In the financial journey of managing and paying off debt, debt consolidation emerges as a beacon of hope for many. It’s not just about simplifying payments; it’s about reclaiming control over your financial health. But, as with any financial strategy, it’s crucial to understand how it interacts with your credit score – the numerical summary of your creditworthiness.

Debt consolidation is often used by individuals looking to manage multiple debts more effectively. By combining multiple debts into a single payment, you may find it easier to keep track of your finances and potentially secure a lower interest rate. But how does debt consolidation affect your credit? In this detailed exploration, we’ll uncover the impacts of debt consolidation on your credit score, exploring the potential benefits and drawbacks.

Does Debt Consolidation Hurt Your Credit?

Debt consolidation simplifies the management of multiple debts by combining them into a single obligation, ideally with a more favorable interest rate. This strategy can lead to significant savings and streamline the repayment process.

Individuals often find themselves juggling various forms of unsecured debt, including balances on multiple credit cards, medical bills, and even payday loans. The diversity of interest rates and payment deadlines can make this a challenging financial landscape.

The consolidation process begins with choosing an appropriate debt consolidation vehicle. Options include balance transfer credit cards, which allow individuals to consolidate multiple credit card balances onto a single card, usually with a low introductory interest rate, or consolidation loans, which provide a lump sum to pay off various debts, leaving the borrower with a single, more manageable monthly payment.

Borrowers can focus on paying down a single debt by transferring existing debts to a new product or using a consolidation loan. This simplification aids in budget management by reducing the number of payments to keep track of each month. More importantly, securing a lower interest rate through consolidation means that a greater portion of each payment is applied to the principal rather than interest, potentially accelerating the debt repayment process.

In addition to logistical ease, debt consolidation can offer psychological benefits. Reducing multiple debt obligations to a single payment can decrease financial stress and provide a clearer path to becoming debt-free. However, it’s crucial for individuals to carefully evaluate their options and consider the terms and conditions of any consolidation product to ensure it aligns with their financial goals and capabilities.

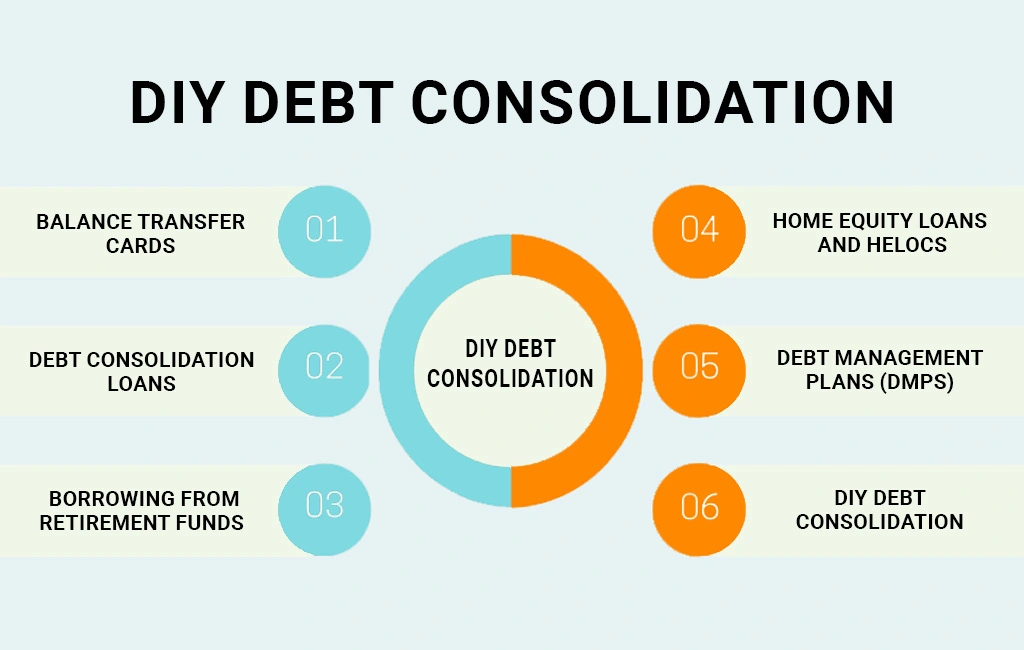

Ways to Consolidate Your Debt

Debt consolidation can be achieved through various means, each with unique implications for your credit score. Common methods include taking out a debt consolidation loan, using a balance transfer credit card, and enrolling in a debt management plan. The choice of method depends on your financial situation, the types of debt you have, and what you qualify for.

