When it comes to financing your dream home, choosing the right mortgage provider is crucial. The decision often boils down to selecting between a credit union and a bank. Understanding the differences between these two options can significantly impact your mortgage experience and financial health. In this article, we’ll explore the pros and cons of both credit unions and banks to help you answer the important question: credit union vs. bank mortgage?

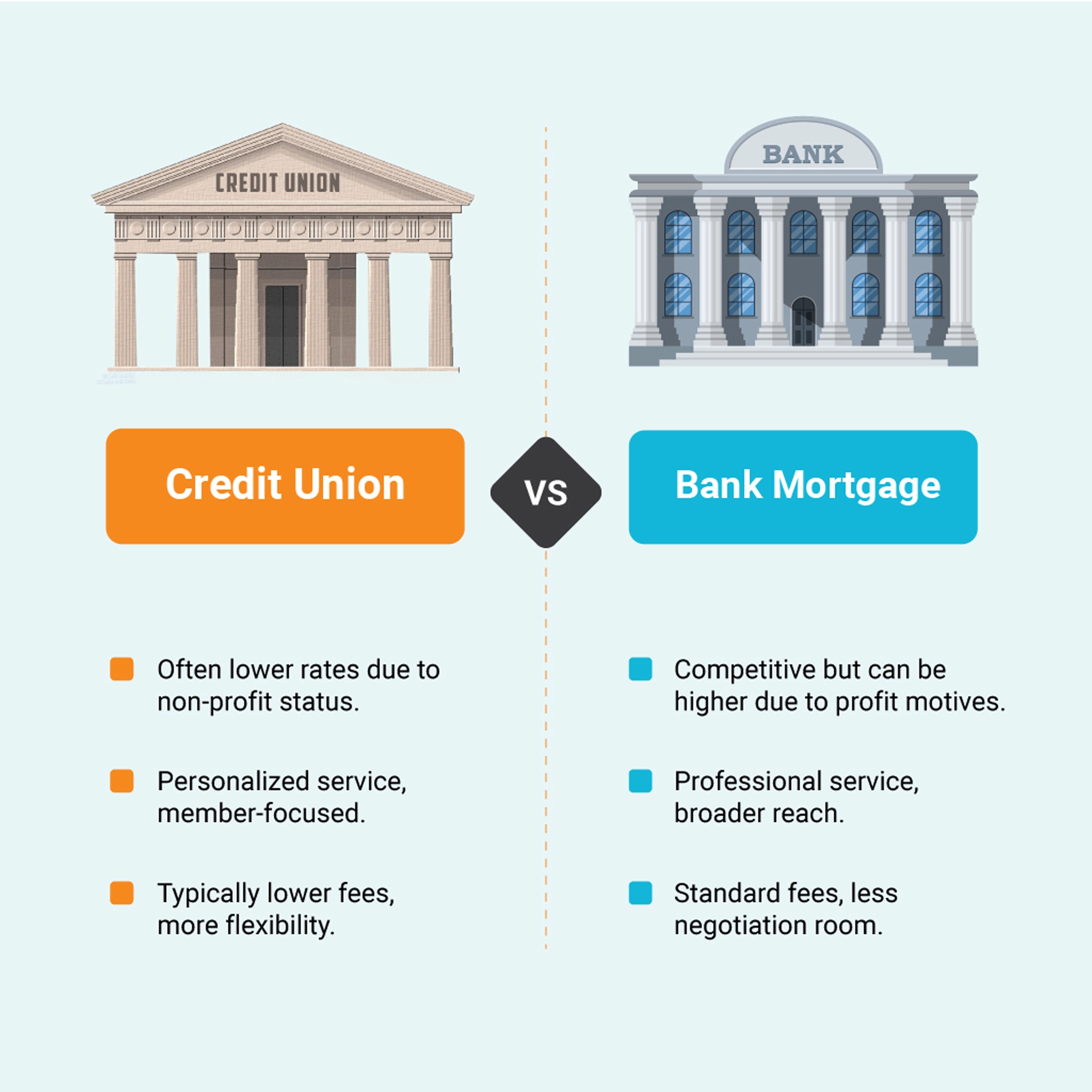

Both credit unions and banks offer unique benefits and potential drawbacks, making it essential to consider your specific needs and financial goals. Credit unions are known for their member-focused approach, often providing competitive rates and personalized service. On the other hand, banks offer a wide range of mortgage products and extensive resources. By examining the key differences and similarities, you can make an informed decision and choose the mortgage provider that best suits your needs.

