Navigating the financial landscape can be challenging, especially when you need funds for various reasons. What is a benefit of obtaining a personal loan? This question is particularly relevant for those seeking financial flexibility. Personal loans offer a versatile solution to various financial needs, providing various benefits that cater to different financial situations. In this article, we’ll explore the advantages of personal loans and how they can be a strategic tool in your financial toolkit.

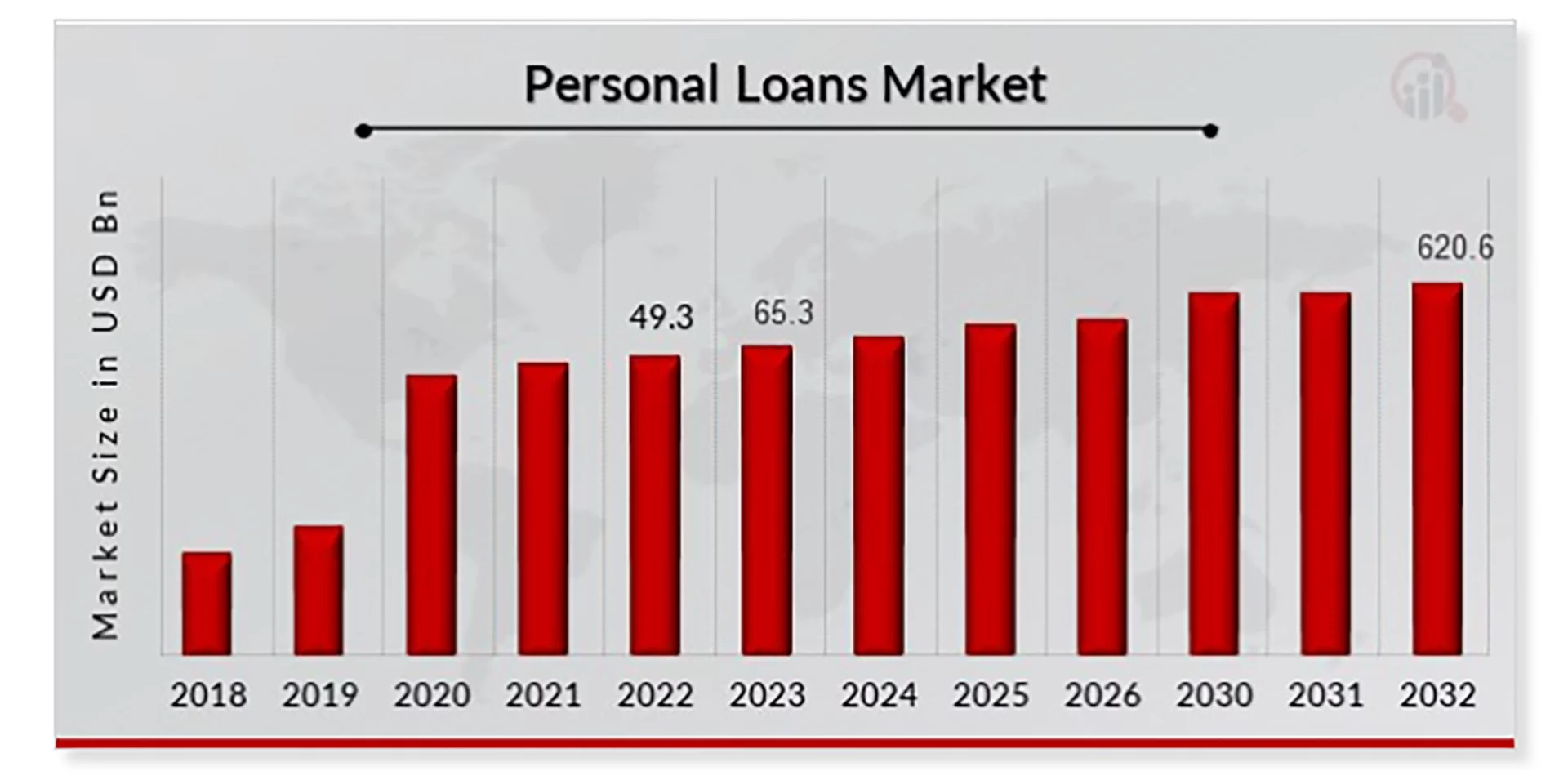

In 2022, the market was valued at a substantial USD 49.3 billion. It’s projected to expand dramatically to an impressive USD 620.6 billion by 2032. This remarkable growth trajectory, featuring a Compound Annual Growth Rate (CAGR) of 32.5% from 2023 to 2032, underscores personal loans’ increasing relevance and popularity in modern financial planning.

