In the world of personal finance, simple vs compound interest can be the deciding factor between financial success and stagnation. Whether you’re looking to grow your savings, take out a loan, or make smart investment choices, understanding how these two types of interest work is crucial. They seem like minor details, but they have the power to significantly affect your financial future.

At its core, interest is the cost of borrowing money or the reward for saving or investing it. But the way that interest is calculated—either using simple or compound methods—can drastically change the amount you either owe or earn over time. The impact of simple vs compound interest becomes even more noticeable when the time horizon is longer.

In this article, we’ll delve deep into both types of interest, how they work, their formulas, and which is better for your particular financial needs. From real-world examples to expert tips, we’ll ensure you have all the information you need to make informed decisions about your money. By the end, you’ll have a solid understanding of simple vs compound interest, how they differ, and why one may be more suitable for certain financial products than the other.

What is Simple Interest?

To start, let’s break down simple interest. This type of interest is straightforward and easy to calculate. It is determined only based on the principal amount—the original sum of money either borrowed or invested. No matter how long the money is loaned or invested, the interest is always calculated on the original principal, which means it doesn’t compound or grow exponentially.

How Simple Interest Works

Let’s take a more in-depth look at how simple interest works. Imagine you’ve borrowed $10,000 from the bank to purchase a car. The bank agrees to charge you a simple interest rate of 5% annually for 5 years. In this scenario, you would only pay interest on the original $10,000 every year, regardless of how much time passes. So, the calculation would look like this:

Year 1: $10,000 x 5% = $500

Year 2: $10,000 x 5% = $500

Year 3: $10,000 x 5% = $500

Year 4: $10,000 x 5% = $500

Year 5: $10,000 x 5% = $500

By the end of the 5 years, you would have paid a total of $2,500 in interest on your $10,000 loan. The total repayment amount would be $12,500 (principal + interest).

Advantages of Simple Interest

Simple interest has its benefits, especially when you’re the one borrowing money. Here are a few reasons why it can work in your favor:

Predictability: Since the interest is always calculated based on the original principal, there’s no compounding effect. You know exactly how much you’ll pay in interest each year and over the loan term.

Cost Control: Because interest doesn’t grow on itself, loans using simple interest often have lower total costs for borrowers compared to loans that compound.

Easy to Calculate: With a basic understanding of the formula, you can easily calculate how much interest you’ll owe, making it easier to budget and plan your repayments.

Disadvantages of Simple Interest

However, simple interest isn’t always the best option. For instance, if you’re an investor or saver looking to grow your money, simple interest can hold you back. Here’s why:

Limited Growth: Since interest is only calculated on the principal, the total interest earned remains the same year after year. This limits the potential for exponential growth, which could be a disadvantage if you’re saving or investing over a long period.

Simple Interest Formula

The formula for simple interest is straightforward:

Let’s break down what each component represents:

Principal (P): The initial amount of money (either borrowed or invested).

Rate (R): The annual interest rate as a decimal (for example, 5% would be 0.05).

Time (T): The duration for which the money is borrowed or invested, usually in years.

By plugging in the relevant numbers, you can easily calculate how much simple interest you’ll either owe or earn over a set period.

Understanding Compound Interest

Now that we’ve covered simple interest, let’s move on to compound interest—the more complex, but also more powerful, form of interest calculation.

Compound Interest Definition

Compound interest means that you’re not just earning or paying interest on the original principal, but also on any previously accrued interest. This is often referred to as “interest on interest.” Over time, this compounding effect can lead to significant growth, especially if the interest is compounded frequently (monthly, quarterly, or annually).

How Compound Interest Works

Let’s break down how compound interest works in practice with an example:

Suppose you invest $1,000 in a savings account with an annual interest rate of 5%, and the interest compounds annually. In the first year, you’d earn $50 in interest, giving you a total of $1,050. In the second year, the 5% interest is applied to the new total of $1,050, so you’d earn $52.50 in interest for a total of $1,102.50 by the end of the second year.