What is a Credit Union Mortgage?

A credit union mortgage is a home loan provided by a credit union. A credit union is a nonprofit institution owned by its members. Unlike banks, credit unions prioritize the needs of their members rather than making a profit. They offer various financial products, including deposit accounts, loans, and mortgages.

Opting for a credit union for mortgage can come with several benefits. Credit unions often provide lower interest rates and fees compared to traditional banks. They also offer more personalized customer service. However, there are some drawbacks to consider. Membership requirements can limit accessibility, and the range of mortgage products might be more limited than what banks offer. Understanding these benefits and drawbacks can help you decide if a credit union mortgage is right for you.

What is a Bank Mortgage?

A bank mortgage is a home loan provided by a bank. Banks are financial institutions that accept deposits, allow withdrawals and issue loans. Unlike credit unions, a mortgage bank operates as a for-profit company. It has a fiduciary responsibility to its shareholders, which means it aims to make a profit. This profit-driven approach can influence its lending practices and customer service.

There are many unique benefits to taking out a bank mortgage. Banks often offer a wide variety of loan products to suit different needs. They also have extensive resources and advanced technology to streamline the mortgage process. Additionally, bank mortgage rates can be competitive, especially for borrowers with strong credit profiles. However, comparing rates and terms from different banks is important to ensure you get the best deal.

Similarities Between Credit Unions and Bank Mortgages

So, how are credit unions similar to banks?

While credit unions and banks have distinct characteristics and operational models, they share many similarities that can make either a viable option for your mortgage needs. Within the discussion of credit union vs. bank mortgage, understanding these similarities can help you make a more informed decision when choosing between a credit union and a bank for your home loan.

Application Process

Both credit unions and banks provide multiple avenues for mortgage applications. Whether you prefer to apply online, in person at a branch, or over the phone, both types of institutions offer flexible options to accommodate your needs.

This convenience ensures you can choose the best application method that suits your schedule and comfort level.

Mortgage Types

Another significant similarity is the variety of mortgage types available. Many banks and credit unions offer a wide range of mortgage finances, including conventional mortgages, fixed & floating-rate mortgages, and FHA loans.

This variety allows you to select a mortgage product that aligns with your financial situation and homeownership goals, regardless of whether you choose a bank or a credit union.

Other Financial Services & Products

Credit unions and banks can serve as comprehensive financial service providers in addition to mortgage services. They often offer various other financial products, such as savings & checking accounts, auto loans, and personal loans.

This ability to handle multiple financial needs under one roof is a major convenience for consumers, simplifying their financial management and allowing for better-coordinated financial planning.

Credit Union vs. Bank Mortgage: Key Differences

Understanding the key differences between credit union vs. bank mortgage options is crucial for making the best choice for your financial situation. These differences can significantly impact your borrowing experience and long-term financial health.

Differences in Profitability

The biggest difference between credit union vs. bank mortgage options is their profitability model. Credit unions are non-profits, meaning any surplus earnings are returned to their members through lower fees, better interest rates, and improved services. This member-focused approach can result in more favorable loan terms and a more personalized banking experience.

In contrast, banks are for-profit institutions aiming to generate profit for their shareholders. This profit-driven model influences their lending practices and fee structures. While banks may offer a wider range of services and advanced technological solutions, the need to generate profit can sometimes result in higher fees and less favorable interest rates than credit unions.

Membership Requirements

Credit union vs. bank mortgage options also differ significantly in terms of membership requirements. Banks are open to the public, allowing anyone to become a customer and apply for a mortgage. This accessibility makes banks a convenient choice for many borrowers.

On the other hand, credit unions often have specific membership criteria. To join a credit union, you might need to live in a specific area, work in a certain profession, or belong to an associated organization. While these requirements can make credit unions more exclusive, they also foster a strong sense of community and ensure that the credit union remains focused on serving its members’ best interests.