Apply for a Balance Transfer Card

Opting for a balance transfer card allows individuals to consolidate credit card debts onto a single card, ideally with a lower interest rate. This method is particularly effective if you qualify for a card offering a 0% introductory APR. Transferring balances can simplify payments and reduce the amount paid in interest, but the initial credit inquiry for the new card may cause a temporary dip in your credit score. Additionally, utilizing a high percentage of the available credit on the new card can affect your credit utilization ratio, a key factor in credit scoring.

Take Out a Debt Consolidation Loan

A debt consolidation loan is a personal loan used to pay off multiple debts, combining them into one monthly payment with a fixed interest rate. This can be advantageous for managing various types of debt, including credit cards, medical bills, and other loans. Securing a lower interest rate and setting a definitive payoff timeline can save money and potentially boost your credit score. However, the initial application will result in a hard inquiry, which may temporarily lower your score.

Borrow From Your 401(K)

Some individuals may consider borrowing from their 401(k) retirement plan to consolidate debt. This option does not impact your credit score directly since it is not reported to credit bureaus. However, it carries significant risks, including the potential loss of investment earnings and penalties if the loan is not repaid according to the plan’s terms. It’s crucial to weigh the long-term impact on your retirement savings against the immediate benefits of debt consolidation.

Tap Your Home Equity

Homeowners might explore using their home equity to consolidate debt through a home equity loan or line of credit (HELOC). These options offer lower interest rates than unsecured loans and credit cards. While tapping into home equity can reduce your monthly payments and interest costs, it also involves risks. Failure to repay the loan can lead to foreclosure. Additionally, the process involves fees and could temporarily lower your credit score due to the new debt incurred.

Other Debt Payoff Options

Exploring alternative paths to manage or eliminate debt can offer a fresh perspective beyond the standard debt consolidation approaches. These alternatives can be tailored to fit different financial situations, offering solutions that range from self-managed plans to seeking professional advice or taking decisive legal action to address overwhelming debt.

DIY Methods

Taking control of your debt through DIY methods involves creating a structured plan to pay down what you owe without external assistance. This approach often includes strategies like the debt snowball method, which focuses on paying off your smallest debts first while maintaining minimum payments on others, or the debt avalanche method, which targets debts with the highest interest rates first. These methods require discipline and a clear understanding of your financial situation but can be incredibly empowering and effective in reducing your debt.

Credit Counseling

Seeking the guidance of a credit counseling agency can provide you with a structured path to debt relief through expert advice and negotiation on your behalf. Credit counselors can work with you to understand your financial situation, offer personalized advice on budgeting and managing your debts, and may help you enroll in a debt management plan (DMP). A DMP can consolidate your debts into a single payment with a reduced interest rate, though it’s important to choose a reputable agency and understand any fees involved.

Bankruptcy

As a last resort, filing for bankruptcy can offer a way out for those facing insurmountable debt. There are two primary types of personal bankruptcy: Chapter 7, which involves liquidating assets to pay off debts, and Chapter 13, which restructures debts into a repayment plan. While bankruptcy can provide a clean slate, it’s a serious decision that has long-lasting effects on your credit score and ability to borrow in the future. It’s advisable to consult with a bankruptcy attorney to understand the implications and process involved fully.

Types of Debt Consolidation

Each debt consolidation method comes with its own set of advantages and potential drawbacks. The choice depends on individual financial situations, the types of debt involved, and personal preferences regarding management and repayment. By carefully considering these options, individuals can select the most effective strategy to achieve financial stability and work toward a debt-free future.

Balance Transfer Cards

A balance transfer card allows individuals to consolidate multiple credit card balances onto a single card, often featuring a low or 0% introductory APR. This method is ideal for those with high-interest credit card debts, offering an opportunity to pay the balance without accruing additional interest. It’s crucial, however, to be mindful of any transfer fees and plan to pay off the balance before the promotional period ends to avoid higher interest rates.

Debt Consolidation Loans

A debt consolidation loan is a personal loan designed to pay off several debts, allowing the borrower to focus on a single monthly payment. This loan can cover a variety of debts, such as credit card balances, medical bills, and other unsecured loans. The key advantage is the potential to secure a lower fixed interest rate, simplifying budget management and accelerating the debt repayment process.

Borrowing from Retirement Funds

Borrowing from a 401(k) or other retirement account presents an option to consolidate debt without directly impacting one’s credit score, as these loans are not reported to credit bureaus. However, this method carries substantial risks, including the loss of potential investment growth and penalties for non-repayment. It’s a strategy that requires careful consideration of the long-term effects on retirement savings.

