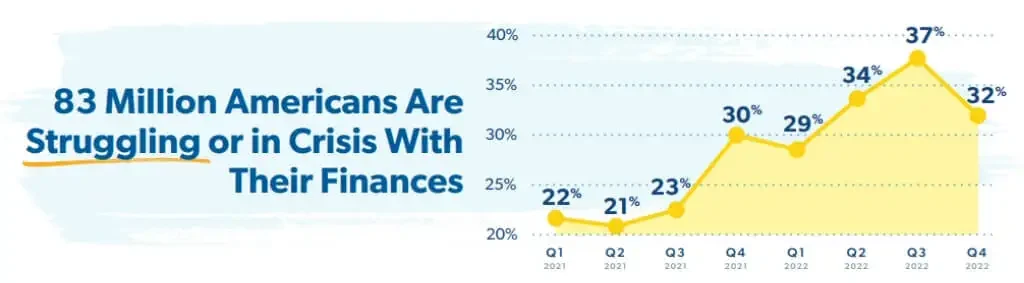

Research shows that in the final quarter of 2022, 32% of Americans reported that they were either struggling financially or in a state of crisis. It marked a substantial 45% increase from the data of 2021. Overall, an estimated 83 million Americans are experiencing considerable financial challenges, underscoring the critical need for strategic financial planning and the establishment of an emergency fund.

Financial security is a cornerstone of peace of mind in today’s unpredictable world. An emergency fund is a bulwark against the unforeseen, ensuring you’re prepared for whatever life throws. However, knowing when to use this safety net is crucial. What are three questions to ask yourself before you spend your emergency fund? This article delves into the essence of emergency funds, their importance, and a guide to judiciously utilizing them.

What is an Emergency Fund?

An emergency fund is a financial safety net designed to cover unexpected expenses or provide support during financial hardship without incurring debt. This fund is typically saved in a readily accessible account, separate from other savings or investment accounts, ensuring it is available when needed.

This could range from sudden job losses and medical emergencies to major home repairs. The purpose of an emergency fund is to ensure that you can cover these unforeseen costs without debt.

How Much Should I Save for My Emergency Fund?

Determining the size of your emergency fund is a critical step towards financial stability. The right amount can vary significantly based on your circumstances, including your job security, health, and financial obligations.

- Starter emergency fund: A starter emergency fund of $1,000 is often recommended for those just beginning. This amount aims to cover smaller, immediate emergencies, allowing you to avoid debt for minor unforeseen expenses.

- Fully funded emergency fund: A fully funded emergency fund should cover 3 to 6 months’ living expenses. This larger cushion supports you through more significant financial challenges, such as prolonged job loss or major medical emergencies.

Where Should I Keep My Emergency Fund?

Your emergency fund should be easily accessible but not too easy to spend on non-emergencies. High-yield savings accounts are popular, offering a balance between earning interest and being readily available without the risk of loss.

Deciding on the optimal location for your emergency fund involves ensuring it is both accessible and secure. The ideal choice would be an option that allows quick and easy access to your funds without tempting you to use them for non-emergencies. Consider these alternatives:

- A basic savings account linked to your primary checking account for easy transfers.

- A money market account equipped with a debit card or the ability to write checks for immediate access.

- An online banking option offering competitive interest rates, with the convenience of swift transfers to your checking account for urgent needs.

How to Build an Emergency Fund

Building an emergency fund can seem daunting. Still, by breaking it down into manageable steps, you can gradually create a financial buffer to protect against life’s uncertainties.

- Set a total savings goal: Start by determining your fully funded emergency fund amount, typically 3-6 months of expenses. This gives you a clear target to work towards.

- Make a budget: Creating a budget is crucial. It allows you to see where your money is going each month and identify areas where you can cut back to redirect funds to your emergency savings.

- Decrease your expenses: Look for ways to reduce your spending, such as canceling unused subscriptions, eating out less, and shopping around for better deals on recurring expenses like insurance.

- Increase your income: Consider ways to boost your income, such as taking on freelance work, selling items you no longer need, or asking for a raise at your current job.

- Automate your savings: Setting up automatic transfers to your emergency fund can simplify the saving process. Automate your savings to occur just after you receive your paycheck to reduce the temptation to spend this money elsewhere.

Why Do I Need an Emergency Fund?

Life is full of surprises – some pleasant and some not so much. Emergency funds are essential because they offer a buffer against unforeseen events, such as sudden job loss, medical emergencies, or urgent home repairs. Having this fund means you can cover these expenses without resorting to high-interest loans or credit cards, thus preventing a spiral into debt.

An emergency fund is not just a financial strategy; it’s a cornerstone of a sound financial plan. It serves multiple critical purposes in safeguarding your financial health and emotional well-being. Here’s why having an emergency fund is indispensable:

You’ll Be Prepared

With an emergency fund in place, you’re equipped to handle unexpected financial demands without panic. Whether it’s a sudden job loss, a medical emergency, or urgent home repairs, this fund ensures you can cover these expenses. Being prepared with an emergency fund means you won’t have to scramble to find resources at the last minute, allowing you to confidently manage life’s surprises.

