When assessing our financial health, there are few things in life as important as our credit score.

Our personal credit score, made up of three digits, can affect the interest rate we are offered on loans, determine our car insurance premiums, and even make or break a landlord’s decision to rent us an apartment. And that’s just the beginning…

So, why is understanding personal credit scores so important? What constitutes a good credit score? What are appropriate credit scores based on age?

Yes, you have questions, and here at EduCounting, we’d like to believe we have the answers.

So, read on to learn more about the good, the bad, and the ugly of credit scores.

What’s a Credit Score?

Your credit score is basically a three-digit number that is assigned to you based on information contained in your personal credit report. A credit score predicts the likelihood that you will repay any loans extended to you and that you’ll make your loan payments on time.

Several scoring models are used to develop a person’s credit score but VantageScore® and FICO® are the most commonly used, and both predict an individual’s ability to repay debt. However, they both can produce a slight difference in scoring.

To calculate these all-important numbers, several key factors come into play. These factors include how much money you owe overall, whether or not you pay bills on time, the length of your credit history, and whether or not you have recently applied for a credit card or loan.

The types of credit you have will play a role as well. Creditors like to see a mix of debt types. For example: having an installment loan, like a mortgage or car loan, along with revolving accounts like lines of credit or credit cards, and managing those debt types responsibly will work in your favor.

Considering all of this, the scoring models use a statistical program that compares all of this information to credit behaviors of those who have similar profiles. Ultimately, you are assigned a credit score from 300 to 850.

The higher your score, the better you’ll look in the eyes of creditors. Someone with a low credit score faces a greater risk of being denied credit or a loan. Those with a lower credit score typically pay a higher interest rate and receive less favorable loan terms when they are approved.

Credit Scores: A Brief History

Determining an individual’s creditworthiness is nothing new. In fact, lenders have been doing it for centuries. But it wasn’t until 1956 that FICO® began to gather data from credit bureaus to use as a predictor of consumer behavior. In 1989, the FICO® score was introduced and the rest as they say is your credit history.

See what I did there?

Once the FICO® score was introduced, there was quick adoption across financial sectors. By the middle of the 1990s, the FICO® score was heavily relied upon by many credit providers. One of the major advantages of its introduction was that consumers could get credit decisions faster than ever before. In some cases, they could instantly receive decisions which was previously unheard of. Understanding credit scores also helped reduce personal bias in lending and created a more consistent outline for interpreting an individual’s credit report.

The introduction of the credit score wasn’t just beneficial to the consumer. It was a win-win for everyone as lenders could now compare credit scores to make faster decisions rather than having to sift through thirty pages of a customer’s credit history.

As time when on, other versions of the credit score were developed to address specific needs of niche lending markets, with particular scores generated for mortgage lenders, credit card companies, auto loan providers and to name a few.

Today, the vast majority of mortgage lending decisions rely partially on a homebuyer’s FICO® score because Freddie Mac, Fannie Mae, and the United States Federal Housing Administration have mandated the use of FICO® scores to maintain constancy. However, VantageScore® continues to lobby to have those guidelines changed.

Over time, the FICO® score model has been redeveloped several times to keep up with ever-changing credit product offerings and credit data reporting practices. It is like when Apple releases a new version of its iPhone, incorporating the latest technologies. From the vantage point of FICO®, the company wants to ensure that the scores it produces are keeping up with the times and continue to represent the most predictive way of determining credit risk.

FICO® scores are used ten billion times over in the United States on an annual basis, and over 100 billion FICO® scores have been sold worldwide since it was introduced according to the company.

In 2016, FICO® for the first time in its long history faced significant competition when the three major credit reporting bureaus decided to launch their own credit score system, known as VantageScore®.

According to the company responsible for bringing us VantageScore®, VantageScore Solutions, over 8.5 billion VantageScore® credit scores are utilized on an annual basis. The VantageScore® has been updated four times so far, including the change that aligned it with the FICO® score range in an effort to reduce consumer and lender confusion.

