Understanding the various electronic funds transfer methods is crucial in today’s digital banking world. One such method is ACH credit, a term frequently encountered but only sometimes fully understood.

In 2023, the volume of B2B payments processed via the Automated Clearing House (ACH) network increased by 4.80% compared to the previous year, reaching 31.45 billion transactions and an aggregate value of $80.1 trillion.

So, what is ACH credit?

This question is essential for anyone looking to streamline their financial transactions, whether for personal use or business operations. ACH credit transactions are a cornerstone of the Automated Clearing House (ACH) network, facilitating efficient and secure money transfers between bank accounts in the United States.

This blog will discuss the meaning and functionality of ACH credit, offering a comprehensive overview of how it works, its benefits, and its common uses. We’ll also explore the differences between ACH credit and ACH debit, provide guidance on setting up ACH credit transactions, and discuss the associated fees and security measures.

What is ACH Credit?

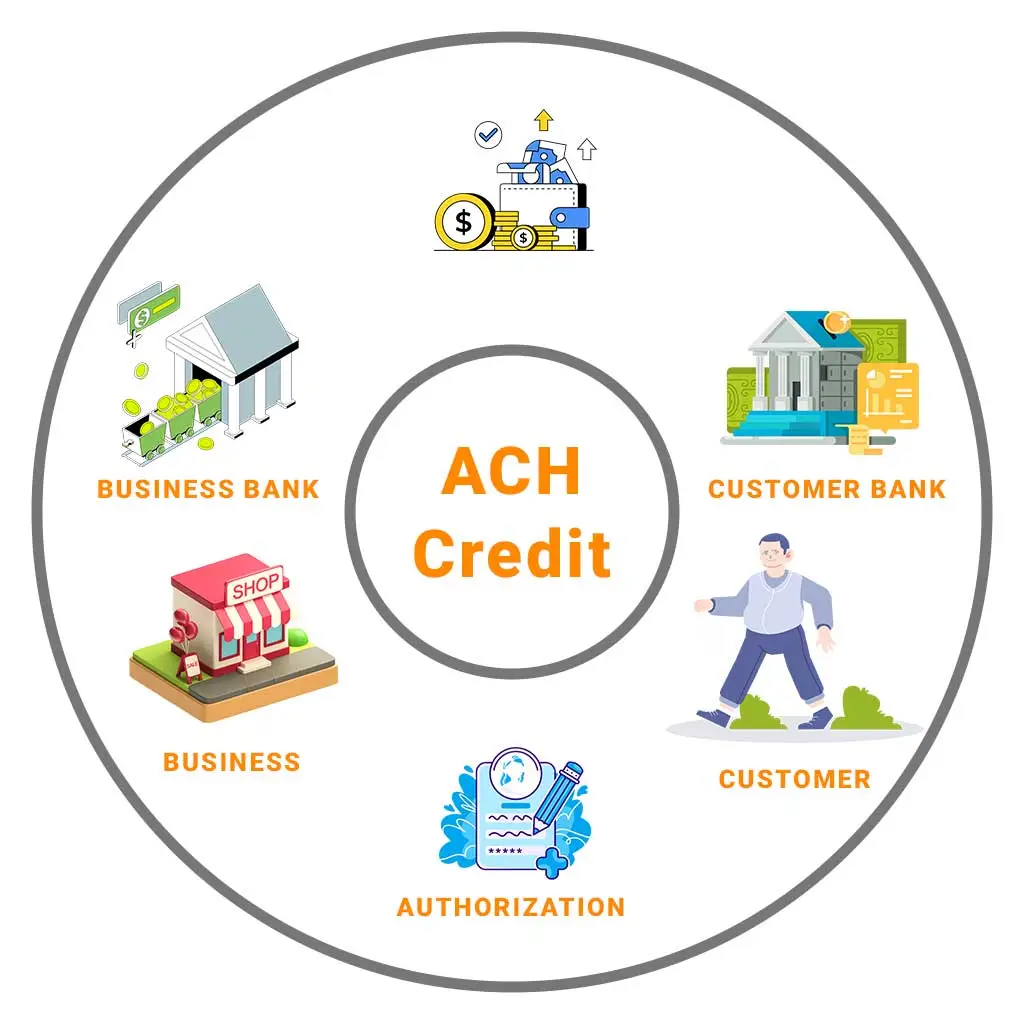

ACH Credit Meaning refers to a type of electronic funds transfer where payments are “pushed” from one bank account to another through the Automated Clearing House Network (ACH network). Unlike other types of transactions, ACH credits are initiated by the sender, who authorizes their bank to transfer a specific amount to the recipient’s account. This process is commonly used for a variety of financial transactions due to its efficiency and reliability.

