When it comes to personal finance definition, it is to say personal finance is using your financial resources to reach your goals. It involves creating a budget, managing money, and making smart investments. It encompasses everything from saving for retirement to paying off debt and protecting yourself with insurance.

Understanding personal finance definition and the value of it is necessary because it helps you understand how to manage your finances and make sound decisions about spending and investing. Having a good grasp of personal finance is important because it can help you prepare for the future and protect your financial health.

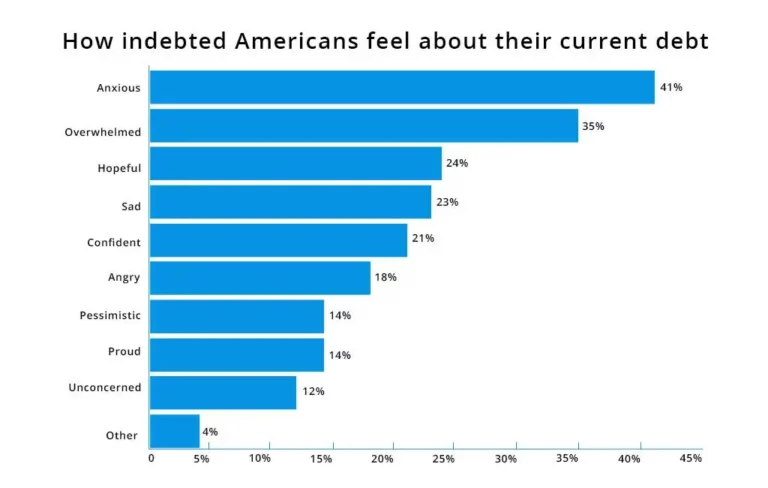

A recent survey shows 41% of US citizens are anxious about their finances. To help alleviate this anxiety and empower people to take control of their finances, it’s essential to understand the basics of personal finance definition.

What is the Personal Finance Definition & Why is It Important?

Personal finance definition may vary, but generally, it’s the ability to control your money and make decisions to help you reach your financial goals. It also involves understanding credit and debt, as well as insurance policies.

Personal finance is about smart decisions and strategizing your short-term and long-term money. Comprehensive personal finance should cover every aspect of handling finances, including goal-setting and risk analysis.

The key skill set in personal finance boils down to gathering information from multiple sources and making an educated guess – backed by data – as you navigate life’s financial challenges! From saving up for a rainy day fund, managing credit debt effectively, or investing with confidence – becoming knowledgeable on how best to manage your wealth will serve you over time, no matter what changes may come.

Personal finance is about making smart decisions with your money, no matter what life throws at you. An effective personal finance program should be data-driven and cover critical topics such as budgeting strategies, risk levels for different investments, and creating a financial cushion in uncertain circumstances – all tailored to the needs of its audience.

Staying on top of your finances means being aware that things can change quickly and taking precautions to protect yourself financially so you’re always ready for whatever comes next.

What are the Types of Personal Finance?

Different types of personal finance include:

Banking

Managing your bank account and investment options, including loans and mortgages. The fundamental banking terms to be familiar with are deposits and withdrawals, interest rates, and loan types.

Investing

Using your money to buy assets, such as stocks or mutual funds, can increase in value over time. Understanding the risk levels of different investments is essential to make informed decisions.

Insurance

Protecting yourself and your family with an insurance plan is essential. It would be best if you understood the different types of coverage available, such as life, health, and car insurance.

Taxation

Understanding taxation can help you to save money and reduce your tax liability. It’s also important to understand the different types of deductions and credits available.

Debt Management

Making sound decisions on how to manage debt is essential for financial health. Knowing the different types of debts, such as credit cards and student loans, and the best strategies for paying off debt is key.

Budgeting

Developing a budget is important to track your income, different types of expenses, and savings goals. Creating a budget can provide clarity on how to reach financial goals.

Examples of Personal Finance in Everyday Life

A strong handle on personal finances is the key to financial freedom – a life lived according to your goals and standards, not anyone else’s. Investing in yourself now can help pave the way for a secure future!

According to the personal finance definition, it is about more than just banking and investing. It’s about making smart decisions with your money to reach your financial goals.

While it may sound intimidating, personal finance examples are everywhere. Here are some examples of personal finance in everyday life:

- Retirement planning

- Setting up a budget

- Creating an emergency fund

- Paying off debt

- Building credit

- Making investments

- Managing taxes

- Purchasing insurance

What are the Five Aspects of Personal Finance?

In the role of personal finance definition, understanding the five core components of personal finance is essential for successful financial planning. These basic building blocks include creating and maintaining a steady stream of income, controlling spending and establishing sensible budgeting practices, setting aside money in savings accounts to prepare for future expenses or emergencies, investing wisely with an eye towards long-term growth potentials, as well as protecting your financial investments through insurance and other risk management solutions.

Income

Income, of course, is the backbone of any personal finance plan. It is important to create a balance between income and expenses to ensure that you can live comfortably within your means while still setting aside money for future goals and investments.

Expenses

It is important to track your expenses, as they can quickly add up over time. Develop a budget that will help ensure you save money for future goals and limit spending on items that are not essential.

Savings

Setting aside a portion of your income in savings accounts ensures you have money for unexpected expenses or emergencies. Having at least six months worth of living expenses is essential in savings.

