The intricacies of tax documentation often present a challenging endeavor. Within the vast array of forms and official paperwork required by tax authorities, the W-2 Form emerges as an indispensable document for both employers and employees across the United States. Grasping what is the purpose of a W-2 form is fundamental for the accurate declaration of earnings and adherence to the prevailing tax regulations. This guide is designed to illuminate the significance of the W-2 form, exploring its essential role, the responsibilities it entails for filers, and the effective management of the information it provides.

What is Form W-2?

Form W-2, commonly known as the Wage and Tax Statement, plays a pivotal role in the tax filing process for employees in the United States. This crucial document outlines an individual’s annual earnings and specifies the total amount of taxes that have been withheld from their paycheck over the course of the year. Additionally, it encompasses details such as employer contributions towards health insurance and any dependent care benefits received, providing a comprehensive overview of one’s taxable income and deductions.

The obligation falls on employers to distribute Form W-2 to each employee and forward a copy to the Social Security Administration (SSA) annually. This ensures that the employee and the federal government have accurate earnings and tax withholdings records. For those juggling multiple jobs within the same tax year, filing each W-2 form separately is necessary, ensuring a thorough account of their total income and withholdings.

Understanding the information reported on Form W-2 is essential for calculating one’s tax liability. If the sum of taxes withheld from an individual’s paychecks exceeds what they owe in taxes, they are entitled to a refund. Conversely, the individual may owe the IRS money if not enough taxes have been withheld. It’s important to accurately report all W-2 income on tax returns, as discrepancies can trigger delays in processing by the IRS due to their rigorous cross-checking procedures to verify reported income. The W-2 form includes information on the following:

Wages, Tips, and Other Compensation

The W-2 form provides a detailed account of an employee’s earnings, encompassing wages, tips, and other forms of compensation. This encompasses all monetary benefits an employee receives from their employer within a fiscal year, ensuring a comprehensive overview of their taxable income. It’s crucial for accurately determining an individual’s tax obligations and potential refunds.

Federal Income Tax Withheld

This section of the W-2 form reports the total federal income tax withheld from the employee’s earnings throughout the year. It plays a vital role in tax preparation, allowing individuals to understand how much they have already contributed towards their annual tax liability and to calculate whether they are due a refund or owe additional taxes to the IRS.

Social Security and Medicare Wages

The form also outlines wages subject to Social Security and Medicare taxes, clarifying the income considered for these specific contributions. It ensures employees and the Social Security Administration have accurate earnings records that count toward future Social Security and Medicare benefits, highlighting the importance of these withholdings in securing social welfare.

Social Security and Medicare Tax Withheld

It details the exact amounts withheld from an employee’s paycheck for Social Security and Medicare taxes. These withholdings are critical for funding the individual’s future entitlements under the U.S. Social Security system, reflecting the contributions made towards these mandatory federal programs for the employment year.

State and Local Wages & Tips, and Taxes Withheld for Each

This part of the W-2 captures earnings subject to state and local taxes, including wages and tips, and those withheld for these jurisdictions. It’s essential for accurately filing state and local tax returns, ensuring all income and tax withholdings are duly reported. This information helps taxpayers comply with local tax obligations and accurately report their income across different government levels.

Who Can File Form W-2?

The responsibility of filing Form W-2 squarely falls on the shoulders of employers. It is mandated that employers furnish their employees with the W-2 forms by no later than January 31st of each year. This can be done either electronically or through mail. Adhering to this deadline is crucial as it allows employees ample time to prepare and file their taxes by the standard deadline of April 15th.

Should the end of January pass without receiving your Form W-2, the onus is on you to secure a copy to ensure the timely filing of your tax return. Here are pivotal steps to take in such a scenario:

- Inquire With Your Employer: Frequently, the absence of a Form W-2 can be attributed to simple oversights or errors in personal details. It’s advisable to first reach out to your employer or the human resources department to verify the accuracy of your recorded mailing or email address.

- Seek Assistance from the IRS: When your employer cannot provide the necessary assistance, turning to the IRS is the next best step. The IRS offers a facility to request your wage and income transcript via the ‘Get Transcript‘ tool or by calling their dedicated line at 800-908-9946. Opting for the online request method ensures quicker reception of the needed documentation.

- Consider Filing for an Extension: Facing the looming tax deadline without your W-2 form might necessitate applying for a filing extension. This grants you additional time to acquire the essential form.

- Estimate Your Earnings and Deductions: When all else fails and an extension is not feasible, estimating your income and tax withholdings becomes an option. For this purpose, Form 4852 serves as a substitute, allowing you to proceed with filing your tax return. If discrepancies arise, you can amend your return upon receipt of your W-2 form, ensuring accuracy in your tax filings.

