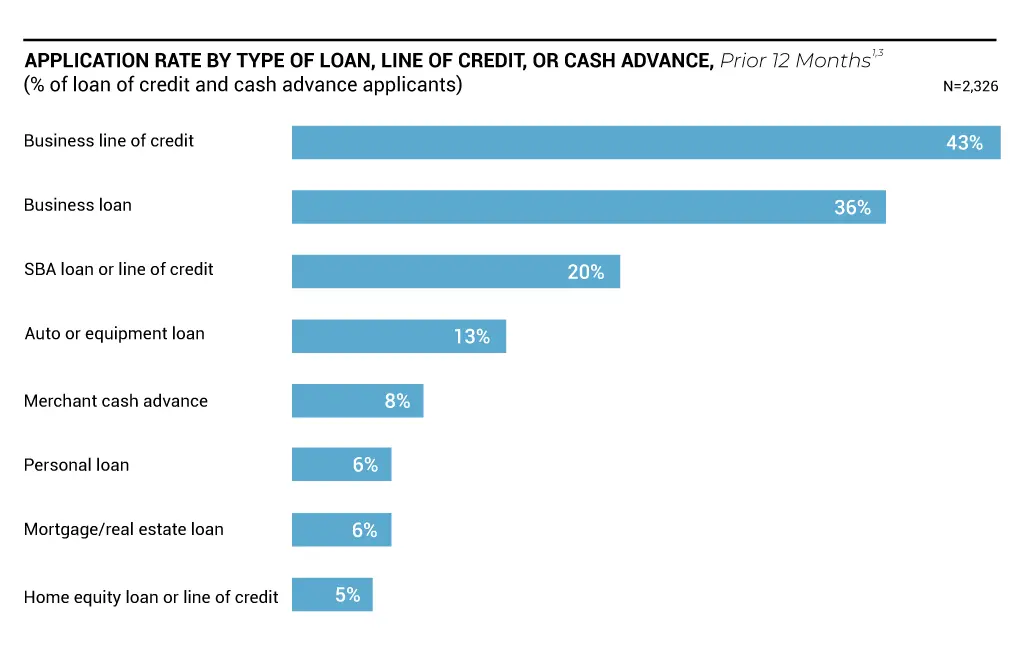

Access to reliable financing is essential for small business success, and lines of credit have emerged as the top choice for American entrepreneurs. According to the Federal Reserve Banks’ 2023 Small Business Credit Survey, lines of credit accounted for 43% of all financing applications, making them the most sought-after funding option. This data underscores the growing reliance on flexible, accessible financial solutions that empower businesses to manage cash flow, seize opportunities, and navigate challenges with ease.

The popularity of lines of credit is no surprise, given their unique advantages. Unlike traditional loans, which provide a lump sum, a line of credit allows businesses to borrow as needed, offering unparalleled flexibility. Whether it’s for covering operational expenses, purchasing inventory, or handling seasonal fluctuations, a business line of credit is a dynamic tool that adapts to the ever-changing needs of entrepreneurs. In this article, we’ll explore what is a business line of credit, how it works, and how it can help your business thrive.

What is a Business Line of Credit?

A Business Line of Credit is a flexible financial tool that allows businesses to borrow funds up to a predetermined limit whenever needed. It works much like a business credit card, where you can withdraw money, repay it, and then access it again. Unlike a traditional loan, where funds are disbursed as a lump sum, a business line of credit provides continuous access to credit, making it an ideal solution for covering short-term expenses or managing cash flow fluctuations.

One of the most significant advantages of a business line of credit is its revolving nature. As you repay the borrowed amount, your credit limit is replenished, allowing you to reuse it for future expenses. This feature makes it a versatile financing option for businesses that need recurring access to funds for inventory purchases, payroll, or other operational needs. Interest is charged only on the amount borrowed, making it a cost-effective choice compared to other loan types.

