Navigating the complex world of personal finance can be daunting. This is where a Financial Needs Analysis (FNA) comes into play, acting as a compass guiding you through the often complex terrain of personal finance. The blog delves into the essence of this important process, illuminating how it can be the key to unlocking a more secure and prosperous financial future.

An FNA is not just a tool; it’s a comprehensive strategy that evaluates your financial situation from all angles. It involves a detailed examination of your income, assets, liabilities, and expenses juxtaposed with your financial goals. This analysis serves a dual purpose: it provides a clear snapshot of where you currently stand financially and outlines a tailored path to achieve your aspirations, including buying a home, saving for retirement, or setting up an educational fund.

This blog aims to demystify the process of a Financial Needs Analysis, breaking it down into manageable, understandable components. It’s designed to empower you, the reader, with the knowledge and confidence to take control of your financial destiny. Whether you’re a seasoned investor or just starting out, understanding the principles and benefits of an FNA is a vital step toward financial freedom.

What is a Financial Needs Analysis (FNA)?

A Financial Needs Analysis (FNA) is an in-depth evaluation of an individual’s or family’s financial health. It involves analyzing various components of your financial life – from income and assets to liabilities and expenses. The goal is to identify your current financial status and lay out a strategic plan for the future.

A Financial Needs Analysis goes beyond mere number-crunching. It’s a personalized approach that considers unique aspects of your financial situation. For instance, it evaluates your income streams, whether stable or fluctuating. It also considers your assets, including savings, investments, property, and even intellectual or digital assets. On the other side of the equation, it assesses your liabilities, such as loans, mortgages, and other debts, along with regular essential and discretionary expenses. This comprehensive analysis provides a holistic view of your financial health, highlighting strengths, uncovering potential risks, and identifying areas for improvement.

The true power of an FNA lies in its ability to project future financial scenarios. Examining current trends in your earnings, spending, and saving habits can forecast your financial trajectory. This aspect is crucial for long-term planning, such as retirement, children’s education, or major purchases like a home. An FNA can reveal if you’re on track to meet these goals or if adjustments are needed. It can also inform decisions about insurance coverage, investment strategies, and emergency funds, ensuring you’re prepared for life’s unpredictabilities. Ultimately, an FNA isn’t just about where you are financially; it’s about where you could be and how to get there.

Purpose of Financial Needs Analysis (FNA)

Financial Needs Analysis (FNA) is a cornerstone in personal financial planning, offering a roadmap to financial stability and success. Through an FNA, individuals gain invaluable insights into their financial situation, empowering them to make informed decisions and plan effectively for their future.

Clarifying Your Financial Status

The primary purpose of a Financial Needs Analysis is to provide a clear and comprehensive picture of your current financial status. This process involves a deep dive into all aspects of your financial life, including income, assets, liabilities, and expenses. By painting a complete picture of your financial health, an FNA allows you to identify strengths, weaknesses, and areas that require attention or improvement. It’s about understanding where you stand financially, which is the first step toward making informed and strategic financial decisions.

Setting and Achieving Financial Goals

An FNA is a critical tool for setting realistic and attainable financial goals. Whether saving for retirement, buying a home, or planning for your children’s education, an FNA helps you clearly outline these objectives. More importantly, it provides a structured approach to achieving these goals. An FNA enables you to devise a strategic plan to turn your financial goals into reality by assessing your financial capabilities and aligning them with your aspirations. It breaks down your long-term ambitions into manageable steps, making the journey towards achieving them more structured and less daunting.

Preparing for Life's Uncertainties

Life is unpredictable, and financial emergencies can arise without warning. The FNA is designed to prepare you for these uncertainties. It evaluates your readiness to face unexpected financial challenges, such as medical emergencies, job loss, or economic downturns. By examining your emergency funds, insurance coverage, and investment diversification, an FNA ensures you can handle unforeseen financial situations. This preparation is crucial for protecting your current lifestyle and future financial plans.

Preparing for a Financial Needs Analysis (FNA)

Preparing for a Financial Needs Analysis (FNA) requires a meticulous approach to gathering and organizing your financial information. Beyond the basic documents like bank statements and investment records, it’s important to include details of all income sources, such as pay slips, rental income, or any side business revenues. You should also compile a comprehensive list of liabilities, including credit card statements, loan documents, and mortgages.

This preparation phase is more than just an exercise in documentation; it’s an opportunity to take a step back and thoroughly review your financial standing. Having all pertinent information at hand ensures that the FNA provides a realistic and holistic view of your finances, paving the way for accurate and meaningful financial planning. This level of preparedness not only facilitates a smoother analysis process but also contributes to a deeper understanding and engagement with your financial health.