What is ACH credit? An ACH credit is a push transaction. This means that the person or entity making the payment actively sends, or “pushes,” the money from their bank account into another individual’s or organization’s account. This is different from a pull transaction, where the recipient pulls money from the payer’s account. The push mechanism ensures that the sender has control over the timing and amount of the transfer.

A common use of ACH credits is in payroll processing. Employers use ACH credits to pay their employees by electronically depositing salaries directly into their checking or savings accounts. This method is convenient and ensures timely payments, reducing reliance on paper checks and manual deposits.

ACH credits are not limited to payroll transactions. They are also used to distribute government benefits, such as Social Security payments, tax refunds, and other types of refunds. Additionally, services like Venmo and PayPal utilize ACH credits to transfer funds between accounts, providing a seamless and efficient way to handle transactions.

The versatility of ACH credits extends to various other financial activities. For instance, businesses use ACH credits to pay vendors and suppliers promptly and securely. This method of payment is also favored for its cost-effectiveness compared to traditional wire transfers.

ACH credit is a powerful tool in electronic banking, offering a secure, efficient, and reliable way to transfer funds. Understanding ACH credit and its applications can help individuals and businesses optimize their financial operations, ensuring smooth and timely transactions across a wide range of needs.

How Do ACH Credits Work?

ACH credits work by moving money electronically through a series of steps involving initiation, batch processing, breakdown and rebuilding, execution, settlement, and finally, the release of funds. This efficient and secure method of transferring money ensures that funds reach their intended recipients promptly, providing a reliable alternative to traditional paper checks. As we get an idea of what is ACH credit, now let’s look into how it works.

So, how does ACH credit work? The process is akin to a digital version of writing and cashing a paper check. Instead of filling out a physical check, the payer instructs the ACH network to transfer funds directly between bank accounts. Here’s a detailed look at the mechanics behind ACH credits:

Initiation

The payer, or their processing partner, begins by providing all necessary details to the Originating Depository Financial Institution (ODFI). This includes the payee’s account information, the amount to be sent, a categorization code, and the target settlement date. The ODFI is typically a bank or another financial institution approved to handle such transactions.

Batch Processing

The ODFI collects and submits these requests to the ACH network in periodic batches. This batching process helps streamline the transfer of numerous transactions, making it efficient and manageable. These batches are sent out multiple times throughout the business day to ensure timely processing.

Breakdown and Rebundling

Upon receiving the batches, the ACH network dissects them into individual messages, each representing a specific transaction. These messages are then bundled into new batches that are sorted according to the Receiving Depository Financial Institution (RDFI), which holds the payee’s account. This process ensures that each transaction reaches the correct destination promptly.

Execution and Error Handling

The RDFI imports the incoming batches and executes the transactions based on the specified processing window. If there are any issues, such as incorrect account details, the RDFI sends back error codes with their next regular batch. These error messages help the ODFI identify and rectify problems swiftly, ensuring smooth processing for future transactions.

Settlement

If no error or ACH return code is received by the requested settlement time, the ODFI and RDFI proceed to settle the transaction using their balances at the Federal Reserve. This step is crucial as it officially transfers the funds from the payer’s account to the payee’s account, making the transaction final.

Funds Release

Once the transaction is settled, the RDFI releases the funds to the payee’s account. The entire process typically takes about two business days, although same-day processing is available for an additional fee. The timing depends on when the initial messages are sent and the specific processing windows involved.

Benefits of Using ACH Credit

There are numerous ACH credit benefits that make it a preferred method for transferring funds. These include:

1. Cost-Effective Compared to Traditional Methods

One of the primary benefits of ACH payments is the lower cost associated with processing transactions. Unlike checks and credit cards, which can incur high fees for both parties, ACH payments typically come with minimal transaction fees. Understanding what is ACH credit helps highlight how these savings are passed on to both businesses and consumers, making it an attractive option for reducing expenses.

