Feeling a bit overwhelmed with all that debt and not-so-awesome credit score? There’s nothing more powerful than taking action, and we have some information for you. This article is about how to get out of debt with bad credit and set you down the path of success. So, kick back, maybe brew yourself a cup of tea, and let’s dive into the world of debt-busting together!

Maybe you owe some (or a lot) money, and your credit score isn’t exactly rocking the charts. But guess what? Many people have been in this situation before you. We’ve rounded up some simple actions that anyone, yes, even if you, who may think financial stuff is like reading ancient scrolls, can follow. Getting rid of debt sometimes feels overwhelming, but it can be managed. So, get ready for a debt-free journey that’s so straightforward. And, honestly, you’ll wonder why you didn’t start sooner. Let’s tackle that debt head-on and say goodbye to the extra money stress!

What is a Bad Credit Score?

Let’s talk about bad credit scores. Your credit score is a report card telling lenders how reliable you are with borrowing and managing the money that you’re given. When your score is low, it’s tagged as bad. This label can make it tough to get the green light on loans and credit cards. It can also cost you higher interest rates, making it tougher to get a job and higher insurance.

Lenders peek at your credit score to decide if they should hand over cash to you to finance purchases. If your score falls below a certain mark, they might see you as a risky bet. So, having a bad credit score means you’re less likely to snag loan approvals or credit cards.

A bad credit score is like getting a low grade on a test. It doesn’t mean you’re a lousy person or that you can’t pull your grade up. It just means that you might need to put in a little work to tweak a few things to bump up that score. But hey, stressing about it doesn’t help! There are tried and true ways to boost your score over time.

Now, let’s break it down a bit more. Lenders use your score to help decide whether or not to lend you money. But here’s the silver lining: you can work on improving your borrowing habits. Paying bills on time, keeping balances low, and not opening too many new accounts can all give your credit score a boost. It might take time, but with patience and some smart moves, you can climb your way to a better score. So, if you’ve got a score that needs help, don’t fret—take it as a challenge to show how you can turn things around and improve it over time!

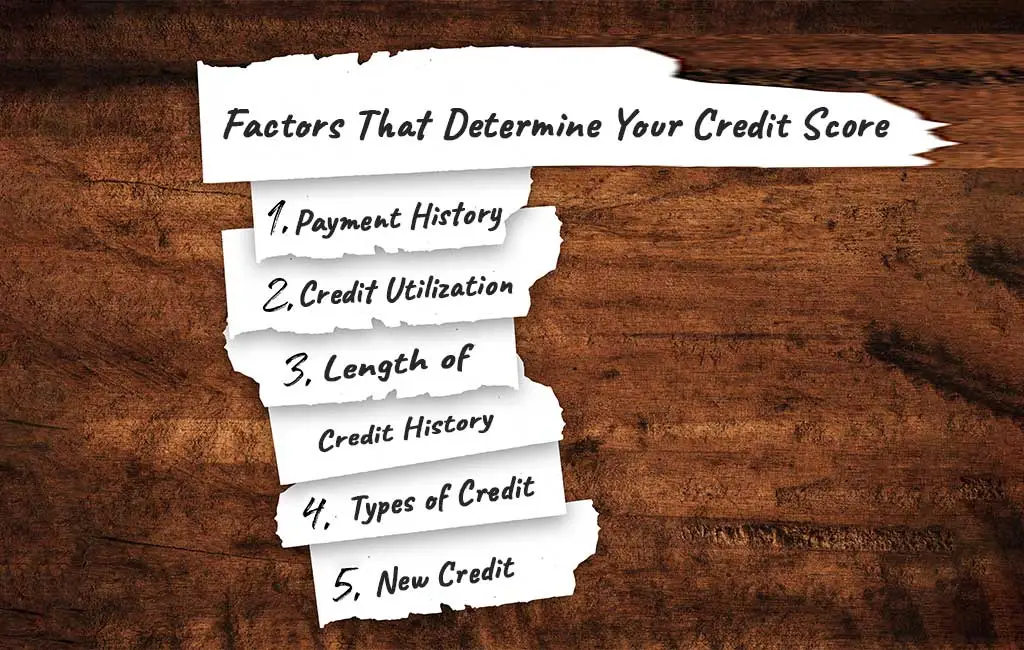

Factors That Determine Your Credit Score

Your credit score may seem like a mysterious number, but it’s not. It’s determined by a few key things. Let’s break them down:

Payment History: This is essentially a record of whether you’ve paid your bills on time. Late payments, defaults, or accounts sent to collections can significantly lower your credit score. It’s crucial to make at least the minimum payment on all your bills by their due dates to maintain a positive payment history.

Credit Utilization: This measures how much of your available credit you’re using. If you’re consistently maxing out your credit cards or using a large percentage of your credit limits, it can suggest to lenders that you’re overly reliant on credit and may be struggling financially. Aim to keep your credit utilization ratio below 30% to maintain a healthy score.

Length of Credit History: This factor considers how long you’ve had credit accounts and how active they’ve been. A longer credit history generally reflects more experience managing credit, which can be seen as a positive indicator to lenders. Even if you’re new to credit, opening an account and using it responsibly over time can help establish a positive credit history.

Types of Credit: Lenders like to see a mix of credit accounts, including revolving credit (like credit cards) and installment loans (like mortgages or auto loans). Having a diverse portfolio of credit accounts demonstrates your ability to manage different types of financial obligations.

New Credit: Opening several new credit accounts within a short period can indicate to lenders that you’re taking on additional financial obligations, which could potentially strain your ability to repay. Each time you apply for new credit, a hard inquiry is added to your credit report, which can temporarily lower your score. Be strategic about applying for new credit and only do so when necessary.