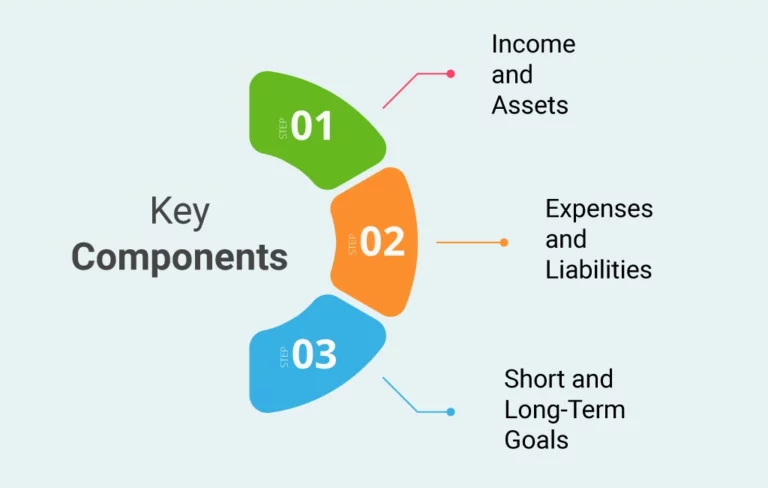

Key Components of a Financial Needs Analysis (FNA)

From understanding the stability of your income and the diversity of your assets to managing your expenses and liabilities effectively, an FNA equips you with the knowledge and tools necessary for sound financial decision-making.

Income and Assets

When it comes to a Financial Needs Analysis (FNA), understanding your income and assets is crucial. This step thoroughly examines your regular income sources, including salaries, investment dividends, rental income, or other consistent cash inflows. It’s not just about how much you earn but also the stability and predictability of these earnings.

Assets play a significant role as well. This encompasses everything from liquid assets like cash and stocks to illiquid ones like real estate or business ownership. Evaluating these helps determine your net worth and financial resilience, clearly showing your financial foundation.

Income and assets are indicators of your current financial health and set the stage for future financial planning. A diverse and robust asset portfolio can mean a higher degree of financial security and greater potential for income generation in the future.

For instance, investment portfolios need regular reviews to align with your risk tolerance and financial goals. Likewise, understanding your assets’ value and potential growth can inform investments, savings, or even debt management decisions. This comprehensive view of your income and assets is critical in the FNA process, setting the groundwork for informed financial decision-making.

Expenses and Liabilities

Expenses and liabilities are another vital component of a Financial Needs Analysis. This section delves into your spending habits, categorizing expenses into essentials like housing, utilities, and groceries and non-essentials like entertainment and luxury purchases. Understanding where your money goes each month is key to identifying potential areas for savings and more efficient budgeting.

On the other hand, liabilities include any debts or ongoing financial obligations you have, such as loans, credit card debts, or mortgages. A detailed analysis of these liabilities is important to assess your debt-to-income ratio, a crucial indicator of financial health.

Managing expenses and liabilities effectively is fundamental to achieving financial stability and freedom. High-interest debts, for example, can significantly drain your financial resources. An FNA can help develop strategies to manage or consolidate these debts more effectively.

It also aids in setting realistic budgets, ensuring that you live within your means while working towards your financial goals. By clearly understanding your expenses and liabilities, you can make informed choices about spending, saving and investing, all essential for a sound financial future.

Short and Long-Term Goals

Setting short- and long-term goals is essential to a Financial Needs Analysis. Short-term goals usually span a period of one to five years and may include saving for a vacation, purchasing a car, or building an emergency fund. These goals are more immediate and require a different financial strategy than long-term goals.

Long-term goals, such as retirement planning, purchasing a home, or funding a child’s education, usually span many years or even decades. These goals require careful planning, as they are often more complex and involve larger sums of money.

The key to effective goal setting in an FNA is specificity and realism. Each goal should be clearly defined with a specific timeframe and cost. This helps in creating actionable steps to achieve these goals.

For short-term goals, you might focus on tactics like automating savings or cutting down on unnecessary expenses. For long-term goals, strategies could include investing in retirement accounts, real estate, or other long-term investment vehicles. Regularly reviewing and adjusting these goals based on changes in your financial situation or life circumstances is also crucial. By aligning your financial plan with your short and long-term objectives, an FNA ensures that every financial decision is a step towards achieving your dreams and securing your future.

Steps to Conducting a Financial Needs Analysis (FNA)

Embarking on a Financial Needs Analysis (FNA) is akin to charting a course through the complex seas of personal finance. It’s an essential process for anyone looking to understand their financial standing and plot a path to financial security and prosperity. An FNA is not a one-size-fits-all approach; it requires a personalized and detailed examination of one’s financial situation.