Funds from a business line of credit are usually accessible through various channels, such as a business checking account, mobile app, or card. This accessibility ensures that businesses can quickly address unexpected expenses, such as equipment repairs or seasonal revenue fluctuations. If you’re wondering, what is a line of credit for a business, it’s essentially a financial safety net that offers flexibility and convenience for both planned and unplanned expenses.

Unlike term loans with fixed repayment schedules and lump-sum disbursements, business lines of credit offer unmatched flexibility in borrowing and repaying funds. Whether used to bridge gaps in cash flow or support growth opportunities, a business line of credit is a vital resource for businesses looking to remain agile in a competitive market.

How Does a Business Line of Credit Work?

A Business Line of Credit provides businesses with quick access to funds, often in smaller amounts than traditional loans. One of its key advantages is the expedited funding process, especially when working with online lenders. Online platforms can often deliver funds within one or two business days, making it an ideal choice for urgent financial needs. While reliable, traditional banks and credit unions may take longer to process and disburse funds, which can affect time-sensitive business operations.

This financing option is particularly suited for short-term needs, such as managing inventory purchases, addressing seasonal cash flow gaps, or covering unforeseen operational expenses. The line of credit process typically includes applying through a lender, providing financial documentation, and receiving approval for a specific credit limit. Repayment terms vary by lender and can range from a few weeks to several years, offering businesses the flexibility to choose repayment schedules that fit their financial situation.

Interest rates for business lines of credit are generally higher than those of traditional loans, reflecting the flexibility and associated risks. Factors like credit history, time in business, and annual revenue significantly influence the rates offered. Businesses with strong credit histories, longer operational tenure, and higher annual revenue are more likely to secure favorable terms, while newer or financially weaker businesses may face higher rates.

Types of Business Lines of Credit

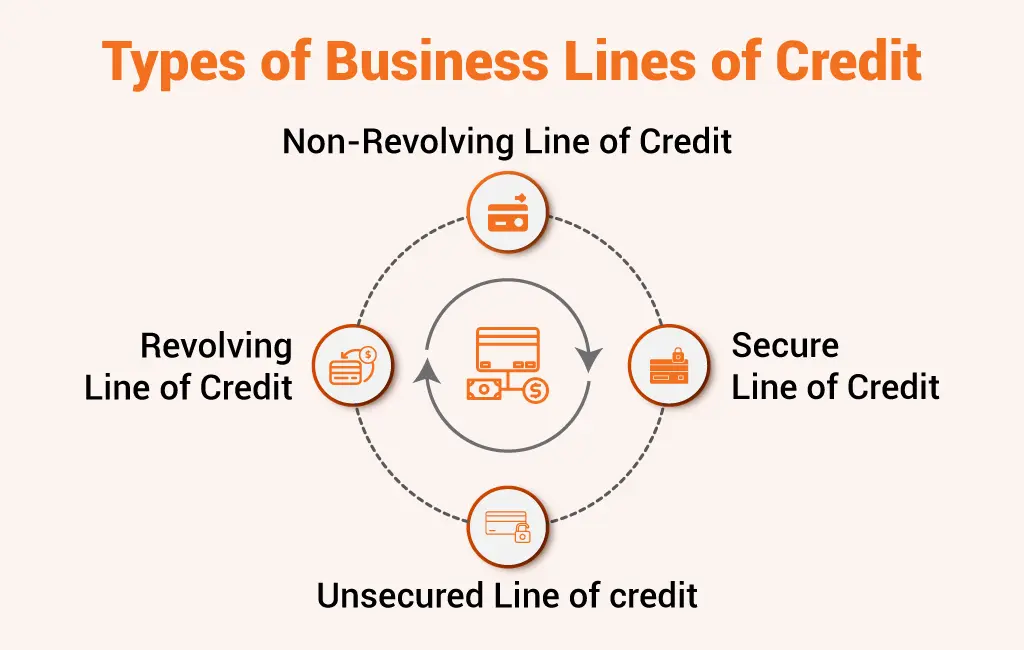

When exploring financing options, businesses often encounter various types of lines of credit that cater to different needs. Understanding these options helps businesses select the most suitable one for their financial goals. Below are the primary types of business lines of credit, each offering unique benefits and considerations.