Investing

Investing is a key component of any sound personal finance plan. Investing offers the potential to earn returns over time through various investments, such as stocks, bonds, mutual funds, and real estate.

Insurance

Insurance is an essential element of personal finance, as it protects in the event of unexpected occurrences. Property or life insurance can be valuable if something happens to you or your family.

Why is Personal Finance Education Important?

Personal financial planning education is essential to understanding the basics of money management skill. It helps you gain financial knowledge and provides the tools you need to make informed decisions about your money. It can also help build a solid foundation for reaching goals and planning for a secure future. Personal finance definition and basic personal finance principles teach you how to save, budget, invest, use credit wisely, and more. With this knowledge, you can make informed decisions throughout life.

From understanding cash flow to learning how to invest, personal financial planning education can provide the guidance needed to make educated decisions about the money. Financial education can help you manage your financial life and reach your goals. Consider working with a financial planner to develop strategies to help you succeed. With the proper education, you can better understand money management and create a plan for success.

Taking Control over the Cost of Living

In the context of personal finance definition, personal finance education is becoming increasingly important as the cost of living rises. In today’s world, it is essential to understand basic financial principles to secure a strong financial future. Education empowers people by providing them with access to the knowledge and tools they need to make sound financial decisions.

Setting Financial Goals

Knowing how to manage your money is critical for setting and achieving financial goals. With the right education, you can learn how to create a budget, plan for retirement, and build an emergency savings fund. Education helps you understand the opportunities available to reach your desired outcomes.

Understanding Investment Options

Investing money can be a great way to earn returns on your savings, but there is an element of risk associated with it. In order to learn the personal finance definition you must use personal finance education. Personal finance education helps you understand the different types of investments and how they work so that you can make informed decisions about where to put your money.

Managing Cash Flow

Cash flow management is one of the most important aspects of personal finance. It involves understanding sources of income, monthly expenses, and how to plan for unexpected costs. Education helps you learn how to budget and create a plan that ensures enough money is available each month to cover all your necessary costs.

Building Wealth

Personal finance education can help you build wealth over time. It teaches you the basics of budgeting, saving, and investing to give you the tools necessary to grow your money healthily and sustainably. With this knowledge, you can create strategies to reach long-term financial goals.

These are just some of the reasons why personal finance education is important. A solid financial foundation is essential for achieving your goals and building a secure future. With the proper knowledge and resources, you can gain control of your finances and create a plan that works best for you.

What are the Basic Personal Finance Tips? Personal Finance Explained

There’s no better way to gain control of your financial future than by having a good foundation in the basics. For more than two decades, the Jump$tart Coalition for Financial Literacy has been advocating for an understanding of these essential personal finance principles – from budgeting and saving to investments and credit management – so that people can make informed decisions about their money throughout life. The 12 proven steps are there as a guide along this journey!

1. Know your net income

Understanding your net income after all expenses, taxes, and deductions is crucial. Knowing how much you take home will help you plan a budget and set realistic savings goals. Your expenses should not exceed your income.

2. Pay yourself first

Before you pay your bills each month, be sure to set aside some money for surprises that come up and any long-term dreams or goals. Planning financially can help make those milestones a reality!

3. Start saving now

Saving regularly is important for long-term financial security. Establish a savings goal and take steps towards reaching it, such as setting up automated transfers or contributing to an employer-sponsored retirement plan.

4. Compare interest rates

Understanding the different interest rates and how they affect your finances is essential. Compare interest rates for savings accounts, mortgages, investments, and credit cards to get the best rate for your money.

5. Consider the “Rule of 72”

This basic math formula helps you calculate how long money costs to double in value. Divide 72 by the interest rate, then multiply it by the years you plan to invest your money.

6. Cut your coat according to your cloth

Good credit is important for your financial future. Make sure you borrow only what you can comfortably afford to repay, and never take out more than you need.

7. Budget wisely

Creating a budget is essential for financial success. Please keep track of all expenses and adjust your spending plan to ensure your money goes where it needs to go.

8. Higher returns come with higher financial risks

Be aware that investments with higher returns usually carry more risk. Have a good understanding of the associated costs and risks before investing your money.

9. Never go for a free lunch

Regarding investments, there is no such thing as a free lunch. Take the time to understand the costs and risks of any investment before putting your money into it.

10. Plan your financial future

Planning for retirement is important as it can help you reach your financial goals. Start planning early and work with a financial planner to develop strategies to help you succeed.

11. Your credit history determines your credit future

Your credit score reflects your financial past and is used to determine your future credit success. Be mindful of how you manage your money, as it can impact your ability to obtain financing.

12. Buy insurance to protect yourself

Insurance is essential for protecting your finances in the event of an unexpected occurrence. Consider property and life insurance to cover potential risks.

Final Words

Through the explanation of the personal finance definition, we hope this article has provided a better understanding of personal finance and why it is important. With the right knowledge, you can become more financially independent and secure. Take the time to learn about money management and develop a plan that best suits your needs. Your financial future depends on it!

At EduCounting, we are committed to helping everyone handle their finances better! We make complicated financial topics easily digestible so that anyone can gain the knowledge and skills needed for wise money decisions. Join us today as we take you through our comprehensive journey into budgeting bliss!