Home Equity Loans and HELOCs

Homeowners may consider leveraging their home equity through a loan or a Home Equity Line of Credit (HELOC) to consolidate debt. These options typically offer lower interest rates than unsecured loans, translating into lower monthly payments. However, the stakes are high, as failing to repay can lead to foreclosure. Assessing the risks and ensuring the ability to maintain payments before tapping into home equity is essential.

Debt Management Plans (DMPs)

Debt management plans, facilitated by credit counseling agencies, offer a structured way to consolidate debts without taking out a new loan. Under a DMP, multiple debts are combined into a single monthly payment, often with negotiated lower interest rates and waived fees. This approach requires a partnership with a reputable agency and may positively impact credit scores over time by demonstrating consistent, timely payments.

DIY Debt Consolidation

For those who prefer a hands-on approach, DIY debt consolidation strategies such as the debt snowball or avalanche methods empower individuals to tackle their debts independently. These methods involve prioritizing debts based on size or interest rate and methodically paying them off. While this approach demands discipline and a solid financial plan, it can effectively reduce debt without qualifying for new credit products.

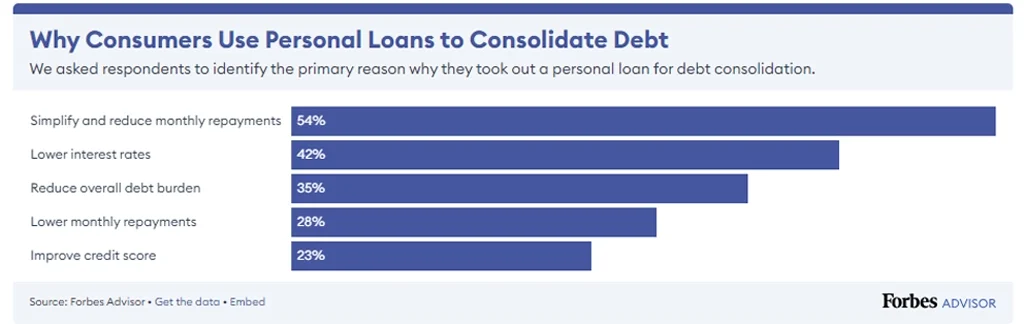

Why Consolidate Your Debts?

Debt consolidation is a strategic approach to managing multiple debts, transforming them into a single, manageable payment. It’s a powerful tool for those looking to simplify their financial life, save money on interest, and pave a clearer path to debt freedom. Below, we explore the key benefits of consolidating your debts, showcasing why it might be the right move for your financial health.

Streamlined Payments

One of the most immediate benefits of debt consolidation is simplifying your monthly payments. Instead of juggling several bills with varying due dates, you’ll have just one payment to manage. This reduces the likelihood of missed payments and eases the mental load of keeping track of multiple debts, making your financial management more straightforward and stress-free.

Lower Interest Rates

Debt consolidation often comes with the opportunity to secure lower interest rates, especially if you’re consolidating high-interest credit card debt into a lower-rate consolidation loan or balance transfer credit card. Lower interest rates mean more of your payment goes towards reducing the principal balance, saving you money in the long run and potentially reducing the total cost of your debt.

Fixed Repayment Schedule

Consolidating your debt usually means transitioning to a fixed repayment schedule. This predictability is invaluable for budgeting purposes, as it sets a clear timeline for when you’ll be debt-free. Unlike credit card debts with fluctuating payments and interest rates, a consolidated debt plan provides a structured path forward, making it easier to plan your financial future.

Credit Boost

While debt consolidation can initially impact your credit score due to credit inquiries, it may actually boost your score over time. Consistent, on-time payments contribute positively to your payment history, the largest factor in credit scoring. Additionally, reducing your credit utilization ratio by paying down revolving credit card debt can further improve your credit standing.

Faster Debt Payment

By securing a lower interest rate and consolidating payments, you may be able to pay off your debt faster than if you continued to tackle each debt individually. The savings on interest alone can enable you to allocate more funds towards the principal balance, accelerating your journey to becoming debt-free and allowing you to focus on other financial goals sooner.

Understanding the Impact: How Does Debt Consolidation Affect Credit Scores?

The impact of debt consolidation on your credit scores can vary. Initially, you might see a dip in your credit score when you apply for a new credit line due to hard inquiries. However, over time, consolidation can improve your credit score as it simplifies your payments and can reduce your credit utilization ratio, provided you don’t rack up more debt.

When Debt Consolidation May Lower Your Credit Score

Introducing new credit accounts and adjusting your credit habits can sometimes have a temporary negative impact on your credit score.

The Addition of a New Account

Opening a new account for the purpose of debt consolidation can initially lower your credit score. This is because it reduces the average age of your credit accounts, a factor that credit bureaus take into consideration when calculating scores. A younger average age of accounts can signal less credit experience, leading to a temporary dip in your score.