You’ll Save Money

An emergency fund can save you money in the long run. By having funds readily available, you avoid the need to take out high-interest loans or rack up credit card debt to cover unexpected expenses. This proactive approach prevents the accumulation of debt and the additional interest burden, saving you money that would otherwise go to lenders.

You’ll Feel Peace

Beyond the financial benefits, an emergency fund contributes significantly to your mental and emotional peace. Knowing you have a financial cushion to fall back on in times of need reduces stress and anxiety associated with financial uncertainties. This sense of security enables you to focus on resolving the situation at hand without the added worry of financial ruin, promoting a calmer and more stable mental state during crises.

When to Use Your Emergency Fund

Determining when to dip into your emergency fund requires careful consideration. It’s meant for true emergencies: situations that threaten your survival, safety, or ability to earn income. No matter how enticing, non-essential expenses should not deplete this vital resource.

Three Questions to Ask Before Spending Your Emergency Fund

When faced with a financial dilemma, the decision to dip into your emergency fund is not taken lightly. This fund serves as a safety net for genuine emergencies, ensuring that you’re not thrown into financial disarray by unexpected events. Before you withdraw from this fund, it’s crucial to assess the situation carefully. Here are three pivotal questions to guide you in making a prudent decision.

1. Is It Unexpected?

The first criterion for using your emergency fund is the unexpected nature of the expense. Emergencies, by definition, are unforeseen and unplanned. If you consider tapping into your emergency savings, ask yourself if the situation is truly unpredictable. This could include sudden job loss, emergency medical bills, or an unexpected major home repair. The fund is not meant for foreseeable expenses, such as routine car maintenance or annual property taxes. By distinguishing between unforeseen emergencies and predictable expenses, you can ensure that your emergency fund is reserved for true surprises.

Furthermore, evaluating whether an expense is unexpected helps in financial planning and encourages the development of specific savings goals for anticipated future needs. This foresight can help prevent the misuse of emergency funds and encourage better budgeting practices.

2. Is It Absolutely Necessary?

Not every unexpected expense necessitates an immediate withdrawal from your emergency fund. The necessity of the expense is a critical factor to consider. It’s essential to differentiate between what you need and what you want. An expense is necessary if it affects your ability to live safely and securely. This includes situations that, if not addressed immediately, could lead to more significant financial or personal loss, such as critical home or vehicle repairs that impact your daily living or employment.

Evaluating the necessity of an expense also means considering alternative solutions. Before using your emergency fund, explore other options that might be available to you, such as payment plans or financial assistance programs. This step ensures that your emergency fund remains intact for when you have no other options.

3. Is It Urgent?

The urgency of the situation is the final litmus test for using your emergency fund. Some situations require immediate financial intervention, while others may allow for time to explore alternative funding sources or to save specifically for that expense. An urgent need implies that delaying the expense could result in significant harm or additional costs. For example, an urgent medical procedure cannot be postponed without serious consequences to your health.

The urgency of an expense also provides an opportunity to prioritize your financial commitments. By assessing the immediacy of your needs, you can make informed decisions that protect your financial stability. This careful consideration helps maintain the integrity of your emergency fund, ensuring it’s available when you truly have no other recourse.

Final Words

Your emergency fund is an essential pillar of your financial health, offering protection from the unpredictable challenges life may present. What are three questions to ask yourself before you spend your emergency fund? Reflecting on these questions is crucial to ensure that this financial safety net serves its intended purpose. By carefully considering whether an expense is unexpected, necessary, and urgent, you can preserve your emergency fund for times of true need.

For more insights on managing your finances effectively and preparing for life’s unexpected turns, we invite you to explore our wealth of resources at EduCounting. Our blogs are designed to empower you with the knowledge and tools needed to navigate your financial journey with confidence. Whether you’re looking to build a robust emergency fund or seeking tips on financial planning, EduCounting is your go-to source for practical, actionable advice. Visit us today and take the next step towards securing your financial future.

FAQs

What is a Good Goal for an Emergency Fund?

A good goal for an emergency fund is to have enough to cover 3-6 months’ worth of living expenses. This provides a substantial buffer to handle most emergencies and adjust to unforeseen circumstances without financial distress.

Should I Keep My Emergency Fund?

Absolutely. Keeping your emergency fund intact is crucial for maintaining financial stability. It should be replenished if used and grown as your financial situation evolves or your living expenses increase.

Why is It Important to Have an Emergency Fund?

An emergency fund is important because it provides financial security and peace of mind. It enables you to manage unexpected expenses or financial emergencies without resorting to debt, preserving your financial health and well-being.