Over time, this compounding effect leads to faster growth of your money because each period’s interest is added to the previous amount, and interest is earned on that larger balance.

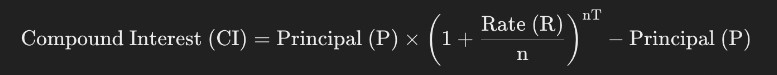

The Formula for Compound Interest

Here’s the formula used to calculate compound interest:

Where:

P = Principal (the original amount of money)

R = Annual interest rate (in decimal form)

n = Number of times interest is compounded per year (e.g., monthly, quarterly, or annually)

T = Time (number of years the money is invested or borrowed)

Example of Compound Interest in Action

Let’s expand on the example of compound interest. Assume you invest $1,000 at 5% annual interest, compounded monthly. Using the formula, after 10 years, your investment would grow significantly. Here’s a rough breakdown of what happens each year:

Year 1: $1,000 x 5% = $50 (interest), total = $1,050

Year 2: $1,050 x 5% = $52.50 (interest), total = $1,102.50

Year 3: $1,102.50 x 5% = $55.12 (interest), total = $1,157.62

As the years go by, you can see that the amount of interest earned increases because you’re earning interest not only on the principal but also on the previously accumulated interest. Over a decade, your $1,000 could grow to $1,647.01, much more than you would earn with simple interest over the same period.

Advantages of Compound Interest

The biggest advantage of compound interest is that it allows your money to grow exponentially. The longer you let your money sit and compound, the greater your returns will be. Here are the key benefits:

Faster Growth: Compound interest builds on itself, which means that over time, the growth of your money speeds up, leading to significantly larger returns than simple interest.

Compounding Frequency: The more often interest is compounded (daily, monthly, quarterly), the faster your investment grows. For example, a savings account that compounds daily will grow more than one that compounds annually, even if the interest rate is the same.

Disadvantages of Compound Interest

While compound interest is great for saving and investing, it can work against you if you’re borrowing money:

Higher Cost of Borrowing: If you’re taking out a loan that compounds interest, such as a credit card or some student loans, the total amount you owe can grow quickly if you’re not paying off the principal.

Complexity: Compound interest calculations can be a bit more complicated than simple interest, especially when multiple variables (such as the frequency of compounding) come into play. However, financial calculators and online tools make it easier to handle these computations.

