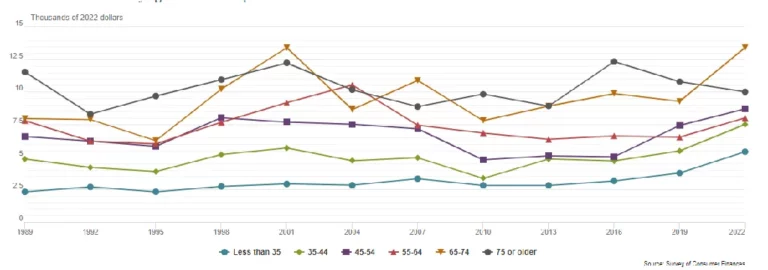

According to Federal Reserve System data, older Americans typically have a heftier bank balance than their younger counterparts. On average, individuals aged 45 to 54 possess a surplus of $50,590 compared to those below 35. Yet, it’s noteworthy that average savings begin to dwindle after 70.

As the world becomes increasingly unpredictable, having a solid savings foundation can offer much-needed peace of mind. However, saving consistently can be challenging, especially when juggling multiple financial obligations. Enter the Bi-Weekly Money Saving Challenge. It’s not only a fun way to put aside some money, but it can also be a game changer for your financial well-being. Let’s delve into how this can help you boost your budget.

What Is a Biweekly Money Saving Challenge?

Savings initiatives typically align with payment schedules, meaning a biweekly savings task prompts you to set aside funds every 2 weeks—equivalent to your next 26 paychecks. A biweekly money-saving challenge is a structured plan that prompts you to save a certain amount every two weeks (14 days).

Whether you receive your paycheck biweekly or monthly, this challenge is designed to help individuals build the habit of saving by setting achievable yet slightly stretching targets. The regularity of this challenge makes it feasible, and its flexibility allows you to choose the plan best suited to your financial situation.

How a Biweekly Money Saving Challenge Works

A biweekly money saving challenge is a structured commitment that prompts individuals to consciously set aside a particular sum from their earnings every two weeks. This routine establishes a rhythm, encouraging savers to prioritize this act of financial discipline and make it a regular part of their lives. The amount to be saved isn’t fixed; it varies depending on which biweekly challenge you opt for, allowing for flexibility based on one’s financial comfort and goals.

For many, the act of saving isn’t just about the act itself but also about tracking progress and maintaining consistency. Using different tools can greatly aid in this endeavor. Such platforms visually represent one’s savings growth over time and offer reminders and motivational boosts to ensure participants stay on track. Being accountable to oneself or with tools is key to making such challenges successful.

8 Great Biweekly Money Saving Challenges

In today’s fast-paced world, saving money consistently can seem like an uphill task. However, structured and fun challenges can make this journey feasible and enjoyable. Dive into these eight fantastic bi-weekly money-saving challenges tailored for beginners to adept savers and discover an engaging path to financial growth. Whether you’re looking to boost your savings or seeking innovative ways to kickstart your savings journey, these challenges offer something for everyone.

1. 26-week biweekly challenge

The 26-week biweekly challenge is a beginner-friendly approach to savings. Beginning with a small amount, such as $5 in the first two weeks, you incrementally increase your savings, doubling it in the subsequent weeks. By the 26th week, if you’ve stayed consistent, you’ll have accumulated a sizable sum without feeling financially strained. This challenge not only helps save a good amount but also instills discipline and a sense of achievement as you progress.

Its incremental nature ensures you’re not overwhelmed initially. As weeks pass, you’ll find yourself more accustomed to setting aside larger amounts, making it an excellent strategy for those new to the savings game or for individuals wanting to restart their saving habits.

2. 52-week biweekly challenge

Building upon the concept of the 26-week challenge, the 52-week biweekly challenge extends the time frame, allowing for a more gradual increase in savings. Starting with a modest amount, perhaps $1 in the first two weeks, you can increment this by $1 or $2 every subsequent period. By the end of the year, you’d be surprised at how these small, consistent contributions add up.

For those who find it difficult to save large sums at once, this method breaks down the process into digestible bits, making saving less daunting and more achievable. Moreover, as the challenge aligns with the entire year, it can become a fulfilling annual financial ritual.

3. $20 money saving challenge

The $20 money saving challenge is straightforward. Every two weeks, set aside a flat $20 into your savings. No calculations, no increments, just a fixed sum every 2 weeks. By the end of the year, you’ll have a neat $520 saved up.

Its simplicity is its strength. Whether you’re a student, a professional, or a retiree, anyone can participate without any complex planning. Plus, the predictability of this challenge ensures you can seamlessly integrate it into any budget.

4. No spend challenge

The ‘No spend challenge’ is more of a behavioral shift than a typical saving technique. Choose one or two days in the bi-weekly period to avoid any kind of expenditures. From morning coffee to online shopping—spend nothing. The money you typically spend on those days can be redirected into savings.

This method boosts your savings and heightens your awareness of daily spending habits. By consciously abstaining from purchases, you begin to differentiate between wants and needs, eventually leading to smarter financial decisions.

5. Biweekly 100 envelope challenge

The 100 envelope challenge adds an element of surprise to your saving journey. Number envelopes from $1 to $100. Randomly pick two envelopes every two weeks and save the combined amount they represent. It’s unpredictable and exciting!

Apart from the thrill of not knowing the amount you’ll save next, this method offers flexibility. On fortunate days, you might draw smaller numbers and more substantial sums on others. It’s a balanced approach, ensuring you save a decent amount without feeling the pinch too severely.

