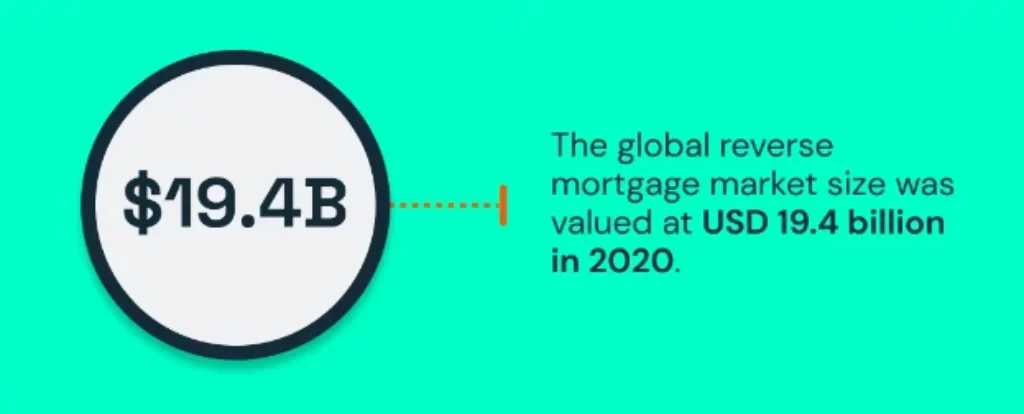

Sketching a comprehensive overview of the worldwide economic scene, the global reverse mortgage sector was valued at approximately USD 19.4 billion in 2020, offering a deep understanding. Between 2021 and 2026, this market is anticipated to expand with an approximate CAGR of 15%.

When it comes to financial solutions for retirees, reverse mortgages often emerge as a popular choice. These specialized loans can be a potential source of income for homeowners who are 62 years or older. But what is the downside to a reverse mortgage? As with any financial option, understanding its drawbacks is essential before leaping.

What Is a Reverse Mortgage?

A reverse mortgage is a unique financial instrument that allows homeowners over 62 to tap into their home equity without selling their property or making monthly mortgage payments. Instead of the homeowner paying a lender each month, in a reverse mortgage, the roles are swapped: the lender makes payments to the homeowner.

These payments can be taken in various forms, such as a lump sum, monthly installments, or even as a line of credit. The homeowner still retains the title to their home and must continue paying property taxes, homeowner’s insurance, and upkeep costs. But how does one determine which type of reverse mortgage is right for them? The answer often depends on the homeowner’s goals, home value, and current financial situation

Single-Purpose Reverse Mortgage

A single-purpose reverse mortgage is often the least expensive option among the reverse mortgage types. Still, as the name suggests, it has a catch: the funds you receive can only be used for one specific purpose, as mandated by the lender. This purpose is usually home repair or property taxes. Because of this restriction, single-purpose reverse mortgages aren’t as common as the other types.

However, they can be a good choice for homeowners who need funds for a specific need and can’t access affordable alternatives. Typically, this type of reverse mortgage is offered by government agencies (state and local) or NPOs, and its availability may vary based on location.

Proprietary Reverse Mortgage

A proprietary reverse mortgage, also known as a private reverse mortgage, is a product private institutions offer. This type of reverse mortgage is specifically designed for homeowners with higher-valued homes, as it can provide a larger loan advance than a Home Equity Conversion Mortgage (HECM). Since it’s not federally insured, a proprietary reverse mortgage can offer more flexibility regarding loan terms and costs.

However, homeowners must understand that proprietary reverse mortgages aren’t standardized like HECMs. As a result, it’s essential to carefully review and compare terms, fees, and potential benefits before committing.

Home Equity Conversion Mortgage (HECM)

This is the most popular type of reverse mortgage and is federally insured. Administered by the U.S. Department of Housing and Urban Development (HUD), HECMs allow homeowners to access a significant portion of their home equity. One significant advantage of HECMs is the freedom to use the loan proceeds for any purpose, from daily living expenses to medical bills or even travel.

Moreover, due to federal insurance, HECMs come with certain protections, like ensuring borrowers won’t owe more than the home’s value when the loan becomes due. To qualify for a HECM, homeowners must undergo a consumer counseling session to fully understand the product and its implications. This is essential in protecting senior homeowners and ensuring they make informed financial decisions.

Drawbacks of a Reverse Mortgage

What is the downside to a reverse mortgage? A reverse mortgage might sound attractive, especially for senior homeowners wanting to cash in on their home equity without selling their property. However, like all financial decisions, weighing the pros against the cons is vital. A reverse mortgage is only sometimes the best option and understanding its potential pitfalls can help homeowners make informed decisions. Let’s explore some of the drawbacks of opting for a reverse mortgage.

