In the world of personal finance, few topics can seem as daunting as loans. From the technical jargon to the complex terms and repayment structures, navigating the loan landscape can feel overwhelming, especially if you’re new to it. But don’t worry—today, we’re going to break down a very common question: what is an amortized loan? Understanding this type of loan can help you better manage your finances and make informed decisions.

Whether you’re looking to buy a home, finance a car, or consolidate your debt, understanding amortized loans is crucial to making the best financial decisions. So, what exactly is an amortized loan? How does it work, and how can you calculate it? How does it compare to other loans? By the end of this guide, you’ll be equipped with all the information you need to manage, calculate, and understand amortized loans—and use them to your financial advantage.

Let’s start by answering the big question right away—what is an amortized loan?

What is an Amortized Loan?

What is an amortized loan? An amortized loan is a type of loan where you repay the principal (the amount borrowed) and interest (the cost of borrowing) in regular, equal payments over a specified period of time. With each payment, you gradually reduce the balance of the loan until it’s completely paid off by the end of the loan term.

Amortized loan definition: An amortized loan refers to any loan that’s repaid in regular, fixed payments (usually monthly), with each payment applied toward both the principal and interest. As the loan term progresses, the ratio of interest to principal in each payment changes. Initially, a larger portion of each payment goes toward the interest, but over time, more of the payment reduces the principal.

Here’s a Step-by-Step Breakdown of What Happens with an Amortized Loan

You borrow a fixed sum of money. This is known as the principal.

You agree to a set repayment schedule—usually monthly payments for a specific number of years.

Each payment includes both interest and principal. Early on, most of your payment will cover the interest, but over time, more will go toward reducing the principal.

By the end of the loan term, the entire balance is paid off.

The beauty of an amortized loan is that your payment amount stays the same throughout the term, which makes it easier to budget. However, the way your payment is applied to interest and principal shifts as the loan matures.

For instance, if you take out a mortgage, in the first few years, most of your monthly payment goes toward paying off the interest on the loan. As time progresses, more of your payment goes toward reducing the principal. This method of repayment ensures that, by the end of the loan term, your debt is fully repaid.

Types of Amortized Loans

Now that you understand the basics, let’s take a look at the various types of amortized loans. Amortization isn’t limited to just one type of loan—it’s a structure used for many different types of borrowing. Here are some common examples:

1. Fixed-Rate Mortgages

A fixed-rate mortgage is one of the most popular amortized loans. The interest rate stays the same throughout the life of the loan, which means your monthly payments are predictable and consistent. This loan is often used for home purchases, with common terms of 15, 20, or 30 years.

How it works: If you take out a 30-year fixed-rate mortgage for $200,000 at 4% interest, you will make the same payment every month for 30 years. However, as we discussed earlier, the amount of interest versus principal changes with each payment. In the early years, most of your payment will go toward interest, but by the end of the loan, nearly the entire payment will go toward paying down the principal.

2. Auto Loans

An auto loan is another type of amortized loan. This loan allows you to finance a car purchase, typically over 3 to 7 years. Auto loans usually have fixed interest rates, and each payment reduces both the interest and the principal. Auto loans can have shorter terms compared to mortgages, which means they are often paid off more quickly.

Example: You take out a $25,000 loan to purchase a car, with a 5-year term at a 5% interest rate. Your monthly payment will stay the same for the entire 5 years, and each payment will help you reduce the principal and interest.

3. Personal Loans

Personal loans are typically unsecured, meaning they don’t require collateral like a house or car. They can be used for a variety of purposes—debt consolidation, home renovations, medical expenses, or other personal needs. Like mortgages and auto loans, personal loans are amortized, which means they’re paid off in equal monthly installments over a fixed period of time.

Example: You borrow $10,000 for home improvements, with a 3-year term at 6% interest. Each month, you’ll make the same payment, and the balance will gradually decrease until the loan is paid off.

4. Student Loans

Many student loans, especially federal loans, follow an amortization schedule. Federal loans often offer longer repayment terms, such as 10 or 20 years, with various repayment plans available. As with other amortized loans, each payment reduces both the interest and principal.