The 7 Benefits of Personal Loans

Personal loans have become a popular financial tool for individuals seeking funds for various purposes. Their growing popularity is due to several inherent benefits that cater to diverse financial needs. Personal loans offer various advantages, whether for consolidating debt, funding a dream vacation, or covering unexpected expenses.

1. Flexible Use

One of the most significant advantages of personal loans is their flexibility. Unlike specialized loans such as auto loans or mortgages, personal loans allow you to use the funds for any purpose. This flexibility is particularly beneficial when you face unforeseen expenses or need funds for multiple purposes simultaneously. For instance, you could use a personal loan to cover medical bills, home renovations, and a family holiday, all with a single loan.

Moreover, this versatility allows borrowers to consolidate their debts into one manageable loan. Combining multiple debts (like credit card balances and other high-interest loans) into a single personal loan allows you to streamline your finances, often at a lower interest rate, making it easier to manage and pay off your debt.

2. Fast Funding

Personal loans are known for their quick processing and funding times. Lenders often offer an expedited approval process, allowing you to receive the funds much faster than other types of loans. This rapid access to funds is crucial in emergencies or when time-sensitive opportunities arise, such as a limited-time business investment or a special sale on a significant purchase.

The speed of funding with personal loans is also a lifesaver in situations where waiting for a loan approval could mean missing out. Whether it’s a medical emergency or a last-minute travel plan, getting funds quickly makes personal loans an attractive option for many.

3. Easy Application Process

Applying for a personal loan is typically a straightforward and hassle-free process. Most lenders now offer online applications, which means you can apply from the comfort of your home without the need to visit a bank or fill out extensive paperwork. This convenience is a significant plus for busy individuals or those who prefer managing their finances digitally.

Additionally, the requirements for a personal loan are often less stringent than other types of loans. While lenders will still evaluate your creditworthiness, the process is generally less invasive, with quicker verification and approval times. This ease of application makes personal loans accessible to a wider range of borrowers, including those who may not have perfect credit.

4. They Can Help Build Your Credit Score

Personal loans can be instrumental in building or improving your credit score. Taking out a personal loan and making timely repayments demonstrates to credit bureaus that you are a responsible borrower. Consistent, on-time payments are reported to the credit bureaus, positively impacting your credit history and potentially increasing your credit score.

Moreover, a personal loan can diversify your credit mix, which is a factor in determining your credit score. Having a mix of different types of credit (like revolving credit and installment loans) can positively affect your credit score, as it shows you can manage multiple types of credit responsibly.

5. Better Than a Credit Card

For many borrowers, personal loans can be more advantageous than credit cards. One of the main reasons is that personal loans typically come with lower interest rates than credit cards, especially for borrowers with good credit. This can result in significant savings over the life of the loan, especially for larger amounts borrowed.

Personal loans also offer a structured repayment plan. Unlike credit cards, which can tempt you to make minimum payments and prolong your debt, personal loans have a fixed repayment schedule with a set end date. This structure can help you stay disciplined with your payments and predictably clear your debt.

6. Flexible Repayment Terms

Personal loans offer flexibility not only in their use but also in their repayment terms. Lenders typically provide a range of repayment options, from short-term loans of a few months to longer terms extending over several years. This flexibility allows you to choose a repayment plan that fits your financial situation and budget.

Selecting the term of your loan gives you control over your monthly payments. A longer repayment term can mean lower monthly payments, which can be easier on your budget. Conversely, a shorter term will mean higher monthly payments but can save you money on interest over the life of the loan.

