When pursuing the dream of homeownership, many find the path blocked by an unexpected obstacle: their student loan debt. Student loans, a common financial burden for many, can significantly impact one’s ability to secure a mortgage. Understanding whether a mortgage is denied due to student loans and learning strategies to overcome this hurdle is crucial for aspiring homeowners.

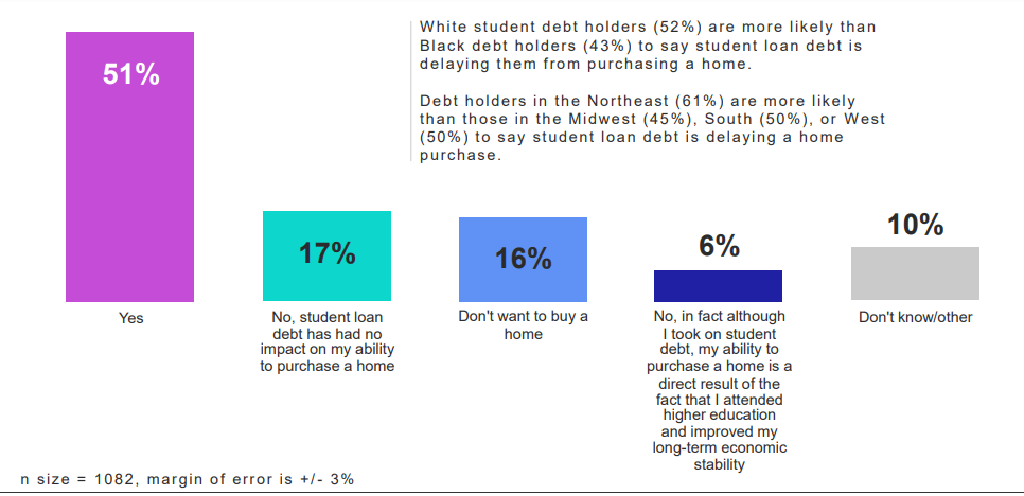

According to a revealing 2021 poll by the National Association of Realtors, 51% of non-homeowners burdened with student loans cited this debt as a key obstacle to their home-buying journey. This statistic highlights a widespread challenge and underscores the crucial need for understanding and navigating the complexities of acquiring a mortgage amidst such financial constraints. So, when is a mortgage denied due to student loans?

In this blog, we delve into the common reasons aspiring homeowners face mortgage denials due to student loans and, more importantly, offer practical solutions to overcome these hurdles. Whether you’re grappling with high debt-to-income ratios or seeking ways to improve your credit score, this guide provides essential insights and strategies to help you move closer to unlocking the door to your home.

What to Do If You Were Denied a Mortgage Due to Student Loan Debt?

Navigating the complexities of obtaining a mortgage can be challenging, especially when student loan debt is a significant factor. Being denied a mortgage due to student loans is common, but it’s not the end. By understanding and addressing the specific reasons for denial, you can improve your chances for a successful application in the future.

1. Diagnose the Specific Reason for Denial

The first step in resolving a mortgage denial is pinpointing its exact reason. Lenders must provide a reason for denial, which often revolves around credit issues, high debt-to-income (DTI) ratios, or the handling of student loans. Obtaining this information is crucial for formulating a plan to address these issues.

Once you know the reasons, thoroughly examine your finances. Assess how your student loans are influencing your DTI ratio or credit score. Are your payments too high, or is it an issue of late payments impacting your credit history? Understanding these factors is key to developing a targeted approach to overcome the denial.

2. Strategies to Lower Your Debt-to-Income (DTI) Ratio

Reducing your overall debt is one effective way to lower your DTI ratio. Focus on paying off smaller debts first, which can quickly improve your ratio and make your financial profile more attractive to lenders.

Consider increasing your income by taking on additional work or seeking a higher-paying job. Alternatively, refinancing other debts at lower interest rates can also help reduce your monthly loan payments, improving your DTI ratio.

3. Adjust Your Student Loan Repayment Plan

If your current student loan payments are too high, consider switching to an income-driven reimbursement plan. These arrangements adjust your EMIs based on inflow, which can significantly lower your payment and improve your DTI ratio.

Temporarily suspending student loan payments through deferment or forbearance can help in certain situations. This strategy might be suitable if you face short-term financial hardship or transition into your career.

4. Improving Your Credit Score

Consistently paying all your bills on time is crucial for a good credit score. Prioritize and manage your debts responsibly, ensuring you don’t miss any payments.

Work on maintaining a low credit utilization ratio (the amount of credit you use compared to your total credit limit) and keep old credit accounts open to lengthen your credit history. Both factors play a significant role in determining your credit score.