Secured Line of Credit

A secured line of credit requires businesses to provide collateral, such as inventory, equipment, or property, to secure the loan. Since the lender has an asset to fall back on, this type of credit often comes with higher borrowing limits and lower interest rates. Secured lines of credit are an excellent choice for businesses that might not have a strong credit score but can offer valuable collateral. However, borrowers must be cautious, as defaulting on payments could result in losing the pledged assets.

Unsecured Line of Credit

Unlike a secured line, an unsecured line of credit does not require collateral, making it a more accessible option for businesses that lack substantial assets. However, because the lender assumes a higher risk, unsecured lines typically have smaller credit limits and higher interest rates. Approval for an unsecured line of credit heavily depends on the business’s creditworthiness, revenue, and financial history. Established companies with strong credit profiles are more likely to qualify for this type of credit.

Revolving Line of Credit

A revolving line of credit offers businesses the flexibility to borrow, repay, and borrow again up to a pre-approved limit. It functions similarly to a credit card, where the available credit replenishes as the borrowed amount is repaid. This type of credit is particularly beneficial for managing fluctuating cash flow or recurring expenses. Businesses don’t need to reapply every time they need funds, making it a convenient solution for ongoing financial needs.

Non-Revolving Line of Credit

In contrast, a non-revolving line of credit provides a fixed amount of funds that can be accessed only once. Once the funds are utilized and repaid, the credit line is closed, and borrowers must apply for a new line if additional funds are needed.

Non-revolving credit is ideal for businesses that need a specific amount for one-time expenses, such as a significant purchase or a unique investment opportunity. While it lacks the flexibility of a revolving line, it offers stability and predictability for targeted financial needs.

Where to Get a Business Line of Credit

If you’re wondering where to find business credit, there are several reliable options available, each catering to different needs and financial situations. Whether you prefer working with traditional institutions or exploring more modern alternatives, finding the right lender can significantly impact your business’s financial flexibility. Below are some of the most common places to secure a business line of credit.

Banks or Credit Unions

Traditional banks and credit unions remain popular for obtaining a business line of credit. They typically offer competitive interest rates and favorable repayment terms for businesses that meet their rigorous eligibility criteria. These lenders often require a strong credit history, proof of steady revenue, and at least a few years of operational experience. Additionally, businesses may need to provide collateral to secure the funds.

Online Lenders

Online lenders have emerged as a fast and flexible alternative to traditional financial institutions. Their streamlined application processes allow businesses to access funds quickly, often within a few days. These lenders are also more lenient when it comes to qualifications, making them an excellent choice for startups or businesses with less-than-perfect credit histories.

U.S. Small Business Administration (SBA)

The U.S. Small Business Administration provides another viable option for businesses seeking a line of credit. Through the SBA CAPLines program, businesses can access revolving lines of credit with limits as high as $5 million and repayment terms extending up to ten years. These lines of credit are designed to support short-term financial needs, such as covering seasonal expenses or managing cash flow gaps.

Secured vs. Unsecured Lines of Credit

When exploring what is a business line of credit, it’s important to understand the two primary types: secured and unsecured. Each option has its own benefits and considerations, depending on your business’s financial situation and risk tolerance.

Secured Line of Credit

To back the loan, a secured line of credit requires collateral, such as real estate, equipment, or cash reserves. Collateral serves as a safety net for the lender, reducing their risk in case the borrower defaults. Because of this, lenders are often willing to offer better terms, such as lower interest rates and higher credit limits, to businesses opting for secured lines of credit.

A secured line of credit can be an ideal choice for businesses with limited credit history or those seeking larger funding amounts. However, failing to repay the loan could result in the loss of the pledged assets, making it essential for businesses to manage repayment responsibly.

