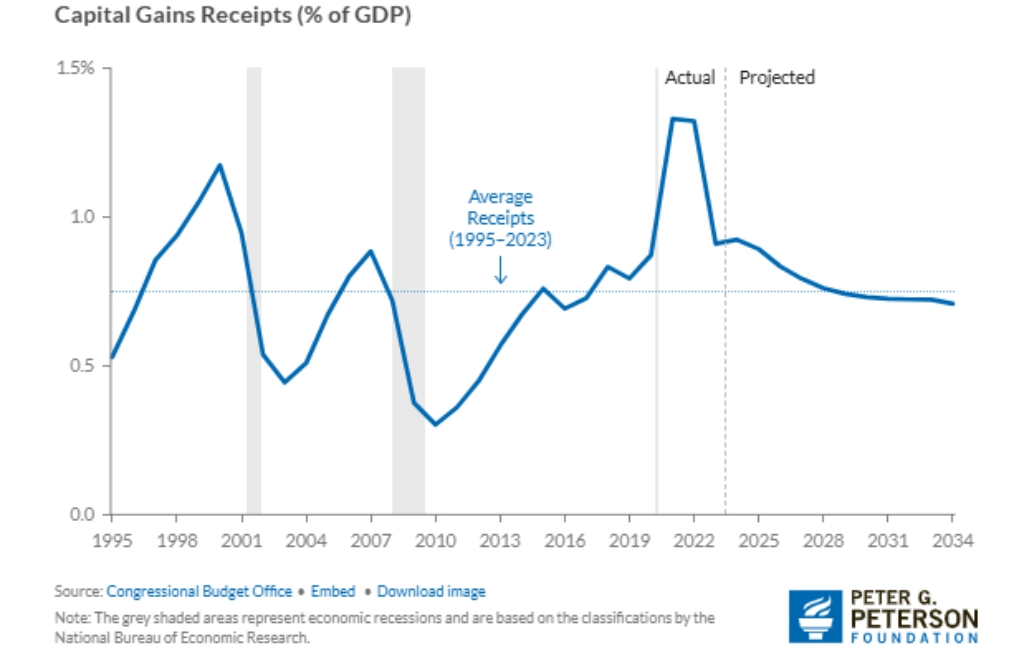

In recent years, tax breaks related to capital gains have consistently outpaced the federal government’s revenue from capital gains taxes. 2023, for example, tax expenditures on capital gains reached $361 billion, almost 50% higher than the revenue generated from these taxes. This growing gap highlights how significant capital gains tax relief can be for investors, making it essential to understand the options available to minimize tax burdens.

Learning how to avoid capital gains taxes on stocks can make a substantial difference in maximizing your investment returns. By applying effective tax strategies, investors can legally reduce their tax liabilities, retain more of their earnings, and strengthen their financial plans. This guide explores practical tips and proven methods to help you make the most of your stock investments while keeping tax costs as low as possible.

Understanding Capital Gains Taxes

Capital gains are profits from selling an asset for more than you paid. These gains are a key component of stock investment, and understanding their tax implications is essential for managing your finances effectively. For instance, if you bought a stock for $1,000 and sold it later for $1,500, the $500 profit is your capital gain, subject to tax.

Capital gains taxes differ from ordinary income taxes, depending on how long you hold the asset before selling. The IRS classifies gains as either short-term or long-term, with each type subject to different tax rates.

Short-Term Capital Gains Tax

Short-term capital gains occur when you sell a stock you’ve held for a year or less. The IRS taxes these gains at the same rate as your ordinary income, meaning they can be taxed as high as your income tax bracket. For example, if your income tax rate is 24%, any short-term gains will also be taxed at 24%. This can lead to a higher tax burden for those frequently trading stocks within short periods. To minimize taxes on short-term gains, many investors focus on long-term strategies or tax-efficient accounts like IRAs.

Why Long-Term Capital Gains are Tax-Favored

Long-term capital gains, generated from stocks or assets held for over a year, enjoy preferential tax treatment compared to short-term gains. Instead of being taxed as ordinary income, long-term gains have a maximum tax rate of 20%, with many investors eligible for rates of 15% or even 0%, depending on their income level. This difference can significantly reduce the tax burden for investors who adopt a buy-and-hold strategy. By holding onto investments for longer than a year, investors not only take advantage of lower tax rates but also reduce the frequency of taxable transactions.

How Capital Gains are Taxed on Stocks

Stock taxation varies depending on how long you hold them before selling. Stock taxation is categorized into short-term and long-term gains, each with unique investment tax rules. Short-term gains apply to assets held for less than a year, while long-term gains are for assets held over a year. This classification impacts your tax rate, with short-term gains generally taxed at higher rates than long-term gains.