May Stop Property From Staying in the Family

One of the primary concerns many homeowners express regarding reverse mortgages is the potential difficulty in passing the property down to heirs. Since a reverse mortgage is a loan against your home’s equity, the loan becomes due upon the homeowner’s passing or if they move out. Heirs will be faced with the choice of repaying the loan to retain the property or selling the home to settle the debt. In many cases, if the heirs cannot repay the loan, the home might need to be sold, preventing it from staying within the family.

Could Delay Your House Move Soon

If you’re contemplating moving or downsizing in the near future, a reverse mortgage might not be the right choice. Given the upfront costs of securing a reverse mortgage, such as origination fees, mortgage insurance, and other closing costs, it might not be financially prudent if you plan to move shortly after. Additionally, if you decide to move or no longer use the home as your primary residence, the reverse mortgage would become due, potentially complicating your plans.

Might Impact SSI and Medicaid Eligibility

For seniors who are on or anticipate relying on Supplemental Security Income (SSI) or Medicaid, it’s crucial to understand that a reverse mortgage could affect eligibility. The funds received from a reverse mortgage could be counted as a resource, pushing them above the allowable limit for these assistance programs. While the reverse mortgage funds aren’t taxable or considered income, not properly managing the distributions can inadvertently jeopardize essential benefits.

Can Worsen a Bad Financial Situation

A reverse mortgage is not a fix-all solution for financial struggles. In fact, it can exacerbate financial challenges for those with poor money management skills or existing significant debts. Homeowners will still be responsible for property taxes, insurance, and maintenance expenses. Failing to meet these obligations can result in foreclosure. Additionally, if the homeowner exhausts the funds quickly without a backup plan, they may find themselves in a worse position than before.

Varies Based on the Value of Your Home

The amount you can borrow with a reverse mortgage is primarily based on the current value of your home. If your property’s value drops due to market fluctuations or other external factors, it can reduce the equity available to you. Moreover, suppose your home’s value is substantially higher than the FHA’s lending limit. In that case, you might only be able to access some of the equity in your home if you opt for a proprietary reverse mortgage, which might come with its own challenges.

Why a Reverse Mortgage Might Not Work for You

A reverse mortgage can allow senior homeowners to tap into their home’s equity without selling their property or making regular loan payments. However, while it may seem attractive, it’s only suitable for some. The type of reverse mortgage, along with individual circumstances, can determine whether this financial instrument is beneficial. Let’s delve into why each of the three main types of reverse mortgages might not be the right fit for certain homeowners.

Single-Purpose Reverse Mortgage

As its name suggests, the single-purpose reverse mortgage allows homeowners to use the funds obtained for one specific purpose, such as home repairs or property taxes. This can be restrictive for many homeowners. If you anticipate needing money for a broader range of expenses, this reverse mortgage might not work for you.

Additionally, they are typically offered by state and local government agencies or non-profit organizations, making them less widely available. Therefore, if you live in an area where single-purpose reverse mortgages aren’t offered or if you require funds for diverse needs, this option might not be feasible.

Proprietary Reverse Mortgage

Proprietary reverse mortgages are private loans, and as such, they aren’t standardized. This can result in significant variations in terms and conditions offered by different lenders. You might benefit from a larger loan amount if you have a high-valued home, but these loans can sometimes come with higher fees and interest rates.

Moreover, because they’re not federally insured, there’s a higher risk involved for the homeowner. If the company offering the proprietary reverse mortgage faces financial challenges or goes out of business, it could lead to complications or potential losses for the homeowner. Hence, if you’re uncomfortable with non-standardized terms and the lack of federal insurance, there may be better choices than a proprietary reverse mortgage.

Home Equity Conversion Mortgage (HECM)

The HECM is the most common type of reverse mortgage and is federally insured. However, it comes with its own set of considerations. Firstly, there are upfront costs such as mortgage insurance premiums, origination fees, and other closing costs. If you plan on moving or selling your home in the near future, these costs outweigh the benefits.

Additionally, to qualify for a HECM, homeowners must participate in a consumer counseling session, which some might find tedious or unnecessary. Another consideration is the loan limit set by the Federal Housing Administration (FHA). If your home’s value significantly exceeds the FHA’s lending limit, you might not be able to access all of your home’s equity with an HECM. Therefore, if any of these conditions or requirements feel restrictive or unsuitable for your situation, an HECM might not work for you.

Alternatives to a Reverse Mortgage

Tapping into home equity is an attractive option for many homeowners, especially those nearing retirement. While reverse mortgages are popular for seniors wanting to use their home equity without selling, they’re not the only avenue available. Let’s compare reverse mortgages with three prominent equity-accessing strategies: home equity loans, HELOCs, and cash-out refinances.

Reverse Mortgage vs. Home Equity Loan

A home equity loan, commonly called a second mortgage, allows homeowners to borrow a lump sum based on their home’s equity, repaid in fixed monthly installments. Unlike a reverse mortgage, which necessitates no monthly payments and is repaid when the homeowner moves or passes away, a home equity loan requires regular repayments.

