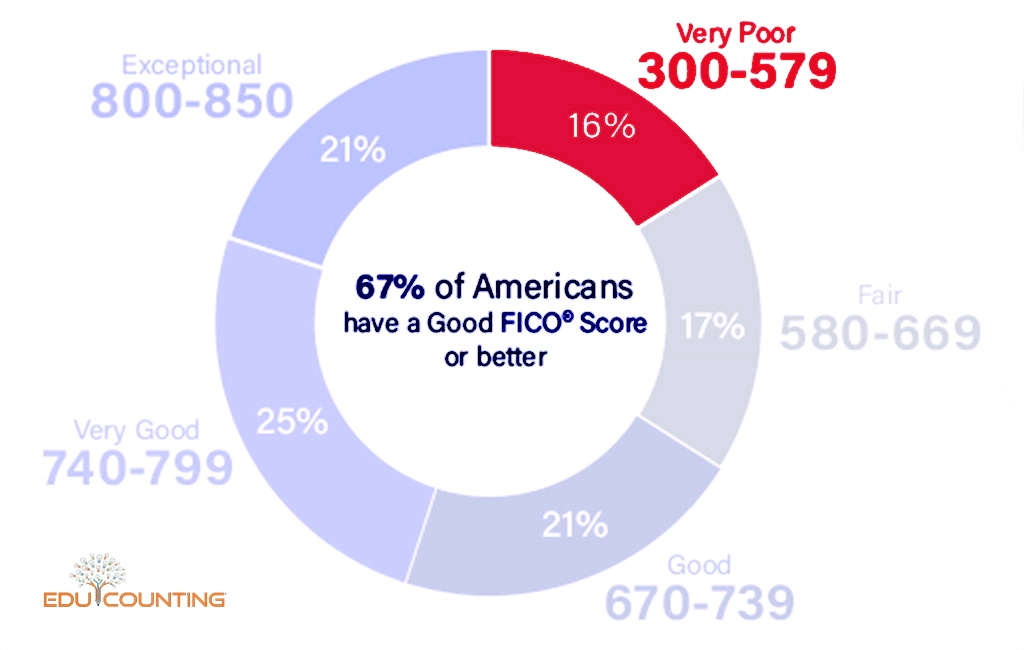

FICO Scores, spanning 300 to 850, categorize individuals with 579 or below as having bad credit. Top credit bureau Experian’s data suggests that approximately 62% of individuals within this score range are more likely to fall significantly behind on their loan repayments in the future, posing a higher risk for lenders. This classification is crucial for those seeking home improvement loans with bad credit, as it influences lenders’ decisions. This guide will explore the various facets of securing home improvement loans, offering insights and tips to navigate this financial landscape successfully.

What is Considered Bad Credit?

“Bad credit” is a term used to describe a low credit score, reflecting a higher risk to lenders based on past financial behavior. The most widely used metric to determine this in the United States is the FICO Score. Understanding what constitutes bad credit requires a look at how the FICO Score is calculated.

The FICO Score, developed by the Fair Isaac Corporation, is a composite number derived from various factors in a person’s credit history. Payment history is the most significant element, making up 35% of the score. This reflects whether a person has consistently paid their bills on time. Even minor delinquencies can negatively impact this part of the score, with more severe lateness causing greater damage.

Another crucial factor is the total amount owed, which accounts for 30% of the score. This includes all debts like mortgages, car loans, credit card balances, and any other outstanding obligations. The credit utilization ratio – the proportion of available credit being used- is particularly important. High utilization, generally above 20% to 30%, is a risk indicator and can lower the score.

Additional factors include the length of credit history (15%), where a longer history is more favorable; the mix of credit types (10%), where a variety of credit accounts is beneficial; and new credit (10%), where applying for multiple new credit lines in a short period can be a red flag to lenders. A low FICO score, typically below 620, is often considered bad credit. This can result from high credit utilization, a history of late payments, a short credit history, or a lack of diverse credit types.

