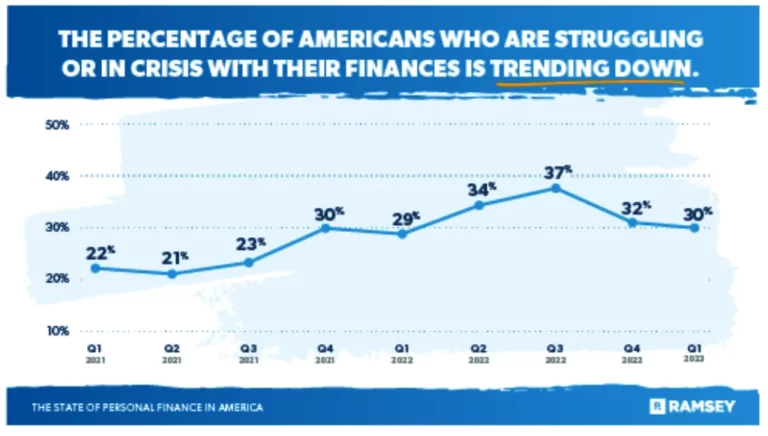

Recent data (1st quarter, 2023) indicates that around 30% of Americans report experiencing financial difficulties or even crisis conditions. Interestingly, this figure shows a noteworthy decline of almost 19% from the numbers recorded in the third quarter of 2022. While this decreasing trend is a positive signal, indicating perhaps improvements in personal finance management or economic conditions, it underscores that a substantial portion of individuals still face financial challenges. This statistic highlights the ongoing importance of financial education and informed policy-making.

In a world where financial acumen is increasingly necessary, understanding the fundamentals of why personal finance depends on your behavior is a cornerstone of securing a stable future. Individual behaviors play a significant role in influencing one’s financial position, and financial stability is often a result of conscious financial behavior rather than an inherent knowledge of intricate financial terminologies.

Behavioral Economics and Personal Finance

Behavioral economics can be defined as the study of how psychological, emotional, and social factors influence decisions related to money and financial matters. In essence, it seeks to identify why people act in a certain way when dealing with money and focuses on individual behavior instead of economic theory.

Behavioral Economics Basics

Behavioral economics is a fascinating field that combines elements of psychology and economics to understand how we make decisions about our finances. Traditional economics often assumes we are perfectly rational beings, making the most optimal choices for our self-interest. However, this is not always the case.

Behavioral economics takes into account our human tendency for irrationality and biases. It recognizes that we are influenced by various psychological, cognitive, emotional, cultural, and social factors that can lead us to make financial decisions that are not always in our best interest.

The Psychology of Spending

The psychology of spending is one area where our human tendencies can significantly impact our personal finances. Our emotions can drive us to make unnecessary or impulsive purchases, and societal pressures can push us to spend beyond our means in an attempt to ‘keep up with the Joneses.’

Retail therapy may provide temporary pleasure but can lead to long-term financial distress. Being aware of these influences and triggers can help us better control our spending habits and make more conscious decisions about our money.

Saving and Budgeting Habits

Our saving and budgeting habits, too, are greatly impacted by our behaviors. It’s common for individuals to procrastinate on setting up a saving plan or creating a budget, often due to perceived complexity or discomfort associated with dealing with money matters.

This avoidance behavior can result in living paycheck to paycheck without substantial savings for emergencies or future needs. Cultivating a disciplined approach to saving and adhering to a realistic budget can significantly enhance our financial security and independence.

Debt and Credit Management

Our attitude and behavior towards debt and credit determine our financial health. Many individuals underestimate the long-term impact of high-interest rates and minimum payments on their overall debt burden.

Additionally, the convenience of credit cards often leads to overspending, pushing individuals further into debt. Understanding the intricacies of debt and credit management and making informed borrowing decisions can prevent a debt spiral and contribute to healthier personal finances.

Personal Behavior Influences

Your behavior plays a pivotal role not just in how you earn, spend, save, or borrow but also in how you invest your money. Decisions about investing are often influenced by fear of loss, desire for quick gains, or following trends, which can lead to sub-optimal investment outcomes.

Investing requires discipline, patience, and a strategic approach, guided more by objective analysis and less by emotions or biases. Understanding your risk tolerance, diversifying your investments, and focusing on long-term goals can greatly improve your financial growth and stability.