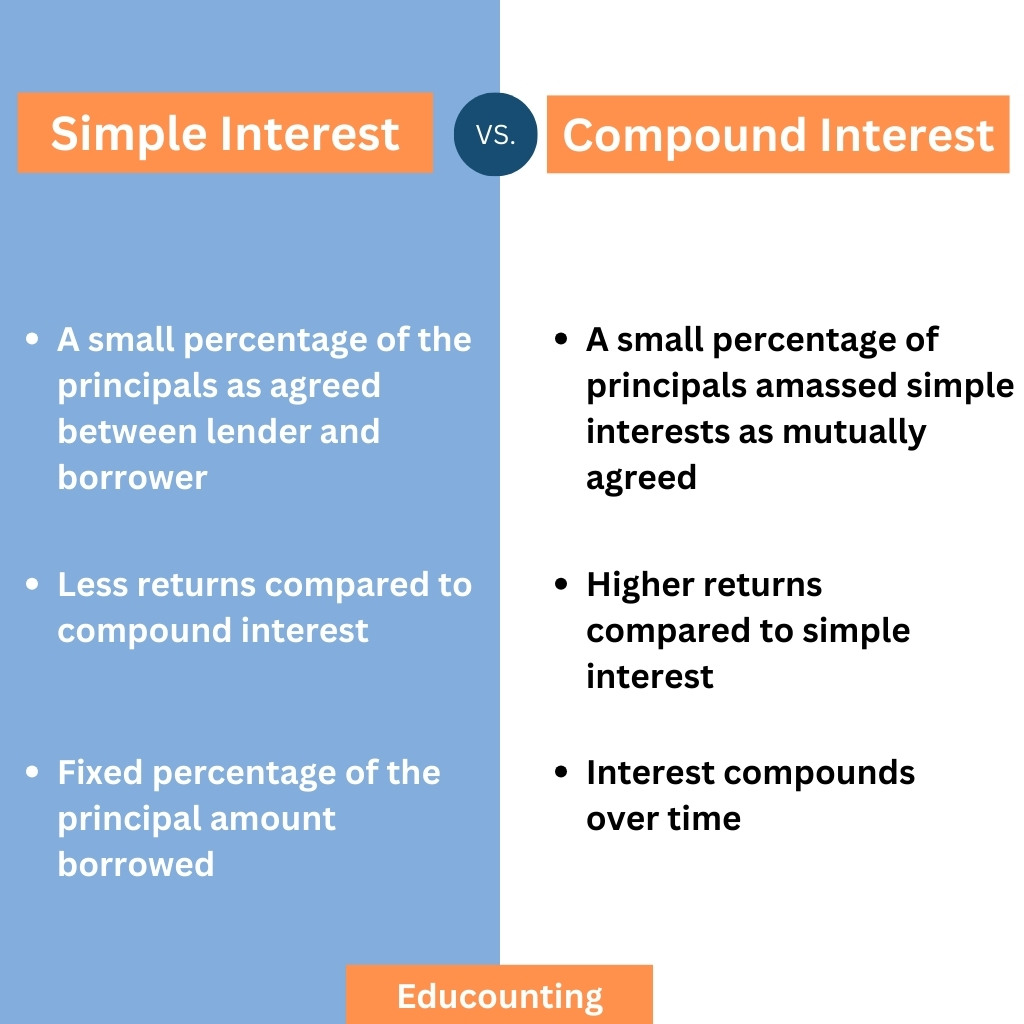

Simple vs Compound Interest: Key Differences

Now that you have a solid understanding of both simple and compound interest, let’s compare them side-by-side. The differences between the two can have a huge impact on your finances, especially over time. Here’s a quick breakdown of the main contrasts:

1. Calculation Method

Simple Interest: Calculated only on the original principal.

Compound Interest: Calculated on the principal and the accumulated interest.

2. Interest Growth Over Time

Simple Interest: Growth remains linear—every year, the interest earned or owed stays the same.

Compound Interest: Growth is exponential, with each period’s interest being added to the principal and earning further interest.

3. Impact on Borrowing

Simple Interest: Borrowers only pay interest on the original loan amount, making it cheaper over time.

Compound Interest: Borrowers can end up paying much more due to the compounding effect.

4. Impact on Saving/Investing

Simple Interest: Investors earn the same amount of interest every year, limiting the growth potential.

Compound Interest: Investors benefit from interest on their interest, leading to much larger returns over time.

5. Best for Short-Term vs. Long-Term

Simple Interest: Best for short-term loans or investments where compounding wouldn’t have a significant effect.

Compound Interest: Best for long-term investments or savings accounts where exponential growth can be fully realized.

Direct Answer: Simple vs Compound Interest

So, which is better—simple or compound interest? The answer depends on whether you’re borrowing or saving.

If you’re borrowing: Simple interest is generally better, as it results in a lower overall cost.

If you’re saving or investing: Compound interest is superior for long-term growth, thanks to the power of exponential returns.

Understanding these differences is crucial when choosing financial products, whether they’re loans or investment accounts.

Formulas for Simple and Compound Interest

Let’s now dive deeper into the mathematical aspect of both types of interest. Knowing how to calculate interest formulas can help you make better financial decisions.

Simple Interest Formula

The simple interest formula is fairly easy to use:

Where:

P = Principal amount

R = Interest rate per period

T = Time period (in years)

For example, if you invest $5,000 at a simple interest rate of 4% per year for 3 years, the interest calculation would be:

So, after 3 years, you would earn $600 in interest, bringing your total to $5,600.

