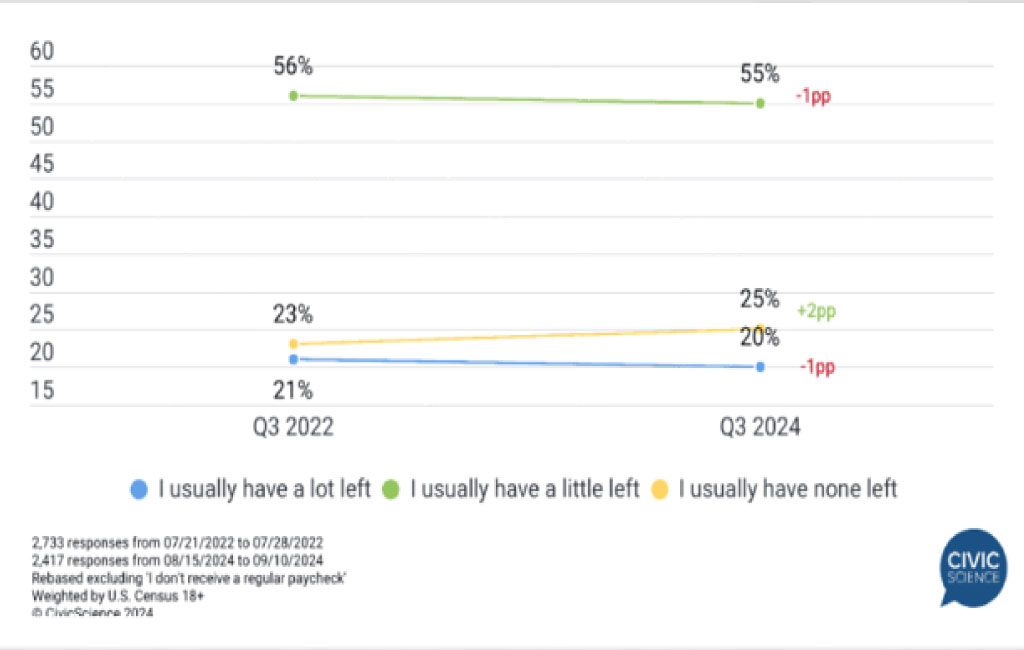

According to a 2024 CivicScience survey, around 1 in 4 adults reported not having enough money to save after covering their bills. This highlights a common struggle many people face when it comes to balancing their expenses with saving for the future.

So, with people struggling to meet their monthly expenses, how much of your paycheck should you save?

Finding the right balance between covering essential living costs and setting aside money for savings can be challenging. In this blog, we’ll explore key savings strategies, how much of your paycheck should ideally go into savings, and practical tips to help you achieve your financial goals amidst rising expenses.

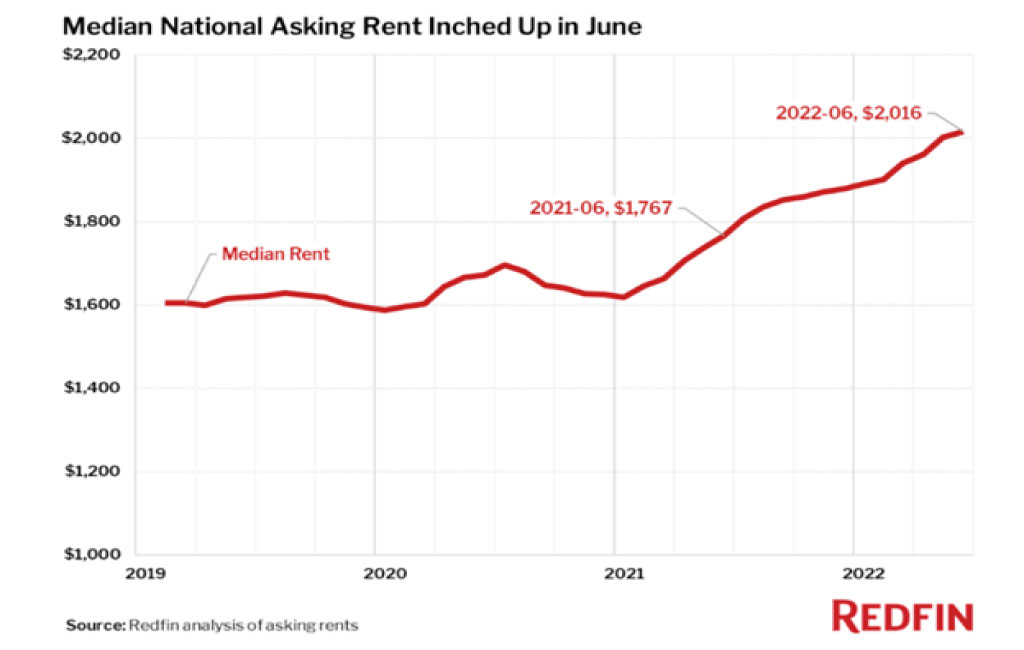

There is no denying the fact that monthly expenses have gone up. According to the latest data from Redfin, the average monthly rent in the U.S. reached $2,016 as of June 2022. This significant cost underscores the importance of effective financial planning, particularly when saving a portion of your paycheck.