6. Trim 1% of your salary challenge

Every paycheck, set aside an extra 1% of your salary. It’s a marginal amount that, over time, compounds into a significant sum. As you receive your pay, calculate the 1% and immediately transfer it to your savings.

This challenge is particularly effective for individuals who have just received a raise or believe they can only save small amounts. The 1% is often small enough not to be missed but, over time, can result in a pleasantly surprising nest egg.

7. Bowl grab challenge

In the Bowl grab challenge, fill a bowl with various money amounts written on paper. Every two weeks, draw a piece and save the denoted amount. It’s an engaging way to save, as unpredictability keeps the challenge fresh.

Whether you’re someone who enjoys a bit of chance or simply wants to mix up your saving methods, the Bowl grab challenge ensures you’re constantly engaged, making saving less of a chore and more of an exciting activity.

8. Holiday helper fund

The Holiday Helper Fund is tailor-made for those who find holiday season expenses daunting. Decide on a set amount to save bi-weekly, ensuring that by the time the holidays roll around, you have a dedicated fund to dip into without affecting your regular savings or finances.

The beauty of this challenge lies in its forward-thinking approach. By saving specifically for the holidays, you’re financially prepared and alleviate the typical stress associated with festive season expenses. Start early and you’ll be more relaxed and ready to enjoy the festivities by the time the holidays approach!

Expert Tips on Bi-Weekly Money Saving Challenge

The art of saving money has become both a necessity and a challenge. While regular saving methods can sometimes feel redundant or insufficient, the Bi-Weekly Money Saving Challenge is an engaging and manageable way to bolster one’s savings. However, expert advice can go a long way like all financial strategies. Below are some expert tips to optimize your bi-weekly saving endeavors.

Start with a Clear Goal

Having a clear, tangible goal can greatly enhance your motivation to save. Whether you’re aiming for a vacation, a down payment on a house, or a rainy day fund, knowing what you’re saving can keep you dedicated to the challenge.

Expert Tip: Visualize your goal. Use pictures, charts, or vision boards. The more real it feels, the more inclined you’ll be to stick to the plan.

Automate Your Savings

In the age of technology, make your bank work for you. Set up an automatic transfer from your main account to your savings every two weeks.

Expert Tip: Schedule these transfers a day or two after your payday. This “out of sight, out of mind” strategy can make saving feel less like a choice and more like a routine.

Adjust According to Financial Health

While consistency is key, there might be times when you face unexpected expenses. It’s essential to adjust your savings amount during these times rather than strain your finances.

Expert Tip: Instead of a fixed sum, consider saving a percentage of your income. This ensures you’re saving proportionally to what you earn.

Celebrate Small Milestones

Every time you hit a savings milestone, no matter how minor, give yourself a pat on the back. These celebrations act as positive reinforcement.

Expert Tip: Set up mini-rewards for yourself at different milestones. It could be something as simple as a treat from your favorite café or a movie night.

Stay Educated and Inspired

The financial world is always evolving. Stay updated with new saving techniques, investment opportunities, and financial trends.

Expert Tip: Regularly read finance blogs and books or even attend webinars. Surrounding yourself with financial knowledge can keep you inspired and informed. Blogs like Educounting can surely help.

Be Accountable

Share your saving goals and progress with someone you trust. This can be a family member, a friend, or a financial advisor.

Expert Tip: Consider forming a saving group or a saving challenge with friends or colleagues. Sharing the journey can make it more enjoyable and provide mutual encouragement.

Review and Reflect

Every few months, take a moment to review your savings. Analyze what worked, what didn’t, and how you can improve.

Expert Tip: Use apps or spreadsheets to track your bi-weekly savings. Visualizing your progress can be a potent motivator and help you identify areas of improvement.

Final Words

Anyone can benefit from a bi-weekly saving challenge. Whether you’re a student trying to save for your future, a professional aiming to buy a home, or someone preparing for unforeseen expenses, the discipline instilled by this challenge is invaluable.

Moreover, for individuals paid biweekly, this method aligns perfectly with their income cycle, making it even more effective. Regardless of your financial goals, the Bi weekly money saving challenge is an innovative approach to ensure you have a cushion for your needs or desires.

FAQs

1. How to save $5000 in 3 months bi-weekly?

To save $5000 in 3 months using a bi-weekly approach, you need to break down the total by the number of bi-weekly periods in 3 months. Since there are roughly 6 pay periods in 3 months, divide $5000 by 6, resulting in approximately $833.33. So, every two weeks, you should set aside about $833.33 to meet the $5000 goal by the end of 3 months.

2. How can I save $10,000 in a year bi-weekly?

To save $10,000 in a year with a bi-weekly plan, you should divide the total goal by the number of pay periods in a year. With 26 bi-weekly periods in a year, you must divide $10,000 by 26. This results in approximately $384.62. Therefore, every two weeks, aim to save around $385 to accumulate $10,000 by the end of the year.

3. How can I save money by getting paid every two weeks?

When you’re paid bi-weekly, the key is consistency and discipline. Here are some steps to help:

- Budget: As soon as you receive your paycheck, allocate a specific percentage or amount to savings.

- Automate: Set up an automatic transfer from your checking account to a savings account on payday. This way, you save before you have a chance to spend.

- Limit Non-Essential Spending: Monitor your spending habits. Limit or cut out any unnecessary expenses. This doesn’t mean depriving yourself, but being more conscious about where your money goes can help you save more.

- Use Savings Challenges: Opt for one of the bi-weekly money-saving challenges discussed earlier to keep yourself engaged and motivated in your savings journey.

- Emergency Fund: Apart from your savings, having a separate emergency fund is also wise. Start with a small goal, like saving $500, then gradually increase as you become more accustomed to saving.