According to the Federal Reserve Board’s data, in 2023, six percent of adults were considered “unbanked,” meaning they or their household had no access to checking, savings, or money market accounts. This highlights the importance of understanding how these accounts work, as they play a crucial role in managing daily expenses and saving for the future.

For those unfamiliar, it’s essential to understand the difference between checking and savings accounts. While both serve to store money, they offer different benefits and cater to unique financial needs. This blog will guide you through what each account offers and help you decide which one—or both—might fit your financial goals.

What is a Checking Account?

A checking account is a type of bank account primarily used for everyday transactions. Whether paying bills, buying groceries, or transferring money, a checking account is designed for frequent, daily use. Unlike savings accounts, there are no limitations on the number of transactions you can make, making checking accounts the most convenient option for handling day-to-day finances.

The meaning of checking account revolves around its accessibility. Most checking accounts come with a variety of tools that make managing money easier, such as debit cards, check-writing capabilities, and online banking services. For instance, with a debit card linked to your checking account, you can make purchases both in-store and online, and use ATMs for cash withdrawals.

Additionally, many banks offer mobile apps, allowing users to track spending, set up automatic bill payments, or transfer money with just a few taps on their smartphones.

One downside of checking accounts is that they often do not earn interest. Unlike savings accounts, where you can grow your funds over time, checking accounts are mainly for immediate access to cash. To maximize your financial strategy, it’s advisable to keep only the amount needed for daily expenses in a checking account and move surplus funds into a savings account to take advantage of higher interest rates.

When choosing a checking account and understanding the difference between checking and savings accounts,, there are several key features to consider:

No monthly maintenance fees: Some banks charge fees for maintaining a checking account. However, many offer ways to waive these fees, such as setting up direct deposit or maintaining a minimum balance.

Free access to an extensive ATM network: It’s important to have easy and cost-free access to ATMs to avoid withdrawal fees.

Low or no overdraft fees: Overdrafts happen when you spend more than what’s in your account. Choosing a bank with minimal fees for overdrawing your account can save you money.

Additionally, some banks offer sign-up bonuses for new customers. For example, many institutions provide bonuses ranging from $100 to $300 if you open a new checking account and set up direct deposit within a specified period. These incentives can make opening a new account even more rewarding.

What is a Savings Account?

A savings account is a type of bank account designed to help individuals save money over time for future financial goals. Unlike checking accounts, savings accounts are not meant for daily transactions but rather for building up reserves. They offer interest on the deposited funds, allowing your money to grow passively over time. This makes savings accounts ideal for long-term financial planning, such as setting aside money for an emergency fund, a major purchase, or a future vacation.

The saving account meaning focuses on its primary purpose: to store money safely while earning interest. While checking accounts allow for unlimited transactions, savings accounts typically limit the number of monthly withdrawals and transfers you can make. Banks usually restrict users to six free withdrawals or transfers per month. This limitation encourages individuals to save rather than spend, making savings accounts less accessible for everyday needs but more beneficial for long-term financial growth.

One of the most significant benefits of a savings account is the opportunity to earn interest on your deposits. High-yield savings accounts, in particular, offer competitive interest rates, known as Annual Percentage Yields (APYs), which allow your savings to grow faster than they would in a checking account.

For example, if you deposit $5,000 into a high-yield savings account with an APY of 2%, you could earn $100 in interest over a year. However, it’s essential to remember that these APYs can fluctuate, so your earnings might vary depending on the current market rates.

When choosing a savings account and understanding the difference between checking and savings accounts, consider the following factors:

APY: The higher the APY, the more you’ll earn in interest. Always compare rates to find the best deal, keeping in mind that APYs can change over time.

Balance requirements: Some savings accounts require a minimum balance to earn interest or avoid fees. Make sure you choose an account with balance requirements you can meet.

Fees: Look for accounts with no monthly maintenance fees or offering easy ways to waive them. Hidden fees can eat into your savings.

Bonuses: Similar to checking accounts, some banks offer sign-up bonuses for new savings accounts. For example, you may receive $150 to open a savings account and maintain a certain balance for a specified period.

Overall, savings accounts are an excellent choice for those looking to grow their wealth while keeping their money secure.