Capital gains taxes on stocks are determined by three key factors: your tax filing status, taxable income, and the duration of time you’ve held the asset. Understanding how these components influence your tax rate can help you make strategic decisions about buying and selling stocks.

Tax Filing Status

Your filing status (such as single, married, filing jointly, or head of household) affects your tax brackets, influencing the rate applied to your capital gains. Different brackets exist for each filing status, impacting whether you fall into a lower or higher capital gains tax rate.

Taxable Income

Your overall taxable income also plays a significant role. Higher income typically means a higher capital gains tax rate, while lower income may qualify you for reduced rates. For long-term capital gains, income thresholds are established by the IRS, allowing some taxpayers to benefit from a 0% tax rate on gains, depending on their income.

Holding Period of the Asset

The time you hold a stock before selling is another critical factor. Assets held for a year or less are considered short-term and are taxed at your regular income tax rate, which can be much higher. By holding assets for over a year, you can qualify for the lower long-term capital gains tax rates, which are generally more favorable and can lead to significant tax savings.

Short-Term Capital Gains Tax Rate Calculation

Short-term gains arise when you sell a stock you’ve held for less than a year. These gains are taxed at the same rate as your ordinary income, with tax rate calculations based on your overall income bracket.

Short-term gains apply when you sell an investment you’ve held for a year or less, and these gains are taxed as ordinary income. Unlike long-term capital gains, which benefit from reduced tax rates of 0%, 15%, or 20%, short-term gains can incur taxes as high as 37%, depending on your income and filing status.

For instance, if a married couple with a combined income of $176,000 files jointly and realizes a short-term gain, their profits would fall under the 22% income tax bracket in 2024. Holdinging onto stocks or other investments for over a year could shift their gains from short-term to long-term, thus lowering the overall tax rate. Understanding this timing can be a key strategy in how to avoid capital gains taxes on stocks by leveraging lower rates for long-term gains.

Long-Term Capital Gains Tax Rate Calculation

When you hold stocks for more than a year, you qualify for long-term tax savings on your capital gains. Long-term capital gains tax rates are lower than short-term rates, typically set at 0%, 15%, or 20%, depending on your income level. This encourages investors to keep their investments longer, as the tax burden decreases with the holding period.

For investors seeking how to avoid capital gains taxes on stocks efficiently, understanding the difference between long-term and short-term capital gains is crucial. The U.S. Tax Code offers more favorable tax rates on long-term gains ranging from 0% to 20% based on factors like your filing status and taxable income. Taxable income is calculated by taking your adjusted gross income (AGI) and subtracting either the standard deduction or eligible itemized deductions.

For example, a married couple filing jointly with a taxable income of $179,000 in 2024 would be taxed at 15% on long-term capital gains. However, if the couple’s taxable income was under $94,050, they could qualify for a 0% tax rate on long-term capital gains.

This favorable treatment clearly benefits holding stocks for more than a year, as opposed to paying higher rates on short-term gains. Investors can use these tax brackets to their advantage, strategically selling investments to minimize the taxes owed and maximize after-tax returns.

How to Avoid Capital Gains Taxes on Stocks: Best Practices

If you could avoid taxes on stocks, it can make a significant difference in your overall returns. From leveraging charitable donations to timing sales effectively, these strategies can help you keep more of your hard-earned money while staying compliant with tax laws. Knowing how to avoid capital gains taxes on stocks involves a mix of strategies:

1. Gift Stock to Charitable Organizations

One way how to avoid capital gains taxes on stocks is to donate appreciated stock to a charitable organization. When you donate stocks instead of cash, you receive a tax deduction based on the stock’s fair market value and avoid paying capital gains taxes on the increase in value. This practice is beneficial if you want to support a cause while minimizing your tax burden.

2. Keep Stocks for Over a Year Before Selling

Holding stocks for more than one year before selling them is a strategic move in how to avoid capital gains taxes on stocks effectively. By doing so, your gains qualify for the long-term capital gains tax rate, which is generally lower than the rate for short-term gains. This approach can significantly reduce the taxes owed on appreciated stocks.

3. Use Tax-Advantaged Retirement Accounts

Investing within retirement accounts, like IRAs or 401(k)s, can help you grow investments tax-free or tax-deferred, offering a key strategy in how to avoid capital gains taxes on stocks. With these accounts, you won’t owe capital gains taxes when you trade or sell within the account. This allows your investments to grow without the drag of capital gains taxes, benefiting you in the long run.