Your credit score is influenced by various factors, including your payment history, credit utilization, length of credit history, types of credit, and new credit. Understanding these factors and how they impact your score can help you make informed financial decisions and work towards improving your creditworthiness over time.

Bad Credit Debt Relief Options

Navigating through the challenges of debt with a less-than-perfect credit score can be tough, but fear not! There are practical options that could make your financial journey smoother. Remember there are professionals out there who can help. But, it’s very important to understand some of the options. So, let’s dive into some of the solutions:

1. Debt Settlement: Imagine having a heart-to-heart with your creditors to work out a deal where you pay less than the full amount you owe. That’s debt settlement for you. It can be a lifesaver if keeping up with your monthly payments feels like juggling too many balls at once.

2. Debt Consolidation: Picture this: instead of dealing with multiple debts scattered around like confetti, you combine them into one easy-to-manage monthly payment. This is debt consolidation. It’s like tidying up your financial space, and it might even score you lower interest rates.

3. Home Equity Line of Credit (HELOC): If you’re a proud homeowner, your home’s value could be your secret weapon. With a Home Equity Line of Credit (HELOC), you can tap into the equity you’ve built up over time. Just remember, your home becomes the superhero here, offering security for the line of credit. But, you must be careful not to overextend yourself as your home could be on the line.

4. Credit Card Debt Forgiveness Programs: Believe it or not, some credit card companies have a soft spot. They offer hardship programs designed to help you settle your debts for less than the full amount. Reach out to them and see if you qualify for this financial lifeline.

5. Bankruptcy: When all else seems to fail, there’s the last resort: bankruptcy. It’s like hitting the reset button on your finances. However, it’s not a decision to take lightly. Think of it as a powerful tool with consequences that stick around for at least 7 years. Before you go down this road, weigh your options seriously.

Remember, each path has its pros and cons, so choose wisely. Consider your situation, goals, and, most importantly, what you can really live with. It’s your financial journey, and with the right steps, you can find relief and pave your own path to a brighter future.

How to Improve Your Credit Score

Improving your credit score requires a little discipline and consistency. If you want to work on your own health you have to focus on the things you can do to improve yourself. Let’s dive into some simple steps you can take to make it happen!

Pay Your Bills on Time: This step is powerful and can really move your credit score. Set up automatic payments or reminders to ensure you never miss a due date. This action alone can make a big difference in your score.

Tackle High-Interest Debt First: It’s time to start by lifting the heaviest weights first, which are your debts with high-interest rates. Once you pay them off, you’ll feel lighter and more in control of your finances. Plus, pay a lot less interest!

Keep Old Accounts Open: It might seem tempting to close old accounts, but it’s like throwing away your favorite pair of jeans! Keeping them open is crucial for your credit score because it shows a longer credit history, which can boost your score. Just give them a little attention now and then to make your you get their positive impact.

Limit New Credit Inquiries: Too many credit applications lead to having too many inquiries on your credit report. Avoid applying for lots of new accounts in a short period of time because each inquiry can lower your score slightly. Be selective about when you apply for new credit to keep your score in top shape.

Regularly Check Your Credit Report: Be your own credit detective! Review your credit report regularly to make sure there aren’t any mistakes or inaccuracies. Most things that are important need a checkup (your car, your teeth, your body!!). You can get a free credit report from each of the major credit bureaus once a year, so make the most of it!

By following these simple steps, you’ll be well on your way to boosting your credit score and improving your financial future. Consistency is key. Small actions over time can lead to big improvements. So start implementing these tips today and watch your credit score soar!

Wrapping Up

Alright, so we covered a bunch of stuff just now, huh? But hey, I hope you’re feeling more confident about handling your debt, even if your credit score isn’t perfect. Just keep in mind that getting rid of debt doesn’t happen overnight. It’s gonna take some time and work, but trust me, it’s doable! If it all seems like a bit much, remember that there are experts out there like financial advisors or credit counselors who can give you a hand with figuring out how to get out of debt with bad credit. You’re not alone in this!

So, take a breather, gather your thoughts, and remember, you’ve got this. With the right game plan, you can knock out that debt. Keep at it, and don’t be afraid to ask for help if needed. You’re on your way to financial freedom!

FAQs

If you’re still scratching your head about debt and credit, no worries. Below, we’ve answered some common questions to help clear things up:

1. How can I clear my debt without paying?

Okay, let’s get real here. Clearing debt without paying? Sounds like a dream, right? Well, in reality, it’s not a thing. Some options, like debt settlement, usually involve paying at least some of what you owe. Even if it’s not the full amount, you’ll likely need to chip in something

2. Can I get a loan to clear my debts?

Ah, the ol’ debt consolidation trick! It’s like rolling all your debts into one to make them easier to manage. But here’s the deal: getting a loan for this can be a bit tricky, especially if your credit score isn’t sparkling. You might need to look into alternative lenders or think about putting up some collateral for a secured loan.

3. Can banks cancel debt?

Wouldn’t that be nice? Just imagine waking up one day to find all your debts have magically disappeared. Unfortunately, banks usually don’t do that out of the goodness of their hearts. But hey, don’t lose hope! They might be open to negotiating a settlement or offering some help if you’re struggling to pay up.

4. How do banks recover bad debts?

Uh-oh, looks like someone’s not playing by the rules! When debt goes bad, banks have a few tricks up their sleeves to get their money back. They might sell the debt to a collection agency (those guys can be pretty persistent), take you to court, or even snatch some cash straight from your paycheck (ouch!)