Navigating the world of home finance can be complex, especially when considering the options available for leveraging the value of your home. A key decision for many homeowners is choosing between a home equity loan and a line of credit. This choice, often summarized as ‘Home Equity Loan vs Line of Credit,’ hinges on understanding the nuances of each option and how they align with your financial goals.

The journey toward financial flexibility requires a deep dive into the specifics of how home equity loans and lines of credit operate. Home equity, essentially the market value of your home minus any outstanding mortgage balance, can be a powerful tool in managing your finances. Whether it’s for making home improvements, consolidating debt, or financing major expenses, understanding the pros and cons of a home equity loan versus a line of credit is crucial. Here, we will explore these options in detail, outlining the benefits, risks, and ideal scenarios for each, ensuring you have all the information needed to leverage your home’s equity wisely.

Home Equity Definition

The home equity concept is pivotal for homeowners as it not only signifies their stake in one of the biggest investments of their lives but also serves as a crucial financial tool.

What is Home Equity?

In its simplest form, home equity is a homeowner’s financial stake in their property. To put it more clearly, it’s the difference between the property’s current market value and any debts or liens against it. This value isn’t static; it changes over time. As homeowners make more payments towards their mortgage, their equity increases. Similarly, changes in the real estate market can either boost or diminish the property’s value, thereby affecting the equity.

More Than Just a Mortgage Repayment

However, home equity encompasses more than just the repayment of a mortgage loan. It’s a valuable asset, offering homeowners a potent financial tool. For instance, they can borrow against this equity for various significant expenses, such as clearing high-interest debts or funding education. This ability to tap into home equity for such needs transforms it from a mere financial figure into a practical financial resource.

A Preferable Borrowing Option

The borrowing rates for home equity loans are typically lower than those for unsecured borrowing options like credit cards and personal loans. This is because the loan is secured against the home’s equity, offering more security to the lender. Moreover, homeowners can often deduct interest on these loans from their taxes, provided the funds are used for home improvements. This tax benefit adds another layer of appeal to using home equity for financial needs.

Smart Financial Management

In conclusion, home equity is much more than a concept tied to property ownership. It’s a dynamic and versatile financial asset that, when managed wisely, can provide significant financial benefits. From debt consolidation to funding major life expenses, the strategic use of home equity can be a smart move for many homeowners. This aspect of home ownership emphasizes the importance of acquiring property and understanding and effectively managing the equity that comes with it.

How Can You Use Home Equity?

Exploring how to utilize home equity can open doors to smarter financial management and opportunities. Understanding how to leverage your home’s equity effectively is crucial as a homeowner. It can lead to substantial savings and provide a more cost-effective approach to handling financial obligations.

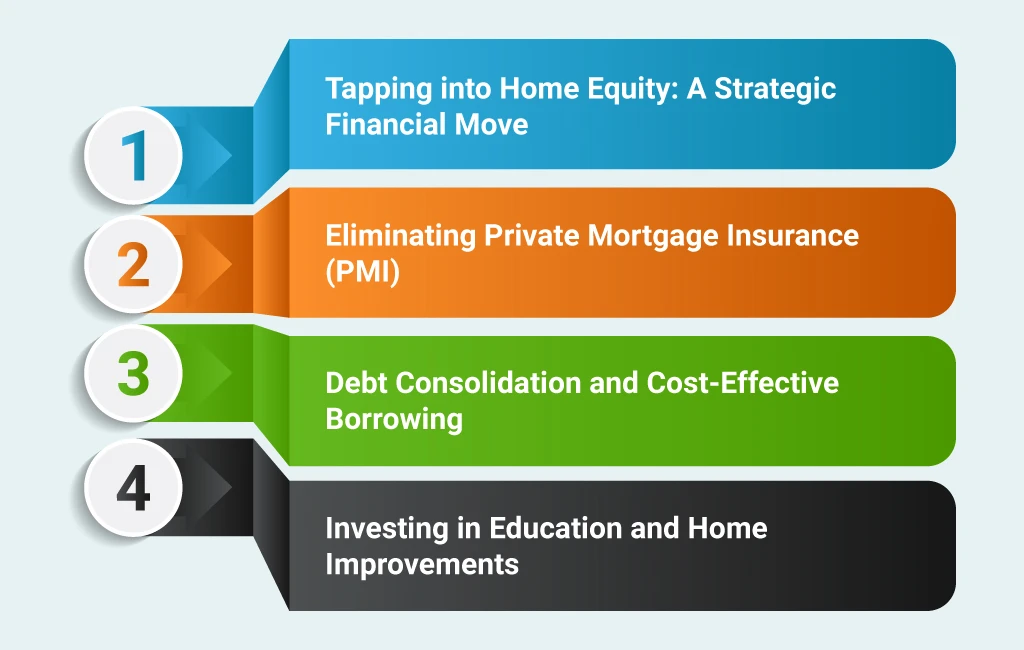

Tapping Into Home Equity: a Strategic Financial Move

Home equity, the difference between your home’s market value and any outstanding mortgage balance, can be a powerful financial resource. Smart use of this asset can lead to significant financial benefits. One of the primary ways to utilize home equity is by borrowing against it, which can open up several opportunities to improve your financial health.