Unsecured Line of Credit

An unsecured line of credit does not require collateral, making it an appealing option for businesses that lack valuable assets to offer as security. Instead, approval for this type of credit is based on the strength of your business’s financial profile, including your credit score, annual revenue, and time in business.

While unsecured lines of credit eliminate the risk of losing assets, they often come with higher interest rates and stricter approval criteria. Some lenders may also require a personal guarantee or lien on your business assets to mitigate risk. This means that while collateral isn’t required upfront, failure to repay could still impact your business’s finances and credit score.

Steps to Secure a Business Line of Credit

Securing a business line of credit is a powerful way to ensure your business has financial flexibility when needed. By understanding what is a business line of credit and following these steps, you can position your business for approval and favorable terms.

Step 1: Understand Your Financial Needs

To make the most of a business line of credit, it’s crucial to evaluate your exact financial requirements. Are you addressing short-term cash flow gaps, purchasing inventory, or funding new marketing campaigns? Knowing what is a business line of credit and how it aligns with your goals will help you decide between a secured business line of credit for higher funding needs or an unsecured option for smaller expenses.

Step 2: Identify Key Factors Influencing Credit Approval

Lenders assess various factors to determine whether your business qualifies for a credit line. They consider creditworthiness, revenue, and time in business. Understanding a business line of credit means recognizing how these criteria shape the terms offered.

Step 3: Explore Lender Options

A strong application is critical to securing a business line of credit. Ensure you have all necessary documents, such as tax returns, profit and loss statements, and a detailed business plan. If applying for a secured business line of credit, include information about the collateral offered.

Step 4: Prepare a Comprehensive Application

A strong application is critical to securing a business line of credit. Ensure you have all necessary documents, such as tax returns, profit and loss statements, and a detailed business plan. If applying for a secured business line of credit, include information about the collateral offered.

Step 5: Submit Your Application and Negotiate Terms

Consider factors such as fixed or variable interest rates, repayment schedules, draw periods, and additional fees when negotiating. Being clear about what is a business line of credit and how you’ll use it ensures you negotiate terms that align with your goals and cash flow projections.

Tips on How to Use a Business Line of Credit Effectively

Knowing what is a business line of credit is only the first step. To fully leverage this financing tool, businesses need to use it strategically. Below are actionable tips to help you use a business line of credit effectively while keeping costs manageable and ensuring long-term financial health.

1. Plan Your Withdrawals Strategically

A business line of credit offers flexibility, but that doesn’t mean you should withdraw funds without a plan. Always align your withdrawals with specific business needs, such as covering seasonal cash flow gaps, purchasing inventory, or funding urgent operational expenses. By understanding how much of the credit line to use, you can avoid over-borrowing and reduce the interest burden. Use only what is necessary to keep your business running smoothly without adding unnecessary debt.

2. Factor in Associated Fees

Understanding what is a business line of credit also involves being aware of the associated costs. Many lenders impose fees, including annual maintenance fees, draw fees, or origination charges. Before withdrawing funds, calculate the total cost, including fees, to ensure the expense aligns with your budget. Factoring in these costs can help you use the credit line more efficiently and avoid unpleasant surprises.

3. Monitor Interest Rates

Interest rates for business lines of credit can vary depending on whether they are fixed or variable. Knowing your specific rate and how it affects your repayments is crucial. If you’re unclear about the details, ask your lender for clarification. By understanding what is a business line of credit interest rate and how it applies to your account, you can make smarter borrowing decisions and minimize overall costs.

4. Always Make On-Time Payments

Timely repayments are critical to maintaining a healthy credit score and ensuring the availability of funds for future needs. Late payments can result in penalties, increased interest rates, or even a reduction in your credit limit. If you’re using a business line of credit, prioritize payments as part of your financial strategy to avoid damaging your creditworthiness.

Consider Increasing Your Credit Limit When Necessary

As your business grows, your existing credit line is insufficient for larger projects or expanded operations. If your financial health supports it, request an increase in your credit limit. Lenders are more likely to approve increases for businesses that have demonstrated responsible credit use.