4. Include Stocks in Estate Planning

If you plan to pass on assets to heirs, you can also consider how to avoid capital gains taxes on stocks by transferring appreciated stocks through estate plans. When your heirs inherit the stock, they receive a “step-up” on a cost basis, meaning they’ll pay capital gains taxes only on the appreciation from the date they inherit the asset—not the entire increase from when you bought it. This can significantly reduce their tax liability.

5. Time Stock Sales for a Low-Income Year

Another effective strategy for how to avoid capital gains taxes on stocks is selling stocks during a year when you’re in a lower tax bracket. For instance, if you expect your income to be lower due to retirement or a career change, you may qualify for a lower long-term capital gains tax rate, or even the 0% rate, based on your taxable income.

6. Offset Gains with Losses Using Tax-Loss Harvesting

Tax-loss harvesting is a useful strategy in how to avoid capital gains taxes on stocks by balancing gains with losses. You can offset gains from appreciated stocks by selling underperforming stocks at a loss. This practice is especially valuable for investors with portfolios containing both gains and losses, as it allows them to reduce their taxable capital gains.

7. Donate and Re-Buy to Adjust Your Cost Basis

A unique approach in how to avoid capital gains taxes on stocks involves donating appreciated stock and then repurchasing it on the open market. This “reset” helps establish a new cost basis: the current market price when you re-buy the stock. By doing this, you’ll have a higher cost basis, potentially reducing future capital gains taxes when you sell the stock later.

Effective Strategies to Minimize Capital Gains Tax on Stock Investments

We have tried to figure out how to avoid capital gains taxes on stocks. Reducing capital gains taxes on stock investments requires a strategic approach, particularly for long-term financial planning. While best practices focus on general principles, these strategies provide targeted, actionable steps to reduce your tax burden. Tax-efficient investing helps you retain a larger share of your stock investment returns. Here are some useful strategies:

1. Optimize Your Investment Timing

Carefully timing when you buy and sell stocks can significantly affect your tax liability. For example, selling stocks during years when your taxable income is lower may allow you to benefit from reduced or even zero long-term capital gains tax rates. If possible, delay selling appreciated assets until you’re in a more favorable tax bracket.

2. Utilize Tax-Loss Harvesting

Tax-loss harvesting is a proactive strategy in which you sell underperforming stocks to offset gains from appreciated ones. This method not only reduces your taxable income but can also carry losses forward to future tax years, providing ongoing benefits for active investors with diversified portfolios.

3. Diversify Into Tax-Advantaged Investments

Shifting part of your portfolio into tax-advantaged accounts like 401(k)s, Roth IRAs, or municipal bonds can help you grow wealth while deferring or avoiding capital gains taxes. Municipal bonds, for instance, are typically exempt from federal taxes and sometimes state taxes, making them a strategic addition to tax-efficient investing.

4. Explore Qualified Opportunity Funds (QOFs)

Qualified Opportunity Funds allow you to reinvest capital gains from stock sales into designated projects in economically distressed areas. By doing so, you can defer taxes on the gains and potentially eliminate a portion of them if you hold the investment long enough, supporting both your financial goals and community development.

5. Implement Asset Location Strategies

Place your investments in accounts that offer the best tax treatment. For example, keep high-growth stocks in tax-deferred accounts and low-yield, stable investments in taxable accounts. This allocation ensures that your portfolio is tax-efficient while optimizing returns.

6. Use a Step-Up in Basis for Estate Planning

Incorporate a step-up basis into your estate plan to minimize taxes on inherited stocks. When stocks are passed to heirs, the cost basis adjusts to the market value at the time of inheritance. This strategy eliminates taxes on the appreciation during your lifetime, making it highly effective for wealth transfer.

7. Take Advantage of Installment Sales

If you plan to sell a large block of stock, consider an installment sale to spread the capital gain across multiple tax years. By breaking up the sale, you can potentially keep your income within a lower tax bracket, reducing the overall tax liability on the gains.

8. Invest in Growth-Focused Stocks

Opt for stocks that emphasize growth rather than dividend payouts. Since dividends are taxed as income, focusing on growth investments allows you to avoid paying taxes until you sell the stock, offering more control over when and how you incur tax liabilities.

Tips for Reducing Taxes When Selling Stocks

Selling stocks can result in a significant tax liability if not approached thoughtfully. To minimize capital gains taxes, consider these actionable tips for reducing taxes that build on both best practices and strategic approaches:

1. Plan Your Sales Around Your Income

One of the most effective ways to reduce taxes when selling stocks is to plan sales during a low-income year. For instance, if you’re between jobs, retired, or experiencing a temporary drop in income, you may qualify for lower capital gains tax rates. Timing your stock sales strategically can help you take advantage of these reduced rates.

