In the United States, the mortgage landscape is a significant part of consumer finance, with a staggering $12.01 trillion owed across 83.6 million mortgages. This averages to about $143,674 per individual holding a mortgage, as reflected in their credit reports. Notably, mortgages comprise a substantial 70.4% of consumer debt in the US, highlighting their pivotal role in the financial lives of many Americans.

Deciding whether or not to pay off your mortgage early is a significant financial decision. For many homeowners, their mortgage is the largest debt they will ever take on, and navigating the intricacies of mortgage management is crucial. In this comprehensive guide, we delve into the various aspects of this decision, focusing on the central question: Should you pay off your mortgage early?

Understanding Early Mortgage Payoff

Paying off a mortgage early means making additional payments toward the principal balance, reducing the loan term and the total interest paid. This can be achieved through various methods, including making extra payments, refinancing to a shorter-term loan, or switching to a bi-weekly payment schedule.

Understanding early mortgage payoff involves paying more than your scheduled monthly payments. It’s a strategic approach to debt management that can have significant long-term financial implications.

When you make additional payments towards your mortgage’s principal, you shorten the duration of the loan and decrease the total amount of interest you will pay over the life of the loan. This accelerated payment method can lead to substantial savings, especially in the case of long-term loans like the typical 30-year mortgage, where interest can accumulate significantly over decades.

Evaluating Financial Readiness

Evaluating financial readiness for early mortgage payoff requires a comprehensive look at your overall financial health beyond just the ability to make extra payments. It’s important to assess your entire financial picture, including emergency savings, other debts, retirement planning, and your income stability. A key factor in this assessment is ensuring a robust emergency fund, typically recommended to cover three to six months of living expenses. This fund acts as a safety net, protecting you from unexpected financial challenges like job loss or medical emergencies without relying on high-interest debt options.

Another crucial aspect to consider is your debt profile. High-interest debts, such as credit card balances or personal loans, should ideally be prioritized for payoff before focusing on mortgage prepayment. These debts often come with higher interest rates than a mortgage, hindering your overall financial progress. Additionally, it’s essential to evaluate your retirement savings status. Are you on track with your retirement goals? Paying off a mortgage early should not come at the expense of underfunding your retirement accounts. The long-term benefits of compound interest in retirement savings often outweigh the short-term satisfaction of mortgage payoff.

Income stability is also a key consideration. If your income is irregular or there’s potential for job loss or industry downturns, there might be better strategies than being aggressive in mortgage payoff. In such cases, maintaining liquidity and financial flexibility is often more prudent. It’s also wise to consider future financial needs, such as children’s education, health care costs, or potential long-term care needs.

Pros of Paying Off Your Mortgage Early

Whether contemplating this step or simply exploring your options, understanding the benefits can help guide your decision-making toward achieving long-term financial stability and success.

Interest Savings

One of the most tangible benefits of paying off your mortgage early is the significant savings on interest. Interest can accumulate substantially over a mortgage’s lifespan, often exceeding the original loan value. Accelerating your mortgage payoff reduces the total interest paid, potentially saving thousands of dollars. This is particularly beneficial in the early stages of a mortgage when a larger portion of your payment goes towards interest rather than the principal.

Moreover, these interest savings can be viewed as a risk-free return on your investment. Unlike the stock market or other investment vehicles, the savings you realize from paying less interest are guaranteed. This makes paying off your mortgage early a financially prudent choice, especially for those seeking a stable and predictable way to improve their financial health.

Peace of Mind

The psychological benefit of being mortgage-free cannot be overstated. Owning your home outright brings a profound sense of security and peace of mind. It eliminates one of the largest monthly expenses, reducing stress and anxiety related to financial obligations. This peace of mind is particularly valuable during economic downturns or personal financial hardships, as it ensures a secure place to live without worrying about a mortgage payment.

This sense of accomplishment fosters a positive financial mindset. It can encourage more prudent financial behaviors and decisions, knowing that you have successfully managed one of the most significant debts most people ever undertake. The mental and emotional relief of being mortgage-free is a powerful motivator for continued financial responsibility and stability.

Improved Cash Flow

Early mortgage payoff improves cash flow, freeing up funds previously allocated to monthly mortgage payments. This flexibility allows you to redirect funds toward other important financial goals, such as retirement savings, investments, or even lifestyle upgrades. The extra money can also be used to build a more robust emergency fund, offering further financial security.