Pros and Cons of a Business Line of Credit

It’s equally important to weigh the line of credit pros and cons before deciding if this financial tool is right for your business. A business line of credit offers flexibility but requires careful management to avoid potential pitfalls.

Pros of a Business Line of Credit

Flexible Access to Funds: A business line of credit allows businesses to withdraw only the funds they need, as needed. This flexibility helps manage cash flow, seize growth opportunities, and address unexpected expenses without the constraints of rigid loan terms.

Interest Savings: Interest is charged only on the portion of credit used, unlike traditional loans that accrue interest on the full amount. This saves money, especially when credit is used wisely.

Improved Lender Relationships: Regular use and repayment of a business line of credit can strengthen your relationship with the lender. It allows them to understand your financial needs better, potentially leading to tailored financial solutions.

Boosts Credit Score: Proper management of a business line of credit can improve your credit history and score. Timely repayments demonstrate financial responsibility and enhance future financing opportunities.

Lower Interest Rates: Business lines of credit typically have lower interest rates than credit cards or personal loans, making them a cost-effective option for short-term financial needs.

Cons of a Business Line of Credit

Complex Application Process: Securing a business line of credit often involves detailed documentation, such as tax returns and financial statements, which can be challenging for newer businesses.

Additional Fees: Origination, maintenance, and draw fees associated with a business line of credit can accumulate over time, adding to the overall cost.

Risk of Over-Borrowing: Easy access to funds can lead to over-borrowing, increasing debt, and repayment challenges. Responsible financial management is crucial to avoid falling into a debt cycle.

Alternatives to Business Lines of Credit

If a business line of credit doesn’t align with your requirements, there are several alternative lines of credit to consider. Below are some popular alternatives, each catering to specific business needs.

Business Credit Card

A business credit card functions much like a personal credit card but is designed for business expenses. It offers flexibility and rewards, such as cashback or travel points, making it a convenient alternative to a business line of credit. For smaller, recurring expenses or quick purchases, a credit card provides an accessible financing option with clear repayment terms. However, it’s important to manage balances responsibly to avoid high-interest charges.

Invoice Factoring

Invoice factoring allows businesses to sell unpaid invoices to a third-party company in exchange for immediate cash. This option is ideal for businesses dealing with delayed payments from clients. Unlike what is a business line of credit, invoice factoring doesn’t require borrowing; instead, it converts your accounts receivable into cash. However, factoring companies charge fees, which can eat into your profits.

Merchant Cash Advance

A merchant cash advance provides businesses with a lump sum of cash in exchange for a percentage of future sales. This alternative is particularly useful for businesses with consistent credit card sales. While it offers quick access to funds, it often comes with higher fees and repayment rates than what is a business line of credit, making it crucial to assess affordability before opting for this solution.

Grants

Grants are non-repayable funds provided by governments, organizations, or institutions to support businesses. Unlike what is a business line of credit, grants are free of interest or repayment obligations. They are typically awarded for specific purposes, such as research, innovation, or community impact. However, the application process can be competitive and time-intensive, requiring detailed proposals and qualifications.

Crowdfunding

Crowdfunding involves raising small amounts of money from a large group of people, often through online platforms. It’s an innovative way to secure funding for new projects or business expansions without taking on debt. Unlike what is a business line of credit, crowdfunding allows businesses to connect directly with their audience, often offering rewards or equity in exchange for contributions. However, success depends on effective marketing and outreach.

Final Words

A Business Line of Credit is a powerful financial tool, offering flexibility and control to manage business finances effectively. Whether you’re addressing short-term cash flow gaps or preparing for future opportunities, understanding what is a business line of credit and using it wisely can provide significant benefits. By choosing the right type, source, and usage strategy, you can ensure that this financial option supports your business’s growth and stability.

At EduCounting, we aim to equip businesses with the financial knowledge needed to make informed decisions. Explore more resources to understand your financing options better and empower your business for the future!