiums, union dues, or charitable contributions deducted directly from your paycheck.

So, which is better? It depends on your personal financial goals and timeline. If you’re looking to reduce your taxable income now, pre-tax options might be the way to go. If you’re planning for tax-free income in retirement, post-tax options like the Roth IRA could be your friend.

Understanding the timing and tax treatment of these deductions can empower you to build a more strategic, tax-efficient financial plan—today and for the long haul.

Employer and Employee Responsibilities: A Shared Duty

When it comes to pre-tax deductions, it’s not a one-person show. Both employers and employees have a role to play to ensure everything runs smoothly—and legally.

Employers, you’re the backstage crew making sure the financial machinery works without a hitch. Your responsibilities go beyond just issuing paychecks. You must accurately calculate and withhold pre-tax deductions, administer benefit programs correctly, and stay on top of compliance with federal and state tax regulations. A misstep here could not only lead to tax penalties but also erode employee trust. Transparency is key—clearly communicating available pre-tax benefits during onboarding and open enrollment helps employees make better decisions.

Now, employees, you’re not off the hook either. Just because deductions are handled by payroll doesn’t mean you can snooze through benefit selections. Understanding what each pre-tax option means—and how it impacts your take-home pay—is crucial. For instance, choosing to contribute to a 401(k) or enrolling in a Health Savings Account (HSA) could lower your taxable income and increase your financial security. But it also means slightly smaller paychecks in the short term. That’s a trade-off worth understanding.

And don’t forget, your needs change. A new baby? A change in health plans? Reviewing your benefits annually ensures your choices stay aligned with your financial goals and life circumstances.

In short, pre-tax deductions work best when employers are diligent and employees are engaged. It’s a team effort that pays off—literally—in the form of tax savings and long-term financial wellness.

Maximizing the Benefits of Pre-Tax Contributions

If you’re not taking full advantage of pre-tax planning, you’re leaving money on the table. These deductions aren’t just financial jargon—they’re smart strategies to keep more of your hard-earned cash and plan for the future.

Start by participating in employer-sponsored plans. Contributions to retirement accounts like a 401(k) or 403(b) are tax-deferred, meaning the money goes in before taxes are taken out. This reduces your taxable income today, while building a financial cushion for tomorrow. Some employers even offer matching contributions, which is essentially free money. Don’t pass that up.

Next, take advantage of Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs). Both allow you to use pre-tax dollars for healthcare expenses. FSAs are great if you know you’ll have regular medical costs, from prescriptions to copays. HSAs, designed for those with high-deductible health plans, offer a triple tax advantage: contributions are pre-tax, the money grows tax-free, and withdrawals for qualified medical expenses are tax-free too.

Lastly, review your benefits annually, especially during open enrollment. Life changes—marriage, a new baby, or even a promotion—can affect your financial needs. Reassessing your pre-tax contributions each year ensures your benefits match your current situation and goals.

In short, using pre-tax contributions wisely helps you lower your tax bill, boost your savings, and stay financially prepared. A few smart choices today can lead to a much more comfortable tomorrow.

How Pre-Tax Deductions Reduce Taxable Income

Pre-tax deductions are like secret savings hacks hidden in your paycheck. When your employer deducts certain contributions—like those for retirement plans or health insurance—before taxes are calculated, it reduces your gross income. That means the amount the government uses to figure out how much tax you owe is smaller.

Here’s how it works: say you earn $60,000 a year. If you contribute $5,000 to a pre-tax retirement plan like a 401(k), your new taxable income becomes $55,000. Instead of paying taxes on the full $60,000, you’re taxed on a reduced amount. That lower number can save you a nice chunk of change at tax time.

The more you contribute to eligible pre-tax benefits, the more your taxable income shrinks—within legal limits, of course. Over time, this can lead to significant tax savings while also helping you build long-term financial security. It’s a win-win: less money to the taxman now, more money for your future.

Think of pre-tax deductions as a financial power move. With smart planning, they let you keep more of what you earn and invest it where it counts most—your health, retirement, and peace of mind.

Conclusion: Empowering Your Financial Future

When it comes to your paycheck, knowledge truly is power. Understanding how pre-tax deductions and contributions work isn’t just financial trivia—it’s a tool that can significantly boost your bottom line. These deductions reduce your taxable income, which means you pay less in taxes and get to keep more of what you earn. Think of them as hidden allies, quietly working behind the scenes to improve your financial future.

By taking advantage of employer-sponsored benefits like 401(k) contributions, health insurance premiums, FSAs, HSAs, and commuter perks, you’re not only saving money today—you’re setting yourself up for a more secure tomorrow. These smart moves help you prepare for emergencies, retirement, and unexpected expenses without sacrificing your current quality of life.

Don’t let valuable benefits go unused. Make it a habit to review your options during open enrollment and adjust your choices as your life and goals evolve. Whether you’re just starting your career or approaching retirement, using pre-tax deductions wisely can be a game-changer.

At the end of the day, it’s not just about how much you make—it’s about how much you keep and what you do with it. Take control. Make informed choices. Your future self will thank you.