Eliminating Private Mortgage Insurance (PMI)

A notable advantage of increased home equity is the potential to cancel private mortgage insurance (PMI). Typically, PMI is required when your down payment is less than 20% of the home’s value. However, once your equity reaches 20%, you can request its removal, potentially saving a considerable amount each month. This is an automatic process once equity hits 22%, but being proactive at the 20% mark can lead to earlier savings.

Debt Consolidation and Cost-effective Borrowing

Another smart use of home equity is consolidation, especially for high-interest debts like credit card balances. Since home equity loans usually come with lower interest rates compared to credit cards and unsecured personal loans, using these funds to pay off credit card debts can save you a significant amount in interest. This method is efficient for managing existing debts and avoiding the accumulation of new high-cost debt. For instance, utilizing home equity can be more cost-effective instead of relying on credit cards or high-interest loans for major expenses like college tuition or home renovations.

Investing in Education and Home Improvements

Finally, home equity can be used for substantial long-term investments like education and home improvements. Instead of taking out student loans, funding college education through home equity can be more financially prudent due to lower interest rates. Similarly, home improvements, which can further increase the value of your property, can be financed through home equity rather than higher-interest personal loans. In these ways, home equity addresses immediate financial needs and can increase your asset’s value over time.

What is a Home Equity Loan?

A home equity loan, sometimes known as a second mortgage, is a type of consumer facility allowing house owners to avail funds against their equity of homes. The loan amount is calculated by the difference between the property’s present market value and the outstanding balance on the mortgage. Typically, these loans have a fixed rate, offering predictability in repayments.

Home Equity Loan Requirements

Obtaining a home equity loan involves meeting certain criteria, similar to securing a primary mortgage.

- Credit Score: A minimum credit score of 620 is often required. A higher credit score can attract better interest rates.

- Equity: At least 20% equity in your home is typically necessary, indicating a loan-to-value ratio of 80% or less.

- Stable Income: Often for the past two years, proof of income is required to demonstrate the ability to repay the loan. This includes tax returns or pay stubs.

- Debt-to-Income Ratio: A low DTI ratio is preferred by lenders, showcasing that your debts are not excessively high compared to your income.

- Property Appraisal: Lenders may require an appraisal to ascertain the current market value of your home, which affects the available equity.

Advantages of Home Equity Loans

Due to the substantial amount received at once, financial experts often recommend home equity loans for sizable, specific expenses, such as major home upgrades or funding higher education.

- Accessibility: They are relatively easy for many consumers because they are secured debts.

- Lower Interest Rates: The rates are generally lower than credit cards and unsecured loans.

- Lump-Sum Funding: Useful for large expenses such as home renovations or education, as you receive the entire amount at closing.

- Potential Tax Benefits: Interest paid might be tax-deductible if used for qualifying purposes.

Disadvantages of Home Equity Loans

It’s crucial for homeowners to realistically assess their financial habits before opting for a home equity loan, especially if borrowing more than the home’s value. Exceeding 100% of the equity can lead to financial strain and, in extreme cases, to bankruptcy and foreclosure.

- Debt Trap: There’s a risk of falling into a cycle of debt, especially if the loan is used to clear existing high-interest debts without addressing underlying spending issues.

- Higher Fees for Certain Loans: Loans exceeding the home’s value can come with higher fees and are not fully secured.

- Risk of Foreclosure: Failure to repay can lead to losing your home.

- Temptation to Overborrow: The one-time payout may tempt borrowers to take more than needed.

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving credit line that lets homeowners borrow against the equity in their homes. Think of it as a credit card secured against your home’s value. It offers flexibility, allowing you to draw funds as needed and repay them over time. Typically, you can access up to 80% of your home’s equity through a HELOC, with repayment terms extending up to 30 years, depending on the lender.

Unlike traditional loans, a HELOC has a draw period, usually between five and 15 years, where you can withdraw funds up to your credit limit. During this period, minimum payments are often limited to interest only. After the draw period ends, you enter the repayment period, which can last 10 to 20 years, to repay the borrowed amount.

A HELOC can be an invaluable resource for homeowners, offering a flexible way to access funds for various needs, from home improvements to debt consolidation. However, it’s essential to approach this option with a clear understanding of the requirements and a solid repayment plan.