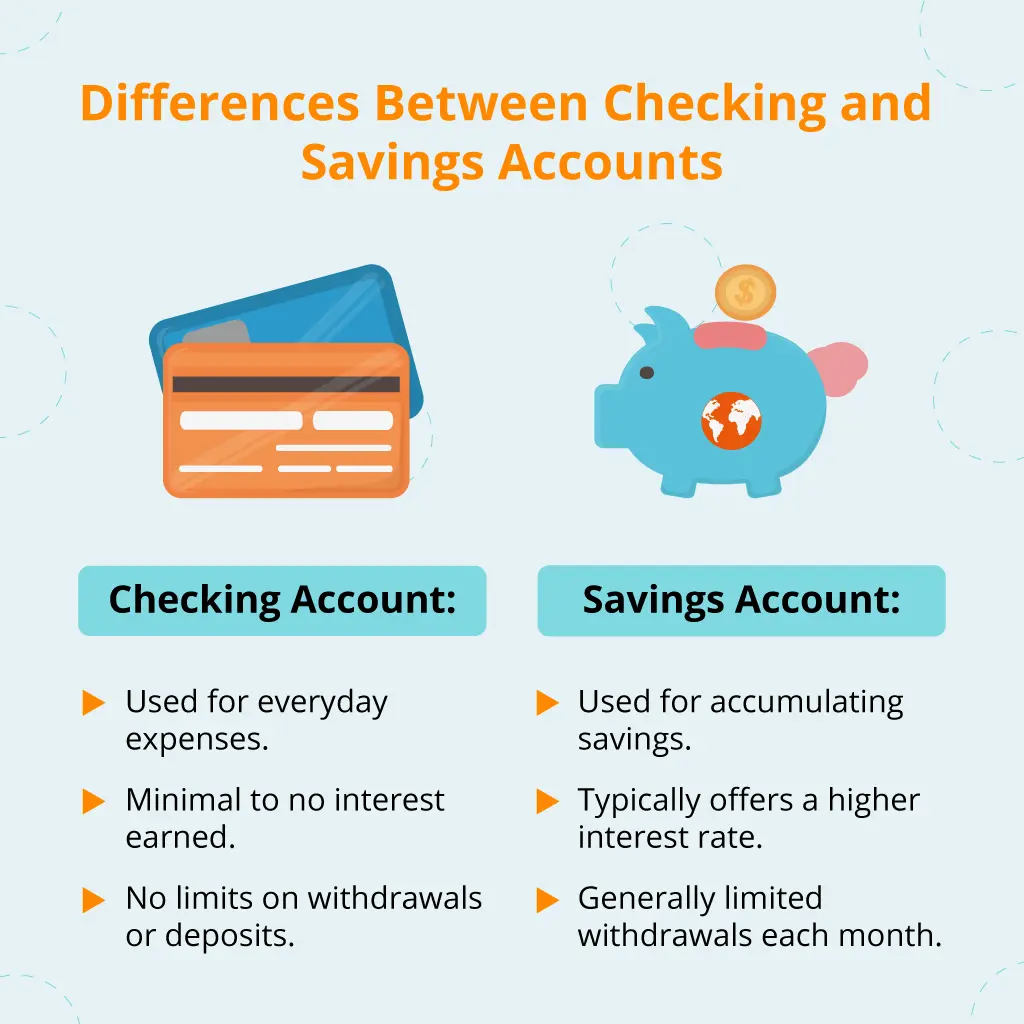

Key Differences Between Checking and Savings Accounts

When comparing checking vs savings differences, it becomes clear that these accounts serve different purposes. Understanding these differences can help you decide which type of account best suits your needs.

Purpose

The difference between checking and savings accounts lies primarily in their purpose. A checking account is designed for everyday transactions like paying bills, making purchases, and withdrawing cash. In contrast, a savings account stores money over time and saves for long-term goals, such as an emergency fund or major purchases.

Interest Rates

Another key difference between checking and savings accounts is the interest rate. Checking accounts typically offer little to no interest on the money you deposit. In contrast, savings accounts, especially high-yield ones, offer higher interest rates, allowing your balance to grow over time.

Accessibility

In terms of accessibility, the difference between checking and savings accounts becomes clear. Checking accounts provide unlimited transactions, making it easy to access funds whenever needed. Savings accounts limit the number of withdrawals you can make each month, encouraging long-term saving habits.

Fees

The difference between checking and savings accounts can also be found in the fees associated. Checking accounts often have monthly maintenance, overdraft, or ATM fees, while savings accounts usually have fewer fees. However, some savings accounts may charge fees if you exceed the withdrawal limit.