The increased disposable income also opens up opportunities for other wealth-building activities. You might choose to invest in the stock market, start a business, or pursue education and career advancement opportunities. The additional cash flow provides a cushion that can be instrumental in navigating life’s uncertainties, offering both financial and personal freedom.

Increased Home Equity

Paying off your mortgage early results in a quicker accumulation of home equity, which is the portion of your property that you truly “own.” This increased equity can be a valuable asset, serving as collateral for loans or lines of credit if needed. It also provides more leverage in real estate transactions, such as selling your home or purchasing investment properties.

Having substantial home equity can be particularly advantageous in a fluctuating real estate market. In times of declining property values, having more equity protects you from the risk of owing more than your home is worth. This positions you better for future real estate investments or transactions, ensuring you have a strong financial foundation in the property market.

Cons of Paying Off Your Mortgage Early

While the prospect of being mortgage-free is undoubtedly appealing, it’s crucial to understand the potential downsides of this decision. From issues of illiquidity to missed opportunities and potential penalties, we explore the reasons why paying off a mortgage early might not always be the most advantageous financial strategy for everyone.

Illiquidity

One of the primary drawbacks of paying off a mortgage early is the risk of illiquidity. When you allocate a substantial portion of your resources to paying off your home loan, those funds become tied up in your property. This means that your cash is not readily accessible in case of emergencies or for other investment opportunities. Liquidity is crucial for financial flexibility and security, enabling you to respond effectively to unexpected expenses or to take advantage of timely investments.

Moreover, while home equity can be valuable, it is not as easily converted into cash as liquid assets like savings or investments. In the event of a financial crisis or a sudden need for funds, you might find yourself in a tight spot, with significant wealth tied up in your property and limited options for quick access to cash. This lack of liquidity can pose a significant risk, especially in unstable economic times or if your income is variable.

Opportunity Costs

Another critical consideration is the opportunity cost of paying off a mortgage early. The extra funds used for mortgage prepayment could potentially be invested elsewhere for a higher return. For instance, if the interest rate on your mortgage is relatively low, investing that money in the stock market or other higher-yielding investments could lead to greater financial gains over the long term.

Focusing solely on mortgage repayment may mean missing out on diversifying your investment portfolio. Diversification is a key strategy in managing investment risk and achieving a balanced financial portfolio. By concentrating your funds on your mortgage, you might be foregoing the chance to spread your investments across different assets, which could offer better returns and provide a more secure financial future.

Potential Penalties

Some mortgage agreements include prepayment penalties, which can make early payoff less appealing. These penalties are fees lenders charge to borrowers who pay off their mortgage before the term ends. They are designed to compensate the lender for the interest they lose when a mortgage is paid off early. It’s essential to read the terms of your mortgage agreement carefully to understand if any prepayment penalties apply and how they are calculated.

Even without explicit penalties, indirect costs may be associated with refinancing to a shorter-term mortgage. Refinancing often involves closing costs, appraisals, and other fees, which can add up. These costs should be weighed against the potential savings from paying your mortgage early. In some cases, these expenses could negate the financial benefits of an early payoff, making it less advantageous than it initially appears.

Different Factors to Consider Before Paying Off Your Mortgage Early

Paying off your mortgage early is a significant financial decision that requires more than just having extra funds at your disposal. It’s a complex choice that involves evaluating various financial aspects and personal priorities. These considerations range from analyzing alternative investments and liquidity needs to understanding opportunity costs and weighing the value of peace of mind.

Analyzing Alternative Investments

When considering paying off your mortgage early, it’s crucial to evaluate the potential returns from alternative investments. The money used for mortgage prepayment could be invested in stocks, bonds, or other investment vehicles, yielding higher returns. Comparing the interest rate on your mortgage with the expected return on these investments is essential to determine the most financially beneficial use of your funds.

Liquidity Considerations

Liquidity, or the ease of converting assets into cash, is a key factor in paying off a mortgage early. Allocating a large sum to your mortgage may significantly reduce your liquid assets, potentially leaving you unprepared for emergencies or investment opportunities. Ensuring sufficient liquidity to cover unexpected expenses is crucial before committing extra funds to your mortgage.

Opportunity Cost Analysis

Opportunity cost refers to the potential benefits you miss out on when choosing one option over another. In the context of mortgage prepayment, this means considering what you could achieve with the money if it wasn’t used to pay down your mortgage. This might include investing in retirement accounts, the stock market, or other ventures offering greater long-term financial growth.