Comprehensive Asset Inventory

The first step in an FNA is conducting a comprehensive asset inventory. This involves cataloging all your assets – from liquid assets like cash and stocks to fixed assets like property and vehicles. It’s essential to assess the value of each asset accurately, considering factors like market value, depreciation, and potential for appreciation.

This step is not just about listing what you own; it’s about understanding each asset’s role in your overall financial health. For example, high-liquidity assets can be crucial for emergency funds, while long-term investments like real estate can form the backbone of your retirement planning. An exhaustive asset inventory gives you a clear picture of your net worth, providing a solid foundation for further financial analysis and planning.

Moreover, a thorough asset inventory helps identify opportunities for diversification or consolidation. Diversification can spread risk and enhance potential returns, while consolidation might be necessary to manage assets more effectively or reduce maintenance costs. This step requires regular updates as the value of assets can change over time, and new assets may be acquired or old ones sold.

Detailed Expense Tracking

The next step in an FNA involves detailed expense tracking. This process is more than just keeping tabs on where your money is going; it’s about understanding your spending habits and identifying areas where you can save. By categorizing expenses into essentials (like housing, utilities, and groceries) and non-essentials (such as dining out, entertainment, and luxury purchases), you can get a clearer picture of your financial priorities and areas where adjustments might be needed.

Detailed expense tracking also helps in identifying patterns and trends in your spending. Are there certain times of the year when your expenses spike? Are there habitual expenditures that, upon reflection, could be reduced or eliminated? This exercise can often reveal surprising insights into your financial behavior, empowering you to make more informed decisions about budgeting and saving. Furthermore, understanding your expenses is crucial for setting realistic and achievable financial goals.

Goal-setting with Actionable Steps

Setting goals is a critical component of an FNA, but it’s not enough to simply state what you want to achieve. Each goal needs to be accompanied by actionable steps. Start by categorizing your goals into short-term (within the next year), medium-term (1-5 years), and long-term (more than 5 years). This classification helps in allocating resources and prioritizing efforts. For each goal, outline specific steps you need to take, resources required, and a realistic timeline.

For example, if saving for a down payment on a house is a goal, determine the amount needed and when you plan to purchase. Then, work backward to figure out how much you need to save each month and what changes to your budget or savings plan are necessary to meet this goal. Regularly review and adjust these goals and steps as your financial situation evolves. This dynamic approach ensures that your financial planning remains relevant and aligned with your changing needs and aspirations.

Focus on Essential Expenditures

The final step in an FNA is on essential expenditures. This involves distinguishing between what you need and what you want. Essential expenditures are those necessary for your basic living and well-being – housing, food, healthcare, and transportation. By prioritizing these expenses, you ensure your most critical needs are always met.

This focus doesn’t mean you must cut out all non-essential spending; it’s about creating a balance. It’s important to periodically review your spending patterns to see if there are areas where you can cut back without significantly impacting your quality of life. For instance, you might find that dining out less frequently or opting for more affordable entertainment options can free up funds for saving or investing. Focusing on essentials also involves planning for future essential expenses, like home maintenance or healthcare costs, ensuring that these inevitable expenditures don’t derail your financial goals.

Final Words

A Financial Needs Analysis is more than just a financial review; it’s a roadmap to achieving financial freedom. By understanding and managing your financial situation, you can make informed decisions that lead to a secure and prosperous future.

Discover the path to financial independence with EduCounting! Our commitment is to empower young individuals with the knowledge and skills they need for effective money management. Our online platform offers extensive resources tailored for children, teenagers, and young adults, guiding them towards financial confidence.

Enroll in our course now and start mastering the fundamentals of financial literacy with EduCounting! We’re excited to support you on your adventure to financial freedom.

FAQs

What do you mean by financial needs?

Financial needs refer to the expenses and monetary requirements necessary to maintain a stable and secure lifestyle. They include costs related to daily living, such as housing, food, healthcare, transportation, and long-term financial obligations and goals, like retirement savings and debt repayment.

What are the four main categories of financial needs?

The four main categories of financial needs are daily living expenses (food, rent, utilities), emergency funds (for unforeseen expenses), savings (for short and long-term goals), and investments (for wealth growth and retirement planning).

How do you demonstrate financial needs?

Demonstrating financial needs involves a comprehensive analysis of your income, expenses, assets, and liabilities. This includes documenting and reviewing all sources of income, regular expenses, debts, and any other financial obligations or goals to show your financial requirements and obligations clearly.