Variety of Loan Programs

The variety of loan programs available is a key consideration when comparing credit union vs. bank mortgage options. National banks typically offer a wider variety of loan types, including specialized loans like jumbo loans, interest-only mortgages, and various government-backed loans (e.g., FHA, VA, USDA). This extensive selection can cater to a broader range of financial needs and circumstances.

Conversely, credit unions may offer a more limited selection of mortgage products. However, the loan programs they do provide often come with competitive terms and lower interest rates. This can make credit unions a great option for borrowers who qualify and are looking for straightforward, cost-effective mortgage solutions.

Loan Retention Practices

Another important difference in the credit union vs. bank mortgage debate is how each institution handles the mortgages it originates. Credit unions often retain the mortgages they originate, known as portfolio loans. This means they keep these loans on their books and service them in-house, which can result in more consistent and personalized customer service throughout the life of the loan.

In contrast, banks often go to sell the mortgage loans they initiated on the mortgage market (secondary). This practice allows banks to free up capital to issue more loans but can lead to changes in who services your mortgage. As a result, borrowers might experience varying levels of service quality and consistency over their mortgage term.

Pros and Cons of Credit Union Mortgages

When evaluating the pros and cons of credit union mortgages, it is important to weigh the benefits and potential drawbacks to determine if this option aligns with your needs.

Pros

- Lower Interest Rates: Credit unions often offer lower interest rates compared to banks, which can result in significant savings over the life of your mortgage.

- Reduced Fees: Many credit unions charge lower fees for mortgage applications, origination, and closing costs, helping to reduce the overall cost of your loan.

- Personalized Service: Credit unions are known for their member-centric approach, providing personalized service and tailored mortgage solutions.

- Member Benefits: As a credit union member, you may have access to additional financial products and services at favorable terms.

Cons

- Membership Requirements: To obtain a mortgage from a credit union, you must meet specific membership criteria, which may limit your options.

- Limited Product Variety: Credit unions may offer fewer mortgage products compared to banks, potentially limiting your choices.

- Geographic Limitations: Some credit unions serve specific geographic areas, which may restrict your ability to obtain a mortgage if you move or live outside the service area.

Pros and Cons of Bank Mortgages

Understanding bank mortgage pros and cons can help you determine if this option best fits your financial situation.

Pros

- Wide Accessibility: Banks do not have membership requirements, making their mortgage products widely accessible to the general public.

- Product Variety: Banks typically offer a broad range of mortgage products, including specialized loans that may not be available at credit unions.

- Extensive Resources: Large banks often have extensive resources and advanced technology, providing a streamlined and efficient mortgage application process.

- Nationwide Presence: Many banks have a nationwide presence, making obtaining a mortgage easier regardless of location.

Cons

- Higher Interest Rates: Banks may charge higher interest rates compared to credit unions, potentially increasing the overall cost of your mortgage.

- Increased Fees: As for-profit institutions, banks may have higher fees for mortgage applications, origination, and closing costs.

- Less Personalized Service: Due to their size and profit-driven nature, banks may offer less personalized service compared to credit unions.

- Profit Motive: Banks prioritize their bottom line, which may result in policies and practices that are less favorable to borrowers.

Credit Unions and Bank Mortgages: Which is Right for You?

Deciding between a credit union or bank for mortgage involves assessing your personal financial situation, preferences, and long-term goals. Here are some steps to help you determine which option is best for you:

1. Evaluate Your Financial Situation

Consider your credit score, income, debt-to-income ratio, and overall financial health. If you have a strong financial profile, you may qualify for competitive rates at both credit unions and banks.

2. Compare Interest Rates and Fees:

Shop around and compare interest rates, fees, and loan terms from multiple credit unions and banks. This comparison will help you identify the most cost-effective option for your mortgage.

3. Assess Customer Service Needs:

If personalized service and a member-centric approach are important to you, a credit union may be the better choice. However, if you value a streamlined, technology-driven application process, a bank might be more suitable.

4. Consider Membership Requirements:

If you are eligible for credit union membership and can meet the criteria, you may benefit from lower rates and fees. If not, a bank mortgage may be more accessible.