5. Exploring Different Mortgage Loan Types

Investigate federal programs like FHA, VA, or USDA loans. These programs often have more lenient requirements regarding credit scores and DTI ratios and might be more forgiving of student loan debt.

Don’t overlook conventional loans and specialized mortgage products that might be more suited to your financial situation. Each loan type has criteria; finding the right fit can be the key to approval.

6. Professional Consultation

Consulting with a mortgage broker or financial advisor can provide invaluable insights into the mortgage application process. They can offer tailored advice based on your unique financial circumstances and guide you through the necessary steps to improve your chances of approval.

A professional can help you understand different mortgage products, advise on credit improvement strategies, and assist in planning a realistic timeline for reapplication.

7. Preparing to Reapply

Before reapplying for a mortgage, ensure that you have adequately addressed the reasons for your initial denial. This might involve improving your credit score, lowering your DTI ratio, or adjusting your student loan repayment plan.

Be prepared with all necessary documentation, and consider ways to strengthen your application. This might include saving for a larger down payment or demonstrating stability in your employment. A stronger application increases your chances of approval on your next attempt.

Understanding Mortgage Lender Guidelines Specific to Student Loans

Mortgage lenders have specific guidelines for student loans. This includes how they calculate student loan payments for DTI purposes, whether they consider loans in deferment, and how they view income-based repayment plans.

When navigating the complexities of mortgage approval, understanding how lenders evaluate your financial situation, especially concerning student loan debt, is crucial. This evaluation often hinges on your debt-to-income (DTI) ratio, a critical measure used by mortgage lenders to assess your creditworthiness as a borrower.

The DTI ratio is calculated by comparing monthly debt payments to gross income. The calculation produces a percentage that lenders scrutinize closely to determine your ability to manage and repay a mortgage.

For instance, if you have ongoing financial obligations like car loan and student loan payments, a mortgage lender will aggregate these with your anticipated mortgage payment. This sum is divided by your gross monthly income to establish your DTI ratio. Typically, lenders prefer this ratio to be at most 43 percent.

However, this threshold is flexible and can vary based on the lender’s policies and the loan program. Some lenders may adopt a more conservative approach, seeking a lower ratio of around 36 percent. In contrast, others may exhibit more flexibility, accepting ratios as high as 50 percent. This variance is essential for prospective borrowers to consider when selecting a lender.

It’s also vital to understand how different lenders view types of student loan repayments. For example, if you’re on an income-driven repayment plan, lenders may calculate your monthly payment differently than a standard repayment plan.

Furthermore, lenders might consider whether your student loans are in deferment or forbearance, potentially treating these scenarios differently in their DTI calculations. Sometimes, even if you’re not making payments, lenders might still factor in a notional or estimated monthly payment for these deferred loans.

The nuances of how student loan debt is treated in the mortgage approval process underscore the importance of thoroughly preparing and understanding your financial profile. Prospective homebuyers should know their DTI ratio, how their student loan repayments influence this ratio, and how different lenders might interpret these figures. By grasping these details, you can better position yourself to meet lender criteria and navigate the path to mortgage approval, even amidst student loan debt challenges.

Final Words

While student loans can be a barrier to securing a mortgage, they do not have to be insurmountable. By understanding lender guidelines and implementing strategies to improve your financial profile, you can increase your chances of mortgage approval, turning the dream of homeownership into a reality despite the challenge of student loans.

Ready to navigate the complexities of mortgages and student loans? Let EduCounting be your guide! Dive into our expertly curated blogs and in-depth courses, where we shed light on the critical aspects of financial literacy, from savvy strategies to effective approaches.

So, is your mortgage denied due to student loans?

Whether you’re just embarking on your financial journey or looking to enhance your fiscal skills, EduCounting stands by your side. Join us and empower yourself with the knowledge and tools needed for financial success, especially if you’ve faced challenges like being denied a mortgage due to student loans. Start your journey toward financial mastery with EduCounting today!

FAQs

Do student loans affect your chances of getting a mortgage?

Yes, student loans can significantly impact your chances of getting a mortgage. When evaluating your loan application, lenders consider your debt-to-income (DTI) ratio and student loan payments contribute to this ratio. High student loan debt can increase your DTI ratio, potentially making it more challenging to qualify for a mortgage.

Do mortgage lenders look at student loans in deferment?

Mortgage lenders do take into account student loans in deferment. While these loans may not require current payments, lenders often calculate a hypothetical monthly payment that could be applied toward the loan. This estimated payment is then used to determine your DTI ratio, affecting your mortgage eligibility.

How do mortgage lenders calculate student loans?

Mortgage lenders calculate student loans by considering the monthly payment amount as reported on your credit report or using a calculated percentage of the loan balance. If the loans are on an income-driven repayment plan or in deferment, lenders may use a standard percentage of the loan balance to estimate a monthly payment, which is then factored into your DTI ratio.