Before deciding how much of your paycheck should you save, it’s essential to clarify your savings goals. Savings goals typically fall into three categories: short-term, mid-term, and long-term. Short-term goals may include saving for vacations or an emergency fund, mid-term goals could involve saving for a new car or home down payment, and long-term goals often include retirement or children’s education. Identifying these goals helps you plan accordingly and determine how much of your paycheck to allocate toward each category.

Types of Savings Goals

Setting savings goals is an essential part of managing your finances effectively. Savings goals can generally be broken down into three categories: short-term, medium-term, and long-term, each addressing different financial needs and timeframes. Understanding how much of your paycheck should you save for these goals will help you stay on track and achieve your financial objectives.

Short-term Savings Goals

Short-term savings goals are typically goals you plan to achieve within a year. These goals could include saving for a vacation, building an emergency fund, or covering seasonal expenses like holiday shopping or car repairs. Short-term goals are often more immediate and focus on smaller sums of money. When considering how much of your paycheck should you save for these goals, setting aside a portion each month can help you achieve these goals without disrupting your day-to-day finances.

Medium-term Savings Goals

Medium-term savings goals are generally set for one to five years. These could include saving for a down payment on a house, purchasing a car, or funding a wedding. Achieving medium-term goals often requires more structured saving strategies, like contributing to a high-yield savings account. When determining how much of your paycheck should you save for medium-term goals, consistency is key to ensuring you meet these larger financial objectives within the desired time frame.

Long-term Savings Goals

Long-term savings goals are focused on goals that are five or more years in the future. These typically include retirement savings, children’s education funds, or significant investments in property. Since long-term savings goals require a greater financial commitment, it’s important to assess how much of your paycheck should you save for these goals and plan accordingly. Contributing regularly to retirement accounts or other investment vehicles can ensure you meet your long-term financial needs.

How Much of Your Paycheck Should You Save? Explained

When it comes to answering the question how much of your paycheck should you save, there isn’t a one-size-fits-all approach. While the common advice suggests saving at least 20% of your income, individual circumstances vary. The ideal amount you should save depends on your financial obligations, goals, and overall income.

Assess Your Financial Situation

The first step is to review your current financial situation. Look at your income, monthly expenses, and any outstanding debts you might have. This will give you a clearer idea of how much money you can realistically set aside for savings without jeopardizing your ability to meet your immediate financial obligations. For example, you might start with a smaller savings percentage if you’re juggling high student loans or mortgage payments.

Set Your Savings Goals

Your savings goals play a critical role in determining how much of your paycheck should you save. Are you saving for short-term goals like an emergency fund or vacation, or are you focused on long-term objectives like retirement? Identifying the purpose of your savings can help you decide how much to allocate. Short-term goals may require less aggressive savings, while retirement planning might encourage you to save a higher percentage of your income.

Determine a Percentage

If you’re new to saving, start by setting aside at least 10% of your paycheck. Over time, as you adjust your spending habits and financial situation, aim to save 15% to 20% of your income. This gradual increase allows you to establish a savings routine without overwhelming your budget. As you become more comfortable with your savings habits, you can increase the percentage as your income grows.

Adjust Based on Your Income

Your income level can significantly influence how much of your paycheck should you save. Higher earners may be able to save a larger portion of their income, allowing them to meet financial goals faster. On the other hand, those with lower incomes may need to start with a smaller savings percentage, gradually increasing their contributions over time as their financial situation improves. Flexibility is key—adjust your savings strategy based on your evolving financial circumstances.

Determining Your Ideal Savings Percentage

Your ideal savings percentage depends on your financial goals, income, and current expenses. For example, if your goal is to save for retirement, experts recommend saving 15% of your income. If you’re building an emergency fund, you may need to save more aggressively in the short term. Keep in mind that the ideal percentage will evolve as your income and goals change, but consistently saving something is the key to financial success.

1. Start With Your Savings Goals

Are you saving for a short-term purchase like a vacation or a long-term goal such as retirement? Having clear goals will guide how much of your paycheck you need to set aside each month. For example, if you’re building an emergency fund, you might aim to save 10% to 15% of your income, while saving for retirement may require setting aside a higher percentage.

2. Consider Your Personal Situation

If you have significant debt, high living expenses, or dependents, you may need to adjust your savings expectations. It’s important to evaluate your financial obligations, such as rent, mortgage, student loans, or medical bills. This helps ensure you’re not saving so aggressively that you struggle to cover essential expenses.