Responsible use of a HELOC not only helps in managing immediate financial needs but also in maintaining long-term financial health and stability. As with any financial decision, it’s advisable to consult with a financial advisor to determine if a HELOC aligns with your overall financial goals and situation.

HELOC Requirements

Qualifying for a HELOC involves meeting specific criteria:

- Equity in Your Home: Generally, you should have between 15% to 20% equity in your home. The amount you can borrow is based on your loan-to-value (LTV) ratio, calculated by dividing your mortgage balance by your home’s current value.

- Credit Score: A good credit score is crucial, typically in the mid-to-high 600s, though 700 or higher is preferable. Your credit score also influences the interest rate offered.

- Sufficient Income and Documentation: You must demonstrate the ability to repay the loan with adequate income. This includes providing documentation like recent W-2s, pay stubs, federal tax returns, or benefit verification letters.

- On-Time Payment History: Lenders will scrutinize your payment history as part of your credit score, emphasizing the importance of reliable repayment.

- Debt-to-Income (DTI) Ratio: Your DTI ratio, which compares your monthly debt payments to your income, should ideally be no higher than 43% to 50%. Lenders use this to assess your capacity to handle additional debt.

Additionally, lenders consider your combined loan-to-value (CLTV) ratio, which includes all secured loans against your property’s value. A CLTV ratio of no more than 85% to 90% is usually required to qualify for a HELOC.

Which Type of Loan is Better for You?

When it comes to leveraging the equity in your home, two primary options are available: a Home Equity Loan and a Home Equity Line of Credit (HELOC). Each of these financial tools offers distinct benefits and can be a viable choice depending on your specific financial needs and circumstances.

The Home Equity Loan: a Predictable Financial Solution

A Home Equity Loan may be the ideal choice if you need a one-time lump sum. This type of loan provides a straightforward, conventional loan structure, offering a sense of predictability and ease in payment schedules. The fixed nature of a Home Equity Loan means that you’ll have a consistent repayment amount throughout the loan term, which can be easier to manage and plan for in your budget. This makes it an excellent option for homeowners with a clear, one-time financial need, such as a major home renovation or consolidating high-interest debt.

The Flexibility of a Home Equity Line of Credit

On the other hand, a Home Equity Line of Credit offers more flexibility. It functions similarly to a credit card, where you have access to a set amount of funds that you can draw from as needed. This flexibility makes a HELOC particularly advantageous for ongoing projects or expenses, like phased home improvements, or as a financial safety net that can be tapped into when unexpected expenses arise. The ability to borrow only what you need, when you need it, can be a significant advantage for those who prefer not to commit to a large lump sum loan.

Considerations and Risks

For both Home Equity Loans and Lines of Credit, the amount you can borrow hinges on the current market value of your home and the amount of equity you have. It’s crucial to remember that in both cases, your home serves as collateral. This means that if your home’s value decreases significantly or there’s an interruption in your income, you could potentially risk losing your home. Therefore, it’s vital to assess the stability of your financial situation before opting for either of these options.

Is a Home Equity Line or Loan Right for You?

Choosing between a home equity loan and a HELOC depends on your financial situation, how you plan to use the funds, and your tolerance for risk with variable interest rates. Consider factors like your financial stability, future income prospects, and how comfortable you are with the idea of putting your home as collateral.

Final Words

Both home equity loans and lines of credit offer valuable ways to leverage your home’s equity. When considering a home equity loan vs. a line of credit, assess your financial situation, your long-term goals, and how you plan to use the borrowed funds to make the best decision.

Unlock the secrets of choosing between a Home Equity Loan vs. Line of Credit with our expert guidance. At EduCounting, we specialize in elevating your financial acumen, particularly through biweekly budgeting strategies. Dive into our carefully curated blogs and comprehensive courses to gain an in-depth understanding and practical insights on this critical financial decision and other vital financial topics. Join us to master the art of savvy financial management.

Frequently Asked Questions

Can I pull equity out of my house without refinancing?

Yes, you can pull equity out of your house without refinancing through a home equity loan or a home equity line of credit (HELOC), both of which allow you to borrow against your home’s equity independently of your original mortgage.

Do I need an appraisal for a HELOC?

Yes, most lenders require an appraisal for a HELOC to determine the current market value of your home, which is essential to calculate the amount of equity available for borrowing.

Is a home equity line of credit risky?

A home equity line of credit can be risky as it uses your home as collateral. If you fail to make payments, there is a risk of foreclosure, so it’s important to consider your ability to repay the borrowed amount.

Is it a bad idea to have an equity line of credit?

Having an equity line of credit is not inherently bad and can be a useful financial tool, but it depends on your financial situation, ability to repay, and the purpose for which you’re using the credit line. It’s essential to use it responsibly to avoid financial strain.