FICO® vs. VantageScore®: What’s the Difference

Although the FICO® and VantageScore® are both based on a consumer’s credit report, the primary difference is the scoring criteria used and the weight given to varying consumer behaviors.

For example, more than 28 million consumers lack a FICO® score because there isn’t enough personal data or their data is stale. FICO® requires at least one tradeline, which means at least one credit card or installment loan for at least six months. That allows FICO® to see a consumer’s credit behavior. FICO® also requires that consumers have new credit file information, meaning that there has been some credit update within the last six months. FICO® argues that their scores will be less reliable if it lowers these standards.

VantageScore® on the other hand, generates consumer credit scores after just one month of credit history, basically as soon as an account appears on a credit report. VantageScore® bases its scores on a 24-month review of the consumer’s credit file. So, even infrequent credit users with dormant accounts will also be eligible for a credit score. Another key difference when comparing FICO® and VantageScore® is that FICO® offers industry-specific score models and a credit score from VantageScore® applies to all lending categories.

What Your Credit Report Says About You

It is incredibly important to fully understand what goes into a credit report because your credit report is a critical factor in determining your credit score. Your credit report is essentially the story of your credit life.

There are three major credit bureaus, Experian, Equifax and TransUnion. These credit bureaus collect financial and other personal information. They know your name, address, Social Security number, and all of the gory details of your loans, any credit cards you have had, and whether or not you’ve filed for bankruptcy.

They basically know everything related to your financial history. That is valuable information for lenders and businesses who ultimately pay the credit bureaus to use that information and check your credit.

Click here to check out a video we made about personal credit scores.

How to Determine Your Credit Score

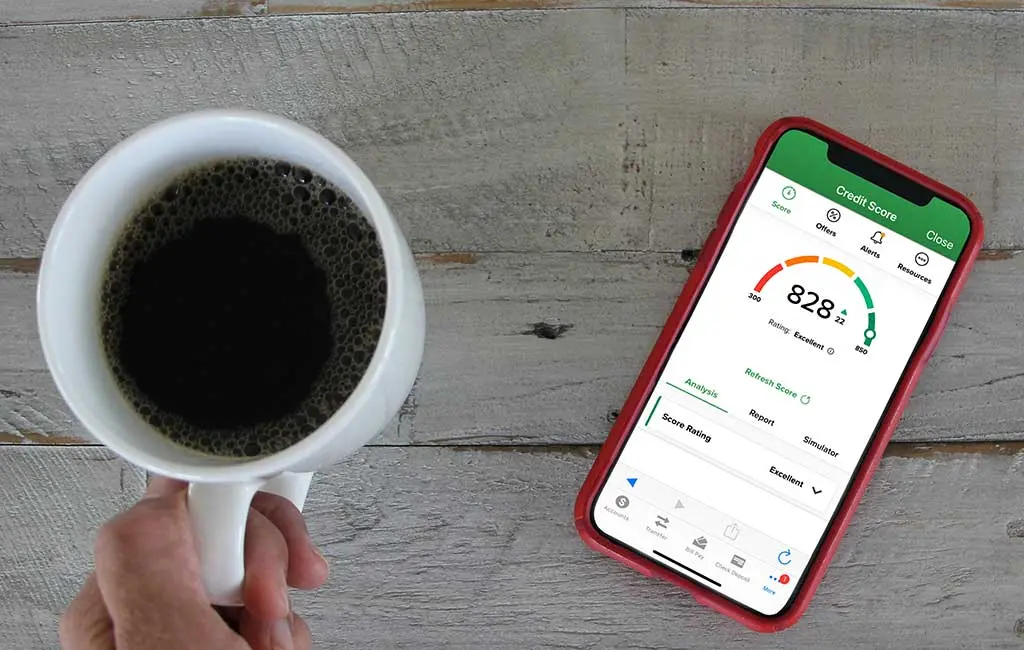

There are several ways to track your credit score. You can purchase your credit score from one of the three credit bureaus or directly from FICO®, but buying the information isn’t always necessary. Often, your credit score is printed on loan or credit card statements. You can also use credit monitoring services or free credit scoring websites to find your credit score.