7. Typically No Collateral Required

Most personal loans are unsecured, meaning they do not require collateral like a car or a house. This is a significant advantage for borrowers who may need more substantial assets for security. The absence of collateral also simplifies the application process, as evaluating and appraising an asset is unnecessary.

However, it’s important to note that because unsecured loans are riskier for lenders, they might come with higher interest rates than secured loans. Nonetheless, for many borrowers, the convenience and accessibility of unsecured personal loans outweigh the potential for higher costs.

How to Decide if a Personal Loan is Right for You

Deciding whether a personal loan is the right choice involves thoroughly evaluating various factors, including loan types, interest rates and terms, loan amounts, fees, customer satisfaction, and the lender’s reputation.

Types of Loans Offered

Consider the types lenders offer when evaluating if a personal loan is right for you. Some loans are tailored for specific uses like debt consolidation or home improvements, while others are more general. Ensure the loan type aligns with your purpose, as this can impact the terms and suitability of the loan for your specific needs.

Interest Rate and Terms

Interest rates are a critical factor. They vary widely based on your credit history and the loan terms. Look for the most competitive rate and decide between a fixed rate that offers repayment stability or a variable rate that might be lower initially but can fluctuate. Also, consider the loan term length, as it impacts your monthly payments and total interest cost.

Loan Amounts Available

Assess the loan amounts offered by lenders. Choosing a lender that can provide the specific amount you need is crucial. Borrowing more than necessary can lead to unnecessary debt, while too little might not sufficiently cover your needs. Also, consider how the loan amount will affect your debt-to-income ratio.

Fees

Investigate any additional fees associated with the loan, such as origination fees, prepayment penalties, or late payment fees. These can add to the cost of the loan significantly. Choose a loan with minimal fees to keep the overall cost down, ensuring it fits within your budget.

Customer Satisfaction

Customer satisfaction is a good indicator of the lender’s service quality. Look at reviews and testimonials to gauge previous borrowers’ experiences. High satisfaction rates often reflect good customer support, transparent policies, and a smooth application process.

Reputation of Lender

Finally, the lender’s reputation is paramount. A solid reputation lender will likely offer fair terms and ethical treatment. Research the lender’s history, regulatory compliance, and standing in the financial community to ensure you’re dealing with a reputable and trustworthy institution.

How to Choose the Best Personal Loan

Selecting the right type of loan is vital as it directly impacts the terms and suitability for your specific requirements. For instance, a loan designed for home renovation might offer different terms than a general-purpose loan. It’s also essential to consider the interest rates and terms. Interest rates vary based on your credit history and the loan terms.

You need to decide between a fixed rate, which offers repayment stability, and a variable rate, which may start lower but can fluctuate over time. Additionally, the length of the loan term is a significant factor, as it affects both your monthly payments and the total interest you’ll pay over the life of the loan.

When selecting the best personal loan, also consider the loan amounts, fees, customer satisfaction, and the lender’s reputation. The loan amount should align with your actual needs, avoiding the temptation to borrow more than necessary while ensuring it covers your requirements. Excessive borrowing can lead to financial strain, whereas insufficient funds won’t solve your financial objectives.

Assess any additional fees associated with the loan, such as origination fees, prepayment penalties, or late payment fees, as these can significantly increase the overall cost. A loan with minimal fees is often the most cost-effective choice. Customer satisfaction and lender reputation are equally important. Look for lenders with high customer satisfaction rates, indicating quality service, transparency, and a smooth application process.

Lastly, the lender’s reputation is paramount. Choose a lender with a strong standing in the financial community, known for fair terms and ethical treatment. Researching the lender’s history and regulatory compliance can ensure you make a well-informed and secure financial decision.

Alternatives to Personal Loans

Alternatives to personal loans include credit cards, home equity loans, and borrowing from friends or family. Each option has pros and cons, and the right choice depends on your financial situation and needs.

Credit Cards

Credit cards are a widely used alternative to personal loans, particularly for smaller expenses or as a revolving line of credit. They offer the convenience of immediate access to funds and can be ideal for short-term financing needs. Credit cards often come with rewards and benefits, such as cashback or travel points, which can be an added advantage.