3. Calculate Your Paycheck Savings Percentage

A good starting point is to aim for saving 15% to 20% of your income, but this percentage can be adjusted based on your needs. You can calculate your savings percentage by dividing the amount you save each month by your total monthly income, then multiplying by 100 to get the rate.

4. Customize Your Savings Strategy

Some people may prefer automatic transfers to their savings accounts, while others might find it easier to budget manually. You may also decide to increase your savings rate over time, especially as your income grows or debts are paid off. Tailoring your savings strategy ensures sustainability and aligns with your financial goals.

The 50/30/20 Rule

The 50/30/20 budgeting rule is a straightforward framework that helps individuals allocate their after-tax income into three essential categories: needs, wants, and savings. This method is popular because it offers a balanced way to manage finances without overcomplicating the process. It ensures you cover your essentials while also saving for the future and enjoying life.

50% for Needs

When answering the question, how much of your paycheck should you save, the 50/30/20 rule suggests allocating 50% of your income for essential expenses. These include housing costs, utilities, groceries, transportation, and other necessities. Ensuring these necessary expenses do not exceed half of your income is crucial, and helping maintain financial stability and balance is crucial.

30% for Wants

The next 30% of your income should go toward wants, such as entertainment, dining out, and hobbies. How much of your paycheck should you save depends on keeping a healthy balance between enjoying life and not overspending on non-essential items. Keeping this category to 30% leaves room for both responsible saving and mindful enjoyment of your money.

20% for Savings and Debt Repayment

The final 20% of your income goes toward savings or debt repayment. This is the crucial step to answering the question, how much of your paycheck should you save? This portion helps you build an emergency fund, contribute to retirement, or pay off debts faster. Ensuring at least 20% of your income goes into saving or debt reduction secures your financial future.

By applying the 50/30/20 budgeting rule, you’ll have a clear structure of your savings while still covering your basic needs and wants.

Alternative Savings Strategies

You can try other budgeting techniques if the 50/30/20 rule doesn’t suit your lifestyle. Some people prefer the 80/20 rule, where 80% of your paycheck goes toward living expenses, and 20% is saved or invested. Others use a zero-based budget, allocating every dollar of their income toward a specific purpose, including savings. Experimenting with different savings strategies will help you find the right fit for your financial goals.

The 80/20 Rule

The 80/20 rule is simple and easy to follow. It suggests you save 20% of your income and use the remaining 80% for all other expenses, including necessities and discretionary spending. This rule is great for those who want a straightforward savings plan without too much categorization. By prioritizing saving 20% upfront, you ensure that your savings goals are met while using the remaining portion for flexible spending.

The 50/15/5 Rule

The 50/15/5 rule offers a slightly different breakdown, focusing more on retirement. In this approach, you allocate 50% of your income to needs (like housing, food, and utilities), 15% to retirement savings, and 5% to emergency savings or short-term financial goals. This method emphasizes long-term financial security while ensuring your immediate needs are met. This rule provides a clearer pathway for those wondering how much of your paycheck you should save for retirement.

Zero-based Budget

A zero-based budget is a method where every dollar of your income is assigned a job, whether it’s for saving, spending, or investing. At the end of the month, your income minus expenses should equal zero. This budgeting method is highly intentional and ensures that money is accounted for. If you’re asking how much of your paycheck you should save, a zero-based budget allows you to tailor your savings to your specific financial goals and expenses, giving you more control over your money.

How to Calculate Your Savings

To calculate savings from your paycheck, multiply your net income by the percentage of income you aim to save.

For instance, if your net paycheck is $4,000 and you want to save 15%, the amount to set aside each pay period would be: $4,000 x 0.15 = $600.

Alternatively, if you have a specific dollar amount in mind, you can determine what percentage of your income that amount represents. This helps understand how your savings align with general recommendations, such as saving 20% of your income.

For example, if you’re saving $800 from a $4,000 paycheck, the calculation would be: $800 ÷ $4,000 = 0.20 0.20 x 100 = 20%.

This means you’re saving 20% of your paycheck. Using this method to calculate savings allows you to evaluate your progress toward goals and make adjustments based on your financial situation. It’s a flexible approach that helps ensure you’re working toward your long-term financial health.

Practical Tips for Saving More

Saving more money often seems challenging, but with the right strategies, it’s easier than you think. Whether saving for an emergency fund, a big purchase, or your long-term financial goals, these practical tips can help you make the most of your paycheck. Here are some money-saving tips to help you boost your savings:

Budgeting and Expense Tracking

One of the most effective ways to save more is by budgeting and tracking your expenses. Knowing exactly where your money goes each month gives you the control to adjust your spending habits. Create a monthly budget that outlines your income and all necessary expenses. Using apps or spreadsheets can help you stay organized and find areas to cut back and redirect that money toward savings.