How to File Form W-2

Employers can file Form W-2 either electronically or on paper. Electronic filing is encouraged by the IRS for its efficiency and reliability. Employers must ensure that each W-2 is accurate and filed by the IRS deadline, typically January 31st, following the tax year.

Filing W-2 forms online is a streamlined process facilitated by the Social Security Administration (SSA) through its Business Services Online (BSO) platform. This digital method is both free and secure, making it the SSA’s preferred option for submitting these important tax documents. To get started, employers must first register for an account on the BSO website. Once registered, they can then proceed to create and submit W-2 forms directly through the site.

The BSO platform is designed to accommodate different filing needs. Employers can manually create up to 50 W-2 forms on the website, allowing for generating and printing these forms for employee distribution. Alternatively, for those utilizing payroll software, there is an option to upload a wage report file. The BSO system can then use this file to generate the necessary W-2 forms.

One key benefit of online filing is immediate feedback on submission errors, such as mismatches between names and Social Security numbers. This feature significantly simplifies the correction process, ensuring that errors can be promptly addressed. Additionally, the BSO system allows employers to track the status of their submissions, offering transparency and peace of mind by confirming when files have been successfully accepted.

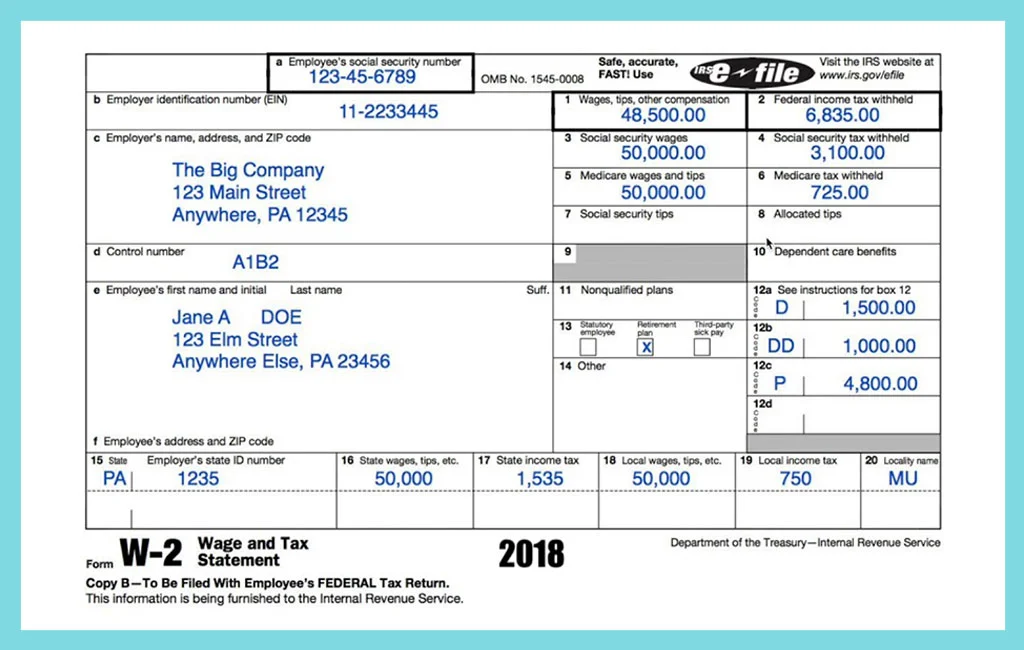

What Information is on a W-2?

The Form W-2 is a comprehensive document beyond merely reporting your annual wages. It provides a detailed snapshot of your earnings, tax withholdings, and benefits, all of which significantly affect your overall tax situation.

Form W-2 is a fundamental document that encapsulates crucial financial information for both the employee and the IRS, ensuring accurate tax reporting and compliance.

Employee’s Social Security number is prominently featured on the W-2 form and serves as a critical identifier, linking the reported income and taxes to the correct individual in the IRS’s records. This number is essential for the IRS to accurately track an individual’s earnings over their lifetime for Social Security and Medicare benefits.

Employee’s personal information, including their name, address, and zip code, is also included on the form. This information ensures that the tax documents are accurately associated with the correct taxpayer and helps in sending any correspondence or refunds to the right location.

Your business’s name, address, zip code, and Employer Identification Number (EIN) are listed to identify the employer. This set of information is vital for the IRS and the Social Security Administration to attribute the reported wages and taxes to the correct business entity, facilitating the proper accounting of payroll taxes and compliance with tax laws.