2. Enhanced Security Measures

ACH payments are highly secure, employing encryption and various authentication methods to protect sensitive financial information. When asking what is ACH credit, it’s important to note that these security measures ensure that both customers and sellers can trust the process, reducing the risk of fraud and unauthorized transactions. The rigorous security protocols make ACH payments a reliable option for safely transferring funds.

3. Superior Convenience for Customers

For customers, ACH payments offer a high level of convenience. They can set up recurring payments, such as for subscriptions or bills, without manually initiating each transaction. This automated process answers the question what is ACH credit by showcasing how it saves time and effort, making it easier for customers to manage their finances and ensure timely payments without the hassle of writing checks or visiting a bank.

4. Streamlined Processes for Sellers

Sellers also benefit from the convenience of ACH payments. The automated nature of these transactions reduces the need for manual processing, freeing up time and resources that can be better spent on other aspects of the business. Knowing what is ACH credit helps businesses understand how setting up and managing ACH payments can streamline their payment processes, enhancing overall efficiency.

5. Higher Reliability with Fewer Failures

ACH payments are known for their reliability, with less frequent payment failures compared to other methods. The structured and automated system of ACH transactions reduces the likelihood of errors and missed payments, ensuring that funds are transferred smoothly and on time. This reliability is a crucial aspect of what is ACH credit, benefiting both customers and sellers by providing a consistent and dependable payment method.

Common Uses of ACH Credit

By utilizing ACH credits for these varied transactions, both individuals and businesses can benefit from the efficiency, security, and reliability this payment method offers. ACH use credit card (or, debit card) transactions are varied, reflecting the versatility of this payment method. Here are some common uses:

- Payroll Deposits: Employers frequently utilize ACH credits to deposit salaries directly into their employees’ bank accounts. This method ensures that employees receive their wages promptly and securely, reducing the need for paper checks and the associated administrative tasks. It streamlines the payroll process, making it more efficient for both employers and employees.

- Vendor Payments: Businesses often pay their suppliers and vendors through ACH credits. This ensures that payments are made on time and securely, fostering good business relationships and maintaining a smooth supply chain. ACH credits help businesses avoid the delays and potential errors associated with manual payments, enhancing overall operational efficiency.

- Tax Refunds: Government agencies use ACH credits to issue tax refunds to taxpayers. This method is faster and more reliable than mailing paper checks, allowing taxpayers to receive their refunds directly into their bank accounts. It reduces the chances of checks being lost or stolen and provides a quicker way for individuals to access their funds.

- Bill Payments: Consumers can set up ACH credits to pay recurring bills, such as utilities, mortgage payments, and other regular expenses. This automation ensures that payments are made on time, helping consumers avoid late fees and maintain good credit standing. It also simplifies bill management by eliminating the need to process each payment manually.

- E-commerce: Online merchants use ACH credits to facilitate customer payments, offering a secure and efficient payment method. This allows customers to make purchases directly from their bank accounts, providing an alternative to credit card payments. ACH credits can reduce transaction fees for merchants and provide customers with a more seamless checkout experience.

ACH Credit vs. ACH Debit: What is the Difference?

Understanding ACH debit vs. ACH credit is crucial for managing your finances effectively. While both are part of the ACH network, they function differently.

Initiation of the Transaction

The primary difference between ACH credit and ACH debit transactions lies in who initiates the transaction. In an ACH credit transaction, the originator (the person or entity making the payment) requests to transfer money from their account to the recipient’s account. This type of transaction is often referred to as a “push.” For example, when an employer deposits salaries directly into employees’ bank accounts or when a person makes a bill payment through an online banking portal, they are initiating an ACH credit transaction.

In contrast, an ACH debit transaction is initiated by the recipient of the funds. In this case, the originator is requesting to withdraw money from the recipient’s account to their own, often called a “pull.” Examples include a utility company withdrawing payment from a customer’s account or a subscription service pulling monthly fees from a subscriber’s bank account. The recipient is effectively pulling funds from the payer’s account.

Perspective Matters

The classification of a transaction as an ACH credit or debit depends on the perspective of the entity initiating the transaction. If a company or government agency is pushing money toward an individual, it is considered an ACH credit. Conversely, if they are pulling money for a payment, it is considered an ACH debit. This distinction is essential for understanding how different entities manage their transactions and the roles they play in the ACH network.