Cutting Unnecessary Costs

Eliminating or reducing unnecessary costs is essential to boosting your savings. Review your monthly expenses and identify services or subscriptions you no longer use. Small changes like dining out less frequently or canceling unused subscriptions can lead to significant savings over time. Cutting these extra costs makes it easier to allocate more of your paycheck toward saving.

Automating Your Savings

Automating your savings ensures you consistently set aside money without thinking about it. You can set up automatic transfers from your checking account to your savings account right after payday. This strategy helps you stick to your savings goals and reduces the temptation to spend money earmarked for future needs. The best part is that you don’t have to worry about forgetting to save once it’s automated.

Start Small

If you’re just beginning your savings journey, starting small is okay. Even saving as little as 5% of your paycheck can build momentum and create a habit. Over time, as you adjust your budget or increase your income, you can gradually increase the amount you save. Starting with a manageable goal makes it easier to stay consistent and motivated.

Benefits of Cutting Unnecessary Expenses

By identifying and eliminating unnecessary expenses, you can reduce spending and allocate more of your paycheck to savings. Common areas where you can cut costs include subscription services, dining out, and impulse purchases. The key is distinguishing between wants and needs and adjusting your spending habits accordingly.

1. More Savings for Future Goals

Cutting unnecessary expenses allows you to allocate more money toward your savings. Whether you’re saving for a home, retirement, or a vacation, reducing frivolous spending helps you reach your goals faster. Every dollar saved from non-essential purchases can accumulate over time, providing a financial cushion for larger investments.

2. Reduced Financial Stress

When you cut back on non-essential purchases, you’ll notice a decrease in financial stress. Fewer expenses mean less pressure to make ends meet, helping you manage your finances more confidently. With less financial burden, you can focus on building your savings and enjoying a more comfortable lifestyle without constantly worrying about bills.

3. Increased Financial Flexibility

Eliminating unnecessary costs gives you more freedom with your finances. You’ll have extra funds for emergencies or spontaneous opportunities, improving your overall financial stability. Whether dealing with unexpected expenses or taking advantage of a unique investment opportunity, having that flexibility can be empowering.

4. Better Budget Management

When you minimize extra spending, it becomes easier to manage your budget. Staying within your budget helps you avoid debt and keeps you on track toward achieving long-term financial success. You’ll also have clearer insights into your spending patterns, making it easier to adjust your budget as your financial situation changes.

Strategies for Monitoring Your Progress

Monitoring your financial progress is essential for staying on track with your savings goals. One effective way to do this is by setting monthly or quarterly check-ins to review your savings. You can also track savings using budgeting apps or spreadsheets. These tools will give you insight into how much you’ve saved, where you’re spending, and areas for improvement.

1. Set Clear Financial Milestones

Breaking your savings goals into smaller, measurable milestones helps track progress more effectively. For example, if you’re saving for a big purchase, set monthly or quarterly targets to reach. This gives you a clear path to follow and allows you to celebrate small wins along the way, keeping you motivated.

2. Use Budgeting and Savings Apps

Technology can be your best friend when it comes to monitoring your financial progress. Apps like Mint or YNAB (You Need A Budget) allow you to track expenses, monitor your savings, and manage your financial goals in one place. These tools offer real-time updates, making spotting spending trends and adjusting your habits easier.

3. Regularly Review Your Bank Statements

Taking time each month to review your bank statements will help you assess your spending patterns and see if you’re sticking to your budget. Look for areas where you may have overspent and identify places where you can cut back. This habit ensures you’re aware of your financial standing and helps prevent overspending.

4. Adjust Your Savings Goals When Necessary

Your financial situation and goals can change over time, so flexibility is important. Regularly reassess your savings goals and adjust them as needed. If you receive a raise, you might increase your savings percentage. On the flip side, if unexpected expenses arise, you can temporarily lower your savings contribution until you’re back on track.

5. Schedule Monthly Financial Check-Ins

Set aside time each month to evaluate your financial health. This allows you to check how well you’re progressing toward your goals and make any necessary adjustments. Regular check-ins ensure you stay accountable and consistently work toward your financial objectives.

Final Words

How much of your paycheck should you save? The answer ultimately depends on your personal financial situation, goals, and lifestyle. By following recommended guidelines, such as the 50/30/20 rule, you can create a balanced approach to saving while covering your essential expenses.

Remember, starting small and increasing your savings over time is better than not saving at all. Implementing smart budgeting techniques and cutting unnecessary costs will help you grow your savings and reach your financial goals.

For more helpful financial tips and advice, check out our blog at EduCounting. We provide valuable insights on smart saving strategies, personal finance management, and building long-term wealth.