5. Look at Product Variety

If you have unique borrowing needs or require specialized loan products, a bank with a wider variety of mortgage options may be better.

Factors to Consider When Choosing a Mortgage

There are several factors to consider when choosing a mortgage that can impact your decision. Both have their advantages, and the best choice often depends on your specific circumstances and needs.

Credit union vs. bank mortgage; let’s explore the key factors to consider when choosing the best mortgage option for you.

1. Your Credit Score

Your credit score plays a significant role in determining your mortgage eligibility and the terms you’ll receive. It is essential to understand how it impacts your choices between a credit union and a bank.

Credit unions are known for being more flexible with borrowers who have lower credit scores. They often look at the overall picture of your financial health rather than just the numbers, which can be beneficial if you have a few blemishes on your credit report. This personalized approach can lead to better mortgage terms and lower rates for those with imperfect credit.

Banks, on the other hand, typically have stricter credit score requirements. They rely heavily on standardized credit score benchmarks to determine eligibility and interest rates. While this can be advantageous for those with excellent credit, it might pose challenges for borrowers with less-than-stellar scores, potentially resulting in higher interest rates or even rejection of the mortgage application.

2. Mortgage Rates

Mortgage rates are a critical factor in your overall loan cost. Comparing the rates offered by credit unions and banks can help you find the best deal.

Credit unions often offer lower mortgage rates compared to traditional banks. As member-owned institutions, they reinvest profits back into their services, which frequently translates into more competitive rates and lower fees. This member-focused model can provide substantial savings over the life of your loan.

Banks may have higher mortgage rates but offer a wide range of mortgage products, including fixed-rate and adjustable-rate options. The extensive product lineup can be appealing if you’re looking for specific loan features or flexible repayment terms. However, shopping around and comparing rates is crucial to ensure you’re getting the best possible deal.

3. Loan Processing Time

The speed of loan processing can significantly impact your home-buying experience. Understanding the differences in processing times between credit unions and banks is vital.

Credit unions typically have a more personalized and streamlined loan processing system. Their focus on member service can result in faster decision-making and quicker loan approvals. This efficiency is particularly beneficial if you’re looking to close on a property promptly.

Banks often have more bureaucratic processes, which can lead to longer loan processing times. While some banks offer expedited services, the timeline may still be longer due to additional paperwork and standardized procedures. If you’re on a tight deadline, this could be a critical factor in your decision.

4. Loan Estimate and Closing Costs

The costs of obtaining a mortgage go beyond interest rates. Loan estimates and closing costs are crucial elements to consider while comparing credit union vs. bank mortgage.

Credit unions offer more transparency and potentially lower closing costs. As nonprofit organizations, their fee structures are generally more favorable, and they may be more willing to negotiate these costs with members. This can result in significant savings at closing.

With their larger operational scale, banks might have higher closing costs and additional fees. However, they also provide detailed loan estimates, giving you a clear picture of what to expect financially. It’s important to review these estimates carefully and ask about any excessive or unclear fees.

5. Loan Term and Monthly Payment

The length of your loan term and the resulting monthly payment are key factors in your mortgage decision. Evaluating the options offered by credit unions and banks can help you find the best fit for your financial situation.

Credit unions often provide flexible loan terms tailored to your needs. They might offer shorter terms with lower interest rates, which can reduce the overall cost of the loan. Additionally, their focus on member satisfaction can lead to more personalized payment plans that align with your budget.

Banks offer many loan terms, including short- and long-term options. This variety allows you to choose a plan that fits your financial goals, whether it’s paying off your mortgage quickly or lowering your monthly payments. However, it’s essential to consider how the term length and interest rate will impact your overall financial health and long-term plans.

Final Words

Choosing between a credit union vs. bank mortgage is a significant decision that requires careful consideration of various factors. Both credit unions and banks offer unique advantages and potential drawbacks, making it essential to evaluate your personal financial situation, preferences, and long-term goals.

By understanding the key differences and similarities between these two types of lenders, you can make an informed decision that aligns with your needs and ensures a secure financial future. Remember to compare rates, fees, and loan terms from multiple lenders, and consider seeking advice from a financial advisor to help guide you through the process.