The Peace of Mind Factor

Finally, the peace of mind that comes with being debt-free cannot be underestimated. For many, eliminating the burden of a mortgage brings a sense of financial freedom and security that outweighs purely mathematical considerations. This emotional aspect is a personal factor and varies significantly from person to person. If the psychological benefits of paying off your mortgage early align with your overall financial goals, it might be the right choice for you.

Is Early Mortgage Payoff Right for You?

Deciding if an early mortgage payoff is right for you requires a deep dive into your personal financial situation and long-term goals. Consider factors such as your current debt load, emergency fund adequacy, retirement savings status, and the potential benefits you might gain from alternative investments.

If you have a stable income, sufficient emergency savings, and are on track with your retirement goals, directing extra funds towards your mortgage could be wise. Especially if your mortgage has a high interest rate, paying it off early could lead to significant interest savings.

However, if you’re juggling high-interest debts, have insufficient emergency funds, or need to adequately plan for retirement, focusing on these areas might be more beneficial before considering an early mortgage payoff. Also, consider your risk tolerance and the potential for higher returns from other investments.

If the peace of mind that comes with being debt-free outweighs the potential gains from investing elsewhere, then paying off your mortgage early could align well with your personal preferences and financial philosophy. Ultimately, the decision hinges on a comprehensive analysis of your financial health and personal comfort with debt.

Strategies for Early Mortgage Payoff

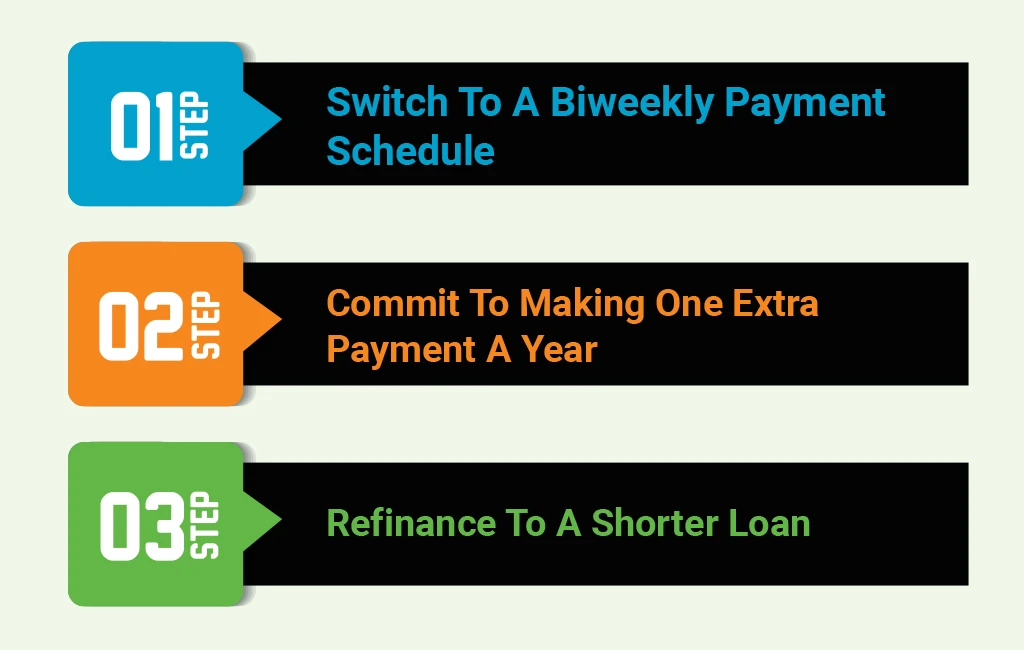

Paying off your mortgage early can be a smart financial move, allowing you to save on interest and gain equity in your home faster. You can adopt several strategies to achieve this goal, each with its own advantages. Implementing these strategies can accelerate your path to being mortgage-free.

Switch to a Biweekly Payment Schedule

Adopting a biweekly payment schedule is a relatively painless way to pay off your mortgage earlier. Instead of making a single monthly payment, you split this amount in half and pay every two weeks. This approach works in 26 half-payments yearly (or 13 full), effectively depositing an extra payment each year without a significant burden on your monthly budget.

The additional payment each year goes directly towards the principal, reducing the amount of interest you’ll pay over the life of the loan and shortening the loan term. This method is particularly effective because it doesn’t require a substantial change in your monthly financial planning, but it can significantly accelerate your mortgage payoff timeline.

Commit to Making One Extra Payment a Year

Another simple yet effective strategy is to make one extra mortgage payment each year. This can be done by saving up throughout the year or using a lump sum you receive, such as a tax refund, bonus, or gift. By applying this extra payment to the principal, you can significantly reduce the total interest paid over the life of the loan and shorten the loan term.