How to Set Up ACH Credit

Setting up ACH credit transactions can streamline your financial operations, making payments faster and more secure. Understanding what is ACH credit and how to implement it can benefit both personal and business finances. Here’s a step-by-step guide to help you set up ACH credit.

Step 1: Collect Required Details

The first step in setting up ACH credit is to gather all required information. You will need the recipient’s bank account number, bank routing number, and transfer amount. Additionally, you might need the recipient’s name and other identification details to ensure the transaction is processed correctly and securely.

Step 2: Determine the Transaction Type

Decide whether you need an ACH credit or ACH debit transaction. ACH credit involves pushing funds from your account to the recipient’s account, which is ideal for payroll and vendor payments. On the other hand, ACH debit pulls funds from the recipient’s account to yours, and it is commonly used for collecting payments such as utility bills or loan repayments.

Step 3: Initiate the Transfer

Once you have the necessary information and decide on the transaction type, you can initiate the ACH transfer. This can usually be done through your bank’s online portal or financial software. Enter the details accurately and authorize the transaction. The ACH network will process the transfer, typically completing it within one to two business days.

Step 4: Set Up for Receiving Payments

To accept ACH payments from customers, ensure your business bank account is set up to receive ACH transactions. Provide your customers with your bank account number and routing number. You can also set up recurring payments for regular transactions, which helps maintain a steady cash flow and simplifies the payment process for both you and your customers.

Fees for ACH Credit Transactions

ACH credit fee structures vary depending on the financial institution and the volume of transactions. Generally, ACH credit transactions are less expensive than wire transfers or paper checks. Fees may include:

Account Fees

Account fees are the charges associated with maintaining an account that can process ACH transactions. These fees may include monthly maintenance fees, minimum balance fees, and charges for account setup. Some banks may offer accounts with no monthly fees if a certain balance is maintained or if specific transaction thresholds are met. Usually, banks charge between $10 and $35 monthly.

Processing Fees

Processing fees are costs incurred each time an ACH transaction is processed. These can vary depending on the volume of transactions and the financial institution. Typically, these fees are relatively low, often ranging from $.20 to $1.50 per credit ACH or push transaction. However, high-volume users may negotiate lower rates or opt for a flat monthly fee to cover a certain number of transactions.

Other Fees

Other fees associated with ACH transactions can include charges for returned transactions, expedited processing, and error correction. Some other examples are Batch Fee, ACH Chargeback, High-Ticket Surcharge, Set-up Fee, etc.

Security Measures for ACH Credit

Ensuring the security of ACH credit transactions is paramount. ACH credit social security measures include:

Utilize NACHA's Standard Protections

Nacha, the organization governing the ACH network, provides several security measures and best practices to protect against fraud. Utilizing these protections, such as requiring multi-factor authentication, encrypting sensitive information, and regularly updating security protocols, can significantly reduce the risk of unauthorized transactions. Familiarize yourself with Nacha’s guidelines to ensure your ACH payments are secure.

Establish Robust Processes and Procedures

Setting up the right processes and procedures is essential for preventing ACH payment fraud. Implement detailed protocols for initiating and verifying transactions, including steps for confirming the identity of transaction initiators and recipients. Regularly review and update these procedures to adapt to new threats and ensure all employees are trained on the latest security practices.

Restrict Access to Necessary Personnel

Limit access to your ACH systems to only those employees who need it to perform their duties. By restricting access, you reduce the risk of internal fraud and unauthorized transactions. Ensure that employees with access undergo thorough background checks and are educated on the importance of maintaining security.

Stay Informed About Scams

Fraud tactics are constantly evolving, so staying informed about the latest scams and security threats is crucial. Regularly update your knowledge through reputable sources, such as financial news outlets and security advisories. Sharing this information with your team can help everyone stay vigilant and recognize potential threats before they become problems.

Partner with a Trustworthy Bank

Choosing a bank that prioritizes security can provide additional protection against ACH payment fraud. Look for a bank that offers robust fraud detection tools, dedicated support for resolving suspicious activities, and comprehensive security measures. A trustworthy bank will have your back, helping you quickly identify and respond to fraudulent activities.

