Navigating the world of retirement planning can often seem complex, but understanding the core principles is crucial for a secure financial future. The question, “How Does a 401k Work When You Retire,” is at the forefront of this journey. This comprehensive guide aims to unravel the intricacies of managing a 401k in your retirement years. As one of the most common retirement savings plans, a 401k can be a significant asset, yet how it functions post-retirement is a topic shrouded in mystery for many.

Whether you are nearing retirement age or are in the early stages of your career, understanding how a 401k operates once you retire is imperative. From withdrawal strategies and tax implications to rollover options and required minimum distributions, this blog will provide a clear, comprehensive understanding of the 401k mechanism in the retirement phase, ensuring you are well-equipped to make informed decisions for a financially stable retirement.

What is a 401(K)

A 401(k) is an employer-sponsored retirement savings plan that offers significant tax advantages to employees. It allows employees to allocate a portion of their pre-tax income into this plan, which is then invested in various options, typically including mutual funds. The idea is to build a retirement fund over time through these contributions.

401(K): Retirement Income You Can Rely on

While a 401(k) is a key component of retirement planning, it is important to recognize that it’s just one potential source of retirement income. A comprehensive retirement plan often includes various income streams such as IRAs, other investments, cash reserves, funds from Social Security, and possibly income from annuities and pensions. This diversified approach helps manage taxes efficiently and ensure a stable income throughout retirement.

Start Withdrawals at 59½

Participants can start withdrawing funds from their 401(k) without penalty starting at 59½. Before this age, early withdrawals are generally subject to a 10% penalty. However, after reaching 59½, you can take distributions as needed. If the funds are not immediately required, it’s beneficial to leave them invested in the 401(k) to potentially grow further.

RMD Starts at 73

Starting at age 73, you must begin taking minimum distributions (RMDs) from your 401(k) and other similar tax-deferred retirement accounts. This age will increase to 75 in 2033. Roth 401(k)s also have RMDs, ending in 2024, but this can be circumvented with a Roth IRA conversion. Notably, distributions from Roth accounts are typically tax-free.

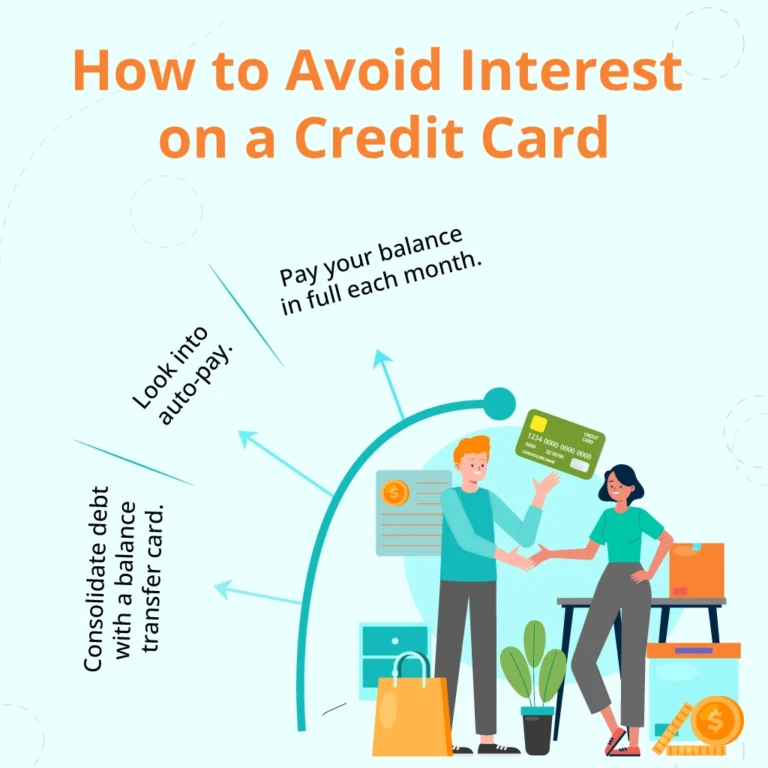

Distributions Are Taxable

Taxes are a significant consideration with 401(k) distributions. Traditional 401(k) contributions are made with pre-tax dollars, reducing taxable income during working years. However, distributions are taxed as ordinary income. This means that the amount you withdraw from a traditional 401(k) is subject to income tax, and excessive withdrawals in a single year could push you into a higher tax bracket.

When You Retire, How Does a 401(K) Work

Understanding the options available for your 401(k) after retirement is crucial. Whether it’s keeping your funds in the plan, transferring to an IRA, taking a lump sum, converting to an annuity, or taking required minimum distributions, each option has its own set of rules and considerations.

1. Keep It in the 401(k)

If your 401(k) has a balance of at least $5,000, you can opt to leave your money in the plan after retirement. This might be a wise choice if you’re satisfied with the investment options provided by your plan. However, once you retire, you won’t be able to contribute further to this 401(k).