This strategy offers flexibility as you can choose when to make this extra payment based on your financial situation each year. It’s a manageable approach that can lead to substantial long-term savings and a quicker path to owning your home outright.

Refinance to a Shorter Loan

Refinancing your mortgage to a shorter loan term, such as switching from a 30-year to a 15-year mortgage, can dramatically accelerate your mortgage payoff. Although this often means a higher monthly payment, the interest rate on shorter-term loans is usually lower. This helps you save on the total interest paid over the life of the loan and builds your home equity faster.

Refinancing to a shorter loan term is particularly beneficial if interest rates have dropped since you took out your original mortgage. However, it’s important to consider refinancing costs, including closing costs and potential fees, to ensure the overall savings justify these expenses. This strategy best suits those who can comfortably afford the higher monthly payments without straining their budget.

Implementation Plan

Implementing a plan to pay off your mortgage early requires a structured approach and disciplined financial management. Start by choosing the strategy that best aligns with your financial situation and goals. If you decide to switch to a biweekly payment schedule, contact your mortgage lender to set up this payment structure. Ensure that the extra payments are going towards the principal and not just prepaying interest.

It’s important to also confirm with your lender that there are no penalties for making extra payments. If you opt for making one extra payment a year, you can plan for this by setting aside a small amount each month in a separate savings account, or earmark a specific source of income, like a tax refund, to be used for this purpose.

For homeowners considering refinancing to a shorter loan term, it’s crucial to do thorough research and possibly consult with a financial advisor. Analyze the current interest rates, calculate the potential savings, and consider the closing costs and fees associated with refinancing. Once you decide to proceed, shop around for the best rates and terms from various lenders.

Regardless of your chosen strategy, reviewing your budget and adjusting your spending is vital to accommodate the new payment structure. Regularly monitor your mortgage statements to track your progress and stay motivated. Remember, an early mortgage payoff plan is not set in stone; it should be flexible enough to adapt to any changes in your financial situation.

Regular Review and Adjustment

Regular review and adjustment of your mortgage payoff strategy are crucial to ensure it remains aligned with your evolving financial circumstances. Set a schedule for periodic reviews, such as semi-annually or annually, to assess your progress and make necessary adjustments. During these reviews, evaluate your current financial situation, including any changes in income, expenses, and savings goals.

This is particularly important if you’ve experienced significant life events like a career change, the birth of a child, or unexpected financial challenges. Such changes might impact your ability to make extra payments or might even present an opportunity to increase them.

Adjustments might also be required based on changes in the broader economic environment, such as fluctuating interest rates or shifts in the real estate market. For instance, if interest rates drop significantly, it might be advantageous to consider refinancing to a lower rate, even if you’ve already refinanced once.

Alternatively, if you find that you’re ahead of schedule on your mortgage payoff, you might choose to redirect some funds toward other investments or savings goals. Keeping your strategy flexible allows you to maximize its effectiveness while ensuring it complements your overall financial plan. Regularly reviewing and adjusting your approach will help you stay on track toward achieving your goal of early mortgage payoff in a way that is sustainable and responsive to your changing financial needs.

Final Words

So, Should You Pay Off Your Mortgage Early?

Deciding to pay off your mortgage early is a complex decision with numerous factors to consider. While the allure of being mortgage-free is strong, evaluating the decision in the context of your overall financial health and goals is essential. Remember, the right choice varies for each individual, and what matters most is making an informed decision that aligns with your financial plan.

EduCounting offers invaluable resources to assist you in this critical decision-making process. Our expertly crafted blogs and comprehensive courses delve into the complexities of mortgage management and offer clear, actionable advice. Turn to EduCounting for guidance and insights that empower you to make the best financial decisions for your future.

FAQs

Is it worth paying a mortgage off early?

Whether it’s worth paying off a mortgage early depends on individual financial circumstances, including interest rates, investment opportunities, and personal financial goals. For some, the savings on interest and peace of mind are valuable, while others may benefit more from investing the money elsewhere.

Is it better to pay off a mortgage or keep money?

Deciding between paying off a mortgage or keeping the money involves weighing factors like the potential return on investments versus the interest saved on the mortgage, as well as personal financial stability and risk tolerance.

What age do most people pay their mortgage off?

The age at which most people pay off their mortgage varies, but traditionally, many aim to have it paid off by retirement. However, this can differ based on individual financial situations, mortgage terms, and personal debt and retirement planning choices.