However, they typically have higher interest rates than personal loans, especially when balances are carried monthly. It’s crucial to manage credit card usage wisely to avoid accumulating high-interest debt, making them a suitable option for those who can pay off their balance in full each month or need a flexible spending mechanism.

Home Equity Loans

Home equity loans are a significant alternative, especially for homeowners. They allow you to borrow against the equity in your home. These loans often come with lower interest rates than personal loans or credit cards, making them a cost-effective option for larger expenses. The loan amount is usually higher, depending on the equity in the home.

However, it’s important to note that your home serves as collateral, which means there’s a risk of foreclosure if you fail to repay the loan. Home equity loans are best for those who need substantial funds for major expenses like home renovations or debt consolidation and are comfortable with the associated risks.

Overdraft

An overdraft facility with your bank is another option. It allows you to spend more money than you have in your account up to a certain limit, providing a cushion for short-term cash flow shortfalls. Overdrafts can be useful for covering unexpected expenses without needing a formal loan application. The main advantage of an overdraft is its flexibility; you only borrow what you need now, and interest is typically charged on the overdrawn amount only.

However, overdraft fees and interest rates can be high, and it’s not a viable long-term borrowing solution. This option is best suited for those with a temporary need for extra funds and who can quickly return to a positive balance.

Borrowing From Friends and Family

Borrowing from friends and family is a more informal alternative to personal loans. This option can be attractive due to potentially lower (or no) interest rates and more flexible repayment terms. It can also be quicker and less bureaucratic than dealing with financial institutions.

However, borrowing from those close to you is risky, especially around relationships. It’s important to treat it as seriously as a bank loan, with clear communication and a formal agreement outlining the terms and repayment plan. This method is best for those with a strong, trustworthy relationship with the lender and confidence to repay the loan without causing tension.

Final Words

Personal loans are a powerful financial tool when utilized judiciously. They encapsulate the essence of what is a benefit of obtaining a personal loan by offering unparalleled flexibility, convenience, and the potential to influence your credit score positively. Before venturing into a personal loan, assessing your financial needs thoroughly, carefully scrutinizing the loan’s terms, and realistically evaluating your repayment capacity is crucial. When your financial needs align with the attributes of a personal loan, it becomes a wise and strategic financial decision, capable of enhancing your financial health and meeting your specific monetary goals.

As you navigate the world of personal finance, staying informed and updated is key. At EduCounting, we offer you a treasure trove of valuable information, offering expert advice, the latest trends, and practical strategies to help you manage your finances effectively. Whether you’re exploring loan options, seeking investment advice, or simply looking to improve your financial literacy, EduCounting is your go-to resource.

FAQs

How Much Can I Borrow With a Personal Loan?

The borrowing limit for a personal loan largely depends on the lender’s policies and your financial standing. Generally, personal loan amounts can start as low as a few thousand dollars and go up to $50,000 or more, with some lenders offering up to $100,000. Key factors such as your income, credit score, and debt-to-income ratio are crucial in determining how much you can borrow. This range ensures that personal loans can cater to a wide variety of financial needs, from minor expenses to substantial investments.

What Happens if You Pay Off a Personal Loan Early?

Paying off a personal loan early can lead to potential savings on interest, but it’s important to check if your loan includes prepayment penalties. Some lenders charge these fees to compensate for the interest they lose when a loan is paid off before the end of its term.

How Much Will a Loan Inquiry Drop My Credit Score?

A loan inquiry, also known as a hard credit check, can temporarily lower your credit score by a few points. However, this impact is generally small and short-lived, with your score typically rebounding within a few months if no new credit obligations are undertaken. Based on information from myFICO, credit scores are affected by hard inquiries only if they have occurred within the past 12 months. In most cases, the influence of one hard inquiry is usually less than five points.

Why Would Someone Use a Personal Loan?

Individuals might use a personal loan for various reasons, such as consolidating high-interest debt, financing large purchases or home improvements, covering unexpected expenses, or funding major life events. Personal loans offer the flexibility to use funds for diverse needs, often with lower interest rates than credit cards.