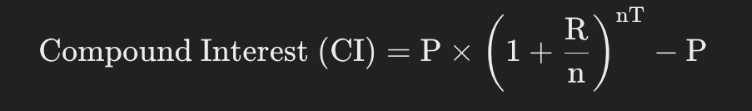

Compound Interest Formula

The compound interest formula is slightly more complex, but it provides more insight into how your money can grow exponentially:

Where:

P = Principal amount

R = Annual interest rate

n = Number of times interest is compounded per year

T = Time period (in years)

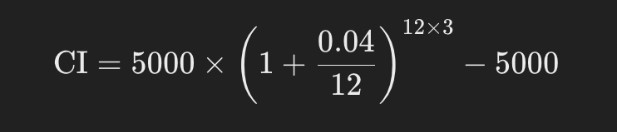

Let’s take the same $5,000 investment at a 4% interest rate, but now the interest is compounded monthly. The formula would look like this:

The total interest earned would be approximately $628.28, bringing your total to $5,628.28—noticeably more than what you’d earn with simple interest.

How to Accurately Calculate Interest

Accurate interest calculation is essential, whether you’re figuring out how much you’ll owe on a loan or how much you’ll earn on an investment. Here’s a step-by-step guide:

Step 1: Identify the Type of Interest

The first step is knowing whether you’re dealing with simple or compound interest. Most loan and savings account agreements will specify this information. If you’re unsure, ask your financial institution.

Step 2: Collect the Necessary Information

To calculate interest, you’ll need the following variables:

Principal: The starting amount of money.

Rate: The annual interest rate.

Time: The length of time the money is borrowed or invested.

Compounding Frequency (for compound interest): How often the interest is applied (e.g., daily, monthly, quarterly, or annually).

Step 3: Use the Correct Formula

Depending on the type of interest, use either the simple interest or compound interest formula.

Step 4: Check Your Work

Once you’ve plugged in the numbers and performed the calculations, double-check your results. If you’re not confident, many online tools and calculators can help ensure accuracy.

Step 5: Experiment with Different Scenarios

One of the best ways to see how interest affects your finances is by experimenting with different variables. For instance, change the time period or interest rate and see how it alters the final outcome. This can help you understand the full impact of your financial decisions.

Expert Tips for Choosing the Best Interest Type

Choosing between simple and compound interest depends on your unique financial situation. To help you make the right choice, here are some financial interest tips from experts:

For Borrowers:

Choose Simple Interest for Short-Term Loans: If you’re borrowing money for a short period, simple interest loans tend to be more cost-effective. You’ll only pay interest on the principal amount, so the total cost of borrowing remains manageable.

Avoid Compound Interest on Debt: Compound interest can make loans much more expensive over time. Try to avoid taking on loans with compound interest, or pay them off as quickly as possible to minimize the total interest paid.

For Savers and Investors:

Take Advantage of Compound Interest for Long-Term Growth: When you’re saving or investing, compound interest can be your best friend. The longer your money is invested, the more powerful the compounding effect becomes. Look for savings accounts, CDs, or investment products that compound interest frequently (e.g., monthly or daily) to maximize your returns.

Start Early: Time is the key factor in compound interest. The earlier you start saving or investing, the more you’ll benefit from the exponential growth of compound interest. Even small amounts invested early can grow substantially over time.

Evaluate the Terms:

Read the Fine Print: Whether you’re borrowing or saving, always read the fine print to understand how the interest is calculated. For loans, check the compounding frequency and any hidden fees. For savings or investments, look for the compounding frequency that will provide the best return.

By following these expert tips, you can make smarter financial decisions, whether you’re borrowing money saving for a big goal, or investing for the future.

Which is Better: Simple or Compound Interest?

The question of whether simple or compound interest is better ultimately depends on the context of your financial situation.

When Simple Interest is Better

Simple interest is better when you’re borrowing money for a short period or want a more predictable repayment schedule. For example, short-term personal loans, auto loans, and some mortgages use simple interest, making it easier to budget for repayment. You pay less interest overall because it’s based on the original loan amount rather than the growing principal.