Example: You borrow $40,000 to cover your education costs, with a 10-year repayment period and an interest rate of 4.5%. Each payment will chip away at the total loan balance, and by the end of the term, the debt will be fully paid off.

5. Business Loans

Business loans are often used by companies to finance new equipment, office expansions, or other major business needs. These loans are typically amortized, ensuring that the business repays the loan in manageable chunks over time.

Example: A business takes out a $100,000 loan to purchase new manufacturing equipment, with a 7-year term and an interest rate of 6%. Over time, the loan is paid down in equal installments, reducing the balance and interest charges.

Each of these loans is structured differently in terms of purpose, term length, and interest rates, but they all share the common feature of amortization. This makes the repayment process predictable and structured.

How Does Loan Amortization Work?

Now that we’ve seen some examples, let’s dive into the mechanics of how loan amortization works. Understanding this process can help you better manage your loans and even save money in the long run.

The Basic Mechanics:

Loan amortization involves paying down a loan through scheduled, regular payments. Each payment consists of two parts: interest and principal.

Interest Calculation: Interest is calculated based on the loan’s outstanding balance (the principal). Early in the loan term, the principal is large, so you pay more interest.

Principal Reduction: As the loan progresses and you make payments, the principal decreases, which in turn reduces the amount of interest charged. Over time, more of your payment goes toward the principal.

Equal Payments: Even though the allocation between interest and principal changes with each payment, the total monthly payment remains the same.

Example of How Amortization Works:

Let’s say you take out a $20,000 loan at 5% interest for 5 years (60 months). Your monthly payment, according to the amortization formula, will be $377.42.

Month 1: You pay $83.33 in interest and $294.09 toward the principal.

Month 2: You pay $81.87 in interest and $295.55 toward the principal.

Month 60: By the last payment, you’ll pay just $1.56 in interest, with the remaining $375.86 going toward the principal.

As you can see, early in the loan, most of your payment goes toward interest. But as the loan progresses, the interest portion decreases, and the principal portion increases. By the end, your entire payment is essentially paying down the principal.

This process continues until the loan is fully repaid at the end of the term. That’s the beauty of amortization—you don’t have to worry about making balloon payments or being surprised by unpredictable payments.

Amortized Loans vs. Other Loan Types

It’s important to understand how amortized loans compare to other types of loans. While amortized loans offer predictability and structure, there are other loan types that function quite differently. Let’s compare amortized loans to several common alternatives:

1. Interest-Only Loans

With an interest-only loan, you pay only the interest for a set period of time, often 5 to 10 years. During this period, none of your payments go toward reducing the principal. After the interest-only period ends, you’re required to begin paying down the principal—often leading to much higher monthly payments.

Example: You take out a $100,000 loan at 5% interest. For the first 5 years, you’ll pay only $417 per month, covering the interest. After that, your payments will jump significantly as you begin to pay off the principal.

Main Difference: Amortized loans reduce the principal with each payment, while interest-only loans delay principal repayment until later, often resulting in a balloon payment.

2. Balloon Loans

A balloon loan has small, regular payments during the loan term, but a large final payment (the “balloon”) is due at the end. These loans can be risky because borrowers may struggle to make the large final payment.

Example: You borrow $50,000 with a 5-year balloon loan. For the first 4 years, you make small payments. In the fifth year, you’re required to make a large payment to cover the remaining balance.

Main Difference: Amortized loans gradually reduce the entire balance over time, whereas balloon loans require a significant final payment to settle the loan.

3. Revolving Credit (Credit Cards)

With revolving credit, like a credit card, you can borrow and repay up to a certain limit, but there’s no fixed repayment schedule. You only have to make a minimum payment, and the amount you owe can fluctuate based on how much you borrow.

Example: You have a credit card with a $10,000 limit. You charge $2,000 and repay $500. The next month, you can borrow up to $8,500 again.

Main Difference: Amortized loans are fixed-term, with predictable payments, while revolving credit offers more flexibility but less predictability.