Higher Credit Utilization

If you consolidate your debt onto a single credit card but then continue to use other credit cards, you might end up increasing your overall credit utilization ratio. A high utilization ratio, which indicates you’re using a large portion of your available credit, can negatively impact your credit score. It’s crucial to manage and minimize credit card use after consolidation to avoid this pitfall.

Credit Inquiry

Applying for a debt consolidation loan or a new balance transfer credit card will result in a hard inquiry on your credit report. Each hard inquiry can slightly decrease your credit score. While the impact is typically minor and short-lived, multiple inquiries in a short period can accumulate and have a more significant effect.

When Debt Consolidation May Raise Your Credit Score

On the brighter side, debt consolidation has the potential to positively influence your credit score through strategic financial management. Here’s how consolidating your debts can lead to an improved credit score over time.

Lower Credit Utilization

Debt consolidation can positively impact your credit score by lowering your overall credit utilization ratio. By paying off multiple credit card balances with a consolidation loan or a single balance transfer card, you’re effectively reducing the amount of credit you’re using. A lower utilization ratio is favorable for your credit score, as it suggests you’re not overly reliant on credit.

On-Time Payments

Consolidating your debts simplifies your monthly payments, making it easier to pay on time. Consistent, on-time payments are critical for a good credit score, as payment history is the most significant factor in credit scoring models. Over time, a history of timely payments can significantly improve your credit score, reflecting your reliability as a borrower.

How to Consolidate Debt

Selecting the most appropriate debt consolidation approach requires a thorough evaluation of your financial situation, including your credit score, the nature and amount of debt you’re aiming to consolidate, as well as the interest rates and monthly obligations associated with them. This preliminary step is crucial in determining the most suitable consolidation solution tailored to your needs.

For example, if you’re looking to consolidate a sum of around $7,500 in credit card debt and you possess a strong credit history, opting for a balance transfer credit card might be your best bet. Conversely, for those with a less favorable credit history and a larger debt load, say over $12,000, leveraging home equity for a loan could offer more advantageous terms, potentially providing access to lower interest rates compared to a standard debt consolidation loan.

Before settling on any consolidation method, it’s essential to meticulously calculate the overall costs associated with your existing debts and contrast them with the projected total costs of various consolidation options. This diligent comparison ensures you don’t end up paying more in the long run and helps you pinpoint the most financially sound consolidation route.

When it comes to securing a debt consolidation loan, a credit score of 700 or above is generally required to access the best possible terms. While a lower credit score doesn’t automatically preclude you from obtaining a loan, be prepared for potentially higher interest rates which can make the loan more expensive.

Proof of income is another critical requirement for loan qualification, as lenders need assurance of your capability to repay the borrowed amount. A stable income not only demonstrates your ability to manage loan repayments but also mitigates the lender’s risk. For larger loan amounts, lenders might also request collateral to back the loan, adding an additional layer of security for the borrowing arrangement.

Best Practices for Debt Consolidation

Debt consolidation can be a smart strategy to reduce your debt burden by combining multiple debts into a single payment. However, to maximize the benefits and minimize the potential downsides, it’s crucial to approach debt consolidation with a well-thought-out plan. By adhering to a few best practices, you can streamline your debts, lower your interest rates, and set a clear path toward financial freedom.

1. Add Up All Your Debt

The first step in effective debt consolidation is to have a complete picture of your financial obligations. Compile a detailed list of all your debts, including credit card balances, personal loans, medical bills, and any other unsecured debts. Knowing the total amount you owe, interest rates, and monthly payments for each debt is crucial for assessing whether debt consolidation is the right move for you and determining the terms you’d need to improve your financial situation.

2. Look for Best Deals

Not all debt consolidation loans or balance transfer credit cards are created equal. It’s essential to shop around and compare offers from multiple lenders and credit card companies. Look for the lowest possible interest rate and favorable terms that match your financial goals. Pay close attention to fees, repayment terms, and any special conditions. Doing thorough research can help you find the best option that will save you the most money in the long run.

3. Ensure a Strong Repayment Plan

Once you’ve consolidated your debts, it’s vital to adhere to a strict repayment plan. This means making your consolidated payment on time, every time, and avoiding unnecessary expenditures that could derail your progress. Consider setting up automatic payments to ensure you never miss a due date. Staying disciplined and committed to your repayment plan is key to successfully reducing your debt through consolidation.