Offering fixed interest rates, it’s best suited for those needing a substantial amount upfront for specific purposes and who are prepared for consistent monthly payments.

Reverse Mortgage vs. HELOC

The Home Equity Line of Credit (HELOC) is a more flexible alternative to reverse mortgages. Instead of getting a fixed lump sum, homeowners are given a credit line based on their equity, which they can draw upon as needed. This flexibility makes HELOCs ideal for those with variable expenses.

However, unlike the no-payment feature of reverse mortgages, HELOCs often come with variable interest rates, and after an initial draw period, regular repayments become mandatory. It’s perfect for homeowners desiring flexibility and being prepared to handle potential rate fluctuations.

Reverse Mortgage vs. Cash-Out Refinance

A cash-out refinance is a two-in-one option: homeowners replace their current mortgage with a new, larger one and then take the difference in cash. Unlike age-restricted reverse mortgages, cash-out refinances are available to a broader demographic. This method can be advantageous if mortgage interest rates are lower than the homeowner’s.

However, it’s worth noting that cash-out refinances demand monthly repayments akin to home equity loans. This is an excellent choice for those who can benefit from a refinance and need immediate cash.

What Happens to a Reverse Mortgage When You Die?

When a homeowner with a reverse mortgage passes away, the loan terms dictate that the outstanding amount is immediately due. This often places heirs, including spouses or other close family members not originally part of the mortgage agreement, in a challenging position. They are required to settle the debt if they wish to retain the property.

When the heirs decide to put the house on the market, the sale proceeds are primarily allocated to settling the reverse mortgage balance. This becomes particularly crucial if the home’s value has appreciated or remained stable, ensuring the loan is paid off without additional financial burdens.

However, complications arise when the property’s current market value falls short of the outstanding loan amount. In such scenarios, heirs have a slightly lenient option. Instead of paying the entire loan amount, they can resolve the debt by remitting at least 95% of the property’s assessed value, offering a slight relief during an already taxing period.

Final Words

Navigating the intricacies of the financial world, especially with products like reverse mortgages, necessitates thorough understanding and caution. “What is the downside to a reverse mortgage?” This is a crucial question that many individuals approaching retirement may be pondering. A reverse mortgage may be a tantalizing prospect for many, especially those nearing retirement. It promises to tap into home equity without selling the property, a lifeline for many seniors.

However, every silver lining has its own cloud. There are potential drawbacks, from the possibility of heirs losing the family home to the impacts on one’s financial state and government benefits. So, before you dive headfirst into a financial commitment like a reverse mortgage, equip yourself with the knowledge, understand the potential pitfalls and ensure that every financial step you take is confident.

FAQs

Is a Reverse Mortgage a Scam?

No, a reverse mortgage is not inherently a scam. It’s a legitimate financial product offered by various lenders to help senior homeowners tap into their home’s equity without selling the property. However, some unscrupulous individuals or entities may attempt to mislead or exploit consumers like any financial product. It’s essential to conduct thorough research, consult with trusted financial advisors, and work with reputable lenders to avoid potential pitfalls.

What Are Alternatives to a Reverse Mortgage?

There are several alternatives to reverse mortgages for homeowners looking to access their home equity. These include home equity loans, which offer a lump-sum amount and require regular monthly repayments; Home Equity Lines of Credit (HELOCs), which provide flexible credit lines drawn upon as needed; and cash-out refinances, where homeowners replace their existing mortgage with a new, larger one, pocketing the difference in cash. Each option has its own advantages and considerations depending on individual needs and circumstances.

Can a Borrower Cancel a Reverse Mortgage?

Yes, a borrower can cancel a reverse mortgage. There is a “right of rescission” period, typically three days after the loan closes, during which a borrower can change their mind and cancel the transaction without penalty. However, once this period passes, canceling the reverse mortgage would require the borrower to repay the loan, which might entail selling the home or refinancing to a conventional mortgage.

Why Do Reverse Mortgages Have a Bad Reputation?

Reverse mortgages have faced criticism and skepticism for several reasons. Some believe the product is confusing or think it takes advantage of senior citizens. High fees, upfront costs, and the potential for heirs to lose the family home can also contribute to its negative perception. Furthermore, past incidents of misleading advertising and aggressive sales tactics by certain lenders have cast a shadow over the industry. It’s crucial to understand that, while there are risks, reverse mortgages can benefit the right individual when approached with knowledge and caution.

Does Having a Reverse Mortgage Hurt My Credit?

Having a reverse mortgage does not directly affect your credit score, as there are no monthly payments to be missed that would typically impact credit. However, keeping up with other housing-related expenses, like property taxes and homeowner’s insurance, is crucial. Failure to pay these can lead to default on the reverse mortgage, which could negatively affect your credit.