Understanding the Psychology of Money

Our beliefs about money often stem from our upbringing and early experiences with money. These deeply ingrained beliefs can affect our financial behaviors in adulthood. Recognizing these beliefs and challenging them can help in developing healthier financial habits.

Our Beliefs about Money

Understanding the psychology of money begins with unraveling our deep-seated beliefs about it. Our upbringing, cultural values, and early experiences with money often shape these beliefs. Some might believe that money is the root of all evil, leading to reluctance to accumulate wealth. Others may view money as a measure of success, which could result in unhealthy striving and pressure to achieve. Recognizing and evaluating these beliefs can be the first step towards developing a healthier relationship with money.

Emotional Connection to Money

Money is more than just a medium of exchange; it has emotional and symbolic meanings. It often represents security, freedom, power, or love. The emotional connection to money can significantly influence our financial behavior. For instance, if we associate money with security, we might be more prone to saving and reluctant to take financial risks.

On the other hand, if we link money with love or approval, we might tend to spend lavishly on gifts for others to win their affection or admiration.

Money Scripts

“Money scripts” are unconscious beliefs about money passed down through generations and can greatly influence our financial behaviors. These scripts can be limiting (“Money doesn’t grow on trees”), leading to anxiety about money, or enabling (“You have to spend money to make money”), encouraging risk-taking. Understanding and challenging our money scripts can help us break free from unhealthy financial behaviors and form new, more positive money habits.

Money Disorders

Money disorders are maladaptive patterns of financial beliefs and behaviors that lead to distress, anxiety, and impairment. These can range from compulsive buying and pathological gambling to financial dependence and excessive hoarding.

Understanding and recognizing these disorders is crucial as they can severely impact one’s financial health and overall well-being. If you or a loved one struggle with a money disorder, it is important to seek professional help.

Money and Self-Worth

Our sense of self-worth can be intricately tied to our financial status. In a society that often equates wealth with success, it’s easy to base our self-esteem on our financial achievements. However, this can lead to a never-ending cycle of striving and dissatisfaction. We must recognize that our bank account balance does not determine our worth. Developing a sense of self-worth independent of financial success can lead to healthier financial behaviors and greater life satisfaction.

Investing and Behavior

Behavior plays a pivotal role in investing. It can lead to irrational decisions such as buying high and selling low, chasing after the next ‘hot’ investment, or succumbing to herd mentality. Long-term investing requires discipline, patience, and an understanding of risk and reward.

Emotions and Investing

Our emotions can have a significant impact on our investment decisions. Fear and greed, for instance, are two powerful emotions that can lead to poor investing outcomes. Fear can cause us to avoid investing altogether or sell investments during market downturns, potentially resulting in substantial losses. Greed, on the other hand, can lure us into risky investments in hopes of quick and high returns.

Behavioral Biases in Investing

Several common behavioral biases can influence our investment decisions. Overconfidence bias can lead us to believe that we can outperform the market or that our chosen investments are less risky than they truly are. Confirmation bias can cause us to seek out and favor information confirming our beliefs while ignoring contradictory evidence. Knowing these biases can help us make more rational and effective investment decisions.

The Importance of a Long-Term Perspective

A long-term perspective in investing is crucial. It allows us to weather short-term market volatility and take advantage of the power of compounding. However, our natural tendency for instant gratification can make it challenging to maintain this perspective. Staying focused on our long-term financial goals and resisting the temptation to react to short-term market fluctuations can significantly improve our investment outcomes.

The Role of Risk Tolerance

Understanding our risk tolerance is a key aspect of investment behavior. Risk tolerance is the degree of uncertainty an investor is willing to handle regarding the negative changes in the value of their investments. It varies from individual to individual and is influenced by factors such as age, income, financial goals, and personality. An accurate risk tolerance assessment can guide us in choosing appropriate investments and developing a balanced portfolio.

The Importance of Financial Education

Financial education provides the knowledge and skills necessary to make informed and effective decisions about money. It also aids in understanding the emotional and psychological factors that influence our financial behaviors and equips us to make better choices.

Empowerment Through Knowledge

Financial education empowers individuals by providing them with the knowledge to make informed financial decisions. It gives individuals the tools to understand and navigate various financial products and services, from savings accounts and loans to insurance and investments. Financial literacy can lead to better credit management, effective saving strategies, and informed investment choices, all contributing to improved financial health and independence.