Advantages for Borrowers:

Lower Interest Payments: Because the interest is only applied to the principal, you won’t see your debt growing exponentially as with compound interest loans.

Predictable: Simple interest loans have fixed interest payments, making it easier to plan your budget.

When Compound Interest is Better

Compound interest is better when you’re saving or investing for the long term. The magic of compound interest is in its exponential growth. The longer your money is invested, the more powerful the compounding effect becomes. For instance, retirement accounts, high-yield savings accounts, and other investment vehicles rely on compound interest to build wealth over time.

Advantages for Investors and Savers:

Exponential Growth: Compound interest allows your savings to grow faster over time, especially if interest is compounded frequently.

Maximizes Long-Term Investments: If you’re investing for the long haul—whether in retirement funds, mutual funds, or savings accounts—compound interest ensures that your money works harder for you as time goes on.

Choosing Based on Your Financial Goals

The choice between simple vs compound interest boils down to your financial goals:

For Borrowing: Simple interest is better if you want to minimize the cost of a loan.

For Investing: Compound interest is best for maximizing long-term returns.

When making a decision, always consider your financial objectives. Are you trying to save money on a loan, or are you looking to grow your investments over time? By identifying your goals, you can choose the type of interest that will work best for you.

Real-Life Applications of Simple and Compound Interest

To better understand the practical implications of simple and compound interest, let’s look at how they apply to common financial situations.

Simple Interest in Real Life

1. Auto Loans

Most auto loans use simple interest, which means the interest is calculated based on the loan’s principal amount, not the remaining balance or any unpaid interest. This makes auto loans more predictable for borrowers because you’ll know exactly how much interest you’ll be paying each month.

For example, if you take out a $15,000 car loan at 4% interest for five years, the interest payments will be based on that $15,000 for the entire loan term. This helps keep the total cost of borrowing lower compared to loans that compound.

2. Personal Loans

Many short-term personal loans use simple interest. Whether it’s a payday loan or a small loan from your bank, the interest is only applied to the original loan amount. This makes personal loans less risky from an interest perspective because the amount you owe won’t grow exponentially.

Compound Interest in Real Life

1. Credit Cards

Credit card debt is one of the most notorious examples of compound interest working against consumers. Credit cards typically compound interest daily, meaning that unpaid balances can grow rapidly if not paid off in full each month. This is why it’s so important to pay off your credit card balance regularly; otherwise, you’ll find yourself paying interest on top of interest, leading to significant debt over time.

2. Retirement Accounts (401(k), IRA)

On the flip side, compound interest is your greatest ally when it comes to long-term investments like a 401(k) or IRA. By consistently contributing to your retirement account, you allow compound interest to work its magic over decades, resulting in exponential growth. Even small contributions early on can grow into substantial savings by the time you retire.

3. High-Yield Savings Accounts

A high-yield savings account is another place where compound interest shines. These accounts often compound interest daily or monthly, allowing your savings to grow faster than in a traditional savings account. The key is to leave the money in the account long enough to benefit from compounding.

Compound Interest and Loans: A Word of Caution

Compound interest can be a double-edged sword when it comes to loans. Student loans, mortgages, and certain types of personal loans can compound interest, meaning that if you don’t pay off your balance regularly, your debt can increase quickly. It’s crucial to read the fine print on any loan agreement to understand how often interest is compounded and what that could mean for your repayment.

Conclusion

When it comes to simple vs compound interest, the choice ultimately depends on your financial goals and the products you’re using. Simple interest is ideal for borrowers who want to keep costs low and predictable, especially for short-term loans. On the other hand, compound interest is perfect for savers and investors looking to maximize their returns over time, leveraging the exponential growth that comes from compounding.

In the end, the key takeaway is this: if you’re borrowing money, seek out loans with simple interest to avoid the rapid accumulation of debt. If you’re saving or investing, prioritize accounts that offer compound interest, allowing your money to work for you in the long run. The better you understand the power of simple vs compound interest, the more informed and strategic your financial decisions will be.