Security

Both checking and savings accounts are secure, but the difference between checking and savings account in terms of security comes from the way they are used. Savings accounts are generally more secure for long-term storage of funds, as they aren’t used for daily transactions. Checking accounts are more vulnerable to fraud since they are frequently accessed for spending. Both account types are usually insured by the FDIC up to $250,000, offering protection to account holders.

By considering these factors, you can better understand the differences between checking and savings accounts and choose the one that fits your lifestyle and financial goals.

Pros and Cons of Checking Accounts

Checking accounts offer a variety of benefits and drawbacks. Here are some key points to consider when evaluating the advantages of checking accounts:

Pros of Checking Accounts

Easy Access to Funds: One of the biggest advantages of checking accounts is their ease of access. Whether paying bills, making online purchases, or withdrawing cash from an ATM, checking accounts allow for unlimited transactions. You can use debit cards, write checks, and manage your funds through mobile apps, providing flexibility for daily financial needs.

No Limits on Transactions: Unlike savings accounts, checking accounts have no restrictions on how often you can withdraw or transfer money. This makes them ideal for managing everyday expenses and payments without worrying about penalties for exceeding a withdrawal limit. Whether covering household expenses or paying bills, checking accounts provide the flexibility needed for regular transactions.

Convenience of Digital Banking: Modern checking accounts come equipped with online banking features, allowing you to pay bills, transfer funds, and monitor your balance from anywhere. Many accounts offer mobile apps that simplify financial management, providing features like mobile check deposits, notifications for low balances, and the ability to set up automatic payments.

Sign-Up Bonuses: Some banks offer sign-up bonuses when you open a new checking account. These promotions range from $100 to $500 or more, especially if you meet certain criteria like setting up direct deposit. This can be a financial perk for new customers looking to maximize their banking options.

Cons of Checking Accounts

Little to No Interest: One of the main downsides of checking accounts is that they typically don’t offer high interest rates. Unlike savings accounts, where you can earn interest on your deposited funds, most checking accounts provide little or no return on your balance. This means that if you’re storing a large amount of money in a checking account, you’re missing out on potential earnings.

Fees and Overdraft Charges: Checking accounts often come with various fees, such as monthly maintenance, ATM, and overdraft charges. If you’re not careful, these fees can add up quickly and eat into your balance. Some banks allow you to waive maintenance fees by meeting specific criteria, such as maintaining a minimum balance or setting up direct deposit.

Overdraft Risks: Because checking accounts are frequently used for everyday transactions, it’s easy to accidentally spend more than you have in the account, leading to overdraft charges. Overdraft fees can be expensive, and frequent overdrafts may also negatively affect your banking relationship or result in your account being closed.

Less Security for Large Sums: While checking accounts are insured by the FDIC up to $250,000, they are not the best option for storing large sums of money over the long term. Because they are easily accessible for spending, they can be more vulnerable to fraud or misuse, especially if your debit card or checks are lost or stolen. Additionally, holding large balances in a checking account isn’t financially advantageous since they don’t earn interest.

Advantages and Drawbacks of Savings Accounts

Savings accounts are an excellent option for growing your wealth over time, but they come with their own set of savings account pros and cons.

Advantages of Savings Accounts

Interest Earnings: One of the biggest savings account advantages is the ability to earn interest on your deposited funds. Most savings accounts offer higher interest rates compared to checking accounts, with some high-yield savings accounts providing even more competitive rates. This allows your money to grow over time, making savings accounts ideal for long-term goals like building an emergency fund or saving for a major purchase.

Security and Stability: Savings accounts are safe places to store money, making them a low-risk option for preserving funds while earning modest interest.

Encourages Saving: Savings accounts are designed to restrict how often you can withdraw money, typically limiting withdrawals to six per month. This limitation can help encourage disciplined saving behavior by making it harder to dip into your funds for non-essential purchases. Separating your spending money from your savings makes it easier to work toward financial goals without constantly being tempted to spend.

Automatic Transfers: Many banks can set up automatic transfers from checking to savings accounts. This feature is especially useful for gradually building savings, as it allows you to set aside a portion of your monthly income automatically. Over time, this can help you build a solid financial safety net without much effort.

Drawbacks of Savings Accounts

Limited Accessibility: One key cons of savings accounts is the limited accessibility of funds. While this feature encourages saving, it can be inconvenient if you need to access your money frequently. Most savings accounts limit the number of withdrawals or transfers you can make each month, which can be frustrating in emergencies or when you need quick access to cash.