2. Prioritize Long-Term Holdings

Aim to hold your stocks for more than one year before selling to qualify for the more favorable long-term capital gains tax rates. This simple but impactful strategy can save you significantly compared to the higher rates on short-term gains, which are taxed as ordinary income.

3. Offset Gains with Losses

Tax-loss harvesting is a valuable tool to reduce your taxable gains. By selling underperforming stocks, you can offset the profits from appreciated stocks, minimizing the overall tax liability. Any excess losses can even be carried forward to future years to offset gains or income.

4. Gift Appreciated Stocks

If you’re considering charitable contributions, donate appreciated stocks instead of cash. This approach not only allows you to support a cause but also provides a double tax benefit: you can claim a tax deduction for the fair market value of the stock while avoiding capital gains taxes on its appreciation.

5. Take Advantage of Tax-Advantaged Accounts

Use tax-advantaged accounts like IRAs or 401(k)s to invest and sell stocks whenever possible. Gains from investments in these accounts grow tax-deferred or tax-free, meaning you won’t owe capital gains taxes on trades within the account.

6. Spread Out Sales with Installments

For significant stock holdings, consider an installment sale to spread the capital gains over multiple tax years. This strategy helps keep your income within a lower tax bracket and reduces the tax burden in any single year.

7. Monitor for Tax-Efficient Opportunities

Keep an eye on opportunities to rebalance your portfolio in a tax-efficient manner. For example, selling stocks with minimal gains during a year of lower income or offsetting gains with carryover losses from previous years can enhance tax savings.

8. Consult a Tax Professional

Navigating capital gains taxes can be complex. Engaging a tax advisor ensures you understand the nuances of the tax code and can implement tailored strategies that maximize your tax savings while aligning with your financial goals.

Additional Considerations for Tax Planning

Tax planning isn’t just about saving money today—it’s about crafting a sustainable financial future. To ensure you’re making the most of your investments, consider these often-overlooked, creative approaches to minimize tax burdens while maximizing opportunities. A tax planning strategy is essential to successfully manage your investment tax liabilities. Additional considerations include:

1. Align Tax Planning with Life Events

Major life events like marriage, home buying, or transitioning careers can significantly shift your tax obligations. For example, getting married might allow you to leverage a higher combined income threshold for capital gains. Similarly, if you plan to retire soon, consider how reduced income levels in retirement could open opportunities for selling stocks at a lower tax rate.

2. Optimize Tax Efficiency with Charitable Trusts

For those with philanthropic goals, charitable remainder trusts (CRTs) offer a dual benefit. Transferring appreciated stocks to a CRT means avoiding immediate capital gains taxes while securing a tax deduction and generating income from the trust. This strategy lets you support meaningful causes while preserving wealth.

3. Harness the Power of Tax-Free Growth Tools

Look beyond traditional tax-deferred accounts and explore innovative tools like Health Savings Accounts (HSAs). These accounts provide triple tax benefits—tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses—offering a unique way to offset capital gains tax indirectly by freeing up other income for investing.

4. Consider Tax-Advantaged Harvesting Across Asset Classes

Don’t limit tax-loss harvesting to stocks alone. Combine the strategy with other assets, like cryptocurrency or real estate, to amplify your tax benefits. For instance, losses from crypto assets can offset gains from stock investments, helping you stay tax-efficient across a diversified portfolio.

5. Keep an Eye on International Investments

Investments in foreign stocks or funds may be subject to double taxation—once in the source country and again in the U.S. However, tax treaties and foreign tax credits can mitigate this. Consider balancing your portfolio with international investments to leverage these credits while diversifying your risk.

6. Build a Tax Buffer with Annual Rebalancing

Your investment portfolio can drift from its original allocation over time, potentially increasing tax liabilities. By rebalancing annually, you can realign your portfolio and strategically sell high-performing assets in years when your tax liability is lower.

7. Monitor Legislative Developments for Strategic Moves

Proposed tax changes often come with transition periods, allowing investors to act before new laws take effect. For example, if capital gains tax rates are expected to rise, selling appreciated stocks under current rates can lock in lower liabilities. Stay informed to time your actions with legislative shifts.

Final Words

Understanding how to avoid capital gains taxes on stocks can empower you to make smarter investment decisions and keep more of your returns. Strategies such as tax-loss harvesting, utilizing Roth IRAs, and leveraging long-term capital gains rates can make a significant difference in your portfolio’s performance.

Thoughtful planning and adherence to tax-efficient practices can reduce your tax burden, enhance your returns, and help you reach your financial goals.