2. Transfer to an IRA

Transferring your 401(k) to an Individual Retirement Account (IRA) can be a strategic move if you’re seeking more diverse investment choices. You can initiate a direct rollover, where your employer transfers the funds directly to your IRA provider, or opt for a 60-day rollover, where you receive the funds and then deposit them into an IRA within 60 days. The direct rollover is generally more straightforward and avoids potential tax complications.

3. Lump Sum Withdrawal

Post-retirement, you can withdraw all or part of your 401(k) balance. Remember, distributions from a traditional 401(k) are taxable. If you’re under 59½, you might face a 10% early withdrawal penalty, but this penalty doesn’t apply if you retire after age 55.

4. Convert Into an Annuity

Converting your 401(k) into an annuity is an option that provides a steady income stream through monthly payments. This immediate annuity setup can be a stable income source, but it’s essential to consider factors like the loss of principal access and the reliability of the annuity issuer. This option may not suit every retiree’s needs.

5. RMDS at Age 73

For traditional 401(k) plans, the IRS mandates required minimum distributions (RMDs) starting at age 73. These RMDs are calculated based on factors like your age, account balance, and life expectancy. It’s important to integrate RMDs into your retirement planning to ensure you’re compliant with IRS regulations and effectively managing this aspect of your income.

What Types of Employer-sponsored Retirement Plans Are There

Employer-sponsored retirement plans offer various features and benefits tailored to different types of workers and organizations. Among the most common are the Traditional 401(k), Roth 401(k), 403(b), and 457(b) plans. Each of these plans has unique characteristics suitable for different employment situations.

Traditional 401(k)

In a traditional 401(k) plan, contributions are made using pre-tax income. This means that the amount you contribute is deducted from your salary before taxes are applied, effectively decreasing your taxable income for that year. For instance, if your annual earnings for 2023 are $90,000 and you allocate $7,500 to your 401(k), your income subject to tax becomes $82,500.

Roth 401(k)

The Roth 401(k) is a relatively newer option that combines the features of a Roth IRA and a traditional 401(k). Unlike the traditional 401(k), contributions to a Roth 401(k) are made with after-tax dollars. This means you pay taxes on your contributions upfront, but withdrawals in retirement, including earnings, are generally tax-free, provided certain conditions are met. This plan benefits those who expect to be in a higher tax bracket during retirement.

403(B)

A 403(b) plan, also known as a tax-sheltered annuity (TSA) plan, is offered to employees of public schools, certain non-profits, and religious organizations. Similar to a 401(k), it allows employees to contribute a portion of their income to a retirement account, with pre-tax contributions and tax-deferred growth. 403(b) plans often include annuity contracts or mutual funds as investment options.

457(B)

The 457(b) plan is designed for government and certain non-profit employees. It shares many characteristics with the 401(k) and 403(b) plans, such as pre-tax contributions and tax-deferred growth. One unique aspect of the 457(b) is that it does not have an early withdrawal penalty if you leave your job, regardless of age. This can be particularly advantageous for those who plan to retire or change jobs before reaching the typical retirement age.

How is a 401(k) Different from an IRA

The distinction between a 401(k) and an Individual Retirement Account (IRA) primarily lies in their setup and management. A 401(k) is a retirement savings plan offered by employers, while an IRA is set up by individuals independently. This fundamental difference leads to several variations in how each plan operates and the benefits it offers.

One of the significant advantages of a 401(k) is the potential for an employer match. Many employers will match a portion of the employee’s contributions, effectively increasing the total savings without additional cost to the employee. Additionally, 401(k) plans often have higher annual contribution limits compared to IRAs. This allows employees to save a larger portion of their income for retirement under a 401(k) plan.

However, IRAs often provide a broader range of investment options and greater flexibility. While 401(k) plans are limited to the investment choices selected by the employer, IRAs offer individuals the freedom to choose from a wider array of stocks, bonds, mutual funds, and other investment vehicles. This can be particularly appealing for those who wish to have more control over their retirement investments.

Interestingly, individuals can contribute to both a 401(k) and an IRA. This decision often depends on the individual’s income level and financial goals. By utilizing both types of accounts, individuals can maximize their retirement savings and enjoy the unique benefits each offers, such as the employer matching higher limits of a 401(k) and the investment flexibility of an IRA.

How Do You Start a 401(k)

Starting a 401(k) plan is crucial to securing your financial future. Whether you’re a newcomer to the workforce or a seasoned professional, understanding how to effectively begin and manage your 401(k) can make a significant difference in your retirement planning.

1. Enrolling in Your 401(k)

Initially, check if your employer automatically enrolls you in the company’s 401(k) plan – a practice that will become more common starting in 2025 due to the Secure Act 2.0. Often, employers begin with a modest contribution, such as 2% of your salary, possibly increasing annually up to a certain limit. If not auto-enrolled, remember to sign up when you’re eligible to maximize your investment gains.