How to Compare Home Improvement Loans with Bad Credit

When comparing home improvement loans with bad credit, it’s important to look for a loan that suits you. The trick lies in comparing various aspects of the loans available to you. These include the Annual Percentage Rate (APR), monthly payments, repayment terms, and the speed of funding. Each element is critical to your loan’s overall cost and feasibility.

APR

The APR is a crucial factor to consider as it reflects the true cost of the loan, including interest and any additional fees. For those with bad credit, APRs tend to be higher. It’s important to shop around and compare APRs from different lenders to ensure you get the most cost-effective option. Remember, a lower APR means lower overall costs throughout the life of the loan.

Monthly Payments

Monthly payments are another vital aspect to consider. You need to ensure that these payments fit comfortably within your budget. Loans with lower monthly payments might seem attractive, but they often come with longer repayment terms, which could mean more interest paid over time. Conversely, higher monthly payments can shorten the loan term but might strain your monthly budget. Find a balance that works for your financial situation.

Repayment Terms

Repayment terms dictate how long you have to repay the loan. Longer terms will reduce your monthly burden but increase the total interest paid. When you have bad credit, lenders might offer shorter repayment terms, so choosing a term that aligns with your financial capacity and goals is important.

Fast Funding

The speed of funding is essential if your home improvement project is time-sensitive. Some lenders offer quick processing and funding, sometimes within a few days. However, fast funding might come with higher costs or stricter terms. Weigh the urgency of your project against the cost implications of fast funding options.

How to Build Up Your Credit to Get a Home Improvement Loan

Improving your credit score can significantly increase your chances of qualifying for better loan terms. Building your credit includes repayment of bills on time, correcting any inaccuracies on your credit report, and reducing financial burden. Gradually improving your credit score can open up more favorable loan options.

- Understand Your Credit Position: Start by obtaining your credit report and score. This will help you understand where you stand in terms of creditworthiness. Regularly reviewing your credit report is also crucial for spotting any inaccuracies or errors that could negatively impact your score.

- Maintain Timely Payments: One of the most effective ways to build a positive credit history is by consistently making at least the minimum payments on all your debts, including loans and credit cards. Payment history is a significant factor in your credit score, so timely payments can positively affect you.

- Manage Credit Utilization: Work on lowering your overall credit utilization – the ratio of your credit card balances to their limits. Aim to keep this ratio as low as possible, ideally below 30%. Paying down existing balances and not maxing out credit cards are key strategies. However, avoid closing credit card accounts as this can shorten your credit history and increase your utilization ratio.

- Be Patient and Persistent: Building credit is a gradual process. It requires time and consistent effort. If your home improvement project is not urgent, improving your credit score can help you secure loans with more favorable terms and lower interest rates.

- Consider Alternative Options: If your home improvement project cannot wait and your credit still needs to be ideal, research lenders willing to work with borrowers with various credit scores. While these loans may be more accessible, they might come with higher interest rates or less favorable terms.

Ways to Improve Your Credit Score Before Borrowing

Improving your credit score before taking out a loan can significantly enhance your borrowing options and potentially lead to better interest rates and terms. Here are some effective strategies:

Stay on Top of Payments

One of the most critical factors in your credit score is your payment history. Ensure you pay all your bills on time, including credit cards, loans, and utility bills. Setting up automatic payments or reminders can help you stay on track. Consistently making timely payments can positively impact your credit score over time.

Pay Existing Debts to Lower Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is a key metric lenders use to assess your ability to manage monthly payments and repay debts. Lowering your DTI can be achieved by paying down debts, such as credit card balances and loans. This improves your credit score and makes you a more attractive candidate to lenders.

Add a Co-Signer or Co-Borrower

If you have a trusted individual with a strong credit history, consider adding them as a co-signer or co-borrower on your loan application. Their good credit can bolster your application, increasing your chances of approval and possibly securing a better interest rate. However, this step involves significant trust and responsibility, as the co-signer or co-borrower is equally liable for the loan.