Wages, tips, and other compensation reported on the W-2 form encompass the total earnings of the employee from that employer during the tax year. This includes not only the regular wages but also any additional compensation such as bonuses, tips, and other taxable benefits, providing a comprehensive picture of the employee’s income for tax purposes.

Taxes withheld, such as Social Security, Medicare, and income taxes, are meticulously detailed on the form. These figures represent the amounts deducted from the employee’s earnings throughout the year for federal and state tax obligations, as well as contributions to Social Security and Medicare. This information is critical for determining the employee’s tax liability or refund when filing their annual tax returns.

Who Receives a Form W-2?

Every employee who has earned a salary, wage, or other forms of compensation from an employer should receive a Form W-2. This does not include freelancers or independent contractors, who typically receive Form 1099-NEC.

How Do You Use a W-2?

Form W-2 primarily functions to report the total annual wages paid to an employee and is indispensable for both the employee and the Social Security Administration (SSA). Employers are obligated to furnish their employees with this form, detailing the gross wages paid and taxes withheld throughout the fiscal year.

The W-2 form encompasses not just the employee’s gross wages but also delineates taxes that have been withheld from their income. This includes federal, state, and local taxes, Social Security, and Medicare taxes. Beyond these fundamental elements, the form may also reflect other pertinent financial details such as contributions towards a health savings account (HSA), deferred compensation, dependent care benefits, and tip income, providing a comprehensive overview of an employee’s earnings and deductions.

The issuance of a Form W-2 is not optional but a legal requirement for employers who have paid salaries, hourly wages, or other forms of compensation to their employees. This mandate holds regardless of the employment duration, whether it spanned a single day or the entire year. The objective is to ensure that all forms of compensation are accurately reported to the tax authorities.

In addition to distributing Form W-2 to employees, employers must also submit these forms to the SSA, accompanied by Form W-3, the Transmittal of Wage and Tax Statements. Form W-3 serves as a collective summary of all the W-2 forms issued by the employer and requires the employer’s signature, acting as an official record of the wages and taxes reported to the SSA.

It’s crucial to distinguish between employees and independent contractors in the context of tax reporting. Unlike employees who receive Form W-2, independent contractors are provided with Form 1099. This distinction underscores the importance of understanding IRS regulations to correctly classify workers and ensure compliance with tax filing requirements.

How to Read Form W-2

- Box 1 reports your total annual wages, tips, and other forms of compensation. This amount is the basis for calculating your federal income tax obligation.

- Box 2 shows the total federal income tax withheld from your paycheck yearly. This figure is crucial for determining whether you’ll receive a refund or owe more taxes.

- Box 3 indicates the portion of your income that’s subject to Social Security tax, which may differ from your total wages due to the income cap on Social Security taxes.

- Box 4 displays how much Social Security tax has been withheld from your earnings. This tax supports the Social Security program, providing benefits for retirees and disabled individuals.

- Box 5 outlines the total earnings subject to Medicare tax, which, unlike Social Security tax, does not have an income cap.

- Box 6 shows the amount of Medicare tax withheld from your income. This contribution funds the Medicare program, offering healthcare benefits to individuals over 65 and certain younger people with disabilities.

- Box 7 details the tip income you reported to your employer, which is also included in your total wages in Box 1 and subject to Social Security taxes.

- Box 8 lists tips allocated to you by your employer, not included in Box 1’s wages. These are additional tip earnings that your employer determined.

- Box 10 includes any dependent care benefits your employer provided, which can affect your taxable income and eligibility for certain tax credits.

- Box 11 is typically used to report distributions from your employer’s non-qualified deferred compensation plan, affecting your tax planning.

- Box 12 contains various codes representing different types of compensation or deductions, such as employer contributions to a retirement plan, which can have tax implications.

- Box 13 has checkboxes to indicate if you are a statutory employee, participated in your employer’s retirement plan, or received third-party sick pay, each affecting your tax filing differently.

- Boxes 16-19 provide details on state and local income taxes, including how much of your income was subject to these taxes and the amount withheld, essential for state and local tax filings.

What is the Difference Between a 1099 and a W-2?

The distinction between a W-2 form and a 1099 form primarily lies in the employment relationship and the method of tax handling associated with each. The W-2 form is designated for reporting the wages of individuals who are classified as employees of an organization.

These employees have taxes automatically deducted from their paychecks by their employers, covering federal, state, and sometimes local taxes, along with contributions to Social Security and Medicare. This system simplifies the tax process for employees, as their employers calculate and withhold the necessary taxes on their behalf.

Conversely, the 1099-NEC form caters to reporting income earned by independent contractors. These individuals are not considered employees but rather self-employed professionals who provide services to businesses or individuals. Unlike employees, independent contractors are tasked with managing their own tax obligations, including the payment of self-employment taxes.