2. Selecting the Right 401(k) Account

You’ll usually have a choice between a traditional 401(k) and a Roth 401(k). The traditional 401(k) offers immediate tax benefits as pre-tax contributions reduce your taxable income. However, taxes will apply upon withdrawal in retirement. Conversely, Roth 401(k) contributions are after-tax, meaning no immediate tax break, but qualified withdrawals are tax-free. Both account types enjoy tax-free growth of investment earnings.

3. Examining Investment Options

Your 401(k) offers a range of investment choices, typically including mutual funds that diversify across stocks, bonds, and other assets. Many plans default to a target-date fund, which adjusts its asset allocation as you near retirement. Understanding each option’s strategy or index alignment is crucial, like the S&P 500 or Nasdaq.

4. Analyzing Investment Fees

Pay close attention to investment fees, often referred to as management fees or expense ratios. High fees can significantly erode your investment returns. Aim for funds with fees under 1% and be aware of the administrative fees associated with your plan.

5. Maximizing Employer Matching

One of the greatest benefits of a 401(k) is the potential employer match, which is essentially free money. Contribute at least enough to receive the full match offered by your employer, usually a percentage of your salary. However, be aware of any vesting schedules that apply to these matching contributions.

6. Supplementing With Additional Savings

The IRS encourages diverse retirement savings, allowing contributions to both a 401(k) and an IRA. IRAs offer more flexibility and investment choices, complementing your 401(k). Combining these accounts can enhance your tax benefits and broaden your retirement savings portfolio.

Rules for Withdrawing From 401(k)s

Navigating the rules for withdrawing from a 401(k) can be complex, but it’s essential for effective retirement planning. Understanding these rules ensures that you can access your funds when necessary while minimizing potential penalties and taxes.

Early Withdrawal Rules

Accessing your 401(k) funds before retirement comes with specific conditions and potential penalties. Generally, you cannot withdraw from your 401(k) if you are under 59 ½ and still employed. However, exceptions exist for hardship withdrawals, which include:

- Postsecondary tuition expenses for yourself or your family.

- Medical or funeral expenses for you or your dependents.

- Certain costs associated with purchasing or repairing your primary residence.

- Avoiding eviction or foreclosure of your primary residence.

It’s important to note that hardship withdrawals from pre-tax contributions and earnings are typically taxed and may incur a 10% early withdrawal penalty. These distributions are not eligible for rollover into an IRA.

Loan Rules

Many 401(k) plans offer the option to borrow from your account, usually up to 50% or $50,000, whichever is less. These loans must generally be repaid within five years, with interest paid back into your account. While this option avoids taxes and penalties, it’s crucial to consider that if you leave your job, you might have to repay the full loan amount in a shorter time frame. Defaulting on a 401(k) loan triggers taxes and possibly a 10% penalty, especially if you’re under 55 and have left your employer.

Withdrawals in Retirement Rules

You can start withdrawing from your 401(k) without penalty at age 55, provided you left your employer in the year you turned 55 or later. If you left your employer before this age, the 10% early distribution penalty applies until you reach 59 ½. Additionally, the IRS mandates that you start taking required minimum distributions (RMDs) at a certain age. The current RMD age is 73 for individuals who turned 72 after 2022. For those who turned 72 before 2023, RMDs are already required. Looking ahead, the RMD age will increase to 75 in 2033.

Final Words

Understanding “How Does a 401k Work When You Retire” is fundamental for anyone planning for their golden years. As we’ve explored in this detailed explanation, a 401k offers several flexible options for retirees, from leaving the funds to grow in the account to taking strategic withdrawals. By familiarizing yourself with the rules for early withdrawals, loans, and distributions in retirement, you can make informed decisions that align with your retirement goals.

Remember, the way you manage your 401k can significantly impact your financial comfort and stability in retirement. As you approach this significant phase of your life, take the time to review your 401k plan, consult with financial advisors if necessary, and plan strategically to ensure that your retirement years are as rewarding and secure as they can be.

For more insights into this and other financial terms and strategies, don’t forget to visit our blog at EduCounting, where we continue to provide valuable information to help you navigate your financial journey.

FAQs

Can I transfer my 401(k) from one job to another?

Yes, you can transfer your 401(k) from one job to another. This is typically done through a rollover process, either to your new employer’s 401(k) plan or into an Individual Retirement Account (IRA).

How long will my 401k last after retirement?

The duration your 401k will last after retirement depends on your withdrawal rate, the total saved amount, and investment performance. A financial advisor can help you create a withdrawal plan tailored to your savings and retirement lifestyle.

What is a good 401k balance at age 60?

A good 401k balance at age 60 varies based on your retirement goals and expected lifestyle, but a common guideline is to have six to eight times your annual salary saved.

Should I invest in 401k if I want to retire early?

Yes, investing in a 401k is beneficial even if you plan to retire early, as it provides tax advantages and potential employer matching. However, consider other savings options as well, since early 401k withdrawals can incur penalties.