4. Adjustable-Rate Loans

Adjustable-rate loans (ARMs) start with a fixed interest rate for a specified period, then the rate adjusts periodically based on market conditions. Your payments may be amortized, but after the initial fixed-rate period, your payment amounts could change based on the new interest rate.

Example: You take out a 5/1 ARM mortgage. For the first 5 years, your rate is fixed at 3.5%, but after that, the rate adjusts annually based on market conditions.

Main Difference: Amortized loans with fixed rates offer predictable payments, whereas adjustable-rate loans can lead to varying monthly payments after the initial fixed-rate period.

How to Calculate Loan Amortization

To fully understand how much of your payment goes toward interest versus principal, you’ll want to know how to calculate loan amortization. While you can always use an online amortization calculator, it’s helpful to know the math behind the scenes.

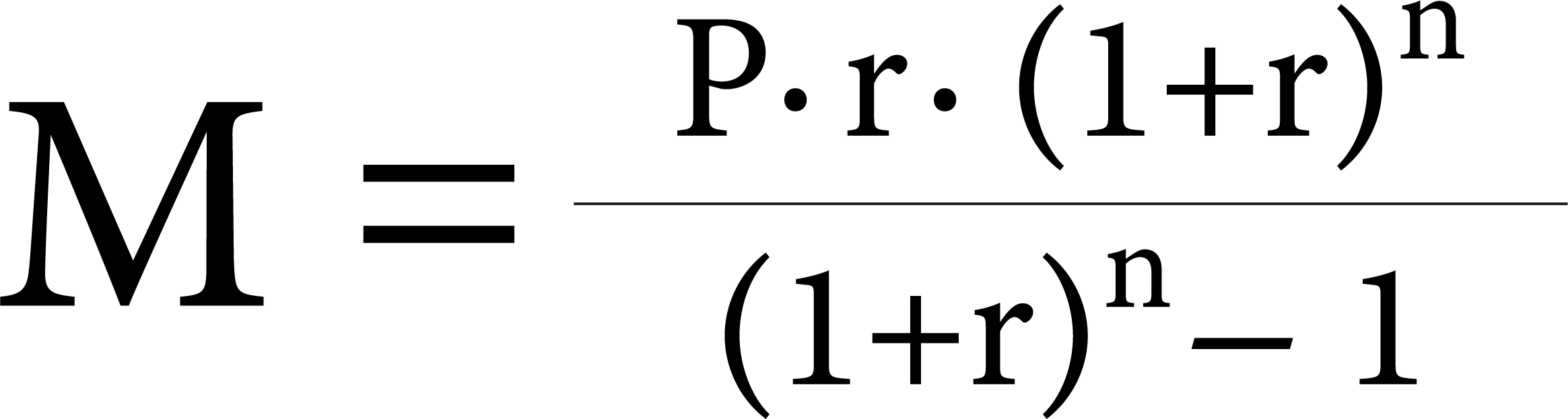

The amortization formula is:

Where:

M = your monthly payment

P = the loan principal (the amount borrowed)

r = the monthly interest rate (annual rate divided by 12)

n = the number of payments (loan term in months)

Step-by-Step Example:

Let’s say you take out a $10,000 loan at a 5% annual interest rate for 5 years (60 months).

Convert the annual interest rate to a monthly rate by dividing by 12: 5% / 12 = 0.00417.

Plug the numbers into the formula:

After calculating, you’ll find your monthly payment is approximately $188.71.

This formula gives you the monthly payment, but the amortization schedule will show how each payment is applied toward interest and principal over time. You can use online tools or spreadsheets to generate an amortization schedule for your loan.

Creating an Amortization Schedule

An amortization schedule is a table that breaks down each loan payment. It shows how much of each payment goes toward interest, how much goes toward principal, and the remaining loan balance after each payment.

For our $10,000 loan example, the schedule might look something like this:

Payment Interest Principal Remaining Balance

1 $41.67 $147.04 $9,852.96

2 $41.05 $147.66 $9,705.30

3 $40.44 $148.27 $9,557.02

… … … … … … … … … …

60 $0.79 $187.92 $0

As you can see, the interest portion decreases over time, while the amount going toward the principal increases. By the end of the loan term, the entire balance is paid off.