Credit Scores: Good, Bad, OMGosh, That’s Bad!

- 800 to 850: exceptional

- 740 to 799: very good

- 670 to 739: good

- 580 to 669: fair

- 300 to 579: very poor

Although previous versions of VantageScore® had a different set of numbers, the VantageScore® model now essentially mimics the FICO® credit score model. As we mentioned before, that change was made because having two different scoring scales was really confusing for lenders and consumers.

The credit score of the average American falls in the 670-739 range, which means that most Americans have “good” credit. However, some lenders have their own definition of a good credit score vs. a bad one. The interesting thing about defining what is and isn’t a good credit score seems to fluctuate just as much as our score numbers do.

- The Silent Generation (75+): 760

- Baby boomers (57-75): 740

- Gen Xers (41-56): 705

- Millennials (25-40): 686

- Gen Z (18-24): 679

4 Steps to Raise Your Credit Score

First of all, cut yourself a little slack. Just because you have a low credit score doesn’t mean you’ve made mistakes. Sometimes, having little or no credit history results in a lower credit score. That is especially true for young people. If you are brand new to the game and the credit bureaus have very little information about you, they may consider you a credit risk simply because there is no track record. Sadly, there is no presumption of innocence when it comes to credit bureaus.

Now that you can see how you compare to other Americans your age, you might feel the itch to boost your score, and we’re here to help.

Consider the following steps that you can take immediately to improve your existing personal credit score and start seeing those numbers begin to move in the right direction… up!

Step 1. Dive deep into your credit reports

One of the most important things you can do to improve your credit score is to check your credit reports for errors or omissions.

Experts recommend that you check your credit report and your personal credit score yearly. However, here at Educounting.com, we believe you should be checking your credit reports more regularly, like two to four times a year. Heck, I review my credit report and score monthly.

Regardless of how often you review your credit report and score, if you find a mistake, you should immediately report it to the credit bureaus, which you can do online, by mail, or by fax. Also, contact the company that originated the erroneous report to the credit bureau. The Consumer Financial Protection Bureau offers a wealth of information about correcting errors found within your credit report and a wide range of other credit-related topics.

Checking your credit report and score regularly is sound advice, but which one should you check?

Free copies of your credit report are available from all three major credit bureaus and can be obtained by visiting this annual credit report website that makes your report easy. Remember that your credit report will not include your credit score. To get that, you may need to pay a nominal fee directly to one of the three credit bureaus. When obtaining your credit score, you will see reason codes explaining why your score looks the way it does from the model used to generate your score and actions you can take to improve it. To better understand these reason codes, VantageScore® created this website.

An individual can usually receive a free credit score from one of the many online credit monitoring websites. However, the credit score you receive from these websites may not be the same score lenders will see when assessing your creditworthiness. Despite the subtle nuances in the different scoring models and how the reporting bureaus report your history, people who have good credit will have a good credit score, regardless of the credit score brand or model used.

Often, a lender may use a different version of the same scoring system, another type of credit score altogether, or a recently adjusted score. Recently, FICO® has partnered with most major credit card companies to provide customers with free credit scores.

The bottom line is that it’s pretty darn easy to get your hands on both your credit report and your credit score. In fact, there are over 250 million consumer accounts that offer free access to the accountholder’s credit scores. So, there is no excuse not to monitor your credit report and credit score regularly.

As we mentioned before, the three major credit reporting bureaus are TransUnion, Experian, and Equifax. However, don’t be surprised if each of these credit bureaus gives you a slightly different credit score. You are likely to see a difference between your credit score, as reported by the three agencies, ranging from just a couple of points to as many as 20 points.

Although FICO® and VantageScore® are the most commonly used scoring models, there are many scoring models out there, and the algorithms that are used to develop credit scores are updated quite frequently. Another reason for the difference is that not all creditors will report your on-time or late payments to all three of the major credit bureaus. That is why it is important to check every report for negative information and errors.