Get a Secured Personal Loan

A secured personal loan can be a stepping stone to improve your credit. These loans are backed by collateral, such as a savings account or a car, reducing the risk for the lender. You demonstrate financial responsibility by successfully repaying a secured loan, which can positively affect your credit score.

Pre-Qualify

Pre-qualifying for a loan gives you an idea of what terms and interest rates you can expect based on your current credit status without impacting your credit score (as it typically involves a soft credit check). This can guide your decision-making and help you understand whether it’s the right time to borrow or focus on improving your credit first.

How to Get a Home Improvement Loan With Bad Credit

Getting home improvement loans with bad credit can be challenging, but it’s not impossible. Here are some steps to help you navigate this process:

1. Know Your Credit Score

Firstly, understand your credit situation by checking your credit score and report. This will give you insight into what lenders see and help you identify any areas for improvement. Even with bad credit, knowing your score will help you set realistic expectations about the types of loans and terms you might qualify for.

2. Improve Your Credit Score, if Possible

Before applying for a loan, take any possible steps to improve your credit score. This might include paying down existing debts, disputing errors on your credit report, or keeping your credit utilization low. Even small improvements in your credit score can increase your chances of loan approval and better terms.

3. Explore Various Lenders

Different lenders have different criteria for issuing loans. Credit unions, online lenders, and specialized financial institutions might be more willing to work with individuals with bad credit. Compare various lenders to find the best rates and terms that suit your situation.

4. Look for Secured Loans or Co-signer Options

Secured loans, backed by assets like home equity, can be easier to obtain and may offer better terms, even for those with bad credit. Alternatively, having a co-signer with good credit can also improve your chances of getting approved for a home improvement loan.

5. Consider Government Loans or Programs

Some government-backed loans and programs are designed to help homeowners with bad credit. For instance, the FHA (Federal Housing Administration) offers loans that are more accessible to those with lower credit scores.

6. Be Prepared for Higher Interest Rates

With bad credit, be prepared for higher interest rates. Lenders see bad credit borrowers as higher risk, often resulting in higher rates to offset this risk.

7. Read the Terms Carefully

Before accepting any loan offer, thoroughly read the terms and conditions. Pay special attention to the interest rate, repayment terms, fees, and any penalties for late payments. Ensure that the monthly payments are manageable within your budget.

8. Consider Alternative Financing Options

If traditional loans aren’t an option, consider alternative financing methods. This might include home equity lines of credit (HELOC), borrowing from friends or family, or even using credit cards for smaller improvements.

Bad Credit Home Improvement Loans vs. Home Equity Loans

When considering financing options for home renovations, homeowners with equity in their property often weigh the merits of bad credit home improvement loans against home equity loans.

Home Equity Loans and Lines of Credit

If you have built up equity in your home, you may access it through home equity loans or lines of credit (HELOCs). Although a credit score of around 620 is usually required, lenders might offer more lenient qualification criteria for these loans since your home acts as collateral – meaning the lender can claim it if you default. An added benefit of home equity financing is that the interest you pay is often tax-deductible when used for home improvements, a perk not available with personal loans.

With a home equity loan, you receive a lump sum with a fixed interest rate. On the other hand, HELOCs offer a flexible credit line with variable rates, from which you can draw funds as needed, typically over 10 years. Both types of equity financing usually have repayment terms ranging from 15 to 20 years.

Compared to personal loans, home equity loans, and HELOCs often feature lower interest rates and longer repayment terms. However, they may require a home appraisal before approval, extending the funding process by several weeks. Personal loans, in contrast, are usually processed and funded within about a week.

Cash-out Refinance

Another option is a cash-out refinance, where you replace your current mortgage with a larger one, taking the difference in cash for your renovation. This option is particularly appealing if the new mortgage rate is lower than your existing one, allowing you to fund your renovation while potentially reducing your mortgage rate.