Lower Interest Rates Compared to Investments: Although savings accounts offer interest, the rates are generally lower than other investment options such as stocks, bonds, or mutual funds. While a savings account provides safety and liquidity, it may not yield high returns over time. Other investment opportunities may offer better long-term results for individuals looking to grow their wealth significantly.

Potential Fees: While many savings accounts come without monthly fees, some require a minimum balance to avoid maintenance fees. Failing to meet this minimum balance can result in charges that reduce your overall savings. Additionally, exceeding the allowed number of withdrawals or transfers in a month may also incur fees, making it important to manage the account carefully.

Inflation Risk: Another drawback of savings accounts is that the interest earned may not always keep up with inflation. Inflation reduces the purchasing power of your money over time, and in periods of high inflation, the interest rate on a savings account may not be enough to offset the loss in value. This makes savings accounts more suited for short-term savings or emergency funds rather than long-term wealth-building.

How to Choose Between a Checking and Savings Account

First, look at the fees associated with the account. Checking accounts often have monthly maintenance fees, while savings accounts may charge fees if you exceed the allowed number of withdrawals. Understanding the difference between checking and savings accounts when it comes to fees is important to avoid unnecessary costs.

Next, consider whether there is a minimum balance requirement. Many savings accounts have balance requirements to earn interest or avoid fees. Checking accounts might also require a minimum balance, but the threshold is often lower than that of a savings account. If you’re unable to meet the minimum balance, the account could incur fees, making it less cost-effective.

Another key factor is whether the account offers ATM or debit card access. Checking accounts almost always provide this feature for convenient daily transactions, while savings accounts may not. If easy access to your funds is a priority, a checking account is usually the better option, as savings accounts are designed for less frequent use.

Finally, check if the account earns interest and the APY (Annual Percentage Yield). While checking accounts typically don’t offer high interest rates, savings accounts are more likely to provide a return on your deposited funds. Knowing the difference between checking and savings accounts in terms of interest rates will help you decide which account fits your financial goals best.

Tips for Managing Checking and Savings Accounts

Proper management of both checking and savings accounts is essential for financial health. Here are some useful credit card interest tips:

Monitor Your Account Regularly

One of the most important tips for managing checking and savings accounts is to keep track of your account activity. Regularly monitoring your balances and transactions will help you avoid overdraft fees, ensure there are no unauthorized transactions, and help you stay within any withdrawal limits for savings accounts.

Set Up Alerts and Notifications

Most banks offer alert services that notify you of low balances, upcoming bills, or large transactions. Setting up these alerts can help you manage your checking and savings accounts more efficiently. You’ll be able to stay on top of important account activity and avoid the risk of missing payments or exceeding withdrawal limits.

Automate Your Savings

A great way to manage both types of accounts is to automate transfers from your checking to your savings account. By setting up automatic transfers, you ensure that a portion of your income is saved each month without any effort on your part. This is a simple but effective way to build savings over time.

Review Fees and Charges

Understanding the fees associated with checking and savings accounts is essential. Look for options that waive monthly fees if you meet specific criteria, like maintaining a minimum balance or setting up direct deposit. Regularly reviewing your account terms will help you avoid unnecessary fees and maximize your accounts.

Use Separate Accounts for Different Goals

For better financial management, consider using your checking account for daily expenses and your savings account for longer-term goals. Keeping your savings separate from your spending money helps reduce the temptation to dip into funds intended for future needs. It’s a simple but effective way to manage both accounts wisely.

Should You Have Both a Checking and Savings Account?

Yes, having both a checking and savings account or multiple bank accounts can provide a balanced approach to managing your finances. A checking account is ideal for everyday transactions like paying bills and making purchases, while a savings account is designed for long-term goals and earning interest on your deposits. Understanding the difference between checking and savings accounts helps you maximize the benefits of each type.

By keeping your checking and savings separate, you can easily manage daily expenses while growing your savings over time. This separation also reduces the temptation to spend money meant for future needs, making it easier to build an emergency fund or save for large purchases. Multiple bank accounts offer flexibility and financial stability, ensuring you have the right tools to manage short-term and long-term financial goals.

Final Words

The difference between checking and savings accounts lies in their purpose, accessibility, and interest rates. Checking accounts are ideal for everyday transactions, while savings accounts are designed to help you grow your wealth over time. By understanding these differences and managing both types of accounts effectively, you can take control of your finances and work toward achieving your financial goals.

For more insights and helpful financial tips, visit our blog at EduCounting. We provide expert advice and resources to help you make informed financial decisions and maximize your money management.