If you don’t pay your student loans, they become delinquent, your credit score may drop, and interest continues to grow. Continued nonpayment can lead to default, collections, wage garnishment, tax refund seizures, and legal action. Federal student loans have more repayment protections than private loans, but neither type disappears if ignored.

Student loans help millions of people pay for college, but repayment doesn’t always go as planned. Job loss, medical expenses, or rising living costs can make monthly payments difficult to manage. This leads many borrowers to ask the same urgent question: what happens if you don’t pay your student loans?

The consequences of unpaid student loans can grow over time, especially if the loans are ignored. Whether you’re dealing with federal or private loans, understanding what happens when you don’t pay student loans can help you avoid long-term financial damage and make smarter decisions early.

What Happens If You Miss a Student Loan Payment?

If you miss a student loan payment, the loan becomes delinquent. Delinquency begins the day after your payment is due and remains until the payment is made or another arrangement is approved.

At first, the effects are relatively mild. Interest continues to accrue, and you may be charged late fees. After about 30 days, the missed payment is typically reported to credit bureaus, which can lower your credit score.

Many borrowers ask, “What happens if you miss a student loan payment once?” A single missed payment is unlikely to cause default, but repeated missed payments can quickly lead to more serious consequences.

What Happens When You Don’t Pay Student Loans for Months?

If you don’t pay your student loans for several months, the situation escalates. Your loan remains delinquent, and lenders may begin contacting you more frequently through phone calls, emails, and letters.

During this period:

- Your credit score continues to decline

- Late fees and interest increase your balance

- Collection efforts may begin

Borrowers often ask, “What happens if I stop paying my student loans?” The longer payments are missed, the closer the loan gets to default.

What Happens If You Default on a Student Loan?

Default occurs when delinquency lasts too long. For federal student loans, default typically happens after 270 days of nonpayment. Private student loans may default much sooner, sometimes after just 90 to 120 days.

Once a loan is in default:

- The full balance may become due immediately

- Your credit report shows a default status

- Collection agencies may take over the debt

- You lose access to flexible repayment plans

A common exam-style question is: Which of the following is not true if you default on a student loan? One thing that is not true is the idea that default makes the loan disappear. Student loan debt does not go away simply because you stop paying.

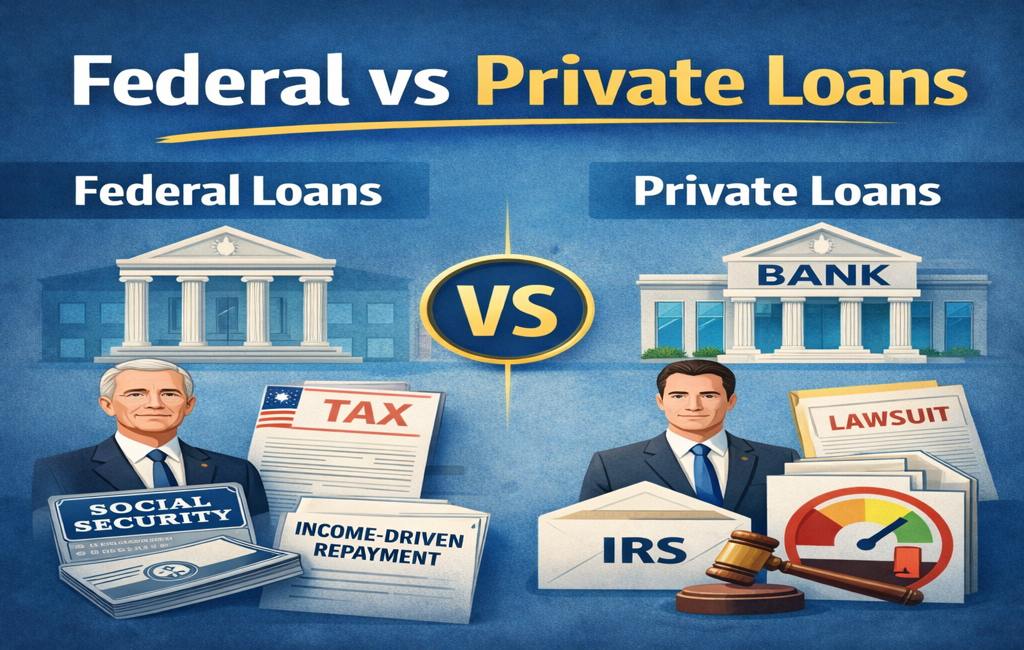

Federal vs Private Loans: How Punishments Differ

How Does the Punishment for Late Payment of Student Loans Differ Between Federal and Private Loans?

The penalties for nonpayment depend heavily on whether your loans are federal or private.

Federal student loans offer more borrower protections, including:

- Income-driven repayment plans

- Deferment and forbearance options

- Loan rehabilitation after default

However, if you don’t pay federal student loans, the government has powerful collection tools. It can garnish wages, seize tax refunds, and withhold Social Security benefits — often without a court order.

Private student loans, on the other hand, have fewer protections. Lenders may:

- Declare default more quickly

- Send the debt to collections

- File a lawsuit to recover the balance

This difference is critical when considering what happens if you don’t pay federal student loans versus private ones.

What Happens If You Never Pay Student Loans?

Many borrowers wonder, “What happens if I never pay my student loans?” The reality is harsh.

Federal student loans generally have no statute of limitations, meaning the debt can follow you for life. Even decades later, the government can still attempt to collect.

If you never pay:

- Credit damage can last for years

- Wages may be garnished

- Tax refunds may be seized

- Social Security benefits can be reduced

Private student loans may have a statute of limitations, but lenders can still sue you before it expires. Ignoring the debt rarely leads to a good outcome.

What Happens If You Can’t Pay Your Student Loans?

If you can’t pay your student loans due to financial hardship, you are not alone. Many borrowers face temporary or long-term difficulties, which is why options exist to help.

Instead of ignoring payments, borrowers should explore:

- Income-driven repayment plans for federal loans

- Deferment or forbearance during hardship

- Loan consolidation to simplify payments

- Negotiation or settlement options for private loans

Asking “what happens if I can’t pay my student loans?” early gives you more flexibility and reduces long-term damage.

What Happens If You Don’t Pay College Debt?

Student loans are different from other types of college-related debt. If you don’t pay tuition or fees owed directly to a school:

- Transcripts may be withheld

- Enrollment may be blocked

- Accounts may be sent to collections

However, student loan debt carries stronger collection powers, especially for federal loans. This makes it more important to address unpaid student loans promptly.

Long-Term Effects of Not Paying Student Loans

When people ask what happens if you don’t pay back student loans, they often focus on short-term issues. Long-term consequences can be even more damaging.

Unpaid student loans can affect:

- Your ability to buy a home or a car

- Approval for credit cards or personal loans

- Employment opportunities that involve credit checks

- Financial security well into retirement

The longer loans go unpaid, the harder they are to resolve.

Final Thoughts

If you’re asking what happens if you don’t pay your student loans, the most important thing to understand is that the consequences worsen over time. Missing payments doesn’t make student loans disappear, but early action can protect your credit, income, and financial future.

If you don’t pay your student loans, they become delinquent and may eventually go into default. This can result in credit damage, collections, wage garnishment, and loss of repayment options.

Missing a payment can lead to late fees and credit score damage after about 30 days. Continued missed payments increase the risk of default.

Federal student loans do not expire, and unpaid balances can follow you for life. Private loans may result in lawsuits and long-term credit damage.

Final Thoughts