In comparison to personal loans, a cash-out refinance can be more suitable for larger renovation projects. This is because the closing costs, ranging from 2% to 6% of the loan amount, might outweigh the benefits of smaller updates. In contrast, personal loans do not incur these closing costs. While a personal loan can provide funds for your project, a cash-out refinance can offer renovation financing and a lower mortgage rate.

Home Improvement Loan Without a Credit Check

For those with bad credit, limited options don’t require a credit check. However, it’s advisable to consider these types of loans only as a final option. Home improvement projects often concern aesthetic enhancements rather than urgent necessities. It might be wiser to focus on elevating your credit score over a while. This approach can open up opportunities to qualify for more traditional home improvement loans, which generally come with better terms and lower interest rates. Patience and strategic financial planning can ultimately lead to more favorable loan options for your home renovation needs.

Other Options for Bad Credit Borrowers

Even with bad credit, there are alternative methods to secure funding for home improvement projects. Understanding these options can help in making a more informed decision that aligns with your financial situation.

Government-insured Loans for Home Improvements

Government-insured home improvement loans, such as those offered by the Federal Housing Administration, provide a more accessible route for homeowners with a minimum credit score of 500. These loans typically offer competitive rates compared to personal loans. The FHA 203(k) renovation loan allows borrowers to refinance their mortgage, combining home improvement costs into the new loan, subject to certain criteria like no foreclosures in the past three years and a process involving pre-qualification and potentially a HUD inspection. Additionally, the FHA Title I loan caters to broader improvement projects, requiring no security for loans under $7,500, while larger amounts necessitate a mortgage or deed of trust on the property, as stipulated by HUD guidelines.

Home Equity Loan

A home equity loan is a viable option for homeowners with some equity in their property. This type of loan allows you to borrow a lump sum based on the equity you have in your home. The amount you can borrow, the interest rate, and the repayment terms will depend on various factors, including your home’s value and credit profile. While your credit score is a factor, the equity in your home acts as collateral, which might make it easier to secure a loan even with bad credit.

Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit, or HELOC, works like a credit card but uses your home’s equity as collateral. It allows you to draw funds as and when needed up to a certain limit and only pay interest on the amount you use. HELOCs often have more flexible repayment options than traditional loans, which can benefit those with bad credit. However, as with home equity loans, your home is at risk if you fail to make payments.

Family Loans

Another option for those with bad credit is to seek financial assistance from family members. Family loans can be more flexible regarding interest rates and repayment terms and might not require a credit check. However, it’s important to treat a family loan with the same seriousness as a loan from a traditional lender. It’s advisable to have a formal agreement in place to avoid any misunderstandings or potential conflicts in the future.

Final Words

Navigating home improvement loans with bad credit can be challenging, but it’s not impossible. By understanding your credit situation, comparing loan options, and improving your credit score, you can find a way to finance your home improvements despite bad credit.

At EduCounting, we’re dedicated to guiding you through the complexities of managing your finances, especially when it comes to securing the right loans. Browse our extensive collection of insightful blogs and detailed guides that shed light on this topic and many other crucial aspects of personal finance. Empower yourself with knowledge and take a step towards financial stability and success. Join our community today to navigate your financial journey with confidence.

FAQs

How Do You Choose the Best Home Improvement Loan?

Assess your financial situation, compare interest rates and terms, and consider the total cost of the loan. Opt for a loan that aligns with your credit status and financial capability.

What Are the Best Alternatives to Home Improvement Loans?

Alternatives include government grants, personal savings, home equity loans, or borrowing from family and friends.

Can You Get a Home Improvement Loan with Bankruptcy?

It’s challenging but not impossible. Some lenders offer loans post-bankruptcy, but these come with higher interest rates and stricter terms.

Should I Raise My Credit Score Before Applying for a Home Improvement Loan?

Yes, improving your credit score can help you qualify for better loan terms and lower interest rates, making it a wise step before applying for a loan.