Pros and Cons of Amortized Loans

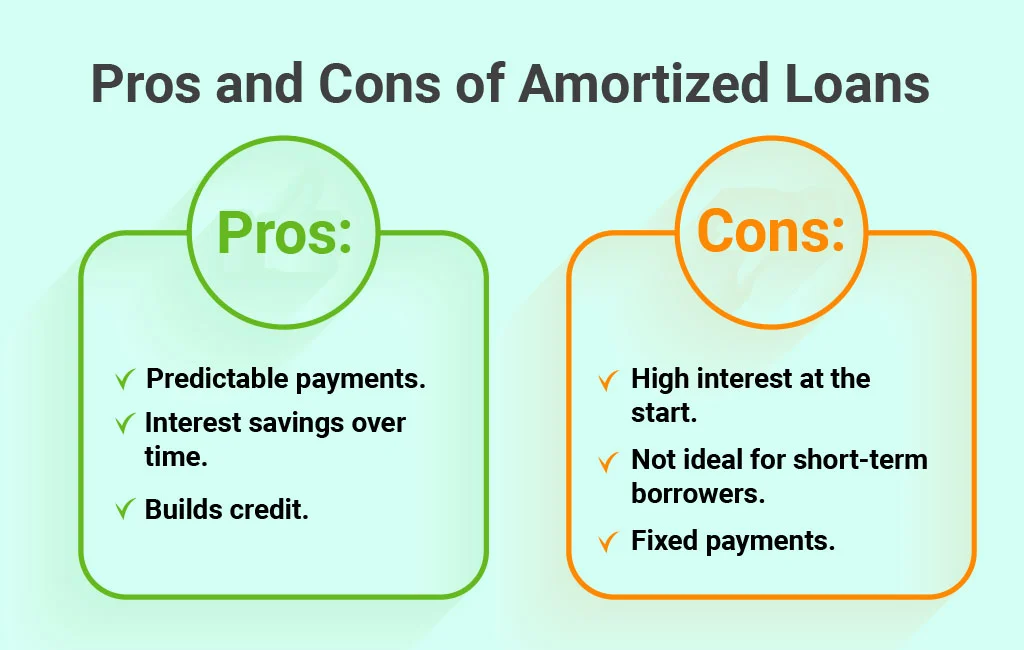

Amortized loans offer a lot of benefits, but like any financial product, they also have drawbacks. Let’s look at the pros and cons of amortized loans:

Pros of Amortized Loans:

Predictable Payments: One of the biggest advantages of an amortized loan is the consistency. You know exactly how much you’ll owe each month, making it easier to plan your budget.

Interest Savings Over Time: As you pay down the principal, the interest charged decreases. This can save you money over the life of the loan, especially if you make extra payments to reduce the principal faster.

Full Ownership: By the end of the loan term, you will fully own the asset you financed (like your home or car), with no large balloon payments or lingering debt.

Builds Credit: Regular, on-time payments can improve your credit score, helping you qualify for better terms on future loans.

Cons of Amortized Loans:

High Interest at the Start: In the early years of an amortized loan, a large portion of your payments goes toward interest, which means it can take time before you make significant progress on paying down the principal.

Not Ideal for Short-Term Borrowers: If you plan to sell your house or refinance your loan within a few years, an amortized loan may not provide the best interest savings, since much of the early payments go toward interest.

Fixed Payments: While predictable payments are a benefit for many, they can also be a drawback if your financial situation changes, and you find yourself struggling to make payments.

Amortized Loans and Credit Impact

Taking on an amortized loan can significantly impact your credit score—for better or worse. Here’s how amortized loans affect your credit:

Positive Impacts

On-Time Payments: Making your payments on time every month will have a positive impact on your credit score. Payment history is one of the most important factors in determining your score, so consistent, timely payments can help boost it.

Credit Mix: Lenders like to see a diverse mix of credit types on your report. Having an amortized loan, such as a mortgage or auto loan, alongside revolving credit like credit cards, can improve your credit profile.

Negative Impacts

Missed Payments: If you miss payments or pay late, it will have a negative effect on your credit score. Even one missed payment can lower your score significantly.