4. Avoid More Debt

Perhaps the most important practice to follow after consolidating your debts is to avoid accumulating new debt. It can be tempting to use your newly freed-up credit lines, but doing so will only set you back on your path to financial freedom. Instead, focus on living within your means and using cash or debit for purchases to prevent falling back into a cycle of debt. Establishing a budget and building an emergency fund can also help safeguard against the need for additional borrowing.

Debt Consolidation Alternatives

Exploring debt consolidation alternatives is essential for those seeking ways to manage debt without consolidating or for whom consolidation may not be the best option. Whether it’s due to personal preference, the nature of your debt, or your financial situation, understanding and implementing alternative strategies can be equally effective in reducing debt.

Never Go Above Your Budget

Creating and sticking to a budget is foundational in managing and reducing debt. By mapping out your income and expenses, you can identify unnecessary expenditures and allocate more funds toward debt repayment. Start by reviewing your spending habits over the past few months to establish a realistic budget that covers essentials, savings, and debt payments. Consistency in following your budget is key, as it helps reduce current debt and prevents accruing new debt by living within your means.

A budget also serves as a financial roadmap, guiding your spending decisions and prioritizing your financial goals. It can reveal opportunities to cut costs, such as dining out less or canceling unused subscriptions, freeing up additional resources to tackle your debt. Over time, adhering to a budget fosters discipline and financial awareness, essential traits for long-term financial health and stability.

Take Advantage of the Debt Avalanche Method

The debt avalanche method focuses on paying off debts with the highest interest rates first while maintaining minimum payments on other debts. This strategy can save you money over time by reducing the amount of interest you pay. Begin by listing your debts from the highest to the lowest interest rate. Allocate as much extra money as possible to the debt with the highest rate, and once it’s paid off, move on to the next highest, and so on.

The debt avalanche method is particularly effective for those motivated by long-term savings and who can stay committed to a plan that may take longer to see initial debts disappear. It requires discipline and patience but ultimately leads to significant interest savings, making it an excellent strategy for individuals with high-interest debts or large amounts of debt.

Use the Debt Snowball Method

Contrary to the avalanche method, the debt snowball method prioritizes paying off debts from smallest to largest, regardless of interest rate, while keeping up with minimum payments on other debts. This approach creates a sense of accomplishment and momentum by quickly eliminating smaller debts, which can be incredibly motivating. Start by listing your debts from smallest to largest balance, focus on paying off the smallest debt aggressively, and then roll the amount paid into the next smallest debt.

The debt snowball method is ideal for those who need quick wins to stay motivated in their debt repayment journey. It’s a strategy that not only helps in reducing debt but also improves financial habits by building the discipline of regular, consistent payments. Though it may result in paying more interest over time compared to the avalanche method, the psychological boost of clearing debts one by one can be invaluable.

Final Words

So, how does debt consolidation affect your credit?

Debt consolidation can be a double-edged sword for your credit. While it has the potential to streamline your payments and improve your credit score over time, initial impacts and missteps can lead to a decrease in your score. By carefully considering your options and managing your consolidated debt responsibly, you can navigate the path to financial health without compromising your credit.

For more insights and guidance on navigating your financial journey, especially in understanding the complexities of debt consolidation and its impact on your credit, we invite you to explore our blog at EduCounting. Our platform is dedicated to providing valuable information and resources to help you make educated decisions and achieve your financial goals.

FAQs

What are the negative effects of debt consolidation?

Debt consolidation can lead to potential negative effects such as a temporary drop in your credit score due to hard inquiries from applying for a new loan or credit card. Additionally, if not managed properly, there’s a risk of accruing more debt if you continue to use your old credit accounts without restraint.

How long does debt consolidation stay on your credit report?

Debt consolidation itself does not have a direct “expiration” on your credit report. However, the new loan or credit card used for consolidation will appear on your report and remain for up to 10 years if it’s managed positively, similar to other types of credit accounts.

How bad is debt settlement for your credit?

Debt settlement can significantly harm your credit score, as it involves paying off debt for less than the amount owed. This can be reported as a negative item on your credit report and may remain for up to seven years, signaling to future lenders that you did not fulfill your payment obligations as agreed.

Is it better to settle or consolidate debt?

Whether it’s better to settle or consolidate debt depends on your financial situation. Debt consolidation is generally a better option if you’re looking to simplify payments and reduce interest rates without damaging their credit score significantly. Debt settlement may be a last resort for those unable to meet their debt obligations, but it can have a more detrimental effect on your credit score.

Can I still use my credit card after debt consolidation?

Yes, you can still use your credit card after debt consolidation, but doing so cautiously is crucial. To avoid falling back into debt, it’s advisable to limit your use of credit cards and focus on paying down the consolidated debt. Creating and sticking to a budget can help manage your spending and prevent accruing new debt.