This necessitates a different form of income reporting, as it reflects the contractor’s responsibility to pay their taxes directly to the IRS. It includes estimated taxes throughout the year, rather than having them withheld by an employer.

What is the Difference Between W-4 and W-2 forms?

The W-2 and W-4 forms serve distinct purposes within the realm of employment and taxation, primarily revolving around the reporting and withholding of taxes. Form W-4 is an action taken by the employee at the outset of their employment or when their financial situation changes.

This form allows employees to specify to their employer the amount of tax they wish to have withheld from each paycheck. The information provided on the W-4, such as marital status, number of dependents, and any additional income, guides employers in determining the correct amount of federal income tax to deduct from the employee’s earnings, aiming to match the employee’s anticipated tax liability for the year.

Contrastingly, Form W-2 is a year-end document prepared by employers that summarizes the total earnings of an employee for the tax year, along with the amount of taxes withheld from those earnings. This includes not only federal and state income taxes but also contributions to Social Security and Medicare.

The W-2 form is critical for employees when preparing their annual tax returns, as it provides a detailed record of their taxable income and the taxes already paid throughout the year. Thus, while the W-4 form is an employee’s directive to their employer on tax withholding preferences, the W-2 form is a factual report of what was earned and what taxes were withheld.

Importance of Your Tax Withholding

The process of tax withholding from your paycheck by your employer plays a crucial role in the overall framework of tax compliance and personal financial management. This system ensures that your income taxes are gradually paid to the IRS and other relevant tax authorities over the year rather than requiring you to pay your entire tax obligation at once during the tax filing season.

This prepayment method is not just a convenience offered by employers; it’s a requirement enforced by tax laws stipulating that taxes must be paid as you earn or receive income throughout the year. Your employer facilitates these periodic payments on your behalf, utilizing the details you provided on your Form W-4 to determine the appropriate amount of tax to withhold from each paycheck.

The significance of accurate tax withholding must be balanced. It is a preemptive measure to avoid underpayment penalties and ensures you’re not left with a surprisingly large tax bill when you file your annual tax return. The information you submit via Form W-4, including your filing status, number of dependents, and any additional income, enables your employer to tailor the withholding amount closely to your expected tax liability. This proactive approach to tax payment helps maintain your financial stability by spreading your tax obligations throughout the year.

Upon filing your tax return, the total amount withheld for taxes, as reported on your Form W-2, is credited against the total tax you owe for the year. This is where the importance of accurate withholding becomes evident. If too much tax has been withheld, you may be entitled to a refund, boosting your finances.

Conversely, if not enough tax has been withheld, you might owe additional taxes, underscoring the importance of regularly reviewing and updating your W-4 information to reflect any changes in your financial situation. This dynamic interplay between the W-4 and W-2 forms underscores the integral role of tax withholding in ensuring that your tax responsibilities are met promptly and efficiently.

Final Words

The Form W-2 is a cornerstone document in the U.S. tax system, providing critical information for both employees and the IRS. By understanding how to read and utilize this form accurately, taxpayers can ensure they comply with tax laws, accurately report their income, and optimize their tax situation. So, what is the purpose of a W-2 Form?

Understanding the purpose of a W-2 form is crucial for employers and employees to navigate the complexities of tax reporting. This guide has provided a thorough overview of the W-2 form, its purpose, and its importance in the tax filing process, ensuring you have all the necessary information.

To delve deeper into the intricacies of tax forms and to gain a more nuanced understanding of financial matters, we encourage you to explore our blogs at EduCounting. Our resources are tailored to demystify the financial landscape, offering insights and guidance to empower your financial journey.

FAQs

What should I do if there's an error on my W2?

If you discover inaccuracies on your W-2, such as incorrect personal information or salary details, you should immediately notify your employer and request a corrected W-2. Ensuring accuracy is essential while correcting these errors might delay your tax filing. Additionally, be aware that your employer could face IRS penalties for significant mistakes, especially those affecting dollar amounts or essential personal details.

Can I file my taxes without a W-2 if I know my income?

Yes, you can still file your taxes on time even if you haven’t received your W-2 or if it contains errors. In such situations, you can use Form 4852 as a substitute for the W-2 when filing your tax return. This form allows you to estimate your income and withholdings based on your pay stubs and other financial records.

Are there any penalties for not filing a W-2 with the IRS?

Failure to file a W-2 with the IRS can result in penalties ranging from $60 to $630 per form for the 2023 tax year. The exact penalty depends on how long the correct W-2 is filed past the deadline. Employers must adhere to filing deadlines to avoid these penalties.