High Debt Load: Having too many loans or a high balance on your loan can increase your debt-to-income ratio, which may negatively affect your credit score.

Overall, managing an amortized loan responsibly—by making on-time payments and avoiding overextending yourself—can help you build a strong credit history.

Tips for Managing Amortized Loans

If you’ve taken out an amortized loan or are considering doing so, here are a few loan amortization tips to help you stay on top of your payments and reduce your overall costs:

1. Make Extra Payments

If your loan terms allow for it, consider making additional payments toward the principal. This will reduce the amount of interest you pay over the life of the loan, as well as shorten the loan term. Even small additional payments can make a big difference over time.

2. Automate Your Payments

Many lenders allow you to set up automatic payments from your bank account. This ensures that you never miss a payment and may even help you qualify for a small discount on your interest rate.

3. Review Your Amortization Schedule Regularly

By keeping an eye on your amortization schedule, you can see how much progress you’re making and how your payments are being applied. This can also motivate you to make extra payments or stay on track with your repayment plan.

4. Refinance if Interest Rates Drop

If interest rates have fallen since you took out your loan, refinancing could lower your monthly payments or shorten the term of your loan. Be sure to weigh the costs of refinancing, such as fees, against the potential savings.

5. Avoid Late Fees

Paying late can result in penalties, which add to your loan costs and may negatively affect your credit score. Set reminders or use automatic payments to avoid missing deadlines.

Common Examples of Amortized Loans

We’ve already discussed the basics of amortized loans, but let’s take a closer look at some common examples of amortized loans that you might encounter in everyday life:

1. Home Mortgages

A mortgage is likely the largest amortized loan you’ll ever take out. Mortgages are typically paid off over long periods—15, 20, or even 30 years. The benefit of a mortgage is that it allows you to purchase a home while spreading the cost over many years, making it more affordable.

Example: You take out a 30-year mortgage for $300,000 at a 4% interest rate. Your monthly payment stays the same, but over time, more of it goes toward reducing the principal.

2. Auto Loans

Auto loans are another common example of amortized loans. When you finance a car, you repay the loan in equal monthly installments over 3 to 7 years. At the end of the loan term, you fully own the vehicle.

Example: You take out a 5-year auto loan for $25,000 at a 5% interest rate. Each month, you make a fixed payment, and over time, you pay off the loan and own the car outright.

3. Personal Loans

Personal loans are typically used for things like home improvements, medical bills, or consolidating credit card debt. These loans are amortized, so you’ll make fixed payments over a set period of time, often 3 to 5 years.

Example: You borrow $15,000 for a home renovation project, with a 4-year repayment period and an interest rate of 6%. Your monthly payment will remain the same for the duration of the loan.

4. Student Loans

Many student loans, particularly federal loans, follow an amortization schedule. Repayment typically begins after a grace period following graduation, and borrowers make equal monthly payments until the loan is paid off.

Example: You take out a $40,000 student loan with a 10-year repayment plan. Each month, you make a fixed payment that goes toward both the principal and interest.

5. Business Loans

Businesses often take out amortized loans to finance equipment, office space, or expansions. These loans help businesses manage large expenses by spreading them out over time.

Example: A small business takes out a $50,000 loan to purchase new equipment, with a 7-year term and a 6% interest rate. The business repays the loan in equal monthly installments, gradually reducing the balance.

Conclusion

So, what is an amortized loan? In simple terms, it’s a loan that’s repaid through equal, scheduled payments over time, with each payment covering both interest and principal. As the loan progresses, more of each payment goes toward paying down the principal, and less goes toward interest.

Whether you’re buying a home, financing a car, or consolidating debt, amortized loans offer predictability and structure, making them easier to manage. Understanding how amortization works, and how to calculate it, gives you control over your finances, allowing you to make smarter borrowing decisions.

Amortized loans have their pros and cons, but if managed responsibly, they can help you build credit, save on interest, and ultimately pay off your debts in a clear, structured way. Keep these principles in mind, and you’ll be better prepared to navigate the world of amortized loans—and take control of your financial future.