Potential Challenges and Solutions

While ACH credits offer many benefits, they are not without challenges. Understanding ACH processing solutions can help mitigate these issues.

1. Delayed Transactions

One of the primary challenges with ACH transactions is the potential for delays. Transactions typically take one to two business days to process, which can be problematic for time-sensitive payments.

To mitigate this issue, plan your transactions to account for processing times. Consider using Same-day ACH services for urgent payments, which can significantly reduce the time required for transactions to be completed.

2. Fraud and Errors

Fraud and errors are significant concerns with ACH transactions. Unauthorized transactions and mistakes in account information can lead to financial losses and operational disruptions.

Implement robust security measures such as multi-factor authentication, encryption, and regular monitoring of transactions. Educate employees about common fraud schemes and establish protocols for verifying transaction details before processing.

3. Compliance and Regulations

Navigating the complex landscape of compliance and regulations can be challenging. ACH transactions must adhere to guidelines set by Nacha, as well as other federal and state regulations.

Stay updated on the latest regulations and ensure your processes comply with all relevant guidelines. Consider consulting with legal and compliance experts to regularly review and update your practices, ensuring that your organization remains compliant.

4. Integration and Automation

Integrating ACH transactions with existing financial systems and automating processes can be difficult. This integration is crucial for efficiency but can be technically complex and resource-intensive.

Invest in compatible financial software that supports seamless integration with ACH processes. Work with IT professionals to ensure that systems are correctly set up and regularly maintained. Automation can also be achieved through advanced software solutions that streamline ACH transactions, reducing manual intervention.

5. Cost and Fees

While generally cost-effective, ACH transactions can still incur various fees, including per-transaction charges, setup fees, and monthly maintenance costs.

To manage costs, compare the fee structures of different banks and payment processors. Opt for a service provider that offers competitive rates and aligns with your transaction volume. Regularly review your account and transaction activity to identify and address any unnecessary fees.

Future of ACH Credit

The ACH credit future looks promising, with ongoing advancements aimed at enhancing the efficiency and security of these transactions. To understand these developments, it is essential to know what is ACH credit and how it plays a pivotal role in modern financial systems.

Instant Payments Are (Almost) Here

Once primarily associated with person-to-person services like Venmo, instant payments are becoming accessible to a broader range of financial institutions. This development is set to expand access to instant payment features, revolutionizing how ACH transactions are conducted. Understanding what is ACH credit can help you anticipate and prepare for these changes in the payment landscape.

Improving ACH Payment Processing

Nacha is continually working to make ACH processes faster and more secure by implementing new operating rules. Adopting strategies to comply with Nacha mandates for organizations already utilizing ACH payments can mitigate compliance risks, reduce the incidence of returned payments, and help identify risky customers before engaging in transactions. Knowing what is ACH credit is crucial for implementing these strategies effectively.

Securing Commercial Banking Solutions

The origination of ACH credit and debit entries involves credit risk that, if not properly managed, can lead to significant financial losses. Effective KYC, underwriting practices, and active credit risk management are essential in this regard. Learn from Smart Tools AI about the importance of managing high-risk accounts to safeguard financial transactions in such industries.

Financial institutions can safeguard themselves and their clients from potential financial pitfalls by understanding and mitigating these risks.

Understanding what is ACH credit helps in implementing robust security measures to protect against these risks.

Embracing Future Innovations

As ACH payments evolve, embracing future innovations will be crucial for staying competitive. Businesses should invest in technologies and services that support instant payments and enhanced security measures. By doing so, they can ensure smoother, faster, and safer transactions, meeting the growing expectations of customers and stakeholders.

Understanding what is ACH credit will help businesses navigate these innovations effectively.

Final Thoughts

So, what is ACH Credit?

Understanding what ACH credit is is crucial for anyone looking to optimize their financial transactions. ACH credit transactions provide a reliable, efficient, and secure way to transfer funds electronically between bank accounts. By leveraging the benefits of ACH credits, such as lower costs, enhanced security, and convenience, both individuals and businesses can streamline their payment processes and improve overall financial management.

Visit our blog at EduCounting to learn more about ACH payments and financial management. Our comprehensive resources will equip you with the knowledge and tools needed to make informed financial decisions and stay ahead of the evolving financial landscape.