Of course, if you notice a major drop in your credit score, that should be a red flag that there is something that you need to address immediately. Usually, it is much more important than the minor point discrepancies that you’ll find between scores from the major reporting bureaus.

Step 2. Pay all of your bills on time

A single late payment can harm a personal credit score, so make sure to pay all of your bills on time. Also, if you have any accounts that are past due, now is the time to bring them current.

Step 3. Pay attention to your existing debt

When you reduce your credit card balances, you reduce your credit utilization ratio. Your credit utilization ratio represents how much of your available credit you are using. It is expressed as a percentage. You should keep your credit card balance (the amount that you owe) below 30% of your total available credit.

However, you should be using your existing credit cards, even if just a little, and pay the balance off in full every month. That helps to prove to the credit bureaus that you can responsibly use credit cards and will help strengthen your credit score.

Step 4. Piggyback with a Family Member

If a member of your family has an excellent credit score, ask them to you as an authorized user of one of their existing credit cards. The best-case scenario would be for the credit card to be an older account with a high credit limit and a good history.

The idea behind piggybacking on a primary cardholder’s excellent credit habits is that it can increase your credit score. Be aware, however that not all credit cards will report an authorized user’s activity to the major credit bureaus. So ask the family member to check with their credit card company before adding you as an authorized user.

What Impacts a Credit Score and What Doesn’t Impact a Credit Score?

FICO® and VantageScore® both rely on the information contained in your credit report as a way to generate your credit score. A consumer’s income is not included because it is not part of a consumer’s credit report. It is also important to note that the consumer’s age, where they live? or any protected class information such as ethnic background or gender, will not impact their credit score.

According to FICO® key areas that can impact your credit score include the following:

- Your payment history (35%): This includes on-time payments, late payments, and missed payments.

- The amount that you owe (30%): This compares your existing balances with your current available credit.

- The age of your credit history (15%): The longer that you have been managing credit, the less risky you are in the eyes of lenders.

- Your credit mix (10%): As I mentioned before, lenders like to see a mix of credit/loan types in your history. Having an installment loan coupled with revolving credit (like a credit card) usually works best.

- Your credit requests (10%): Your score can be negatively impacted by too many credit inquiries or opening several new accounts.

According to VantageScore® key areas that can impact your credit score include the following:

- Your payment history (extremely influential) : 90% of consumers rated as “prime” by VantageScore® pay their bills on time.

- The age of your accounts and the credit types (highly influential) : VantageScore® prefers a mix of accounts and particularly favors older accounts.

- Credit limit percentage (highly influential) : You can boost your credit score by maintaining balances below 30% of your credit limit.

- Total debt and balances (moderately influential) : You can improve your score by reducing your overall debt.

- Your recent credit behaviors (less influential) : You may see a reduction in your score when you open several new accounts.

- Your available credit (less influential) : To keep your credit score strong, only open credit accounts you need.

The Benefits of an Exceptional (800+) Credit Score

According to Experian, only 21% of American consumers have a FICO® credit score in the exceptional range, which is between 800 and 850. You deserve a pat on the back if you’ve found your way into the 800+ credit score club because it is truly an exclusive one.

You likely worked very hard to get there and stay there. You also probably know better than anyone else about the rewards of being part of the creme de la crème of credit scores.

With an 800+ credit score, you can expect to get the best interest rates on mortgages. Credit cards with awesome premium rewards programs that people with “good” credit scores only dream about, and easy access to personal loans and lines of credit. Also, you’ll get higher credit limits which will help strengthen your purchasing power and maintain low credit utilization ratios.

I think that’s what the kids call a “playa,” but I digress.

Yeah, it feels good to be exceptional so why wouldn’t you want to shoot for that?

The Final Word on Understanding Credit Score

An individual’s credit score is the foundation of their financial security.

A good credit score will open the door to new opportunities, while a poor credit score will undoubtedly impede your long-term progress.