Prevention of Financial Mistakes

A lack of financial knowledge can lead to costly mistakes, such as high debt levels, inadequate savings, or poor investment decisions. Financial education provides a strong foundation for understanding the implications of financial decisions and helps prevent these pitfalls. It can help individuals understand the importance of budgeting, the power of compounding, the implications of high-interest rates, and the need for long-term financial planning.

Developing Healthy Financial Habits

Financial education can foster the development of healthy financial habits from a young age. It encourages saving, budgeting, investing, and thoughtful spending, habits integral to achieving financial stability and success. By embedding financial literacy in children’s education, we can equip them with the skills to manage their finances effectively.

Mitigating Financial Stress

Financial stress can significantly impact one’s mental and physical health. Lack of financial knowledge often leads to uncertainty and anxiety about the future. Financial education can help individuals plan for their financial future, thus reducing stress and contributing to overall well-being. Through financial education, one can learn how to build an emergency fund, plan for retirement, and secure adequate insurance, all of which can provide peace of mind and financial security.

Behavior Modification Techniques

Behavioral changes are not achieved overnight. It requires self-awareness, discipline, and time. Techniques such as setting financial goals, budgeting, automating savings, and seeking professional financial advice can help modify financial behaviors.

Goal Setting

Setting specific, measurable, achievable, relevant, and time-bound (SMART) financial goals can drive positive behavior change. When you have a clear objective, like paying off debt, saving for a vacation, or investing for retirement, it becomes easier to align your financial habits to achieve these goals.

Use of Technology

Today’s technology offers numerous tools and apps to facilitate healthier financial behaviors. Budgeting apps can help you track and control your spending, saving apps can automate your savings, and investing platforms can simplify investing, making these financial tasks less daunting and more manageable.

Cognitive Re-Framing

Cognitive re-framing involves changing your perspective toward money and finances. For instance, rather than viewing budgeting as a restrictive practice, see it as a tool for gaining financial freedom. This shift in mindset can make the process more appealing and sustainable.

Implementing the 48-Hour Rule

Impulsive spending can be curbed by implementing the 48-hour rule. If you’re tempted to make a non-essential purchase, wait for 48 hours before making the decision. This pause allows you to evaluate the necessity of the purchase, reducing impulsive spending.

Enlisting Support

Change can be hard, and having support can make the process easier. Enlisting the support of a financial advisor or a trusted friend or family member can provide accountability, guidance, and encouragement as you strive to modify your financial behaviors.

FAQs

A. How does behavior affect personal finance?

Behavior impacts personal finance in numerous ways, from spending and saving habits to investing choices and debt management. Emotions, psychological biases, and societal pressures often drive these behaviors.

B. What are some common behavioral biases in financial decision-making?

Common behavioral biases include overconfidence, confirmation bias, loss aversion, and herd mentality. These biases can lead to poor financial decisions and potential losses.

C. How can I develop better saving and budgeting habits?

Start by setting clear, achievable financial goals. Create a realistic budget, automate your savings, and monitor your spending regularly. Don’t be too hard on yourself if you slip up. Instead, learn from it and make necessary adjustments.

D. What is the significance of long-term investing?

Long-term investing allows you to take advantage of compounding, helps in weathering market volatility, and can lead to significant wealth creation over time. It requires patience, discipline, an understanding of your risk tolerance, and investment objectives.

E. How can I modify my behavior to improve my financial outcomes?

Developing self-awareness about your financial behaviors, educating yourself about personal finance, setting financial goals, and seeking professional advice are all effective ways to modify your behavior and improve your financial outcomes.

Final Words: Why is Personal Finance Dependent Upon Your Behavior?

To understand why personal finance depends on your behavior, we must recognize that emotions, psychological biases, societal pressures, and personal beliefs often drive financial decisions. By acknowledging these influences and striving to make more informed, objective financial decisions, we can improve our financial behaviors and, ultimately, our financial well-being.

EduCounting enlightens you on why personal finance is so profoundly linked to your behavior. We provide tools and knowledge to help young adults navigate the complex world of finance, ultimately strengthening their money management skills. Let us guide you on this journey as you discover the importance of financial behavior in shaping your economic future. Get started with us today!